Our PDF editor was developed with the goal of making it as simple and user-friendly as possible. All of these actions are going to make filling out the Irs Gov Ptin Renewal easy and quick.

Step 1: To get going, hit the orange button "Get Form Now".

Step 2: Right now, you may change the Irs Gov Ptin Renewal. This multifunctional toolbar helps you include, get rid of, adjust, highlight, and also do other commands to the text and fields inside the file.

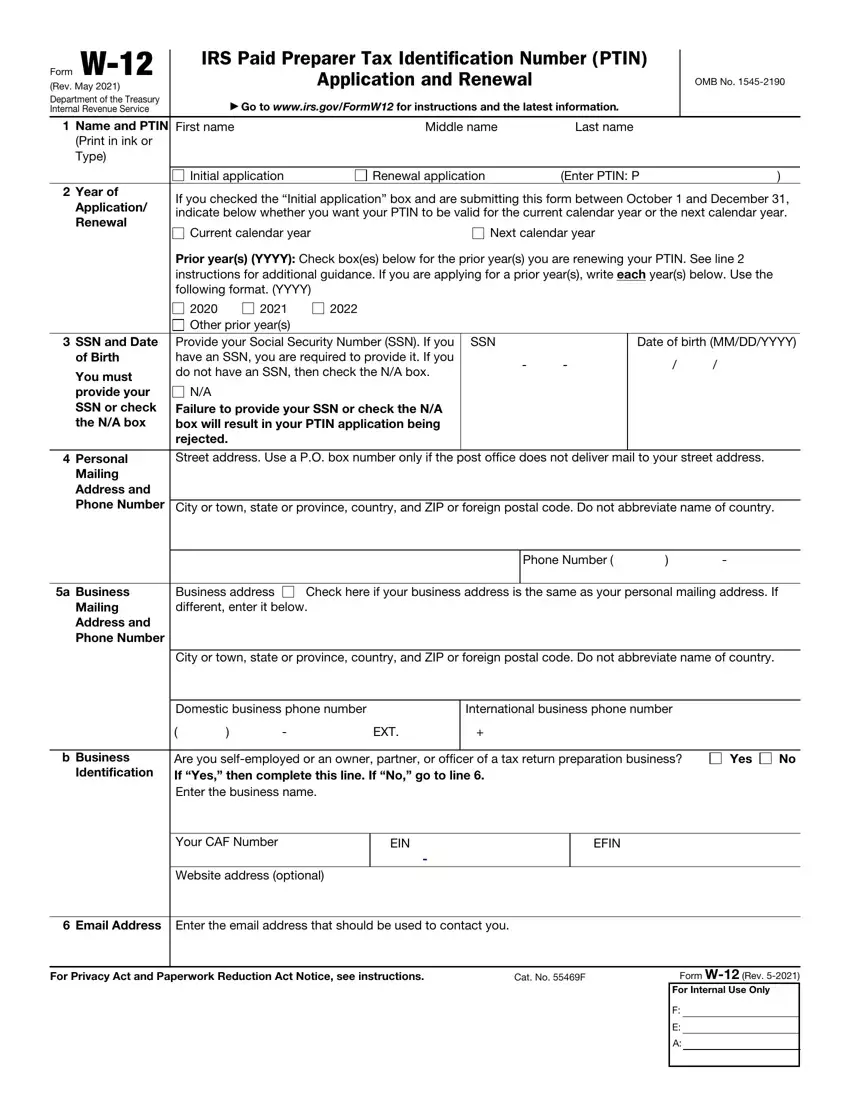

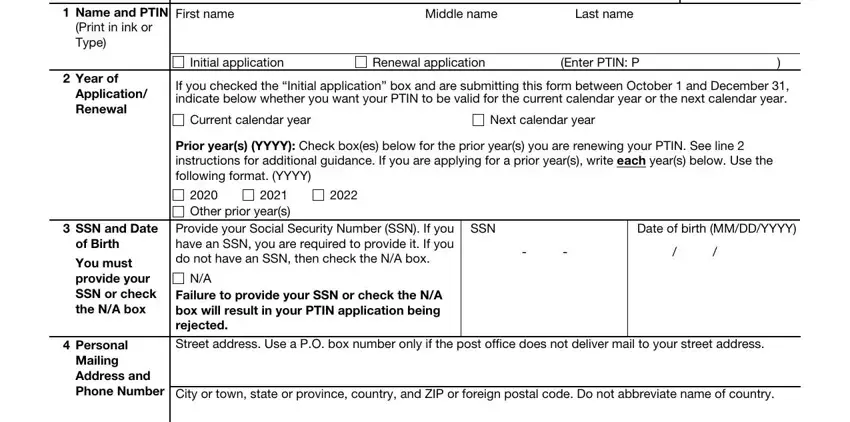

The next few sections are going to make up the PDF document:

