It's quite simple to fill out the FEIN. Our tool was intended to be allow you to complete any document efficiently. These are the steps to take:

Step 1: Select the "Get Form Now" button to begin.

Step 2: The file editing page is right now open. Include information or manage present information.

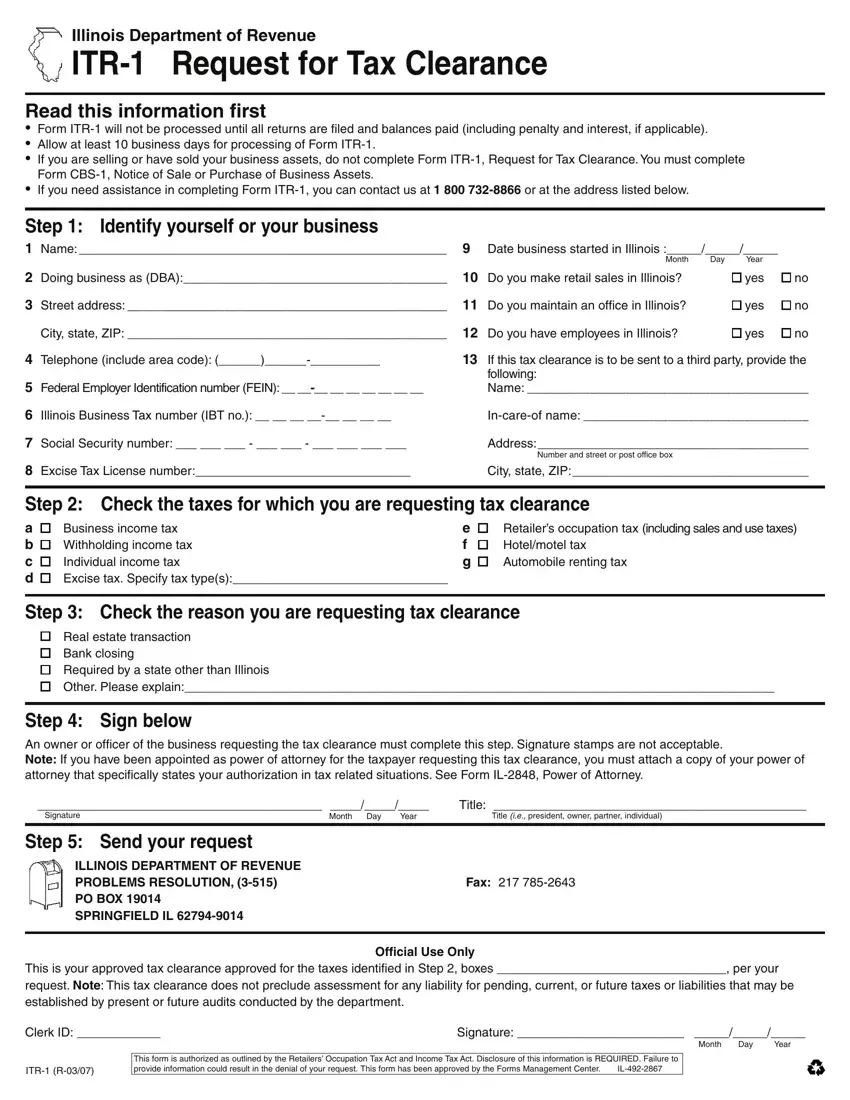

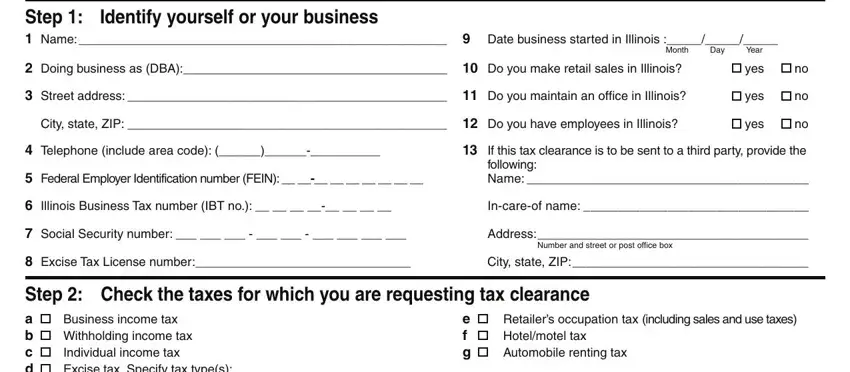

Complete the FEIN PDF and provide the material for every single segment:

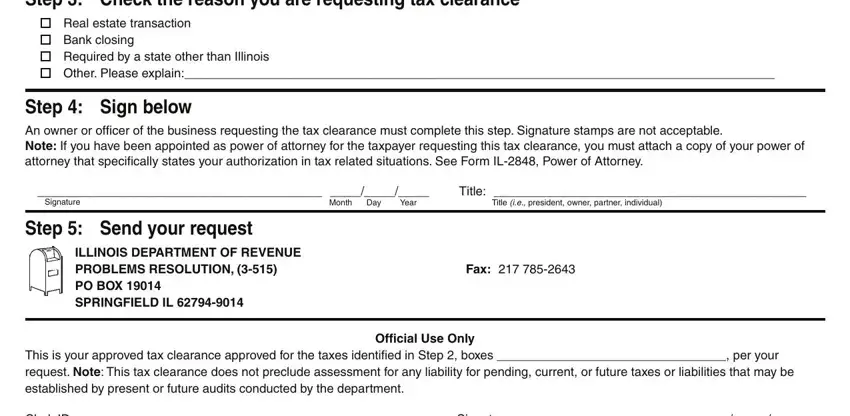

Note the information in Step Check the reason you are, Real estate transaction Bank, Step Sign below An owner or, Title, Signature, Step Send your request, ILLINOIS DEPARTMENT OF REVENUE, Month Day Year, Title ie president owner partner, Fax, This is your approved tax, Official Use Only, Clerk ID, and Signature.

Step 3: Click the "Done" button. Now you can transfer the PDF document to your gadget. As well as that, you can easily send it via electronic mail.

Step 4: In order to avoid potential future complications, ensure you hold no less than a pair of copies of each separate document.