A Guide for Successfully Completing the

Group Long-Term Disability Claim Form

Mutual of Omaha appreciates the opportunity to provide you with valuable income protection. We rely on the information you provide on this form to effectively determine if you qualify for group long-term disability benefits.

This guide provides information and instruction to help you successfully complete and submit the claim form. Please consult your employer/benefits administrator if you need assistance in providing information for the form.

IMPORTANT TIPS FOR PAPER COPY SUBMISSION

nPrior to submission, make sure all required information is provided and all questions have been answered completely and accurately. If information is missing or is illegible (unreadable), the processing of your form will be delayed.

nRefer to the guidelines for each section below, which provide valuable information to help you successfully complete the form.

nMake a copy of the completed form for your records before submitting it to Mutual of Omaha/United of Omaha.

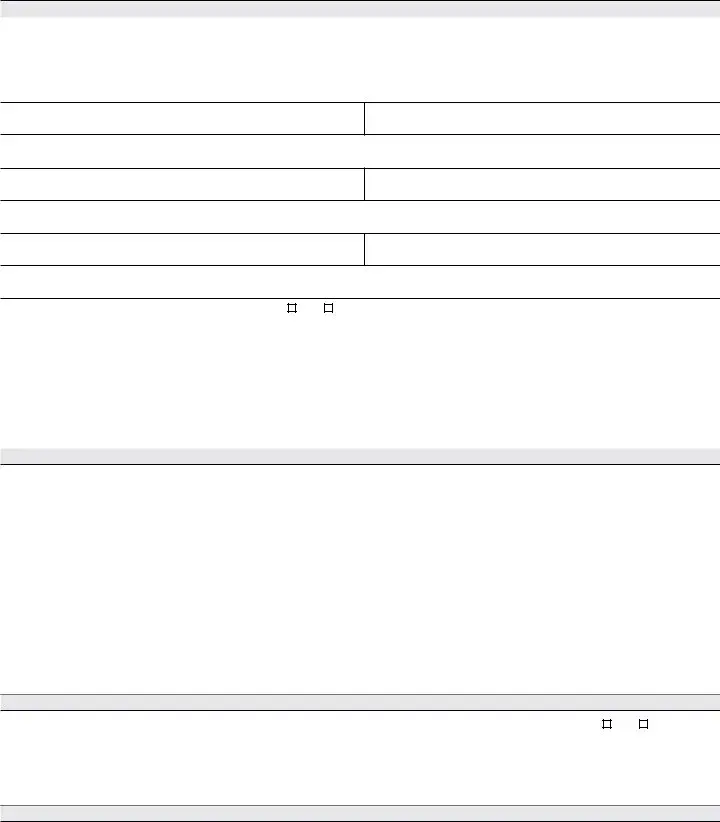

GUIDELINES FOR SECTION 1: EMPLOYEE’S STATEMENT

This section is to be completed by the Employee. Please answer all questions in order to avoid possible delays. All dates should indicate the month, date and year.

A. Information About You

nThe Group Policy Number will have eight characters, beginning with “G000” followed by four additional letters or numbers specific to your employer.

nProvide weight in pounds, and height in feet and inches.

nYour Occupation/Job Title is the title of your position held with the employer.

nIndicate any other Mutual of Omaha/United of Omaha plans in which you are currently insured.

C. Information About Your Disabling Condition

nThe Date First Treated is the date you first sought out medical care because of the disabling condition.

D. Information About Work

nThe Last Day Worked is the day before you were first absent from work because of the disabling condition.

E. Information About Care and Treatment

nProvide the name, specialty, phone and address for each doctor or hospital that treated you for the disabling condition.

F. Information About Other Income Benefits

nOther Income means money you are currently receiving or have applied to receive from any source in addition to your claim for disability benefits with Mutual of Omaha/ United of Omaha.

nCheck all sources of other income that apply.

G. Information For Tax Withholding

nIf your claim is paid, indicate whether or not you would like Mutual of Omaha to withhold income tax from your benefit payment, and if so, how much. Minimum is $88 per month.

H. Signature

nYour signature is required.

