Once you open the online tool for PDF editing by FormsPal, you can fill in or change jt1 application here and now. To maintain our editor on the forefront of efficiency, we work to put into practice user-oriented capabilities and improvements regularly. We are routinely thankful for any suggestions - play a vital part in reshaping the way you work with PDF docs. This is what you will want to do to begin:

Step 1: Click on the "Get Form" button above. It will open our pdf tool so that you can begin completing your form.

Step 2: As soon as you access the tool, you will notice the document all set to be completed. Apart from filling out different blanks, it's also possible to perform some other actions with the file, particularly putting on any textual content, editing the initial text, adding illustrations or photos, placing your signature to the document, and more.

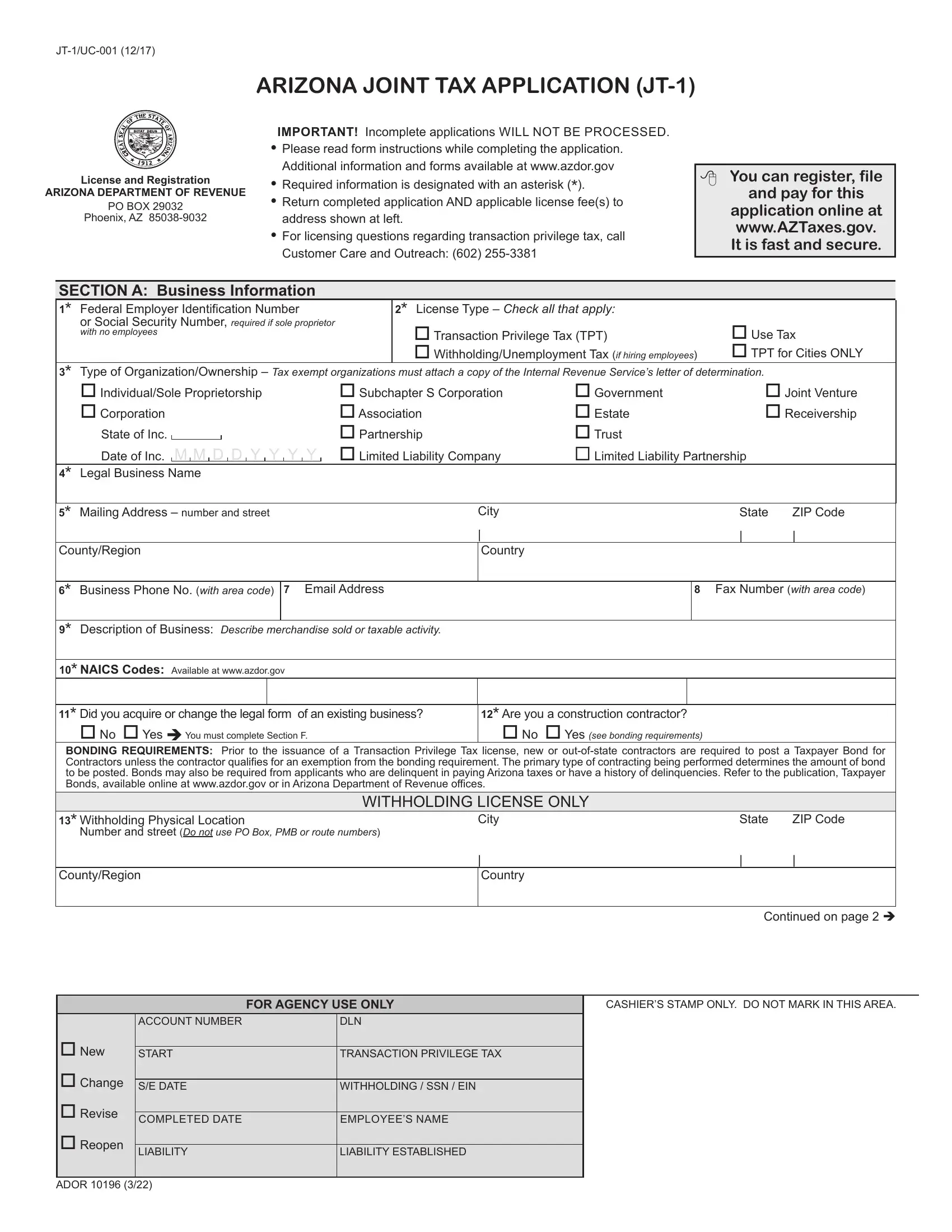

This PDF requires specific details to be typed in, thus make sure you take some time to enter what's expected:

