Due to the goal of making it as effortless to apply as possible, we generated this PDF editor. The entire process of preparing the form 1000a los angeles can be very simple in the event you consider the following steps.

Step 1: Pick the button "Get Form Here".

Step 2: It's now possible to alter your form 1000a los angeles. Our multifunctional toolbar will allow you to add, erase, adapt, and highlight content material or perhaps perform several other commands.

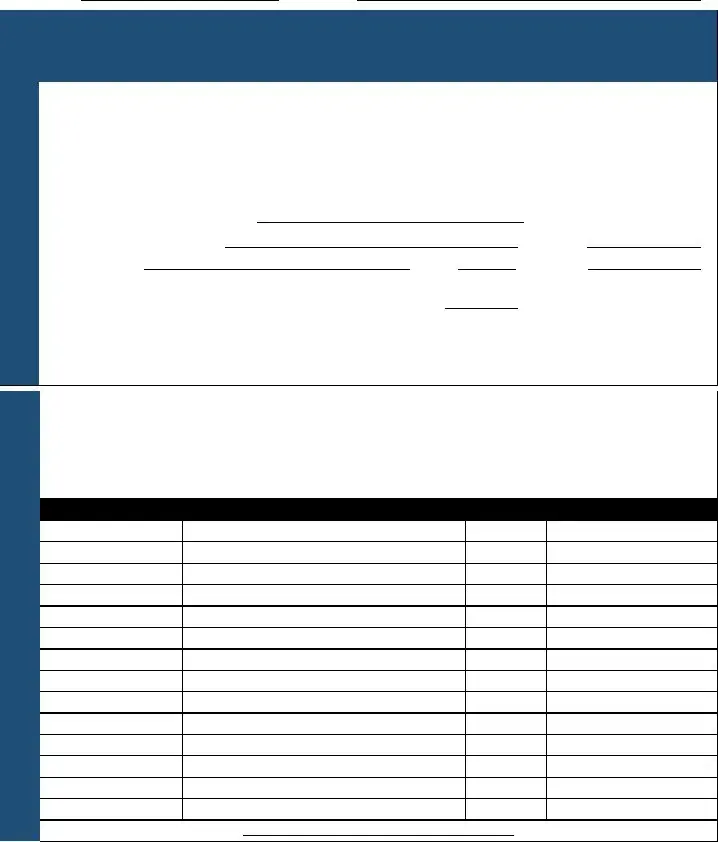

These sections will help make up the PDF document:

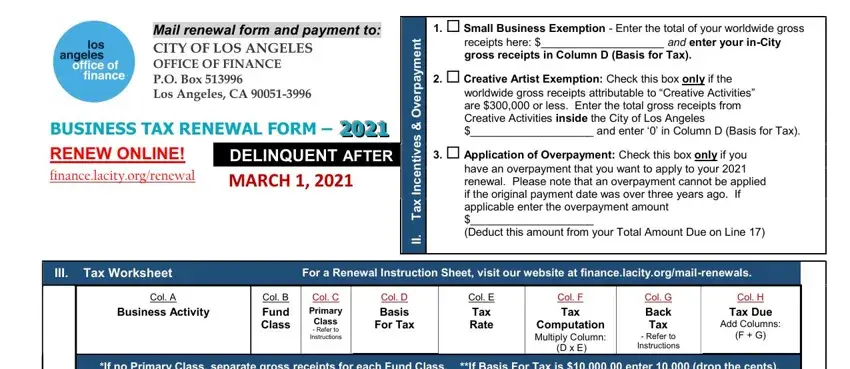

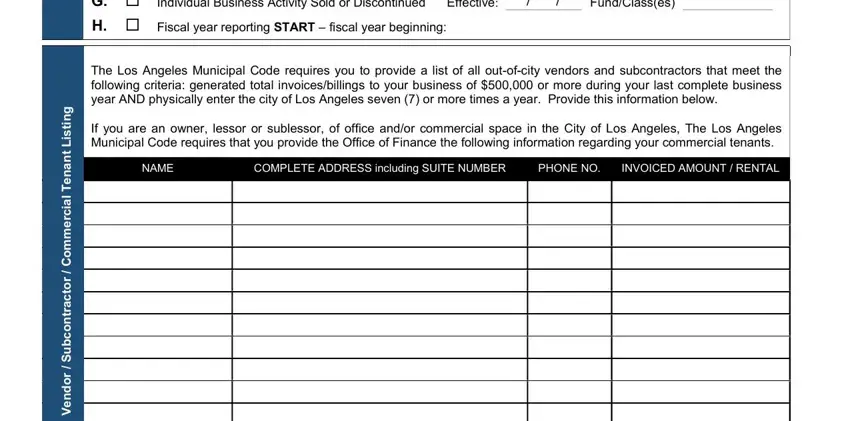

Jot down the data in If no Primary Class separate gross, CA STATE FEE AB, Only include the N fee in Line if, Late Payment, Total Amount Due, Add Lines through in Column H, Total Tax Due, Interest If paid after March, Add Lines through, KNOWLEDGE THE INFORMATION PROVIDED, s I DECLARE UNDER PENALTY OF, Print Name, Signature, Phone No, and Title.

