Using PDF files online can be surprisingly easy with this PDF tool. Anyone can fill in R-1111 here and try out various other functions we provide. Our tool is consistently evolving to give the very best user experience attainable, and that is because of our dedication to continuous development and listening closely to feedback from customers. If you're seeking to get going, this is what it requires:

Step 1: Just hit the "Get Form Button" above on this webpage to open our form editing tool. This way, you will find everything that is needed to work with your document.

Step 2: After you launch the file editor, you will see the form prepared to be filled out. Aside from filling in different blank fields, you might also do other actions with the form, that is adding custom textual content, modifying the original text, inserting images, putting your signature on the document, and much more.

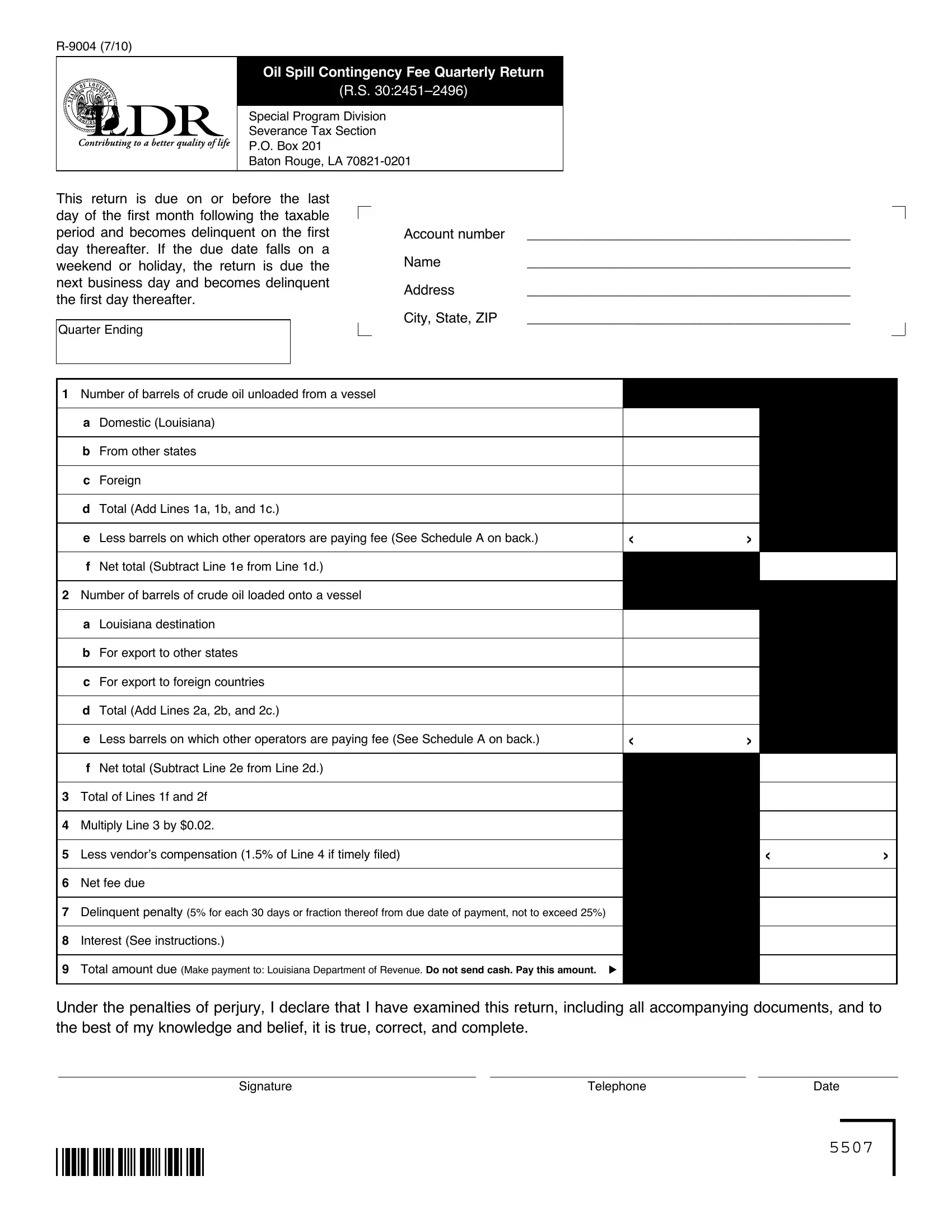

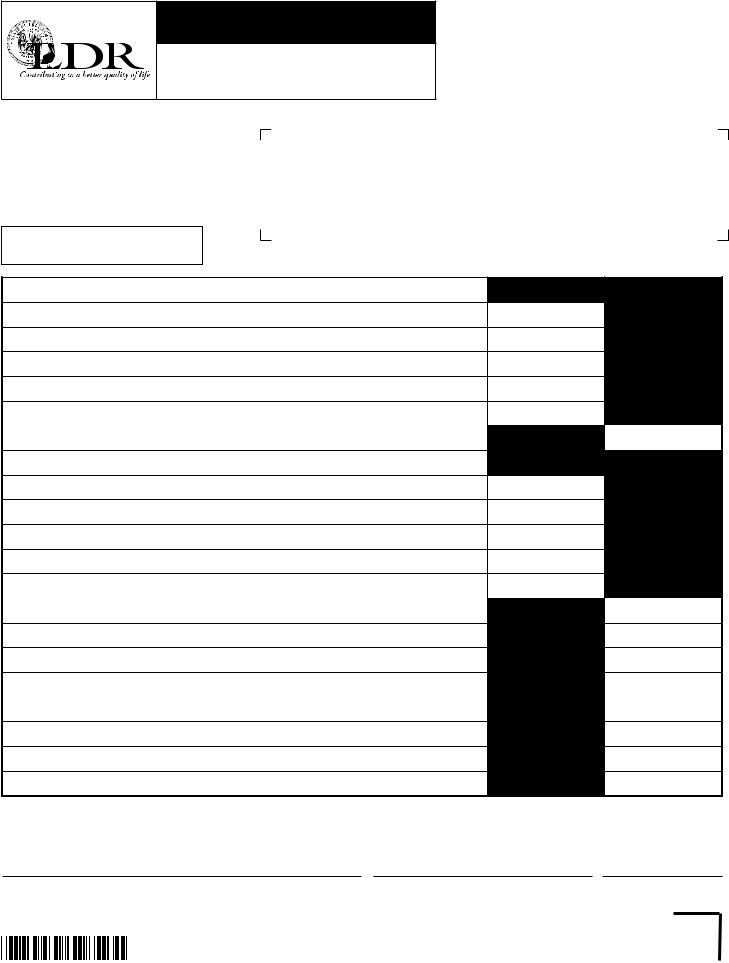