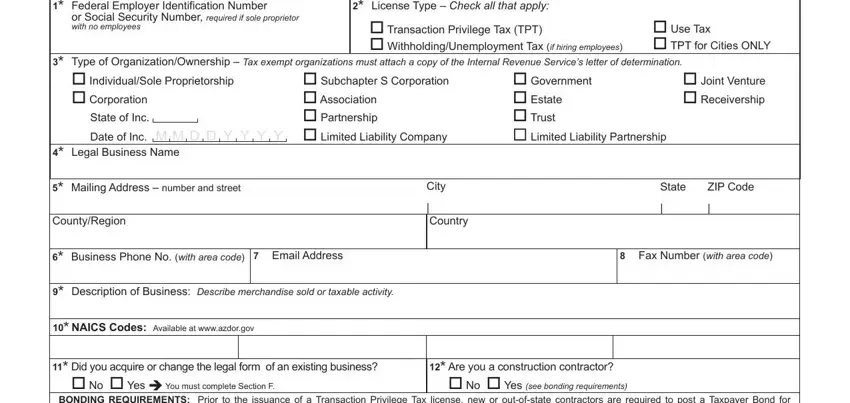

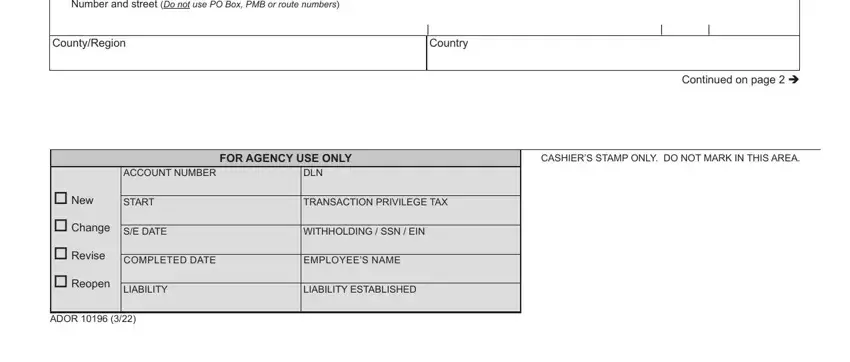

1. It's very important to fill out the jt1 application accurately, thus pay close attention while filling out the areas that contain all of these blank fields:

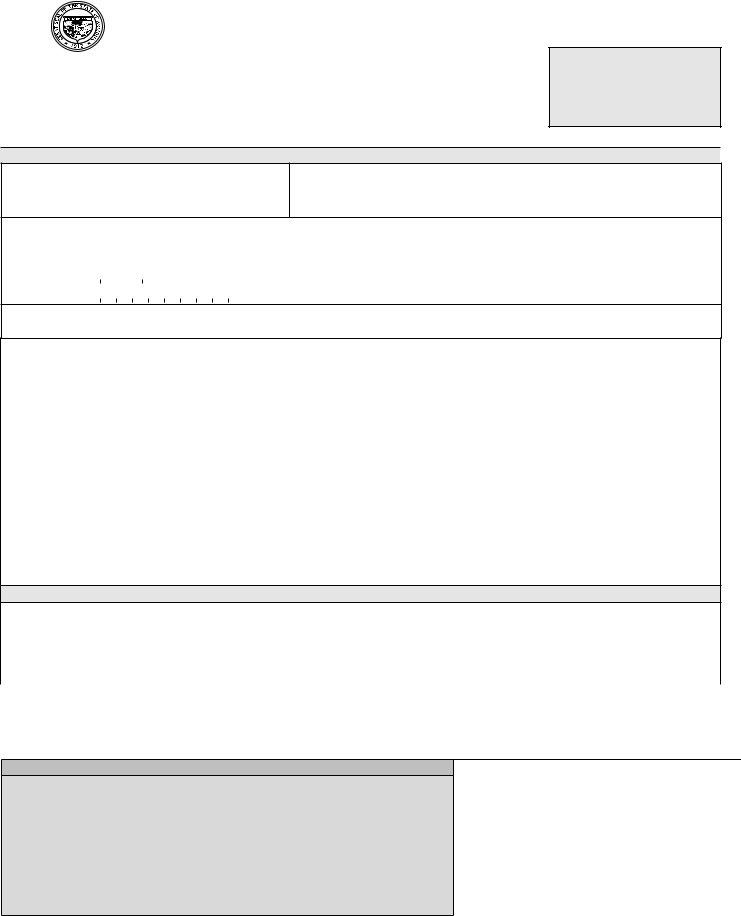

2. Just after completing the previous step, go on to the subsequent part and fill out all required details in all these blanks - Withholding Physical Location, Number and street Do not use PO, CountyRegion, Country, Continued on page, FOR AGENCY USE ONLY, CASHIERS STAMP ONLY DO NOT MARK IN, ACCOUNT NUMBER, DLN, New, START, TRANSACTION PRIVILEGE TAX, Change, Revise, and Reopen.

