Working with PDF forms online is certainly quite easy using our PDF editor. You can fill in it 203 here without trouble. To have our tool on the forefront of convenience, we strive to put into practice user-oriented capabilities and enhancements regularly. We're always grateful for any feedback - help us with reshaping PDF editing. This is what you would want to do to start:

Step 1: Open the PDF file inside our tool by hitting the "Get Form Button" above on this page.

Step 2: Once you start the online editor, you will get the document all set to be filled out. Apart from filling out various fields, you can also do various other things with the form, namely writing your own words, modifying the initial textual content, inserting images, signing the document, and more.

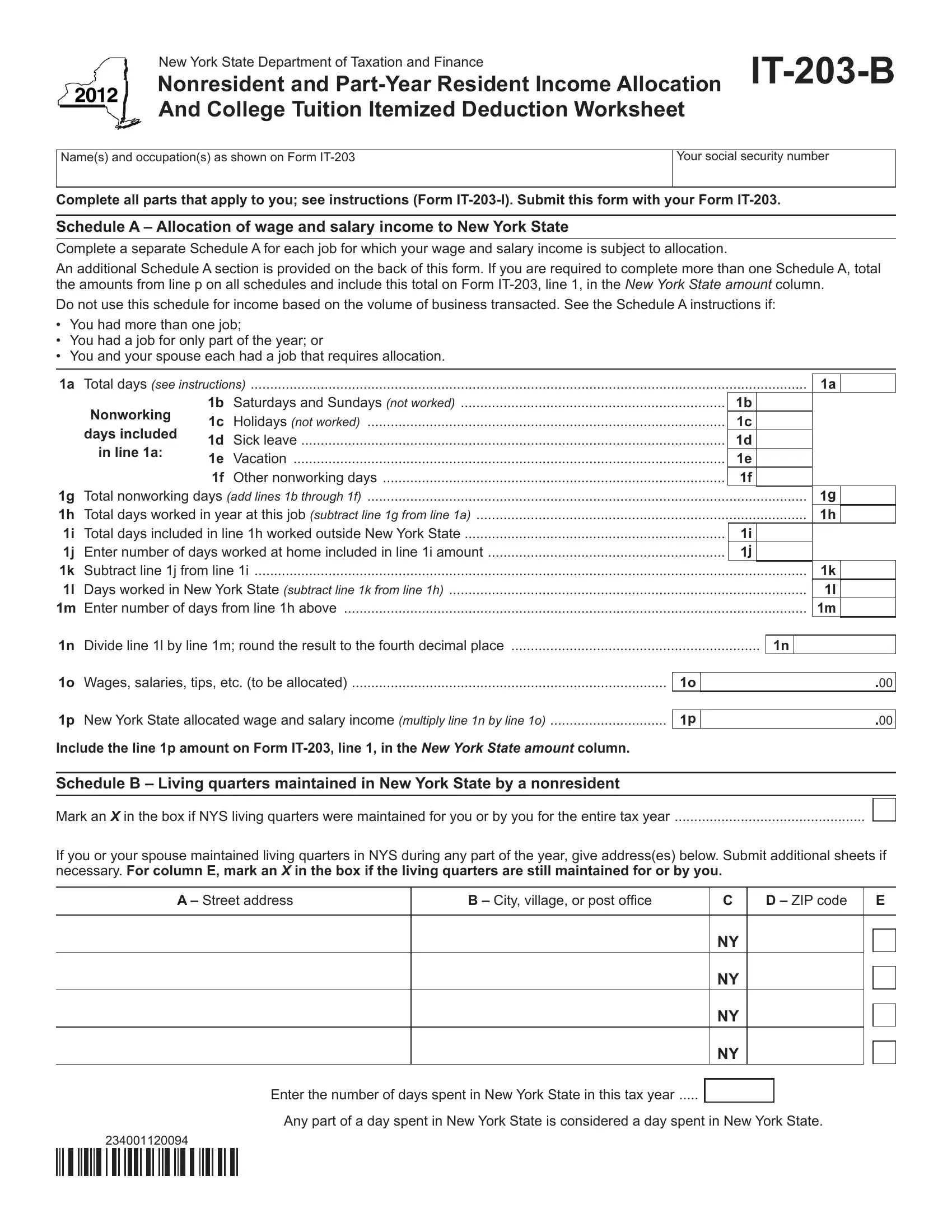

As for the fields of this specific PDF, this is what you should consider:

1. Whenever completing the it 203, be sure to complete all needed blank fields in its associated form section. This will help to hasten the work, allowing for your details to be processed quickly and properly.

