Opening a bank account represents a pivotal step towards financial independence and the Karur Vysya Bank Ltd. extends a structured pathway through its M 325 Account Opening Form intended for resident individuals seeking to initiate either a savings or a current account on an individual or joint basis. Designed with user accessibility in mind, this document emphasizes the importance of filling out the application in capital letters with black ink to avoid any readability issues, ensuring that all mandatory fields marked with an asterisk are completed. With sections dedicated to personal details, including familial information and identification numbers like the Aadhaar and PAN, the form meticulously captures essential data to authenticate the identity of the account holder. Furthermore, it details the operational specifics of the account, such as initial payment methods and instructions for the account’s operation, ranging from single to joint management options. The inclusion of introducer’s details substantiates the applicant's credibility, while the segment on required services like cheque book issuance and e-mail statements customization underscores the bank’s commitment to cater to diverse banking needs. The form also incorporates provisions for nominating individuals to manage the account in unforeseen circumstances, alongside declarations that bind the applicant to the bank's terms and conditions, signifying a mutual agreement on operational dynamics. Additionally, a section dedicated to minor accounts provides a framework for guardians to control and oversee the financial transactions made by their wards, ensuring a protective measure is in place. Altogether, the Karur Vysya Bank’s Account Opening Form not only facilitates a seamless account setup process but also meticulously safeguards the interests of both the bank and its prospective customers through thorough data collection and clear terms of engagement.

| Question | Answer |

|---|---|

| Form Name | Kvb Account Opening Form |

| Form Length | 16 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min |

| Other names | kvb account opening online, karur vysya bank zero balance account opening online, karur vysya bank account opening online, karur vysya bank online account opening |

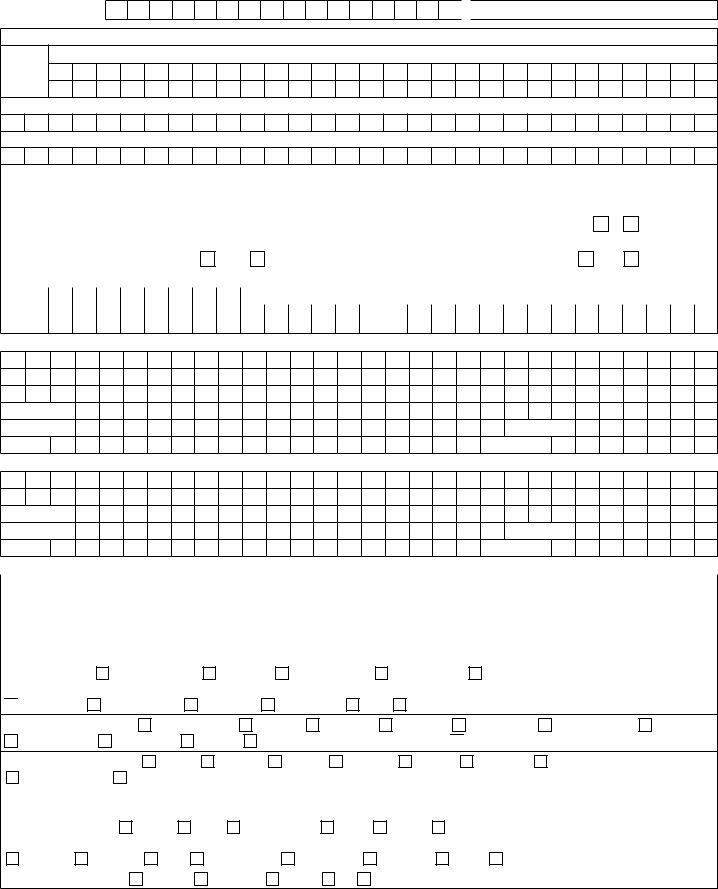

This is a machine readable form. Please avoid overwriting while illing the application

M 325

Account Opening Form

FOR RESIDENT INDIVIDUALS

FOR SAVINGS ACCOUNT (INDIVIDUAL/JOINT) AND CURRENT ACCOUNT (INDIVIDUAL)

To |

Branch address: |

|

The Branch Manager, The Karur Vysya Bank Ltd. |

||

|

||

Please open my /our account at your Branch. |

|

Please ill all the details in CAPITAL LETTERS and in BLACK INK only. Fields with * are MANDATORY.