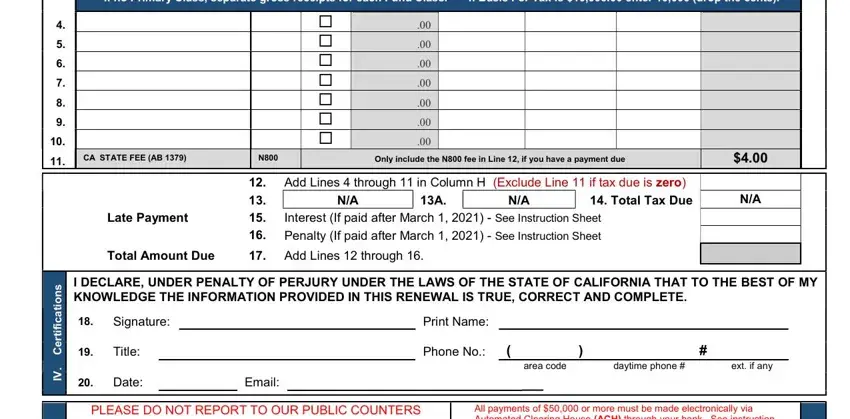

You'll be expected to note the data to let the application prepare the area n o i t a m r o f n, r e y a p x a T, Change of Information Check this, MAKE CHECK PAYABLE TO Office of, Payment Type, Check, Money Order, ACH, Payment Type RETURN CHECK FEE, Please note that if a payment is, GO GREEN, Sign up for paperless statements, n o i t a m r o f n, t n e m y a P, and PLEASE MAKE A COPY FOR YOUR RECORDS.

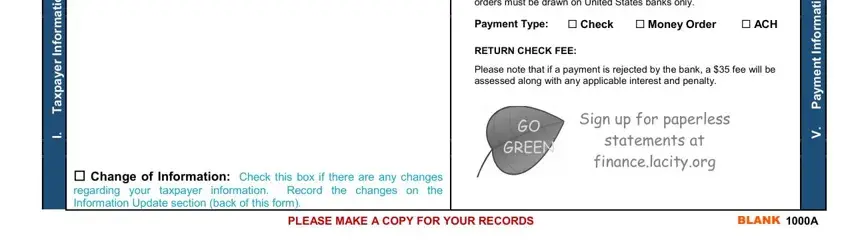

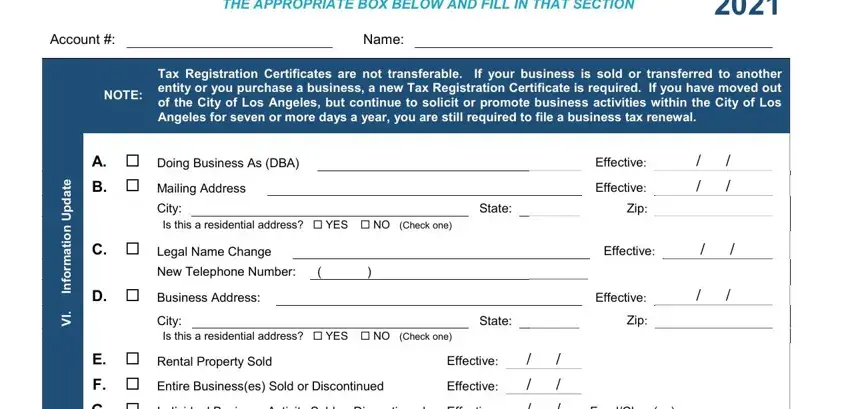

The THE APPROPRIATE BOX BELOW AND FILL, Account, Name, NOTE, Tax Registration Certificates are, e t a d p U n o i t a m r o f n, A Doing Business As DBA B, State, C Legal Name Change, New Telephone Number, D Business Address, City Is this a residential address, State, Effective, and Effective segment will be applied to list the rights or obligations of each party.

Finish by reading the next fields and typing in the relevant details: g n i t s L t n a n e T, a c r e m m o C, r o t c a r t n o c b u S, r o d n e V, E Rental Property Sold F Entire, Individual Business Activity Sold, Effective, FundClasses, The Los Angeles Municipal Code, If you are an owner lessor or, NAME, COMPLETE ADDRESS including SUITE, PHONE NO, and INVOICED AMOUNT RENTAL.

Step 3: Press the "Done" button. Now you can export your PDF file to your electronic device. In addition, you can send it by means of email.

Step 4: Have a minimum of two or three copies of your form to remain away from different future problems.

11.

11.