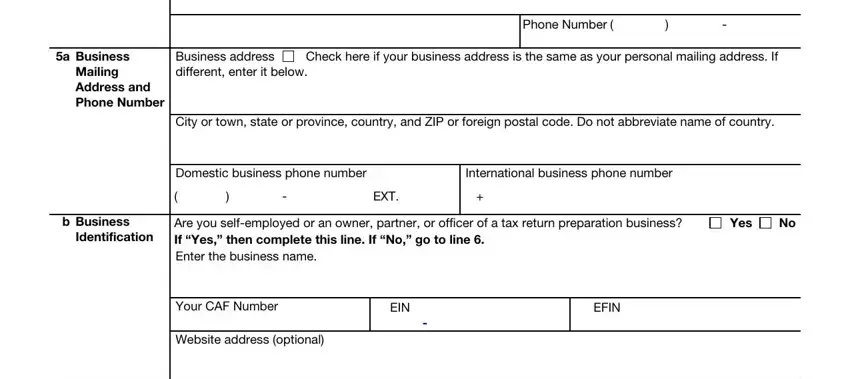

The program will require you to complete the a Business Mailing Address and, Business address Check here if, Phone Number, City or town state or province, Domestic business phone number, International business phone number, EXT, b Business, Identification, Are you selfemployed or an owner, Yes, Your CAF Number, Website address optional, EIN, and EFIN field.

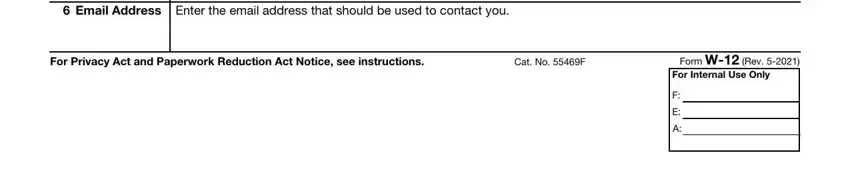

Type in any particulars you need in the segment Email Address Enter the email, For Privacy Act and Paperwork, Cat No F, Form W Rev, and For Internal Use Only.