FOR OFFICE USE ONLY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

DATE |

D |

D |

M |

M |

Y |

Y |

Y |

Y |

CUSTOMER IC* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CUSTOMER ID |

|

|

|

|

|

|

|

|

ACCOUNT NO.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ACCOUNT OPTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

Savings |

(Specify category) |

|

|

(Product No. _____) |

Current (Specify category) |

|

|

(Product No. _____) |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INDIVIDUAL DETAILS (DETAILS FOR JOINT APPLICANT TO BE GIVEN SEPARATELY)

Mr/ Ms

*

*NAME: INDIVIDUAL (IN THE ORDER OF FIRST, MIDDLE & LASTNAME) leave space between words. Eg. RAM GOPAL VARMA

*FATHER’S NAME

MOTHER’S NAME

SPOUSE NAME

AADHAAR ID:

PAN NO.:

FORM 60/61 (ENCLOSED)

Y N

DATE OF BIRTH* |

|

|

|

|

|

|

|

MINOR A/C |

|

MARITAL STATUS |

NATIONALITY* |

|

|

RELIGION |

|

GENDER* |

|

|

|||||||||||||||||||||

D |

D |

|

M |

|

M |

|

Y |

|

Y |

|

Y |

Y |

|

|

Y |

|

|

M |

UM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

F |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOBILE NO.:* |

|

|

|

|

|

|

|

|

|

|

|

|

EMAIL ID: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RES TEL |

|

S |

|

D |

|

C |

|

O |

|

D |

|

|

|

|

|

|

|

|

|

OFF TEL |

S |

D |

C |

O |

D |

|

|

|

|

|

|

|

|

|

|

||||

NO.: |

|

T |

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

NO.: |

T |

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

*MAILING ADDRESS: FIRST INDIVIDUAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY/TOWN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

DISTRICT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PINCODE |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

STATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTRY |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

PERMANENT ADDRESS (IF DIFFERENT FROM ABOVE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY/TOWN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

DISTRICT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PINCODE |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

STATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTRY |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

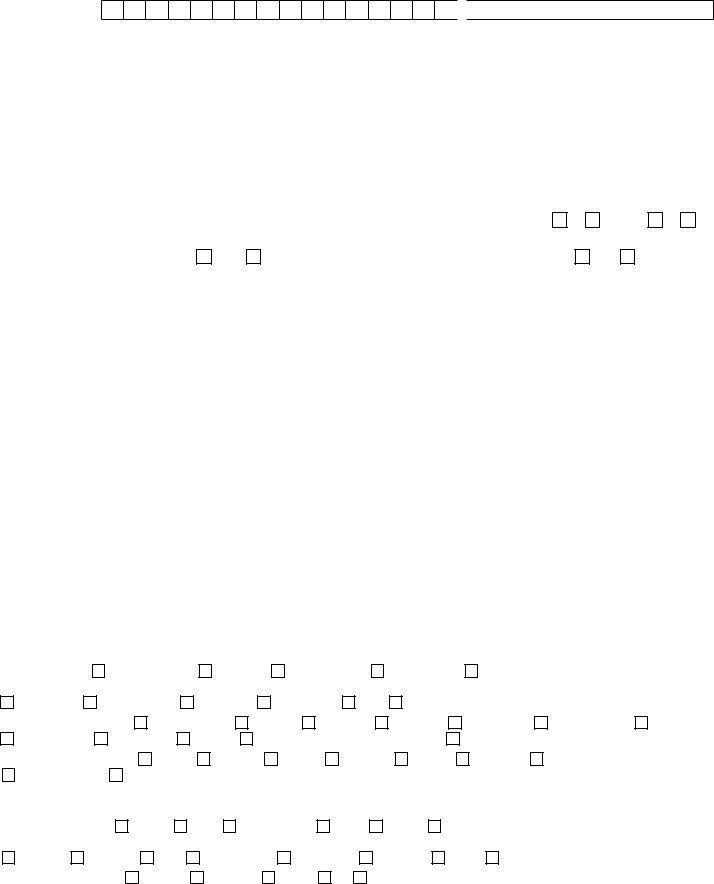

Note: For Joint holder/s additional SB Joint Applicant Form to be attached. |

1 of 12 |

|

IF MINOR ACCOUNT

Name of the Parent / Guardian ______________________________________________________________________________________________________________________________________________

Relationship |

Father |

Mother |

By Court order (enclose a copy) |

I shall represent the minor in all transactions of any description in the above account till the said minor attains majority. I shall fully indemnify the bank against any claim of the above minor for any withdrawal/transaction made by me in his/her account.