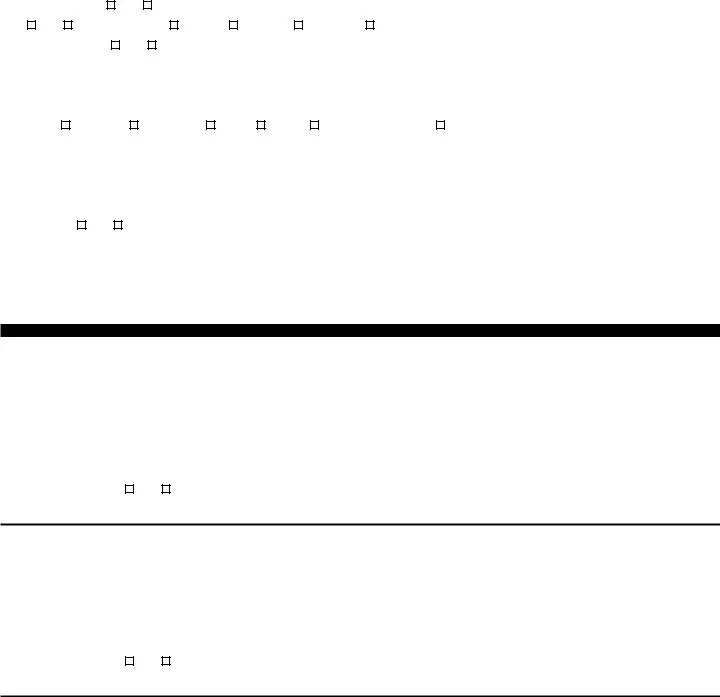

EDUCATION, TRAINING AND WORK EXPERIENCE

nThis form is to be completed by the employee. Please make sure all questions have been answered completely and accurately. If information is missing or is illegible (unreadable), the processing of your form will be delayed.

nVocational rehabilitation services include, but are not limited to (a) job modification; (b) job placement;

(c) retraining; and (d) other activities reasonably necessary to help you return to work.

AUTHORIZATION TO DISCLOSE PERSONAL INFORMATION

This authorization is to be completed by the employee.

nPlease read this section in its entirety. By signing the authorization, you are applying for long-term disability benefits with Mutual of Omaha/United of Omaha, and are agreeing to allow disclosure of personal information to the necessary parties for purposes of claim processing.

nIf the name associated with any of your medical records differs from the name provided on the form, provide any alternate names. This might occur in the event of a name change due to marriage or adoption, for example.

nIMPORTANT: To be complete, the form must be signed by you.

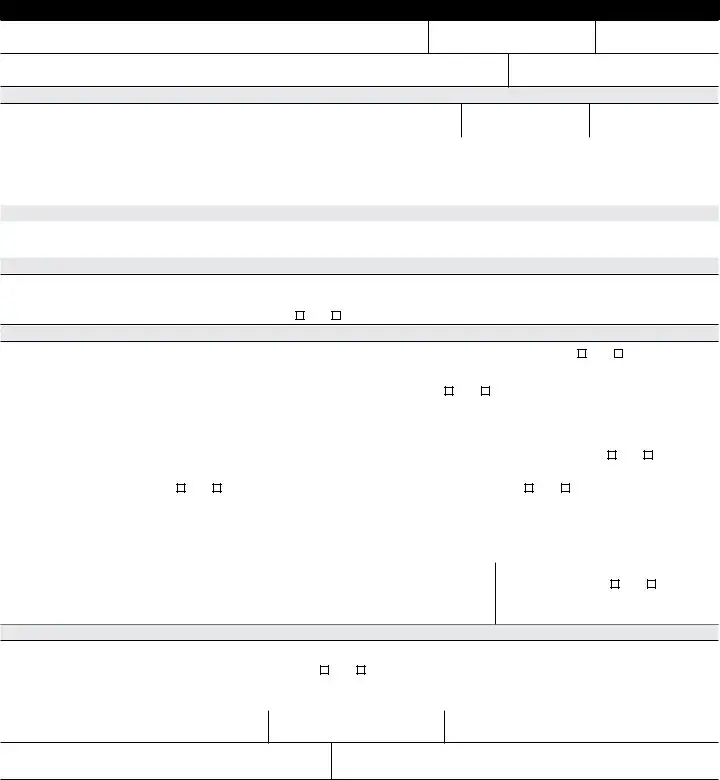

GUIDELINES FOR SECTION 2: EMPLOYER’S STATEMENT

This section is to be completed by the employer. Please answer all questions in order to avoid possible delays. All dates should indicate the month, date and year.

