Whenever you need to fill out 40 kansas tax, you won't need to download any applications - just give a try to our online PDF editor. Our editor is consistently developing to deliver the very best user experience attainable, and that is thanks to our dedication to constant development and listening closely to customer comments. To get the process started, consider these basic steps:

Step 1: Hit the orange "Get Form" button above. It will open up our pdf editor so you can begin filling out your form.

Step 2: With this handy PDF editor, you're able to do more than simply fill in blank form fields. Try each of the functions and make your documents seem great with customized textual content put in, or adjust the original input to perfection - all that supported by an ability to insert your own photos and sign it off.

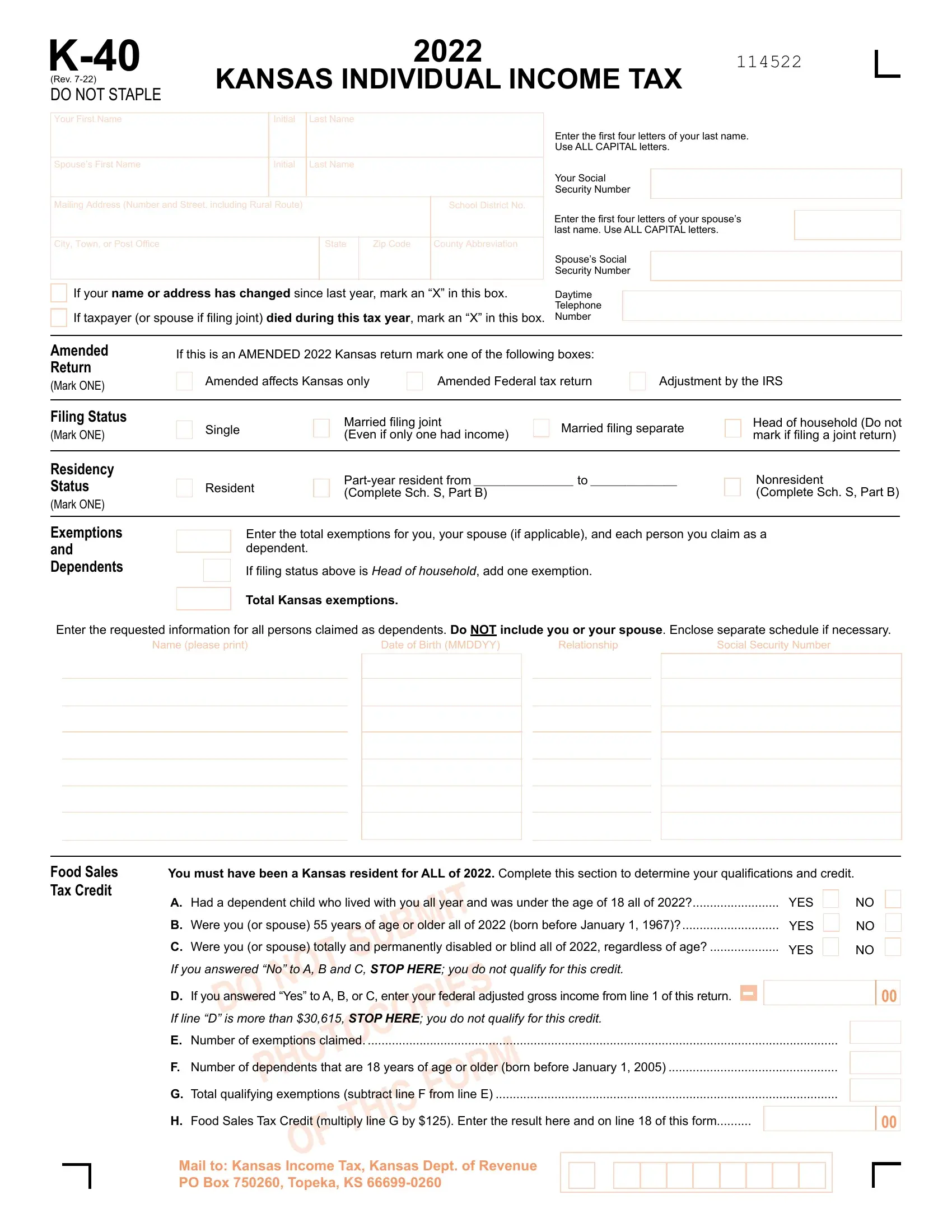

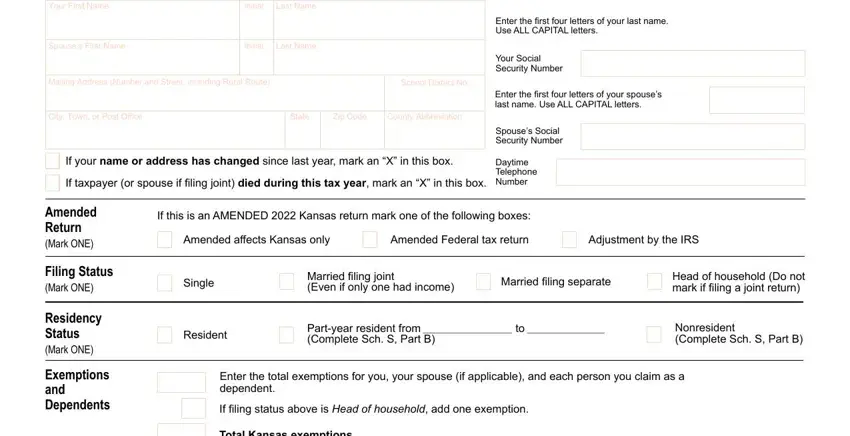

When it comes to blank fields of this particular form, here's what you want to do:

1. To get started, when filling out the 40 kansas tax, start in the area that contains the subsequent blanks:

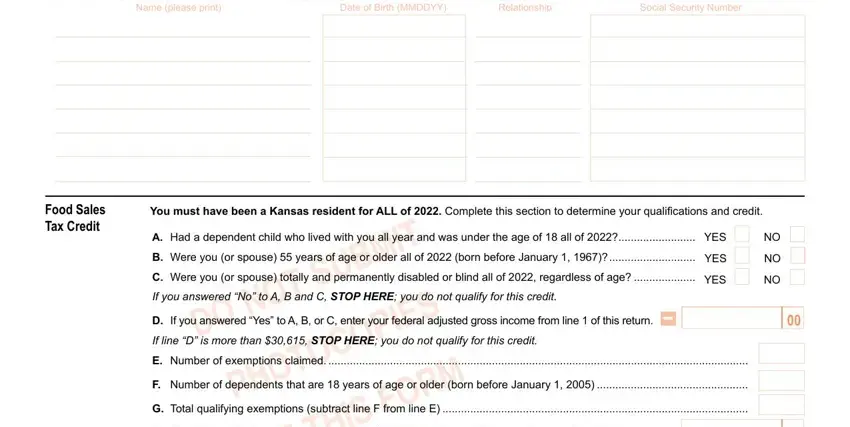

2. Right after completing the last part, go to the next part and fill in all required details in all these fields - Name please print, Date of Birth MMDDYY, Relationship, Social Security Number, Food Sales Tax Credit, You must have been a Kansas, A Had a dependent child who lived, YES, B Were you or spouse years of age, C Were you or spouse totally and, YES, YES, If you answered No to A B and C, D If you answered Yes to A B or C, and If line D is more than STOP HERE.