Signature of the Guardian

INITIAL PAYMENT DETAILS

`

`IN WORDS

Cash (Please make cash remittance only at the branch. Please do not handover cash to unauthorized persons)

OPERATING INSTRUCTIONS

Single |

Either or Survivor |

|

Former or Survivor |

|

any one or Survivor |

PA Holder By_______________________ |

||||||||||||||||||||||||||||||||||

Jointly by all |

|

|

|

|

Minor A/c Operated by Guardian |

|

Mandate Holder By_______________________________________ |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTRODUCER’S DETAILS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Introduction by existing KVB Account Holder. |

Introduction by existing Banker. |

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Introducer ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Account No.

I conirm that I personally know the applicant / s detailed herein for more than 6 months and conirm his/her/their identity and address.

_______________________________________________

Signature of Introducer

FOR BANK USE:

Name, Code and Signature of the Manager/Oficer who veriied the introducer’s signature.

SERVICES REQUIRED

1. |

CHEQUE BOOK FACILITY |

Yes |

No |

2. |

YES |

NO |

|

||

3. |

A/C STATEMENT FREQUENCY (CURRENT A/C) |

M |

Q |

HY |

Y |

|

|

||

4. |

CONSENT TO COMMUNICATE NEW PRODUCTS/OFFERS (THROUGH |

YES NO |

|||||||

Customer Signature

2 of 12

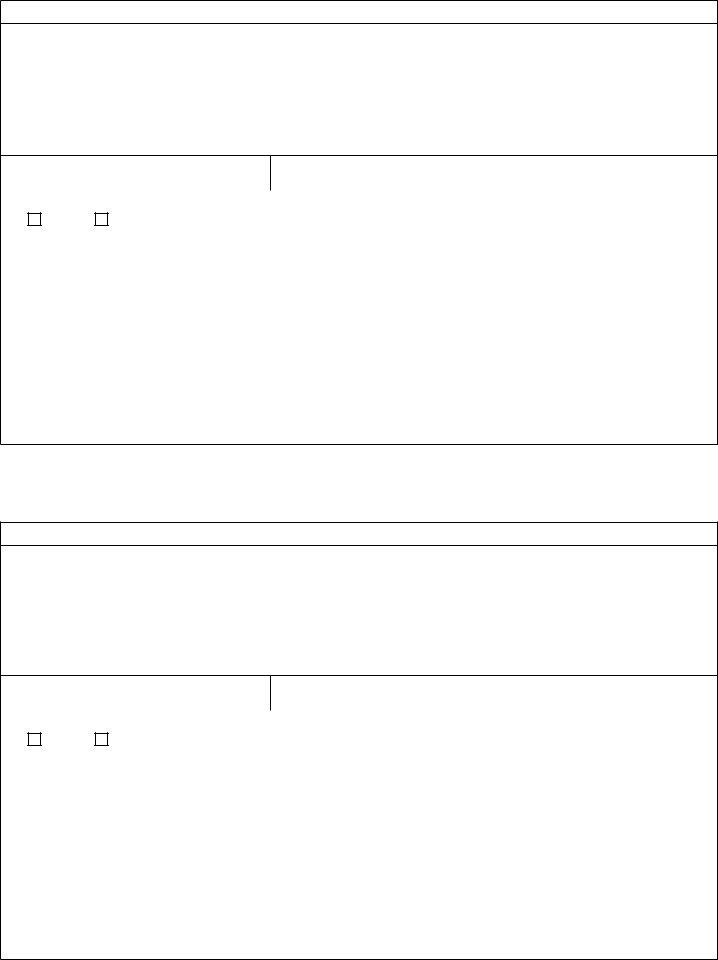

Applicant No. 1

Please paste colour photo

here. Please do not use pins,

staples or tape

ACCOUNT NO.:

Applicant No. 2 |

|

Applicant No. 3 |

Please paste colour photo |

|

Please paste colour photo |

here. Please do not use pins, |

|

here. Please do not use pins, |

staples or tape |

|

staples or tape |

|

|

|

Applicant No. 4

Please paste colour photo

here. Please do not use pins,

staples or tape

CUSTOMER ID |

CUSTOMER ID |

CUSTOMER ID |

CUSTOMER ID |

|

|

|

|

NAME: |

NAME: |

NAME: |

NAME: |

|

|

|

|

Signature (with seal) |

|

Signature (with seal) |

|

|

|

(USE BLACK INK AND SIGN WIThIN ThE BOx ONLY)

Signature (with seal)

Signature (with seal)

(Incase of LTI) |

Witness No. 1 |

|

|

|

|

Witness No. 2 |

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

____________________________________________ |

|

|

____________________________________________ |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

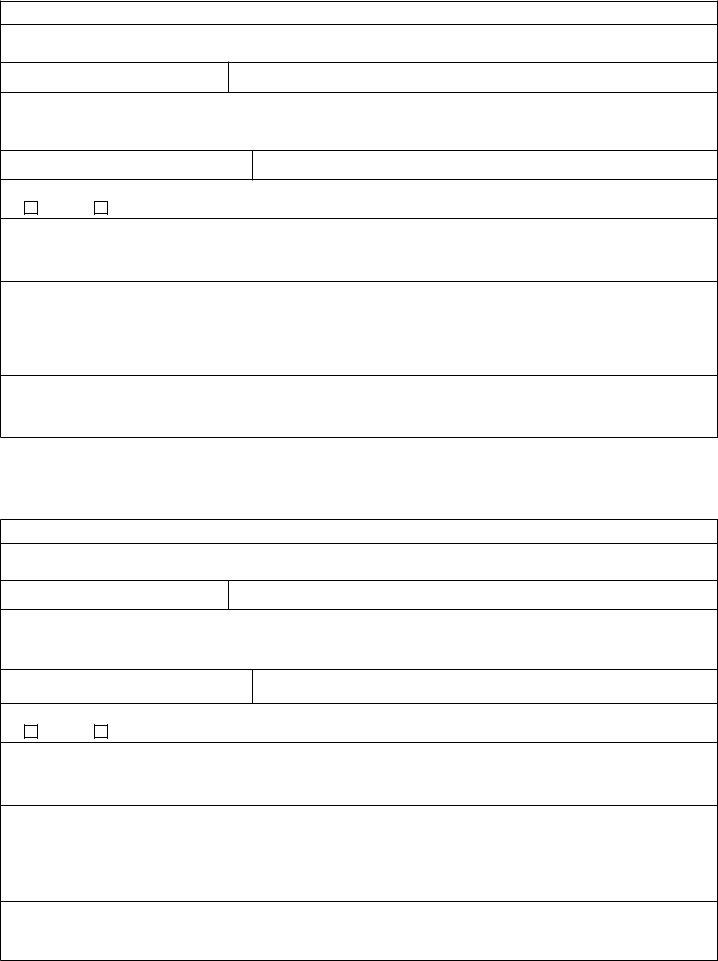

KYC AND RISK PROFILE CERTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPLICANT |

|

PROOF TYPE |

NAME OF THE DOCUMENT |

NUMBER |

|

|

|

ISSUE DATE |

|

|

EXPIRY DATE |

|||||||||||||||

|

NO. |

|

|

|

|

|

|

|

D |

D M M Y Y Y Y |

D D M M Y Y Y Y |

|||||||||||||||

1. |

IDENTITY PROOF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS PROOF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

IDENTITY PROOF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS PROOF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

IDENTITY PROOF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS PROOF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

IDENTITY PROOF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS PROOF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

We have perused the Original Documents and as per KYC norms all are correct. Further to know about the customer we have enquired locally and/or we |

||||||||||||||||||||||||||

personally visited the places of addresses given by the customer, to ascertain the correctness. All the signatories have signed before me. I authorize opening of |

||||||||||||||||||||||||||

the account. Also we certify that according to the nature of Business/activity, this account may be treated under the below selected risk category: |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

Expected level of turnover: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

RISK LEVEL |

LOW |

MEDIUM |

HIGH |

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

(In a quarter) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CANVASSED BY |

|

CODE NO.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

DATE: |

|

SIGNATURE OF ThE MANAGER |

||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 of 12 |

||

*PERSONAL INFORMATION OF ThE APPLICANT

NAME OF THE APPLICANT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NO. OF DEPENDENTS |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