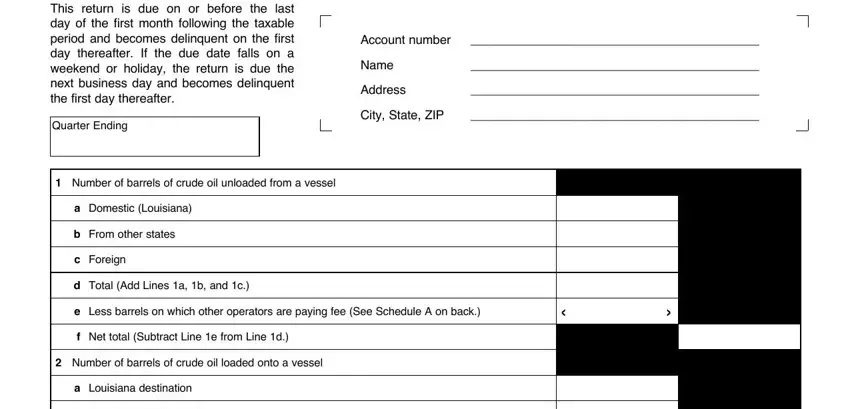

This PDF will require particular data to be typed in, thus make sure you take whatever time to type in exactly what is expected:

1. Fill out your R-1111 with a group of necessary fields. Consider all the information you need and ensure nothing is missed!

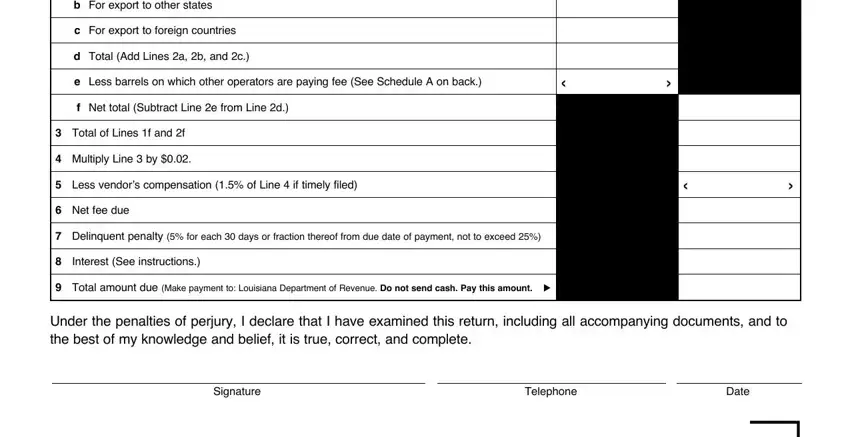

2. Once your current task is complete, take the next step – fill out all of these fields - b For export to other states, c For export to foreign countries, d Total Add Lines a b and c, e Less barrels on which other, f Net total Subtract Line e from, Total of Lines f and f, Multiply Line by, Less vendors compensation of, Net fee due, Delinquent penalty for each, Interest See instructions, Total amount due Make payment to, Under the penalties of perjury I, Signature, and Telephone with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is easy to get it wrong when completing your Less vendors compensation of, therefore make sure you reread it prior to deciding to send it in.