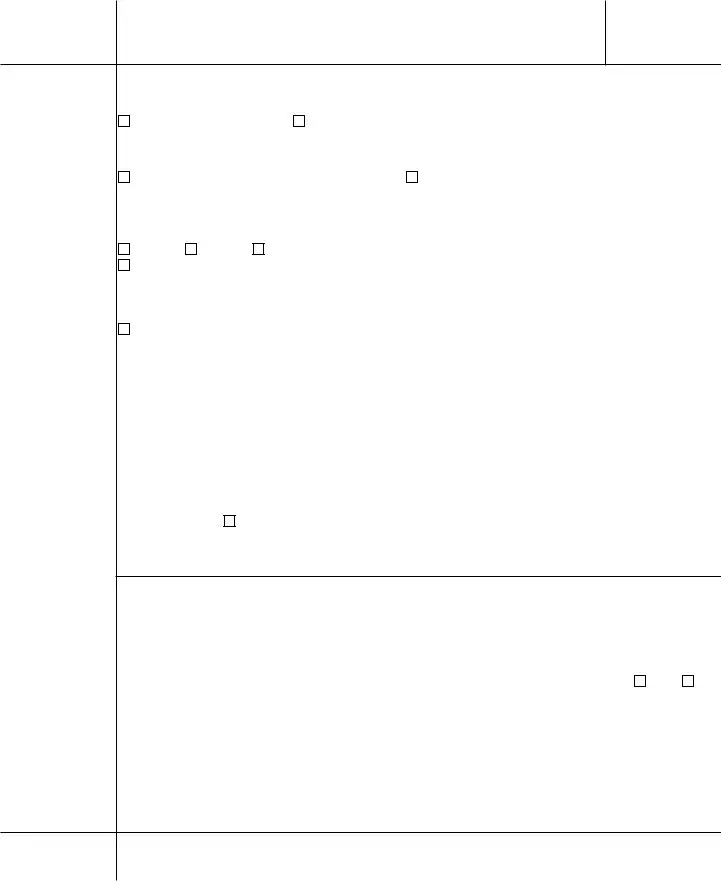

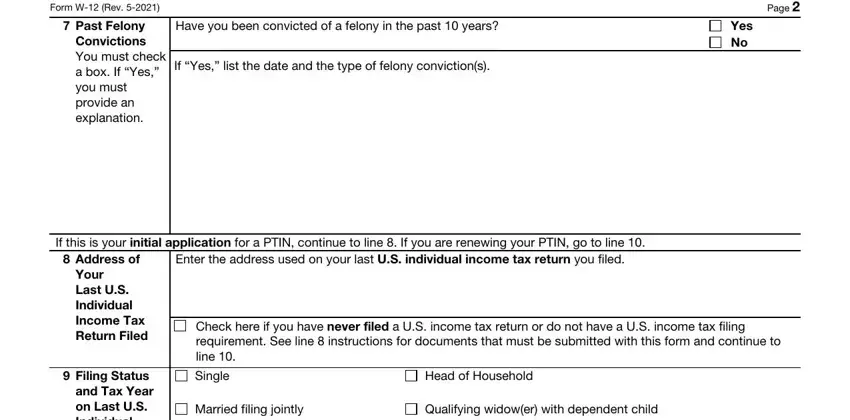

You'll need to describe the rights and obligations of each party in section Form W Rev, Past Felony Convictions You must, Have you been convicted of a, If Yes list the date and the type, Page, Yes No, If this is your initial, Address of, Enter the address used on your, Your Last US Individual Income Tax, Filing Status and Tax Year on, Check here if you have never filed, Single, Head of Household, and Married filing jointly.

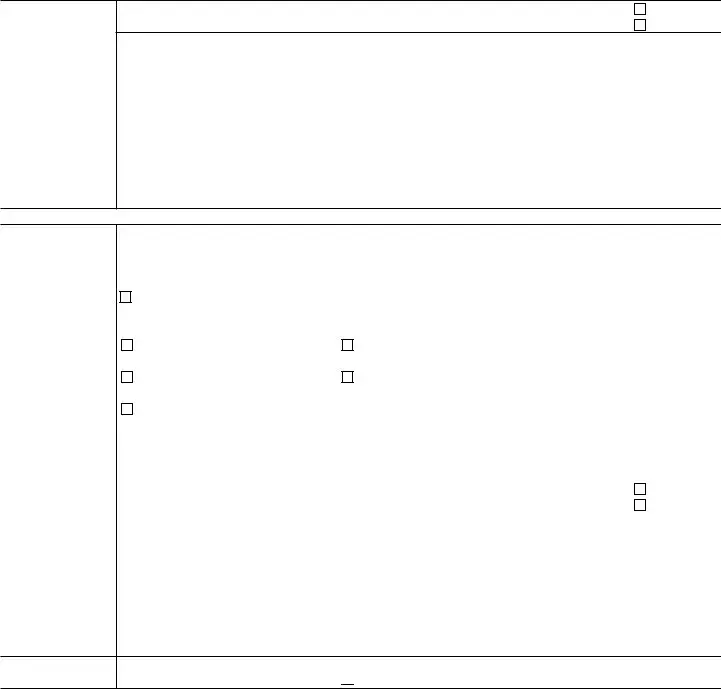

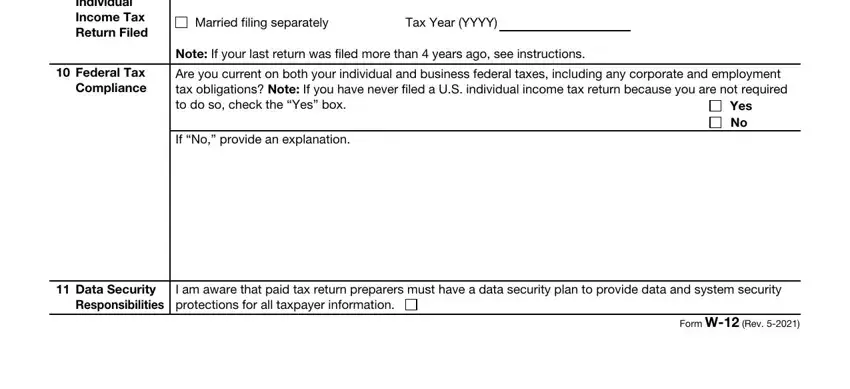

End by looking at the following fields and completing them as required: Filing Status and Tax Year on, Federal Tax Compliance, Married filing separately, Tax Year YYYY, Note If your last return was filed, Are you current on both your, Yes No, If No provide an explanation, Data Security Responsibilities, I am aware that paid tax return, and Form W Rev.

Step 3: Choose the Done button to save your file. At this point it is obtainable for export to your device.

Step 4: It's going to be safer to save copies of your file. You can rest assured that we are not going to share or view your particulars.