louisiana solar energy tax credit can be filled in effortlessly. Simply use FormsPal PDF editor to do the job in a timely fashion. Our editor is consistently developing to present the very best user experience attainable, and that is because of our resolve for continual improvement and listening closely to feedback from customers. Starting is effortless! What you need to do is stick to the following easy steps down below:

Step 1: Press the orange "Get Form" button above. It will open up our pdf tool so that you can begin filling in your form.

Step 2: This tool enables you to work with PDF forms in a range of ways. Transform it by writing customized text, adjust what's originally in the PDF, and include a signature - all doable in no time!

This form will require you to provide specific details; to ensure accuracy, be sure to pay attention to the next tips:

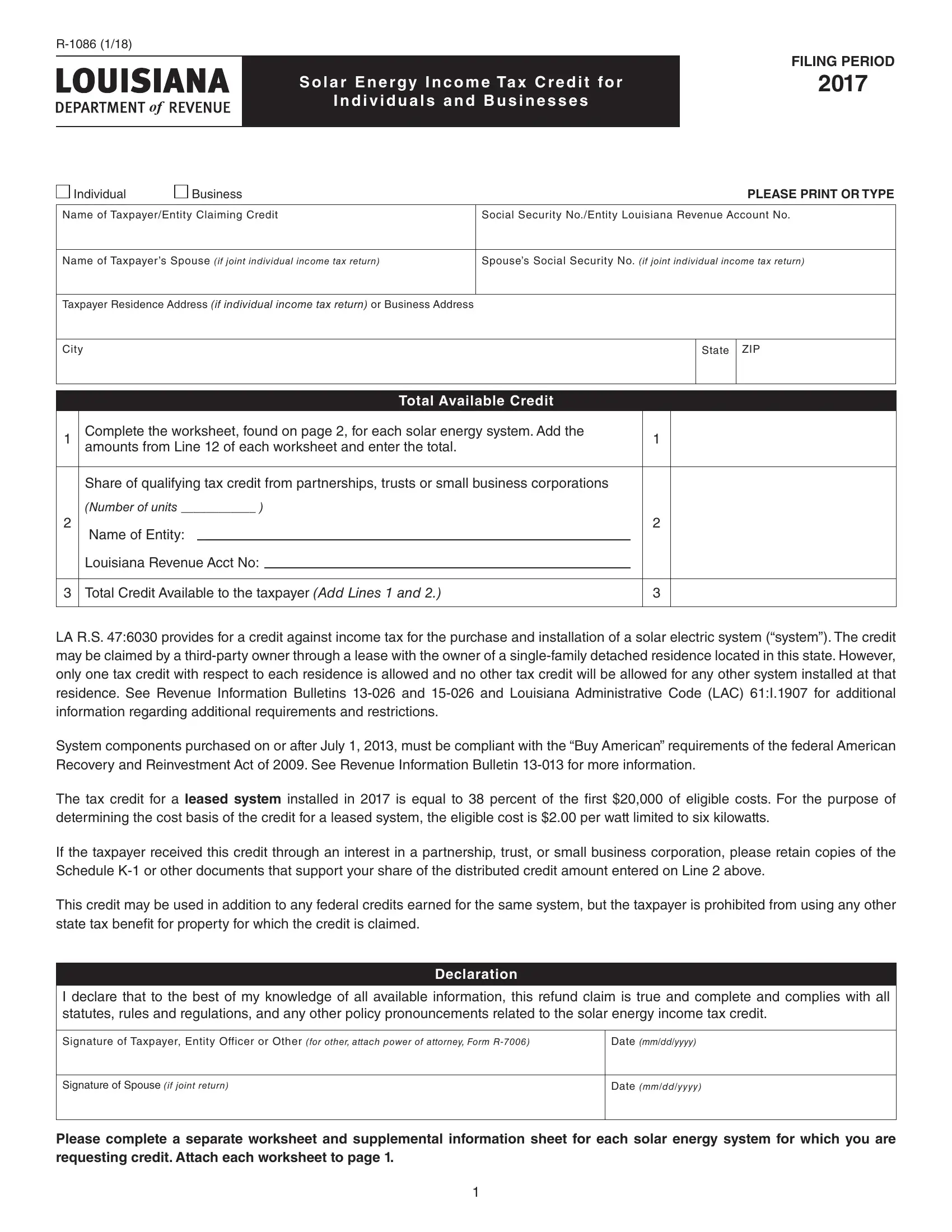

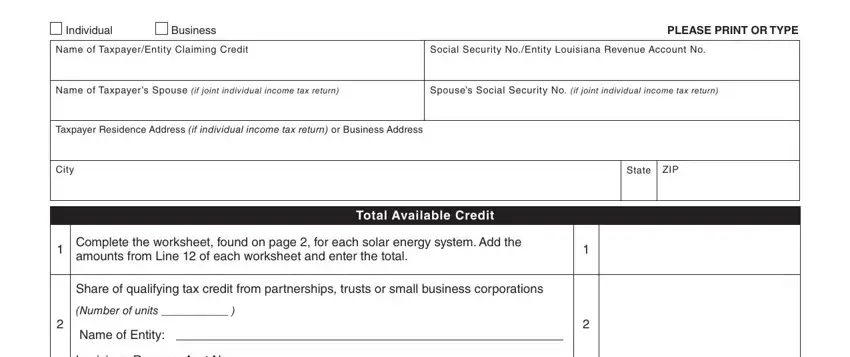

1. The louisiana solar energy tax credit involves certain information to be entered. Ensure that the following fields are complete:

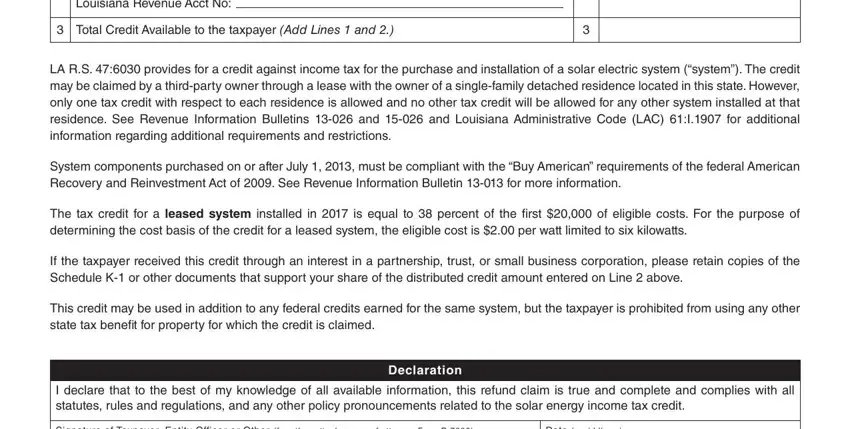

2. Just after the previous section is done, go to type in the applicable details in all these - Louisiana Revenue Acct No, Total Credit Available to the, LA RS provides for a credit, System components purchased on or, The tax credit for a leased system, If the taxpayer received this, This credit may be used in, I declare that to the best of my, Signature of Taxpayer Entity, Date mmddyyyy, and Declaration.

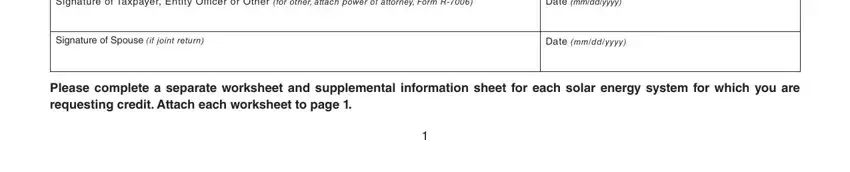

3. This subsequent segment is considered relatively easy, Signature of Taxpayer Entity, Date mmddyyyy, Signature of Spouse if joint return, Date mmddyyyy, and Please complete a separate - every one of these form fields must be filled out here.