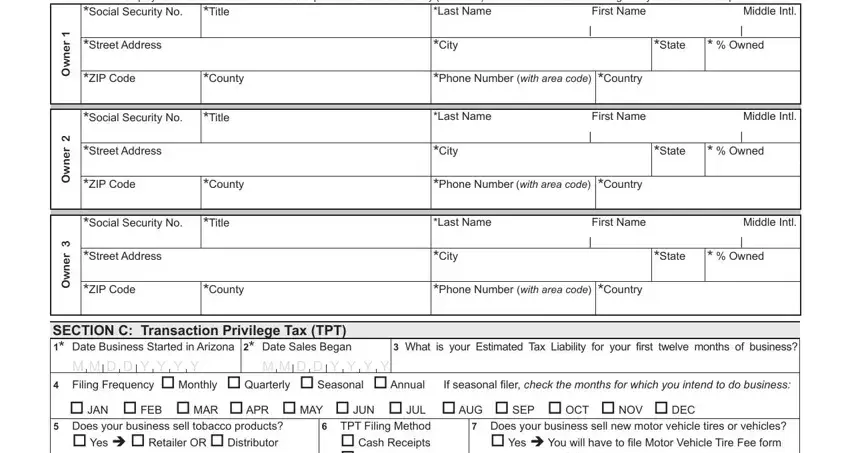

3. The third stage is normally hassle-free - fill out all the empty fields in owned and unemployment insurance, Social Security No, Title, Last Name, First Name, Middle Intl, r e n w O, r e n w O, r e n w O, Street Address, City, State, Owned, ZIP Code, and County to conclude this segment.