FAMILY MEMBERS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOB |

|

|

|

|

|

|

|

RELATIONSHIP |

|

|

|

OCCUPATION |

|

|

|

|||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

QUALIFICATION |

|

|

UNDERGRADUATE |

|

GRADUATE |

|

|

|

POST GRADUATE |

|

PROFESSIONAL |

ILLITERATE |

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYED WITh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE GOVT |

|

CENTRAL GOVT |

PUBLIC LTD |

PRIVATE LTD |

MNC |

OTHER ENTITY (specify……………………………………) |

|

|

|

||||||||||||||||||||||||||||||||||||||||

NATURE OF BUSINESS |

|

|

|

MANUFACTURING |

|

TRADING |

SERVICES |

RETAILING |

|

|

AGRICULTURE |

|

MONEY SERVICES |

AGENCY |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

STOCK BROKER |

|

|

REAL ESTATE |

NGO/NPO |

|

|

JEWELS/GEMS/PRECIOUS METAL DEALER |

|

|

OTHERS (specify) _______________________ |

|

|

|

||||||||||||||||||||||||||||||||||||

TYPE OF PROFESSION |

|

|

|

|

DOCTOR |

|

ENGINEER |

|

BANKER |

|

TEACHER |

|

LAWYER |

ARCHITECT |

|

CONSULTANT |

|

|

|

||||||||||||||||||||||||||||||

IT PROFESSIONAL |

|

|

OTHERS (specify) _________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

ANNUAL INCOME |

|

|

|

|

|

|

|

|

|

|

SELF |

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE |

|

|

|

|

|

|

HOUSEHOLD |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

` |

|

|

|

|

|

|

|

|

|

|

|

` |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

ASSETS OWNED |

|

|

|

HOUSE |

CAR |

TWO WHEELER |

|

GOLD |

SILVER |

LAND |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

LOANS WITh OThER BANKS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

HOUSING |

BUSINESS |

|

CAR |

TWO WHEELER |

|

|

|

CREDIT CARD |

PERSONAL |

JEWEL |

PROFESSIONAL |

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

OThER INVESTMENTS |

|

DEPOSITS |

|

INSURANCE |

|

SHARES |

|

MF |

DEMAT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

SIGNATURE OF ThE ACCOUNT hOLDER/S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

NOMINATION REQUIRED: |

|

|

NO: I / We do not require Nomination facility: Signature ____________________________________ |

||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

YES (If yes submit Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

NOMINATION FORM |

|

|

|

NOMINATION UNDER SECTION 45ZA OF THE |

NOMINATION |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BANKING REGULATION ACT 1949 AND RULES (1) OF |

REGISTRATION NO. |

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THE BANKING COMPANIES (NOMINATION) RULES, |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1985 IN RESPECT OF BANK DEPOSIT. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

I/We_________________________________________________________________ nominate the following person to whom in the |

|||||||||||||||||||||||||||||||||||||||||||||||||

event of my/our/minor’s death, the amount of deposit in the account(s), particulars whereof are given below, may be returned by |

|||||||||||||||||||||||||||||||||||||||||||||||||

THE KARUR VYSYA BANK LTD. ____________________ in which the deposit is held. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

Account Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

NOMINEE NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOMINEE ID: |

|

|

|

|

|

|

RELATIONSHIP |

|

|

|

|||||||||||||

& AGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DOB OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

NOMINEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOMINEE PAN NO.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

2. As the nominee is a minor on this date, I/we appoint Shri/Smt./Kum.** |

NAME/S AND ADDRESS/ES OF THE WITNESS/ES* |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

_____________________________________________AGE____ |

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

_____________________________________________________ |

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

_____________________________________________________ |

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

_____________________________________________________ |

|

SIGNATURE/S OF THE WITNESS/ES |

SIGNATURE(S)/THUMB |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPRESSION(S) OF THE |

||||||||||||||||||||||||||||||||||||

(Name, address & age) to receive the amount of deposit on behalf of the |

1. |

|

|

|

|

|

|

|

|

|

|

|

DEPOSITOR(S)* |

|

|

|

|||||||||||||||||||||||||||||||||

nominee in the event of my/our minor’s death during the minority of the |

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

nominee. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

*Where the deposit is made in the name of a minor, the nominations should be signed by a person lawfully entitled to act on behalf of the minor. |

|||||||||||||||||||||||||||||||||||||||||||||||||

** Strike out if the nominee is not a minor. *. Thumb impression(s) shall be attested by two witnesses. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

PLACE __________________________________ |

|

|

|

|

|

|

|

|

|

|

DATE __________________________ |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: The acknowledgement for Nomination Registered is attached to the last sheet of the Account Opening Form.