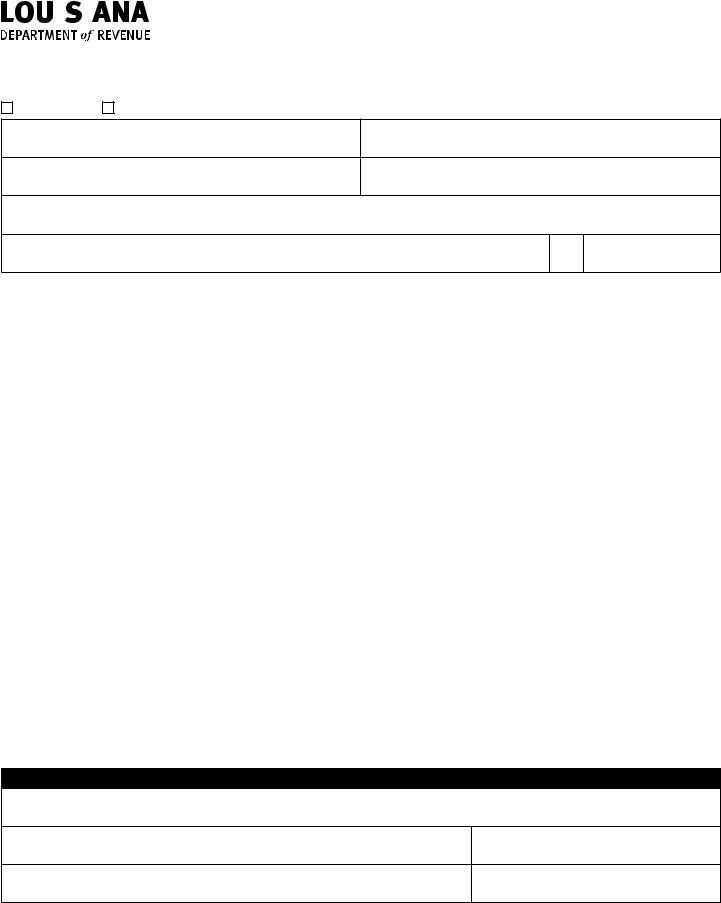

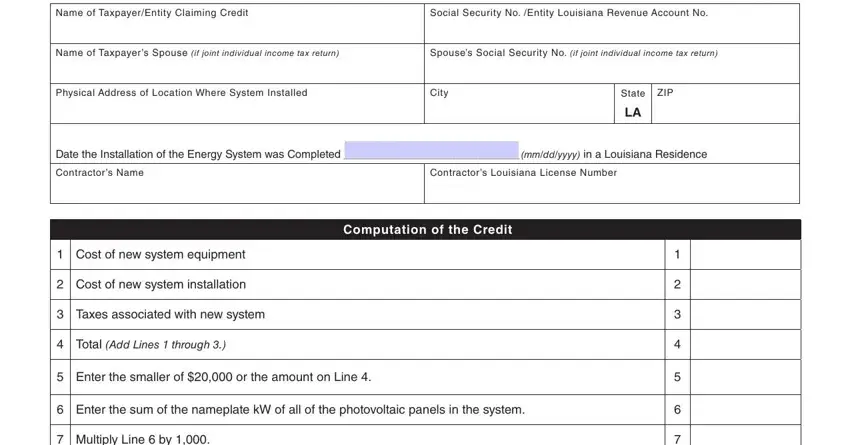

4. Your next paragraph will require your involvement in the subsequent parts: PLEASE PRINT OR TYPE, Name of TaxpayerEntity Claiming, Social Security No Entity, Name of Taxpayers Spouse if joint, Spouses Social Security No if, Physical Address of Location Where, City, State, ZIP, Date the Installation of the, Contractors Name, Contractors Louisiana License, Computation of the Credit, Cost of new system equipment, and Cost of new system installation. Remember to fill in all needed info to move onward.

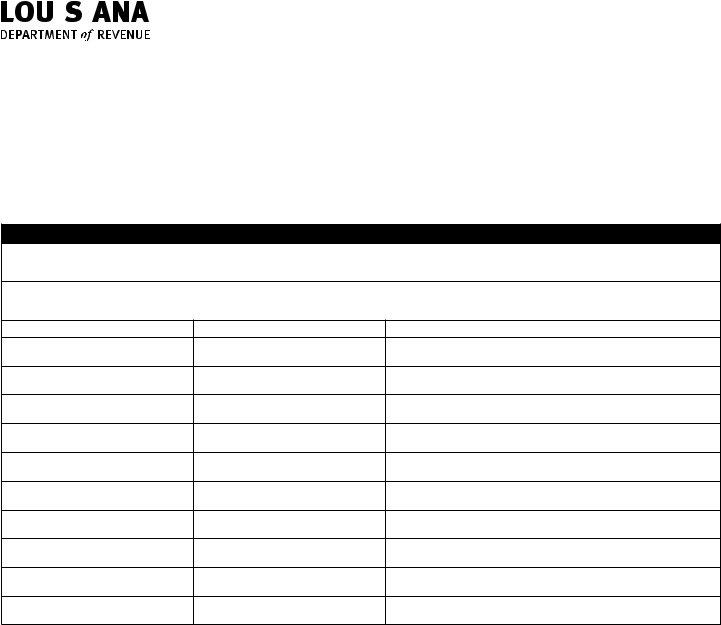

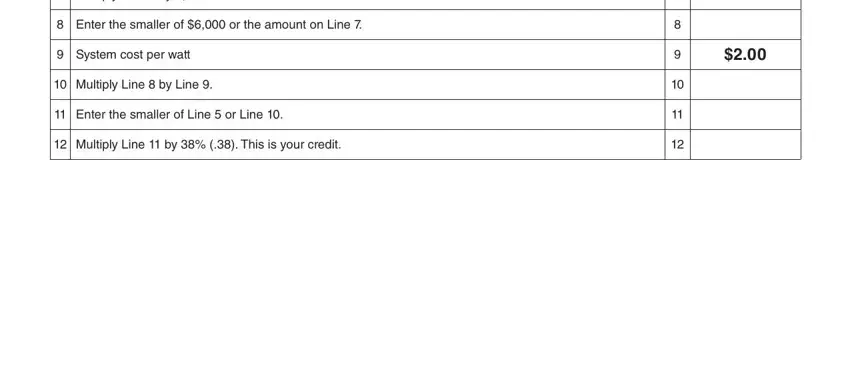

5. Since you get close to the conclusion of the file, you'll find a few more requirements that should be fulfilled. Mainly, Multiply Line by, Enter the smaller of or the, System cost per watt, Multiply Line by Line, Enter the smaller of Line or, and Multiply Line by This is your should be filled out.

People generally get some points wrong while completing Multiply Line by in this section. Be sure to review whatever you enter right here.

Step 3: Make certain your information is right and then just click "Done" to progress further. Join us right now and easily get access to louisiana solar energy tax credit, all set for download. Each and every change you make is conveniently saved , helping you to customize the document at a later point if required. When you work with FormsPal, it is simple to fill out forms without needing to get worried about data breaches or records being distributed. Our secure system helps to ensure that your private data is stored safely.