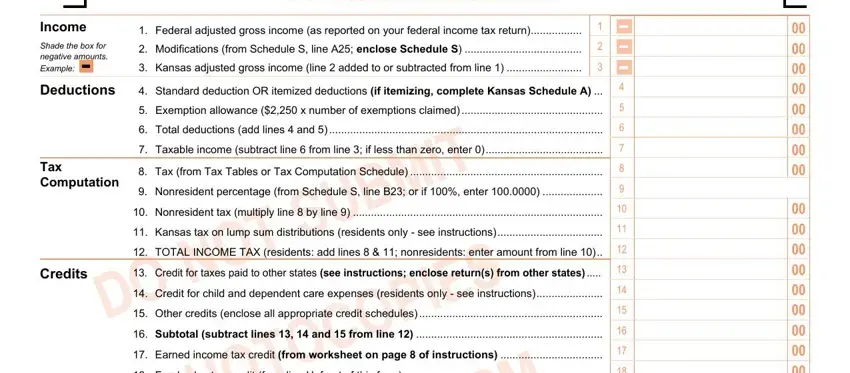

3. This next section should be pretty simple, ENTER AMOUNTS IN WHOLE DOLLARS ONLY, Income, Shade the box for negative amounts, Deductions, Tax Computation, Federal adjusted gross income as, Standard deduction OR itemized, Exemption allowance x number of, Total deductions add lines and, Tax from Tax Tables or Tax, Nonresident tax multiply line by, Credits, Credit for taxes paid to other, Credit for child and dependent, and Other credits enclose all - every one of these fields must be filled in here.

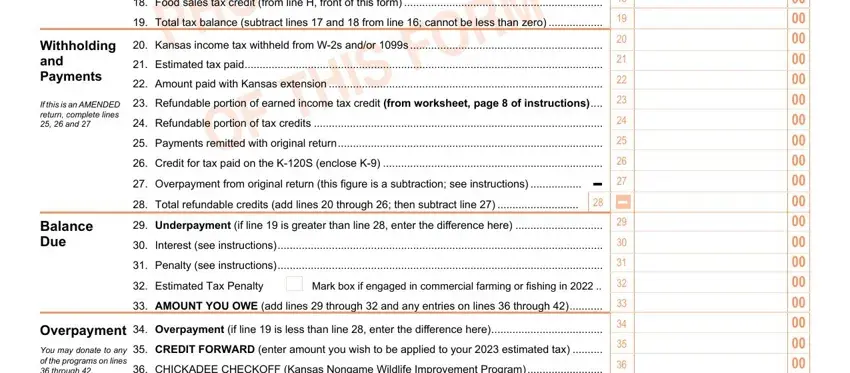

4. Filling out Withholding and Payments, If this is an AMENDED return, Balance Due, Overpayment, You may donate to any of the, Food sales tax credit from line H, Estimated tax paid Amount paid, Refundable portion of earned, Refundable portion of tax credits, Payments remitted with original, Interest see instructions, Penalty see instructions, Estimated Tax Penalty, Mark box if engaged in commercial, and AMOUNT YOU OWE add lines through is essential in this next part - don't forget to be patient and be mindful with every empty field!

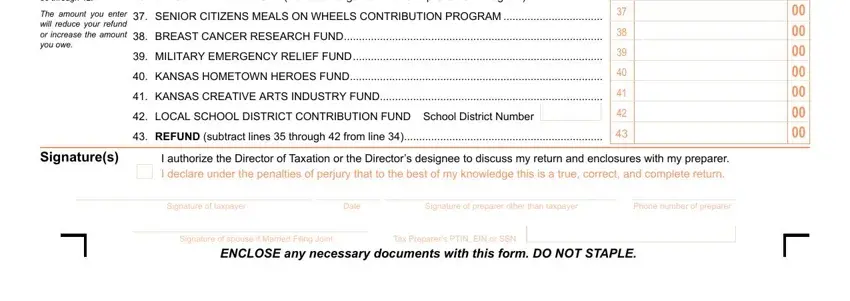

5. To wrap up your document, the particular part includes several additional fields. Filling in You may donate to any of the, The amount you enter will reduce, CREDIT FORWARD enter amount you, BREAST CANCER RESEARCH FUND, MILITARY EMERGENCY RELIEF FUND, LOCAL SCHOOL DISTRICT, REFUND subtract lines through, Signatures, I authorize the Director of, Signature of taxpayer, Date, Signature of preparer other than, Phone number of preparer, Signature of spouse if Married, and Tax Preparers PTIN EIN or SSN should wrap up the process and you'll be done very quickly!

Always be really attentive while completing Signature of taxpayer and LOCAL SCHOOL DISTRICT, because this is the part where a lot of people make errors.

Step 3: Prior to submitting this file, it's a good idea to ensure that all blanks are filled out properly. Once you think it's all good, click on “Done." Acquire the 40 kansas tax once you register at FormsPal for a free trial. Conveniently use the pdf from your FormsPal account, together with any modifications and changes being automatically kept! FormsPal is dedicated to the personal privacy of all our users; we always make sure that all information handled by our system continues to be confidential.