4 of 12

ACCOUNT NO.:

DECLARATION

I/We have read and understood the Terms and Conditions (a copy of which I/we am/are in possession of ) governing the opening of an account with KVB and those relating to various services including but not limited to (a) ATMs (b) Anywhere Banking Convenience Plus. (2) I/We accept and agree to be bound by the said terms and conditions including those/limiting the Bank’s liability. (3) I/We understand that the Bank may, at its absolute discretion, discontinue any of the services completely or partly without any notice to me/us. (4) I/We agree that the Bank may debit my account for service charges as applicable from time to time. (5) I/We conirm that I/We am/are residents of India. (6) I/We agree to notify the Bank in future if I/We avail any credit facility from any other bank and I/We authorize you to inform the existence of our account with you to the lending banker. (7) I/We also abide by the terms and conditions of the bank for off line transactions. (8) I/We shall be liable to you for any monies owing to you from time to time in case the account is overdrawn and /debit balance is caused including your commission, interest and other incidental charges. (9) In the event of death or insolvency or withdrawal of any of us the survivor/s shall have full control of any monies standing to my/our credit in our account with you and the survivor/s will have full powers to operate the account / close the account. (10) I/We request and authorize you to honor all cheques and other orders drawn or bills of exchange accepted or notes made on our behalf, to debit such cheques to our account with you whether such accounts be for the time being in credit or overdrawn. (11) I/We also request you to accept the endorsement signed by me/us on cheques /orders/bills or notes payable to us. (12) The cheques/Bills presented by us in our account for collection are at our sole risk and responsibility and the bank may engage the services of courier/post ofice for sending the instruments for collection and the bank is not liable for any loss or damages in case the instruments are lost in transit. (13) I/We accept the Bank's right to take steps to close the account if frequent return of cheques for want of funds or any other undesirable feature is observed. (14) The loating rate of interest is subject to loating interest rate ixed by the bank from time to time and notiied by the bank and no separate intimation or notice will be given to the depositor. (15) Failure to maintain monthly/quarterly minimum average balance in the SB/CA attracts penal charges.

General: I/We have read the terms & condition of the Bank and pertaining to the Savings/Current accounts and anywhere banking,

Core Banking: (1) The Bank shall facilitate payment and collection of cheques through alI its branches while I/we shall have one account at the branch (for short "Home Branch") Bank shall also accept cash from me/us or my/our representatives and pay in cash against presentation of cheques drawn by me/us in favour of myself/ourselves or third party to the credit or debit to my/our designated account with the Home Branch as per the appIicable Iimits for the account. The cash transaction will be on the same lines as is the case when deposits/ withdrawals take place at the home branch. (2) While the instruments for and on my/our behalf will be collected in local clearing, the credit in respect of the proceeds, thereunder will be afforded at the home branch on and subject to realization at the respective centre(s)/branch(es). (3) The Bank will be entitled to debit by its home and any other branch(es) my/our account at its base branch against the cheques presented at various branches of the Bank. (4) My/our written intimation of "stop payment" to the various branches of the Bank will be at my/our risk and I/We agree to grant a lead time of at least 24 hours for intimation of such "stop payment" instruments to all its branches. In case of any erroneous information which may emerge due to any communication error and if the "stop payment" is not carried out in good faith based on the said information, the Bank shall not be held responsible for the said act. (5)I/We agree at any given time to maintain the average balance in my/our account as applicable for the account and informed to us by the Bank. In the event of my/our failing to maintain the minimum balance and for conduct of the account not being satisfactory, the Bank will at its discretion be entitled to forthwith terminate the facility hereby granted to me/us or to levy service charges as mutually agreed upon. (6) I/We agree to inform my/our existing bankers for the availment of any of the facilities hereby granted to me/us. I/We also agree from time to time to furnish such information/details and the documents to the existing bankers and also to the Bank as is mandatory under the law in force from time to time or as the Bank regards necessary and/ or expedient under the banking practice/procedure or to maintain the comity and

SIGNATURE OF ThE DECLARANT/APPLICANT

GUARDIANS DECLARATION (MINOR ACCOUNTS)

*My minor son/daughter, Master/Miss ……………………………………………......................................................................................….… has opened as SB Account with your bank with

A/c No. …………………………………………..… in his/her own name. I declare the date of birth of the minor is ……...../………./……….