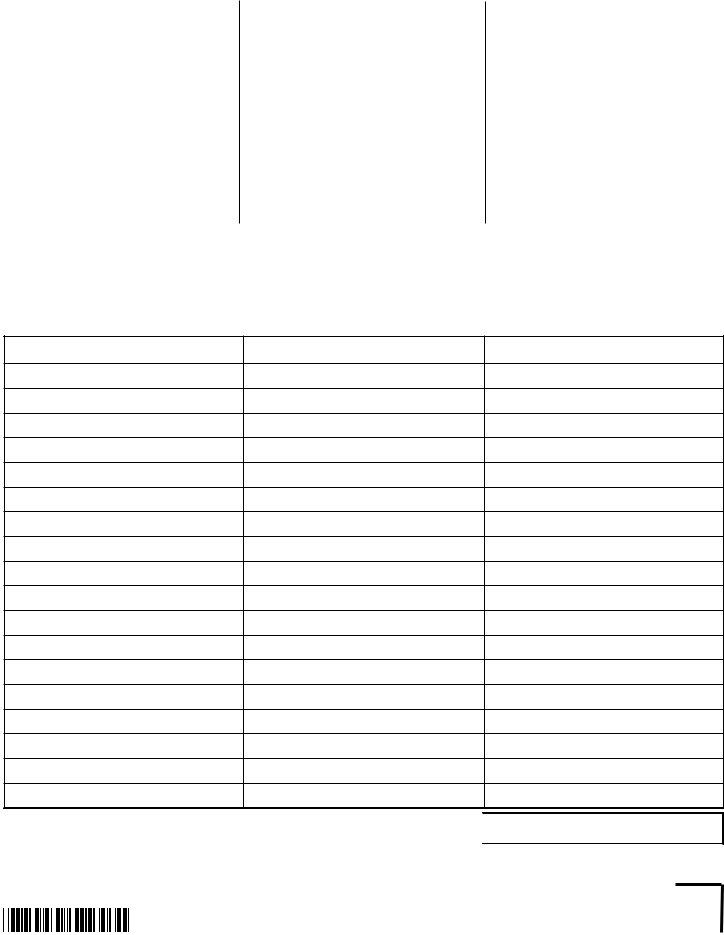

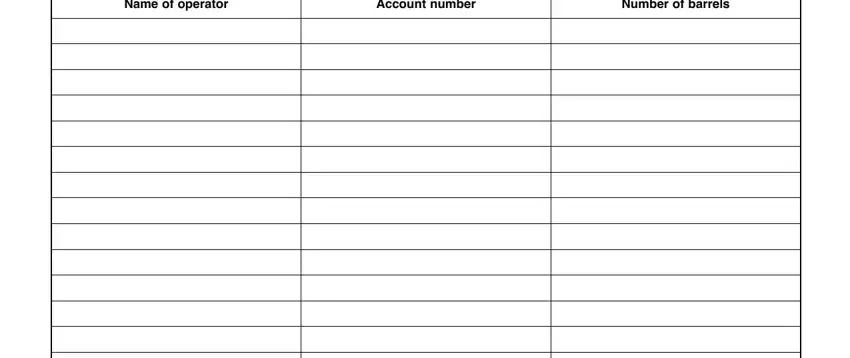

3. Completing Name of operator, Account number, and Number of barrels is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

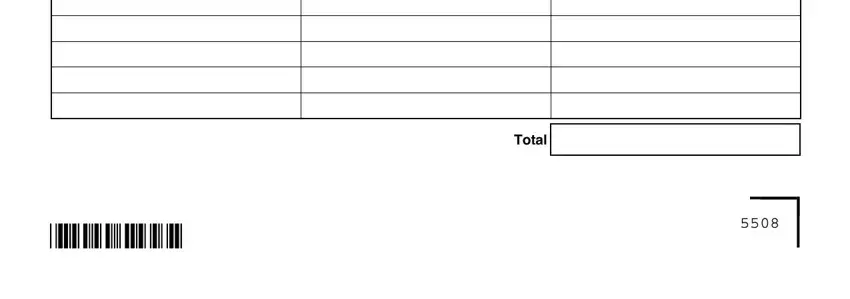

4. This fourth subsection comes with these fields to complete: Total.

Step 3: Check everything you've entered into the blank fields and click on the "Done" button. Grab the R-1111 as soon as you register at FormsPal for a 7-day free trial. Conveniently view the form from your personal account page, along with any modifications and adjustments being conveniently synced! At FormsPal, we do everything we can to ensure that all your details are maintained protected.