You may fill in Lcmw 811 Form effectively in our PDF editor online. FormsPal development team is always working to enhance the tool and insure that it is much easier for users with its many features. Take your experience to a higher level with constantly growing and exciting options available today! This is what you'd want to do to start:

Step 1: Simply click on the "Get Form Button" above on this page to get into our pdf editor. Here you will find everything that is needed to fill out your file.

Step 2: The tool provides you with the ability to change your PDF in a range of ways. Change it by adding your own text, correct original content, and include a signature - all within the reach of a couple of mouse clicks!

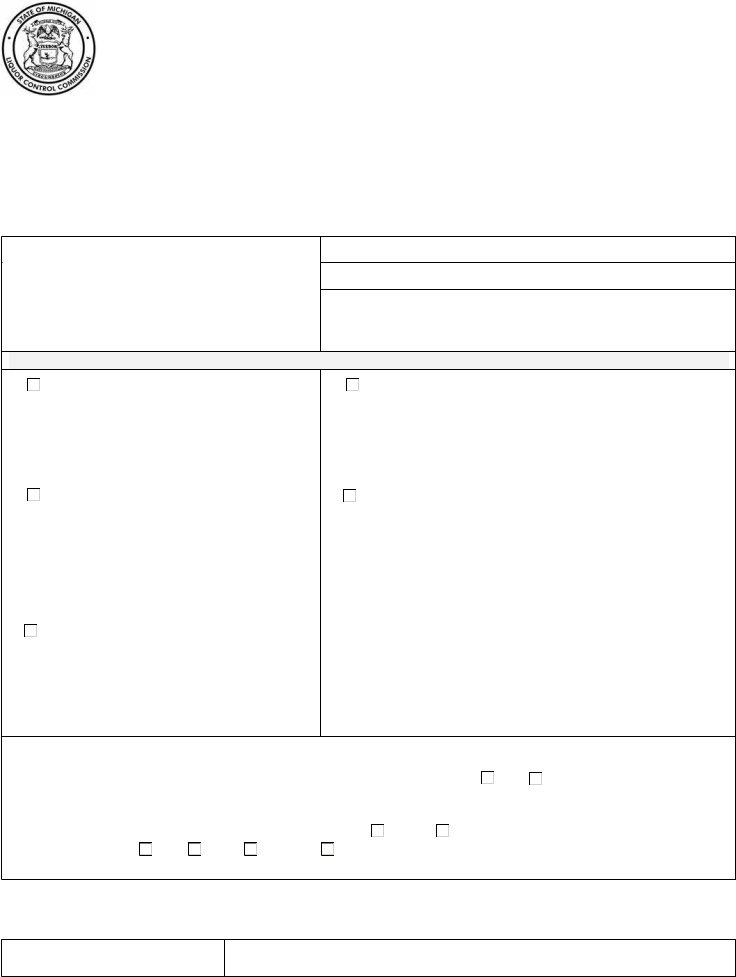

This form will require particular details to be entered, therefore you should definitely take the time to provide what is expected:

1. You will need to complete the Lcmw 811 Form accurately, hence be careful while working with the sections containing these particular blank fields:

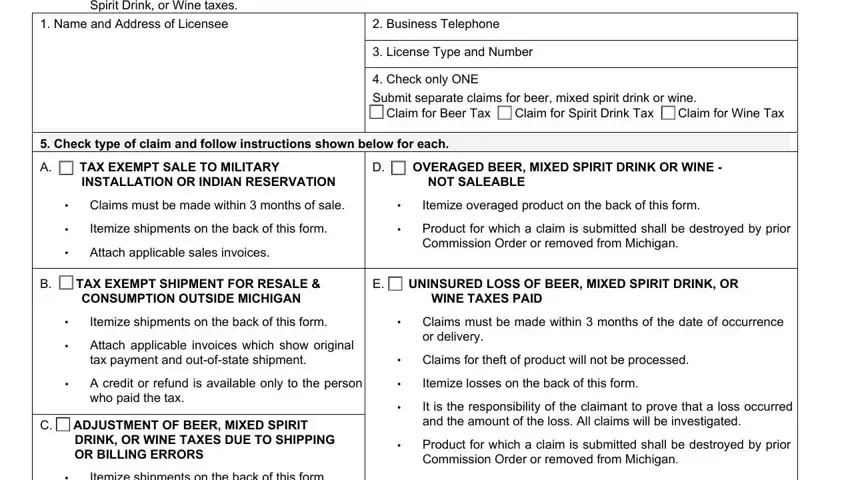

2. Just after the previous part is done, go to enter the suitable information in these - If you checked UNINSURED LOSS OF, Was the loss or damage incurred, Yes No, Was the product in your, I swear that all of the, Signature Title Date, LCMW Rev Authority MCL, and LARA is an equal opportunity.

3. Within this part, look at SIZE, BOTTLES, BARRELS OF BEER, TOTAL TAX PAID, INVOICE NUMBER, and DATE. Each one of these need to be completed with highest accuracy.

Always be extremely careful when filling in INVOICE NUMBER and TOTAL TAX PAID, since this is the section in which a lot of people make some mistakes.

4. Filling out is crucial in the next step - ensure that you take your time and fill in each blank area!

Step 3: Ensure your information is right and then just click "Done" to proceed further. Sign up with FormsPal right now and easily obtain Lcmw 811 Form, available for download. All adjustments you make are preserved , allowing you to modify the document later if needed. FormsPal ensures your information privacy by using a protected system that never records or shares any kind of private information typed in. Rest assured knowing your documents are kept safe every time you work with our services!