v form can be filled out effortlessly. Just make use of FormsPal PDF tool to complete the task without delay. To have our editor on the leading edge of convenience, we work to adopt user-oriented capabilities and enhancements regularly. We're at all times pleased to receive suggestions - join us in revolutionizing PDF editing. Starting is effortless! Everything you need to do is follow the following simple steps below:

Step 1: Hit the "Get Form" button above on this page to get into our editor.

Step 2: This tool offers you the ability to modify PDF forms in a variety of ways. Change it by adding your own text, correct what is originally in the file, and include a signature - all close at hand!

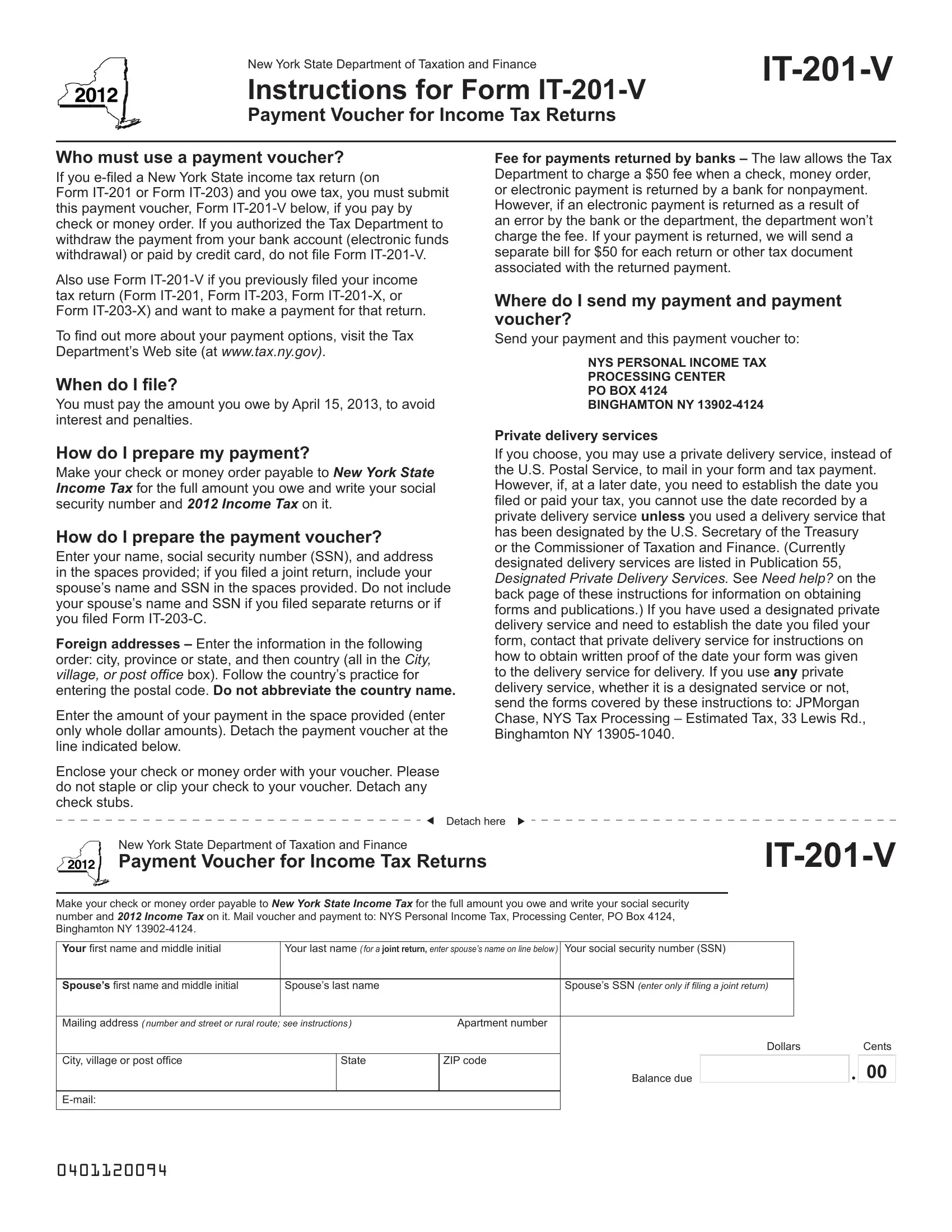

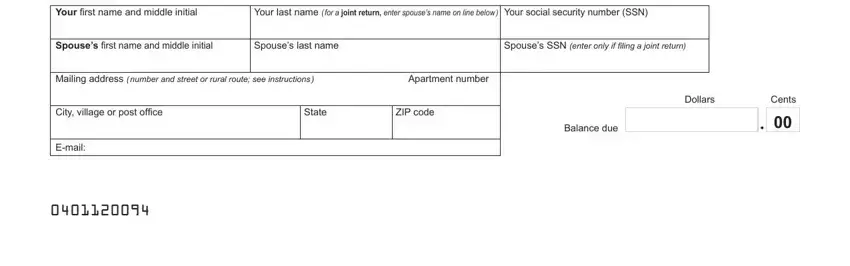

It is actually straightforward to complete the pdf using this detailed tutorial! Here's what you need to do:

1. Start filling out your v form with a group of essential fields. Note all the important information and make certain not a single thing missed!

Step 3: Just after proofreading your fields, press "Done" and you are all set! Right after setting up afree trial account with us, it will be possible to download v form or email it directly. The form will also be available through your personal cabinet with your each edit. With FormsPal, you're able to complete documents without the need to be concerned about information breaches or records getting shared. Our secure platform helps to ensure that your private data is stored safely.