*I have opened a joint SB A/c with your bank in the name myself and my minor son/daughter, Master/Miss …………….....................................................................................………. with

A/c No. …….......…………….…….....................……… I declare the Date of birth of the minor is…….../……../……........

*I am his/her natural and lawful guardian. *I am the guardian appointed by the court vide order dated……/….../….. (Copy enclosed).

For the sake of operational convenience, I have requested the bank to issue an ATM Debit Card to my minor son/daughter to be used by him/her. I will explain to the minor, the rules of operation of the account as well as safeguards to be followed while using ATM Debit Cards. I will suitably guide my son/daughter for the safekeeping of the ATM Debit card and maintaining the secrecy of PIN number allotted to him/her. I will also explain the consequences of loss/misuse/abuse of the ATM card. I undertake to supervise the use of the ATM debit card by the minor and the account would be operated under my guidance and I will monitor the transactions done through ATM. I will not hold the bank responsible and liable for any transactions done by the minor and I undertake not to make any claim against the Bank for consequences arising out of unauthorized use/misuse/abuse of the card. All the transactions done using the ATM Debit Card will bind me, as if done by me only.

SIGNATURE OF ThE GUARDIAN

*Strike out whichever is not applicable.

5 of 12

Terms & Conditions of EFT Executed in the RBI EFT SYSTEM (as per form

I/We am / are desirous of availing the Electronic Funds Transfer (EFT) through the RBI EFT System. In consideration of the bank agreeing to extend to me/us the said EFT facility, I/we hereby agree to and undertake the following terms and conditions.

1.Deinitions (a) “Customer” means the person named

4.Security procedure (a) For the purpose of agreement for security procedure, the bank may offer one or more or a new combination of one or more security device. (b) A security procedure once established by Agreement shall remain valid until it is changed by mutual agreement. 5. Rights and Obligations of Customer (a) The customer shall be entitled, subject to other terms and conditions in the Regulations and this Agreement to issue payment orders for execution by the bank. (b) Payment order shall be issued by the customer in the form annexed hereto, complete in all particulars. The customer shall be responsible for the accuracy of the particulars given in the payment order issued by him and shall be liable to compensate the bank for any loss arising on account of any error in his payment order. (c) The customer shall be bound by any payment order executed by the bank if the bank had executed the payment order in good faith and in compliance with the security procedure, Provided that the customer shall not be bound by any payment order executed by the bank if he proves that the payment order was not issued by him and that it was caused either by negligence or a fraudulent act of any employee of the bank. (d) The customer shall ensure availability of funds in his account properly applicable to the payment order before the execution of the payment order by the bank. Where however, the bank executes the payment order without properly applicable funds being available in the customer's account the customer shall be bound to pay to the bank the amount debited to his account for which on EFT was executed by the bank pursuant to his payment order, together with the charges including interest payable to the bank. (e) The customer hereby authorises the bank to debit to his account any liability incurred by him to the bank for execution by the bank of any payment order issued by him. (f) Customer agrees that the payment order shall become irrevocable when it is executed by bank. (g) Customer agrees that the bank is not bound by any notice of revocation unless it is in compliance with the security procedure. (h) Customer agrees that he shall not be entitled to make my claim against my party in the RBI EFT System except the bank. (i) Customer agrees that in the event of any delay in the completion of the Funds Transfer or any loss on account or error in the execution of the Funds Transfer pursuant to a payment order, the bank's liability shall be limited to the extent of payment of interest at the Bank Rate for my period of delay in the case of delayed payment and refund of the amount together with interest at the Bank Rate upto the date of refund, in the event of loss on account of error, negligence or fraud on the part of any employee of the Bank. (j) Customer agrees that no special circumstances shall attach to my payment order executed under the EFT facility under this Agreement and under no circumstances customer shall be entitled to claim any compensation in excess of that which is provided in clause

(9) above, for any breach of contract or otherwise.