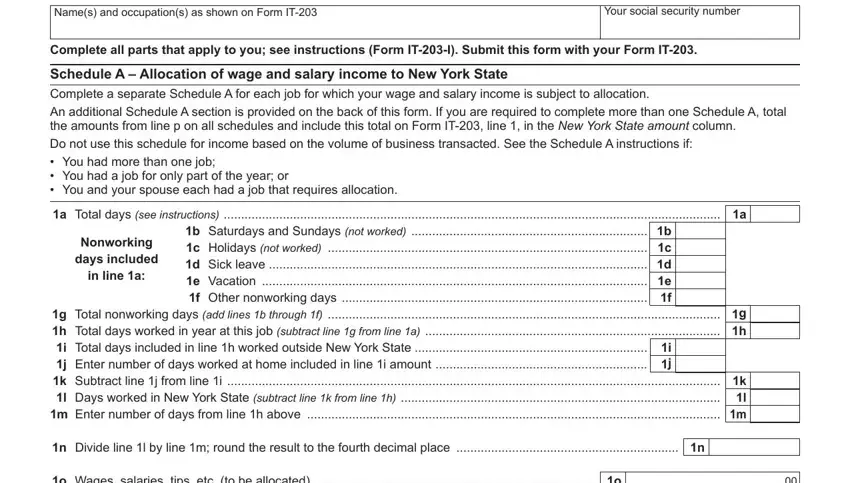

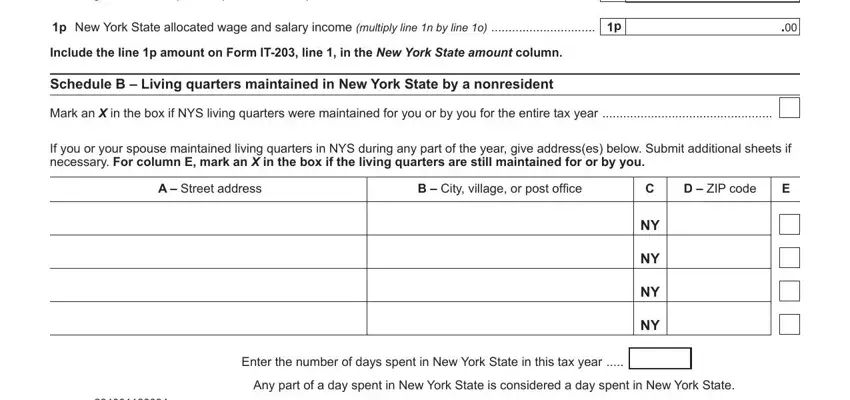

2. Once the last selection of blanks is filled out, go to enter the relevant information in all these - o Wages salaries tips etc to be, p New York State allocated wage, Include the line p amount on Form, Schedule B Living quarters, Mark an X in the box if NYS living, If you or your spouse maintained, A Street address, B City village or post ofice, D ZIP code, Enter the number of days spent in, and Any part of a day spent in New.

