Only a few things can be easier than preparing documents using the PDF editor. There is not much you need to do to modify the form long term claim form - only adopt these measures in the following order:

Step 1: Seek out the button "Get Form Here" and select it.

Step 2: You'll notice all the functions you can undertake on the file after you've entered the form long term claim editing page.

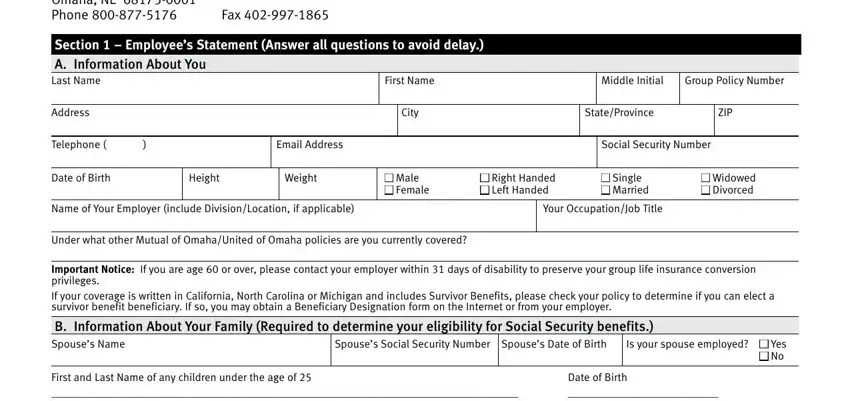

Please type in the following information to create the form long term claim PDF:

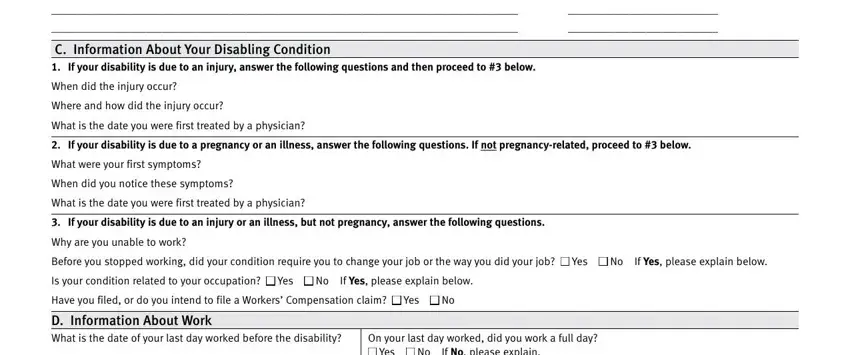

Note the information in C Information About Your Disabling, When did the injury occur, Where and how did the injury occur, What is the date you were first, If your disability is due to a, What were your first symptoms, When did you notice these symptoms, What is the date you were first, If your disability is due to an, Why are you unable to work Before, D Information About Work What is, and On your last day worked did you.

Identify the most significant details of the MUGA, Page of, and Form continued on Page part.

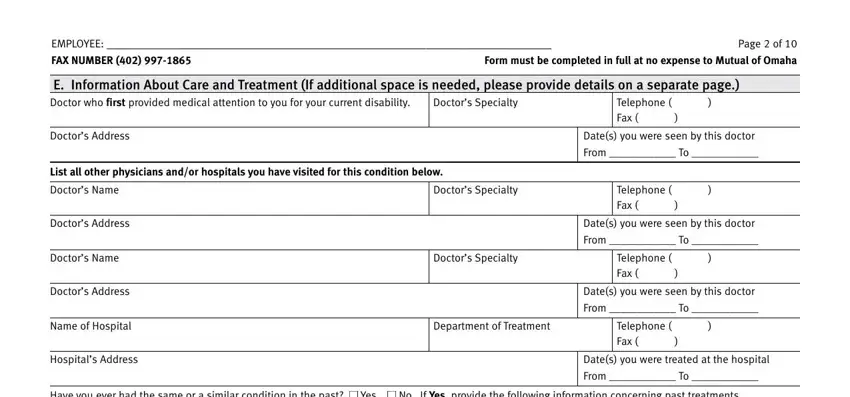

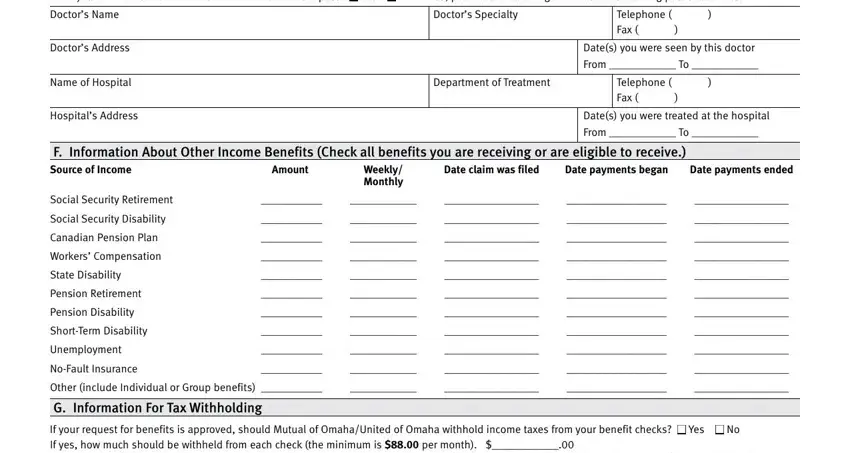

It's essential to spell out the rights and responsibilities of every party in field EMPLOYEE FAX NUMBER, Form must be completed in full at, Page of, E Information About Care and, Doctors Specialty, Telephone Fax, Doctors Address, List all other physicians andor, Doctors Name, Doctors Address, Doctors Name, Doctors Address, Name of Hospital, Hospitals Address, and Doctors Specialty.

End by reading the next fields and submitting the required information: Have you ever had the same or a, Doctors Specialty, Telephone Fax, Doctors Address, Name of Hospital, Hospitals Address, Department of Treatment, Dates you were seen by this doctor, From To, Telephone Fax, Dates you were treated at the, From To, F Information About Other Income, Date payments began, and Date claim was filed.

Step 3: Press the button "Done". The PDF file may be exported. You can easily download it to your computer or email it.

Step 4: Create duplicates of the form - it can help you prevent future difficulties. And don't worry - we cannot share or check the information you have.