Rights and Obligations of the Bank: 1. The bank shall execute a payment order issued by the customer duly authenticated by him as deined by the security procedure, unless

(a)The funds available in the account of the customer are not adequate or properly applicable to comply with the payment order and the customer has not made any other arrangement to meet the payment obligation. (b) The payment order is incomplete or it is not issued in the agreed form. (c) The payment order is attached with notice of any special circumstances.

(d)The bank has reason to believe that the payment order is issued to carry out an unlawful transaction. (e) The payment order cannot be executed under the RBI EFT System. 2. No payment order issued by the customer shall be binding on the bank until the bank has accepted it. 3. The bank shall, upon execution of every payment order executed by it, be entitled to debit the designated account of the customer, the amount of the funds transferred together with charges payable thereon, whether or not the account has suficient balance.

SIGNATURE OF ThE DECLARANT / APPLICANT

Current Account / Credit facility with other bank

I/We declare that I / We do not enjoy credit facilities with other bank/s.

I/We enjoy credit facility / have current account with other banks, details of which are furnished below: (If credit facility is enjoyed with other bank, NOC should be obtained and produced for opening the account)

Name of the Bank

Account No.

Facility

Amount

SIGNATURE OF ThE DECLARANT / APPLICANT

…….....……………............................................………………….…TEAR hERE…………………………………………………………………………......…..….

ACKNOWLEDGEMENT FOR NOMINATION REGISTRATION (TO BE RETURNED TO CUSTOMER AFTER REGISTRATION)

THE KARUR VYSYA BANK LIMITED

BRANCH ______________________

ACCOUNT NUMBER

NOMINEE NAME AND ADDRESS

RELATIONSHIP

REGISTRATION NO. AND DATE

MANAGER/OFFICER

6 of 12

Application for

For Individuals / Corporate

Please ill all the details in CAPITAL LETTERS and in BLACK INK only.

BRANCH NAME: ________________________________BRANCH CODE: __________DATE_______________

Photo

Please paste colour stamp size photo here. Please do not use pins, staples or tape.

CUSTOMER ID

ACCOUNT

NO.

I/We wish to apply for the following

FACILITY / SERVICES REQUIRED

ATM Card Debit Card Add on Card Alert (Mob /

Mr./ Ms/ Messers

ACCOUNT NAME : (IN THE ORDER OF FIRST, MIDDLE & LAST NAME) leave space between words.

Fill up the rows applicable to the facility requested

1.ATM/DEBIT CARD

(Name to appear on the card)

PHOTO CARD |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADD ON CARD : |

YES |

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

2. ADD ON CARD DETAILS |

|

|

|

|

|

CUSTOMER ID |

|

JOINT HOLDER |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ADD ON CARD (Name to appear on the card) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. ALERT: |

SMS / |

|

|

|

|

|

|

|

Customer ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile Number / |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ALERT: |

SMS/ |

|

|

|

|

|

|

|

Customer ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile Number / |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ALERT: |

SMS/ |

|

|

|

|

|

|

|

Customer ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mobile Number / |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

SMS: TRANSACTION TYPE – |

Debit |

|

Credit |

|

Balance |

|

|

Debit |

Credit |

Balance |

||||||||||||||||||||||||||||||||||||||||||||

AUTHORISED USER NAME – 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(For Alert) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

AUTHORISED USER NAME – 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(For Alert) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

AUTHORISED USER NAME – 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(For Alert) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

4. MOBILE BANKING – |

|

|

|

|

|

9 |

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

HANDSET MAKE – MODEL (Eg.: NOKIA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

AUTHORISED USER NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(For Mobile banking – |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5. NET BANKING : |

Retail – |

|

RSA TOKEN (Optional and charges are applicable) |

|||||||||||||||||||||||||||||||||||||||||||||||||||

Corporate – |

Fin |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

AUTHORISED USER NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(F/ NF) |

|

Maker / Checker |

|

|

|

|

Limit (`) |

||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

I/We conirm that the mandate from the competent |

authority has been obtained for the corporate user(s) for |

operating our |

accounts and transaction |

through internet |

||||||||||||||||||||||||||||||||||||||||||||||||||

banking services of KVB. The copy of the resolution is enclosed. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURE OF ThE ACCOUNT hOLDER/S

7 of 12

DECLARATION