A. Information About the Employer

nThe Group Policy Number will have eight characters, beginning with “G000” followed by four additional letters or numbers.

B. Information About the Employee

nThe Date Employee Became Insured Under This Plan indicates the date in which the employee’s coverage became effective.

nThe Date Employee Became Insured Under Prior Plan indicates the date in which the employee’s coverage was in effect under a plan prior to the Mutual of Omaha plan.

nThe No. of Hours Employee Regularly Works is the number of hours the employee is typically at work per day/per week for the employer.

MUG1710A_0212 |

LTD Claim Form Guide_1009 |

REQUIRED FRAUD WARNINGS (STATE SPECIfiC WARNINGS APPLY TO THE RESIDENT OF SUCH STATE)

nFraud Warning: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

nAlabama: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject

to restitution fines or confinement in prison, or any combination thereof.

nArkansas/Kentucky/Louisiana/Maine/New Mexico/ Ohio/Tennessee: Any person who, with intent to defraud or knowing that he/she is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

nCalifornia: For your protection California law requires

the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

nColorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado division of insurance within the department of regulatory agencies.

nDistrict of Columbia: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

nKansas: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties as determined by a court of law.

nMaryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

nNew Jersey: Any person who includes any false or misleading information on an application for insurance is subject to criminal and civil penalties.

nNew York: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

nOregon: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which may be a crime and may subject such person to criminal and civil penalties.

nPuerto Rico: Any person who furnishes information verbally or in writing, or offers any testimony on improper or illegal actions which, due to their nature constitute fraudulent acts in the insurance business, knowing that the facts are false shall incur a felony and, upon conviction, shall be punished by a fine of not less than five thousand (5,000) dollars, nor more than ten thousand (10,000) dollars for each violation or by imprisonment for a fixed term of three (3) years, or both penalties. Should aggravating circumstances be present, the fixed penalty thus established may be increased to a maximum of five (5) years; if extenuating circumstances are present, it may be reduced to a minimum of two (2) years.

nRhode Island: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information on an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

nVermont: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claims containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto may be committing a fraudulent insurance act, which may be a crime and may subject such person to criminal and civil penalties.

nVirginia: Any person who, with the intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may have violated state law.

Long-Term Disability Claim Form

Mutual of Omaha Insurance Company

United of Omaha Life Insurance Company

Group Insurance Claims Management

Mutual of Omaha Plaza |

|

Omaha, NE 68175-0001 |

|

Phone 800-877-5176 |

Fax 402-997-1865 |

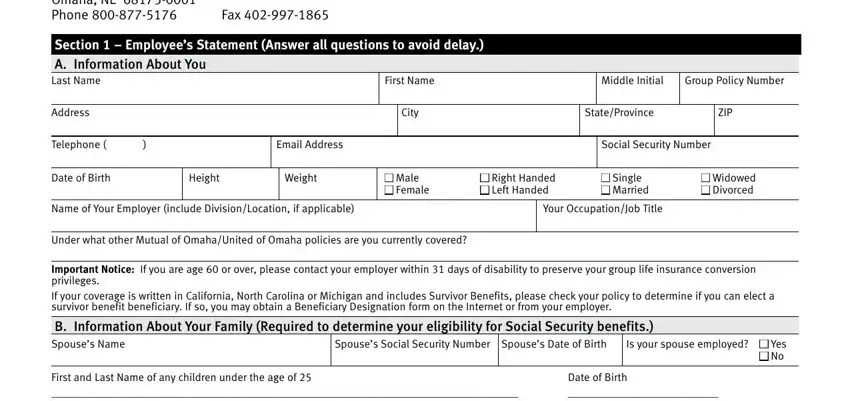

Section 1 – Employee’s Statement (Answer all questions to avoid delay.)

A. Information About You

Date of Birth |

Height |

Weight |

n Male |

n Right Handed |

n Single |

n Widowed |

|

|

|

n Female |

n Left Handed |

n Married |

n Divorced |

|

|

|

|

|

|

|

Name of Your Employer (include Division/Location, if applicable) |

|

|

Your Occupation/Job Title |

|

|

|

|

|

|

|

|

|

Under what other Mutual of Omaha/United of Omaha policies are you currently covered?

Important Notice: If you are age 60 or over, please contact your employer within 31 days of disability to preserve your group life insurance conversion privileges.

