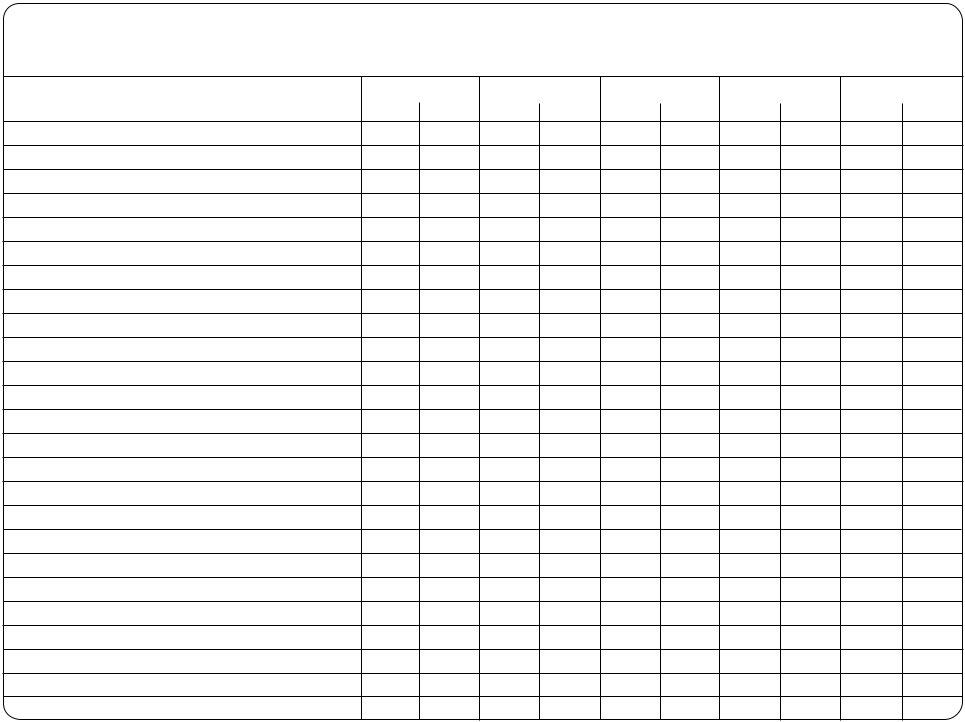

At the heart of every business's financial management practices lies the Ledger Debit Credit form, a fundamental document designed to meticulously record transactions in a double-entry accounting system. This form not only serves as a linchpin in organizing financial data but also plays a critical role in the creation of key financial statements such as the trial balance, income statement, and balance sheet. The form methodically categorizes each transaction into debits and credits, encapsulating a comprehensive record of a company's financial activities including cash flow, accounts receivable, and payable, among others. Moreover, it extends its utility to adjusting entries that refine preliminary figures, ensuring the accuracy of financial reports. By encompassing a wide array of financial attributes such as office supplies, equipment, depreciation, and even net income, the Ledger Debit Credit form provides an indispensable tool in assessing the financial health and operational success of a business, thereby guiding strategic decision-making.

| Question | Answer |

|---|---|

| Form Name | Ledger Template Debit Credit Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | fill in blanks debit the and credit the, ADJUSTED, UNEARNED, fillable debit and credit totaling sheet |

BY

PREPARED DATE

______________________________________________

_______________________________________________________

TRIAL BALANCE |

ADJUSTMENTS |

ADJUSTED TRIAL |

INCOME STATEMENT |

BALANCE SHEET |

|||

BALANCE |

|||||||

|

|

|

|

|

|||

|

|

|

|

|

|

||

DEBIT CREDIT |

DEBIT CREDIT |

DEBIT |

CREDIT DEBIT CREDIT |

DEBIT |

CREDIT |

||

CASH

ACCOUNTS RECEIVABLE

UNEXPIRED INSURANCE

OFFICE SUPPLIES

OFFICE EQUIPMENT

ACCUMULATED DEPRECIATION: OFFICE EQUIPMENT

NOTES PAYABLE

ACCOUNTS PAYABLE

UNEARNED COMMISSIONS

CAPITAL

DRAWING

FEES EARNED

ADVERTISING EXPENSE

RENT EXPENSE

SALARIES EXPENSE

TELEPHONE EXPENSE

INSURANCE EXPENSE

OFFICE SUPPLIES EXPENSE

DEPRECIATION EXPENSE: OFFICE EQUIPMENT

COMMISSIONS EARNED

INTEREST EXPENSE

INTEREST PAYABLE

SALARIES PAYABLE

FEES RECEIVABLE

NET INCOME