Through the online editor for PDFs by FormsPal, you are able to fill out or alter Kcmo Rd 110 Form right here. The tool is constantly improved by our team, getting powerful functions and growing to be greater. Starting is simple! All you should do is stick to the following basic steps below:

Step 1: Press the "Get Form" button above on this page to access our PDF editor.

Step 2: The editor offers you the capability to modify your PDF form in many different ways. Modify it by writing customized text, correct what's already in the PDF, and put in a signature - all doable in no time!

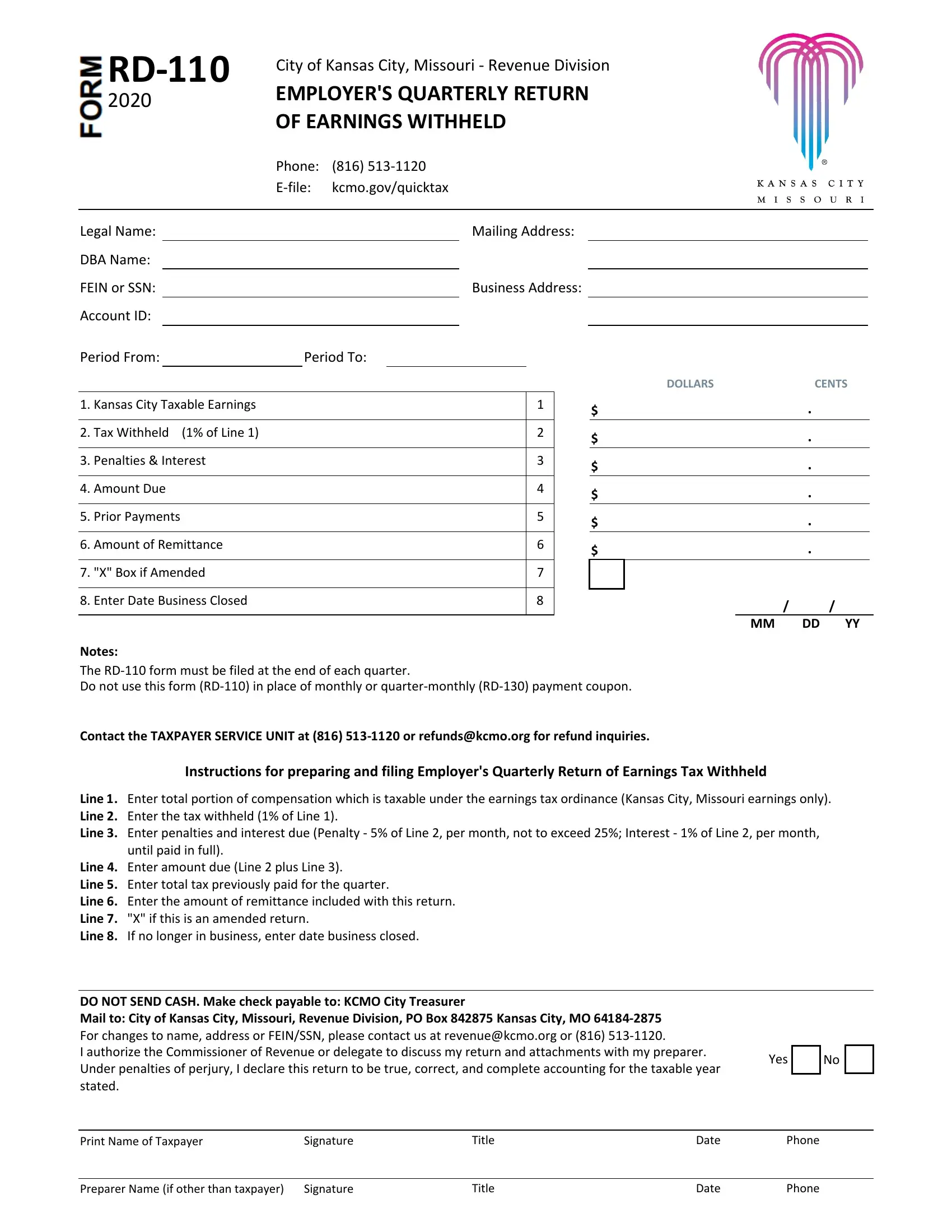

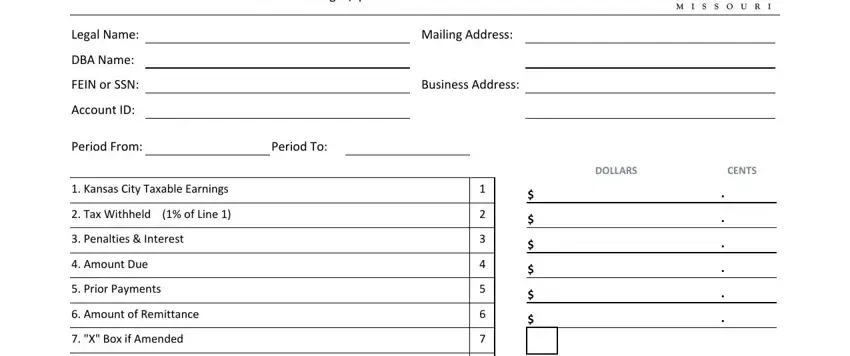

As a way to finalize this PDF form, be certain to type in the necessary information in every blank field:

1. Whenever completing the Kcmo Rd 110 Form, be certain to include all of the essential fields in the associated part. This will help to expedite the work, allowing for your details to be processed promptly and correctly.

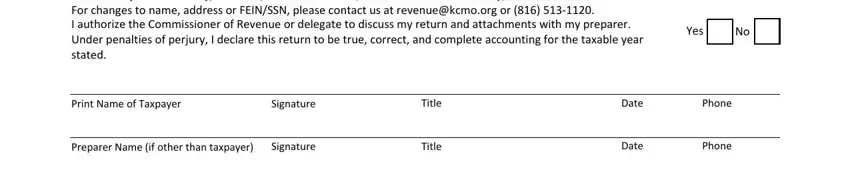

2. The next part would be to fill in all of the following blank fields: DO NOT SEND CASH Make check, Yes, Print Name of Taxpayer, Signature, Preparer Name if other than, Signature, Title, Title, Date, Date, Phone, and Phone.

As for Preparer Name if other than and Phone, be certain that you review things in this section. The two of these could be the key fields in this page.

Step 3: Look through all the details you've inserted in the blanks and then click on the "Done" button. Right after starting a7-day free trial account at FormsPal, it will be possible to download Kcmo Rd 110 Form or email it right off. The file will also be easily accessible from your personal account menu with your each edit. Whenever you work with FormsPal, it is simple to fill out documents without needing to get worried about information leaks or entries being distributed. Our secure platform ensures that your private data is kept safe.