It is very easy to fill in the net profit from. Our software was meant to be easy-to-use and help you fill in any form quickly. These are the four steps to take:

Step 1: You should choose the orange "Get Form Now" button at the top of the page.

Step 2: Now you may manage the net profit from. You may use our multifunctional toolbar to insert, erase, and change the text of the form.

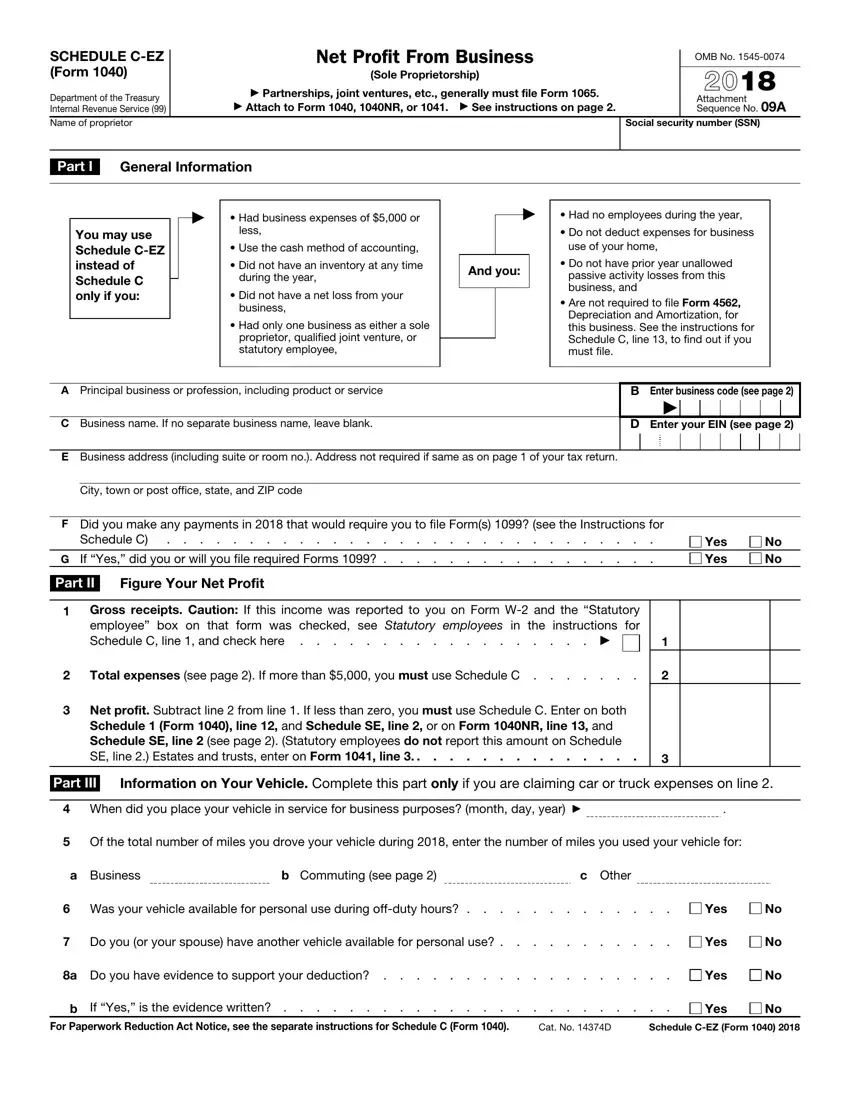

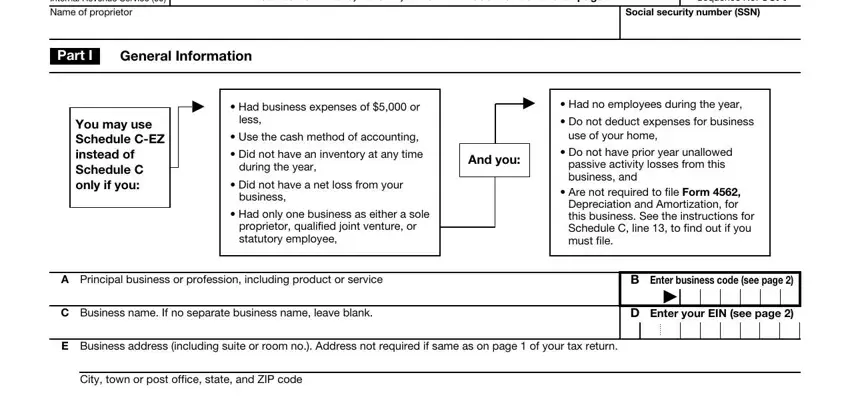

To be able to create the net profit from PDF, enter the content for each of the parts:

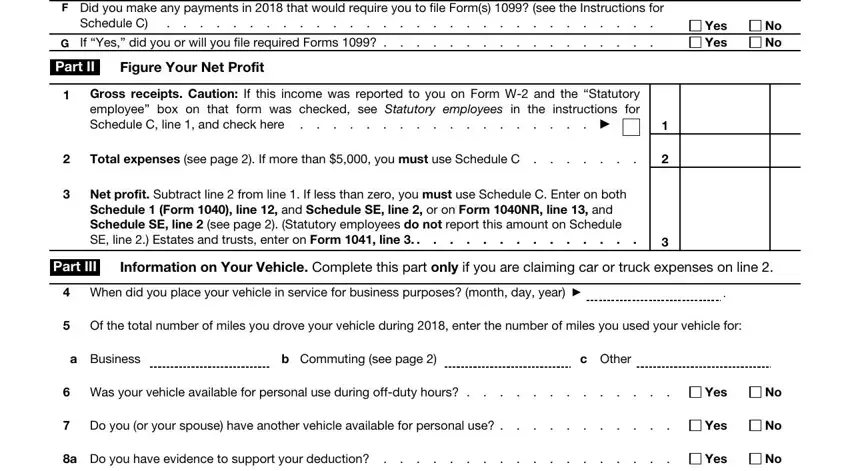

Fill out the F Did you make any payments in, Schedule C, G If Yes did you or will you file, Part II, Figure Your Net Profit, Gross receipts Caution If this, Total expenses see page If more, Net profit Subtract line from, Yes Yes, No No, Part III, Information on Your Vehicle, When did you place your vehicle, Of the total number of miles you, and a Business fields with any information that will be requested by the system.

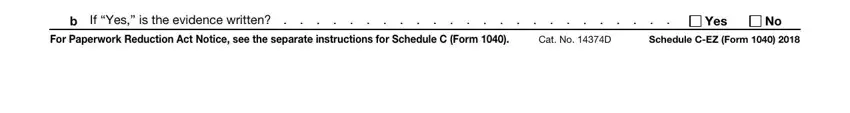

The system will request details to instantly fill out the part b If Yes is the evidence written, Yes, For Paperwork Reduction Act Notice, Cat No D, and Schedule CEZ Form.

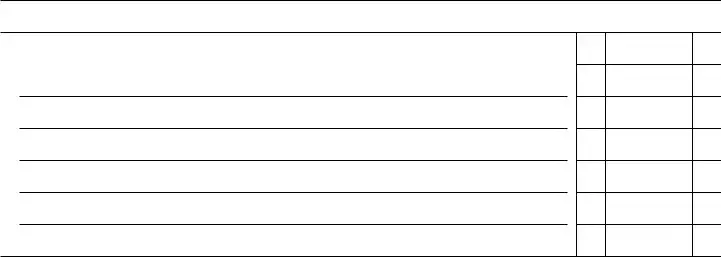

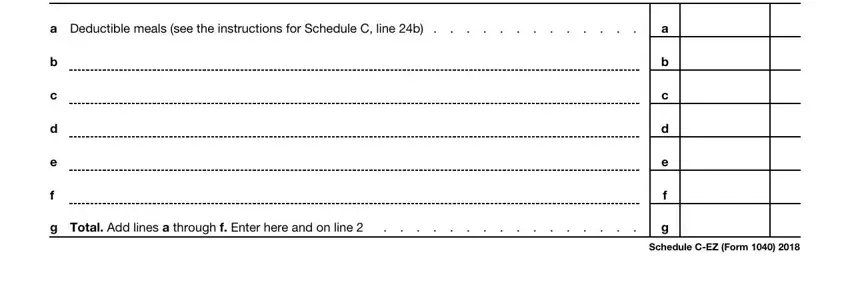

Explain the rights and responsibilities of the sides inside the box a Deductible meals see the, g Total Add lines a through f, and Schedule CEZ Form.

Step 3: Select "Done". It's now possible to export the PDF document.

Step 4: Produce around two or three copies of your document to stay away from any kind of forthcoming troubles.