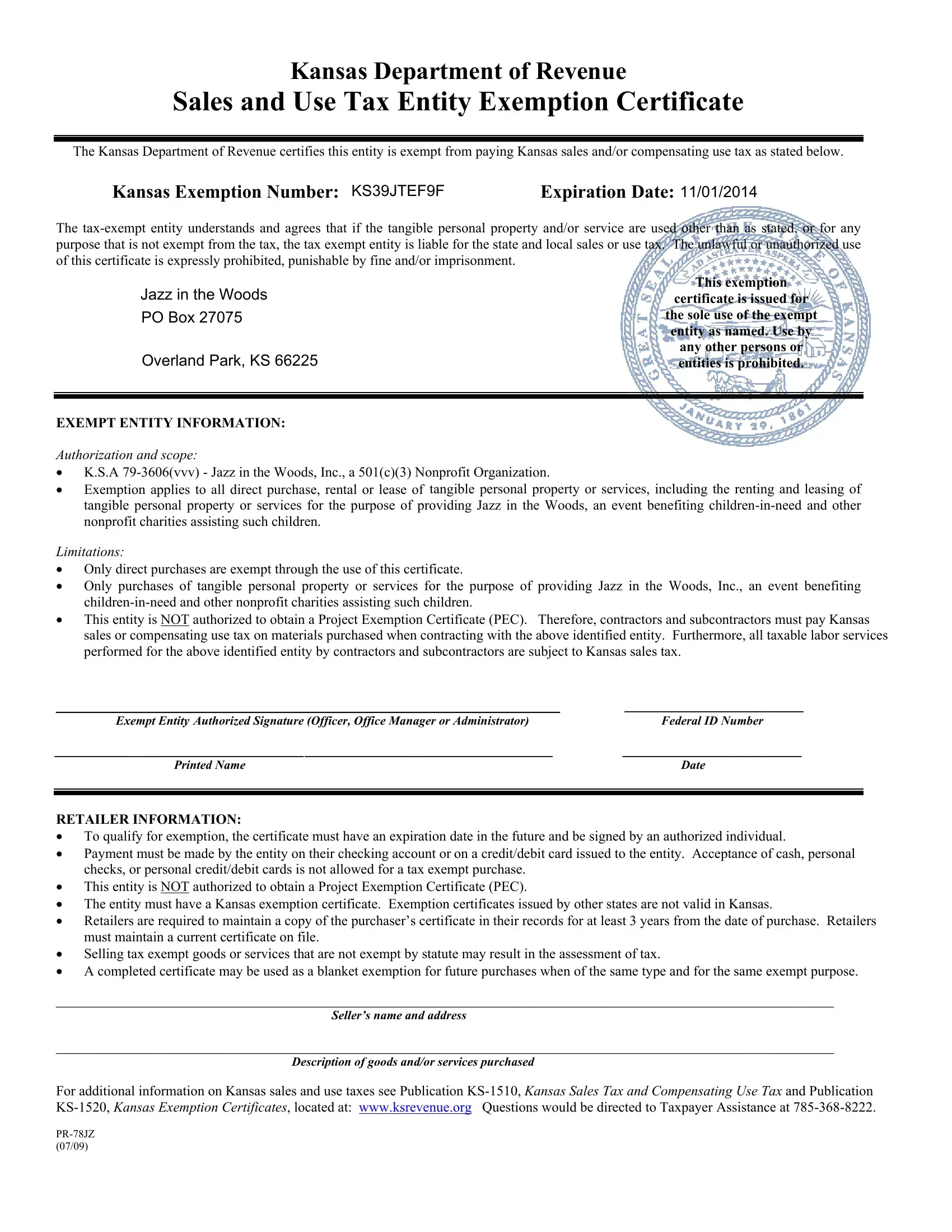

Kansas Department of Revenue

Sales and Use Tax Entity Exemption Certificate

The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales and/or compensating use tax as stated below.

KS39JTEF9F |

11/01/2014 |

Kansas Exemption Number: <KS12345678> |

Expiration Date: <MM/DD/YYYY> |

The tax-exempt entity understands and agrees that if the tangible personal property and/or service are used other than as stated, or for any purpose that is not exempt from the tax, the tax exempt entity is liable for the state and local sales or use tax. The unlawful or unauthorized use of this certificate is expressly prohibited, punishable by fine and/or imprisonment.

EXEMPT ENTITY INFORMATION:

Authorization and scope:

•K.S.A 79-3606(vvv) - Jazz in the Woods, Inc., a 501(c)(3) Nonprofit Organization.

•Exemption applies to all direct purchase, rental or lease of tangible personal property or services, including the renting and leasing of tangible personal property or services for the purpose of providing Jazz in the Woods, an event benefiting children-in-need and other nonprofit charities assisting such children.

Limitations:

•Only direct purchases are exempt through the use of this certificate.

•Only purchases of tangible personal property or services for the purpose of providing Jazz in the Woods, Inc., an event benefiting children-in-need and other nonprofit charities assisting such children.

•This entity is NOT authorized to obtain a Project Exemption Certificate (PEC). Therefore, contractors and subcontractors must pay Kansas sales or compensating use tax on materials purchased when contracting with the above identified entity. Furthermore, all taxable labor services performed for the above identified entity by contractors and subcontractors are subject to Kansas sales tax.

______________________________________________________ |

_______________________ |

Exempt Entity Authorized Signature (Officer, Office Manager or Administrator) |

Federal ID Number |

________________________________________________________________ |

_______________________ |

Printed Name |

Date |

|

|

RETAILER INFORMATION:

•To qualify for exemption, the certificate must have an expiration date in the future and be signed by an authorized individual.

•Payment must be made by the entity on their checking account or on a credit/debit card issued to the entity. Acceptance of cash, personal checks, or personal credit/debit cards is not allowed for a tax exempt purchase.

•This entity is NOT authorized to obtain a Project Exemption Certificate (PEC).

•The entity must have a Kansas exemption certificate. Exemption certificates issued by other states are not valid in Kansas.

•Retailers are required to maintain a copy of the purchaser’s certificate in their records for at least 3 years from the date of purchase. Retailers must maintain a current certificate on file.

•Selling tax exempt goods or services that are not exempt by statute may result in the assessment of tax.

•A completed certificate may be used as a blanket exemption for future purchases when of the same type and for the same exempt purpose.

____________________________________________________________________________________________________

Seller’s name and address

____________________________________________________________________________________________________

Description of goods and/or services purchased

For additional information on Kansas sales and use taxes see Publication KS-1510, Kansas Sales Tax and Compensating Use Tax and Publication KS-1520, Kansas Exemption Certificates, located at: www.ksrevenue.org Questions would be directed to Taxpayer Assistance at 785-368-8222.