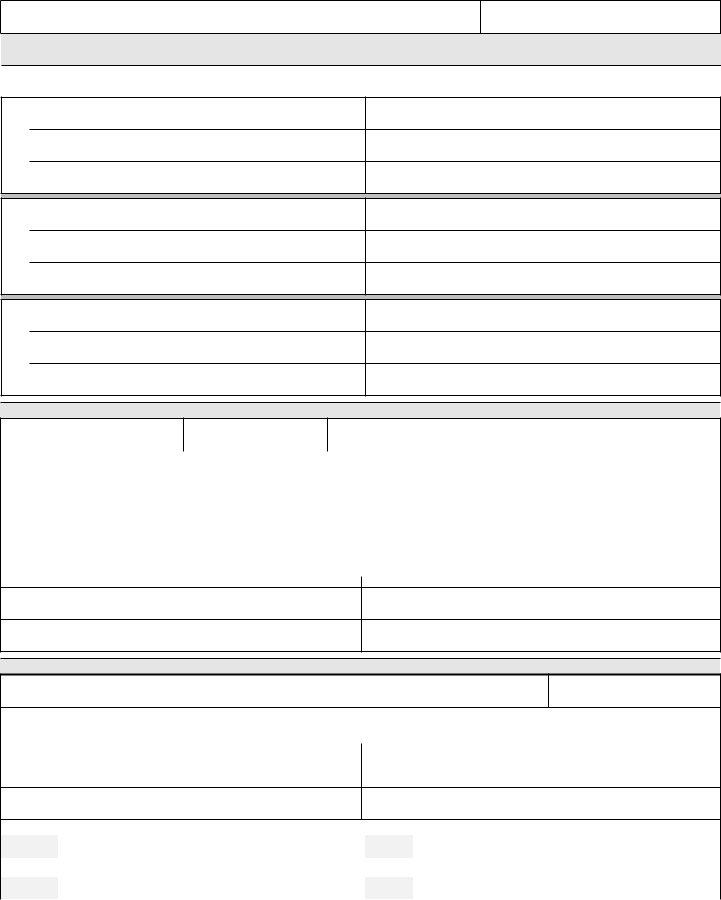

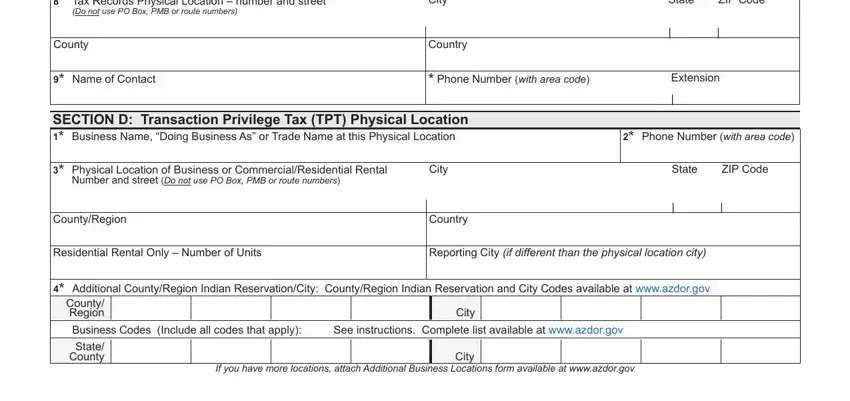

4. This fourth subsection comes with these particular fields to consider: Tax Records Physical Location, Do not use PO Box PMB or route, County, Name of Contact, City, Country, Phone Number with area code, State, ZIP Code, Extension, SECTION D Transaction Privilege, Phone Number with area code, Physical Location of Business or, Number and street Do not use PO, and City.

Be really attentive while filling in Name of Contact and State, as this is the part in which a lot of people make a few mistakes.

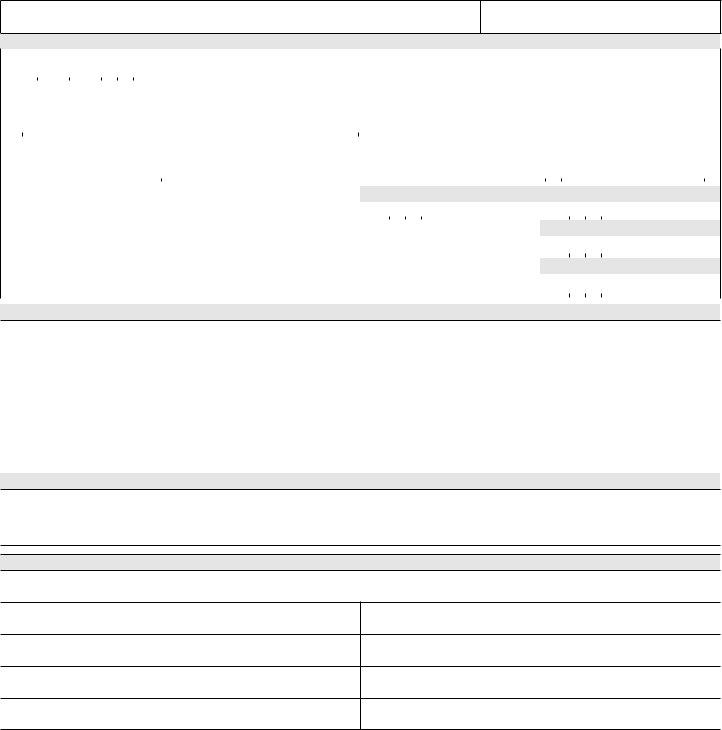

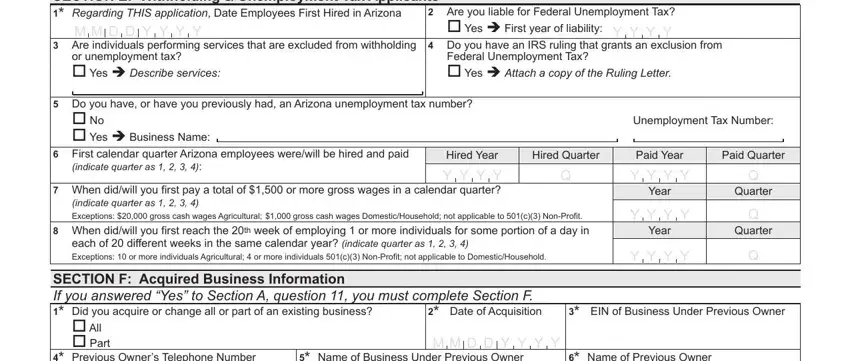

5. To conclude your document, the particular subsection has several additional fields. Typing in SECTION E Withholding, M M D D Y Y Y Y, Are individuals performing, or unemployment tax, Yes Describe services Do you, Hired Year, Are you liable for Federal, YYYY, Federal Unemployment Tax, Yes Attach a copy of the Ruling, Unemployment Tax Number, Hired Quarter, Paid Year, Paid Quarter, and indicate quarter as will certainly conclude everything and you'll certainly be done very fast!

Step 3: As soon as you have reviewed the information in the document, simply click "Done" to conclude your form at FormsPal. Sign up with us now and instantly gain access to jt1 application, set for download. All modifications made by you are preserved , which enables you to modify the form at a later stage if required. FormsPal provides safe document editing without personal data recording or distributing. Feel at ease knowing that your details are secure with us!