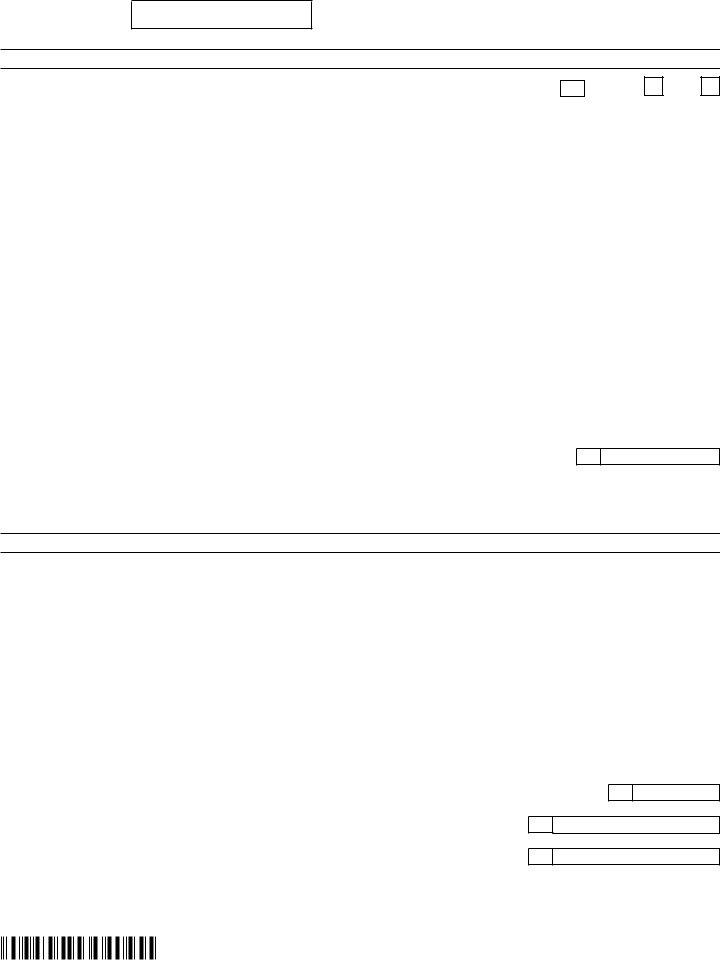

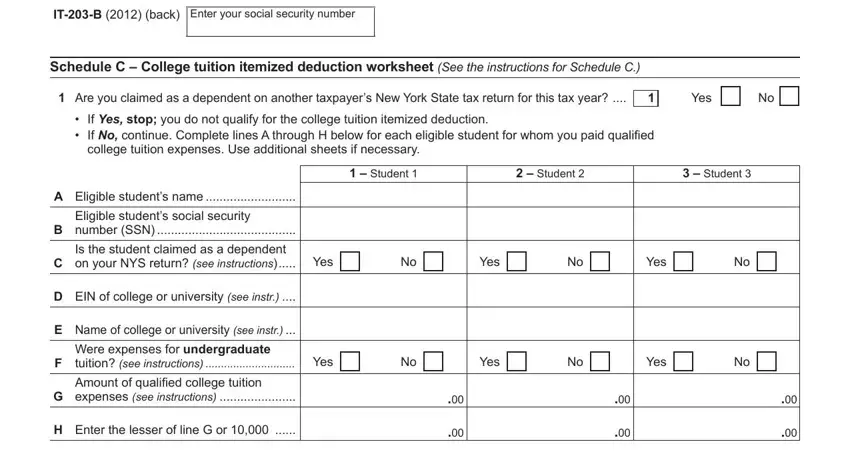

3. Completing ITB back Enter your social, Schedule C College tuition, Are you claimed as a dependent on, If Yes stop you do not qualify, Yes, Student, Student, Student, Eligible students name, Eligible students social security, Is the student claimed as a, Yes, Yes, Yes, and EIN of college or university see is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Regarding Yes and EIN of college or university see, ensure you get them right here. These two are certainly the most important ones in the page.

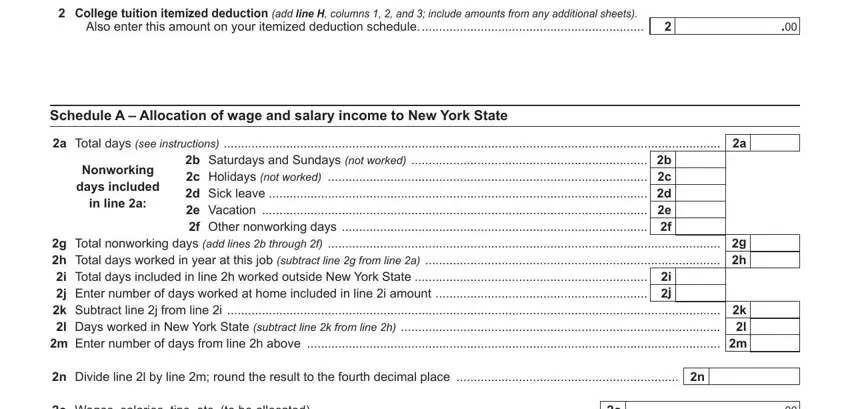

4. This subsection arrives with all of the following blank fields to fill out: College tuition itemized, Also enter this amount on your, Schedule A Allocation of wage and, in line a, Nonworking days included, b Saturdays and Sundays not worked, a Total days see instructions a g, n Divide line l by line m round, and o Wages salaries tips etc to be.

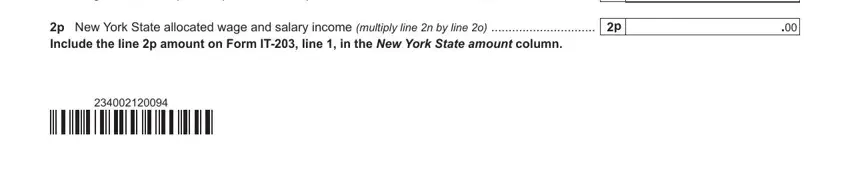

5. The form needs to be concluded with this area. Further you will notice an extensive list of form fields that need correct details in order for your form submission to be faultless: o Wages salaries tips etc to be, and p New York State allocated wage.

Step 3: Soon after looking through the fields you have filled in, click "Done" and you're done and dusted! Make a 7-day free trial plan at FormsPal and get direct access to it 203 - which you may then make use of as you would like inside your personal account. We do not share any details that you provide when working with documents at our website.