It is possible to complete kansas tag refund form effortlessly by using our online tool for PDF editing. The tool is constantly updated by our staff, receiving powerful functions and becoming much more versatile. Starting is easy! Everything you need to do is follow these easy steps directly below:

Step 1: Click on the "Get Form" button at the top of this page to get into our PDF editor.

Step 2: With the help of this online PDF editor, you're able to accomplish more than merely fill out blanks. Edit away and make your documents appear great with customized text added in, or fine-tune the original input to excellence - all comes along with an ability to insert your own graphics and sign the file off.

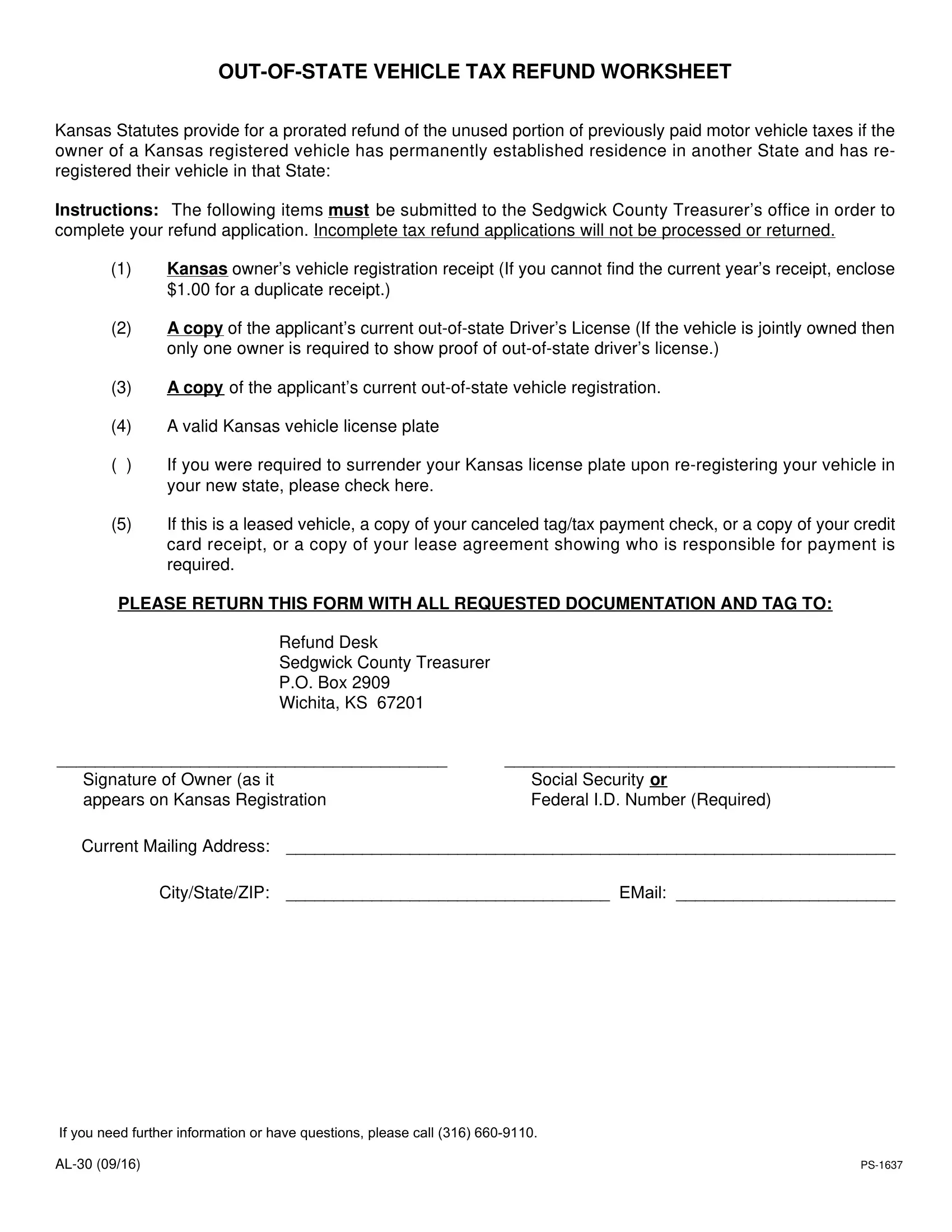

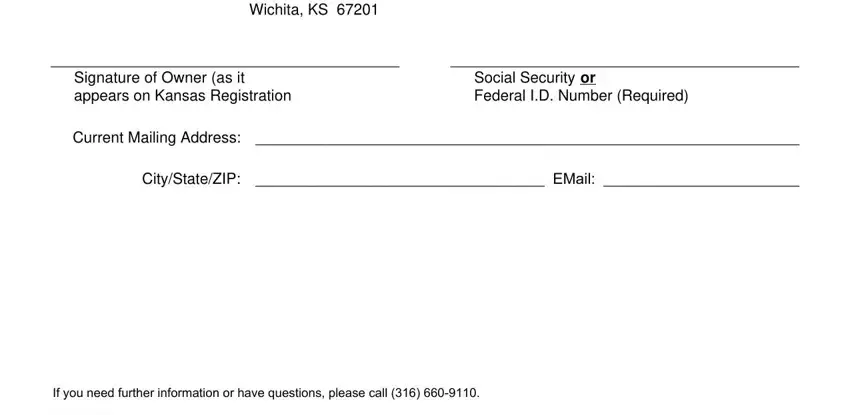

If you want to finalize this form, make sure that you enter the information you need in each and every blank:

1. It's very important to complete the kansas tag refund form correctly, therefore pay close attention when filling in the segments containing all these blanks:

Step 3: Prior to getting to the next stage, make certain that blank fields have been filled in the proper way. Once you’re satisfied with it, click on “Done." Sign up with us now and immediately use kansas tag refund form, prepared for download. Each and every change made is conveniently preserved , which means you can edit the file at a later time as required. FormsPal is invested in the privacy of all our users; we always make sure that all personal information coming through our editor remains confidential.