If your coverage is written in California, North Carolina or Michigan and includes Survivor Benefits, please check your policy to determine if you can elect a survivor benefit beneficiary. If so, you may obtain a Beneficiary Designation form on the Internet or from your employer.

B. Information About Your Family (Required to determine your eligibility for Social Security benefits.)

Spouse’s Name |

Spouse’s Social Security Number |

Spouse’s Date of Birth |

Is your spouse employed? n Yes |

|

|

|

|

n No |

|

|

|

|

|

First and Last Name of any children under the age of 25 |

|

|

Date of Birth |

____________________________________________________________________________________ |

___________________________ |

____________________________________________________________________________________ |

___________________________ |

____________________________________________________________________________________ |

___________________________ |

C.Information About Your Disabling Condition

1.If your disability is due to an injury, answer the following questions and then proceed to #3 below.

When did the injury occur?

Where and how did the injury occur?

What is the date you were first treated by a physician?

2. If your disability is due to a pregnancy or an illness, answer the following questions. If not pregnancy-related, proceed to #3 below.

What were your first symptoms?

When did you notice these symptoms?

What is the date you were first treated by a physician?

3. If your disability is due to an injury or an illness, but not pregnancy, answer the following questions.

Why are you unable to work? |

|

|

|

|

|

|

Before you stopped working, did your condition require you to change your job or the way you did your job? n Yes |

n No If Yes, please explain below. |

Is your condition related to your occupation? n Yes |

n No If Yes, please explain below. |

|

Have you filed, or do you intend to file a Workers’ Compensation claim? n Yes |

n No |

|

|

|

|

|

|

|

|

D. Information About Work |

|

|

|

|

|

|

What is the date of your last day worked before the disability? |

On your last day worked, did you work a full day? |

|

|

|

n Yes |

n No |

If No, please explain. |

|

|

|

|

|

|

What is the date you were first unable to work? |

|

|

Have you returned to work? n Yes, Part-Time |

n Yes, Full-Time n No |

|

|

|

What date did you return to work? |

|

|

|

|

|

|

|

If you haven’t yet returned to work, do you expect to? |

n Yes, Part-Time |

n Yes, Full-Time n No |

|

What date do you expect to be able to return to work? |

|

|

|

|

|

|

|

|

|

|

|

|

|

Are you currently self-employed or working for another employer? n Yes

n No If Yes, provide details.

MUG1710A_0212 |

Page 1 of 10 |

Form continued on Page 2 |

|

|

|

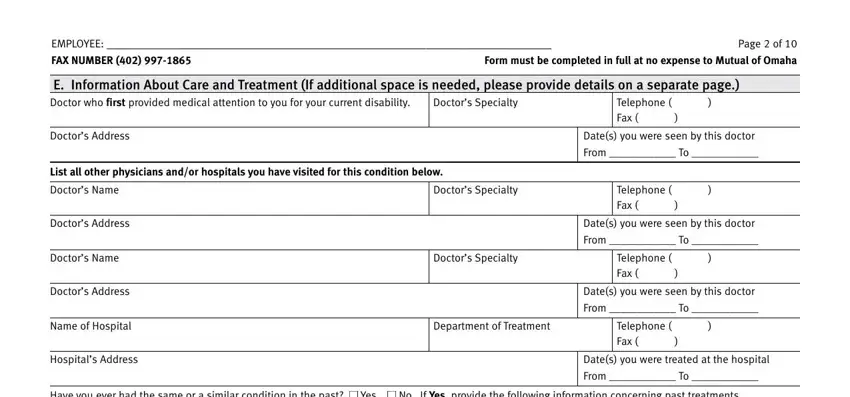

EMPLOYEE: ________________________________________________________________ |

Page 2 of 10 |

FAX NUMBER (402) 997-1865 |

Form must be completed in full at no expense to Mutual of Omaha |

E. Information About Care and Treatment (If additional space is needed, please provide details on a separate page.)

Doctor who first provided medical attention to you for your current disability. |

Doctor’s Specialty |

|

Telephone ( |

) |

|

|

|

Fax ( |

) |

|

|

|

|

Doctor’s Address |

|

Date(s) you were seen by this doctor |

|

|

From ____________ To ____________ |

|

|

|

|

|

List all other physicians and/or hospitals you have visited for this condition below.

Doctor’s Name

Doctor’s Address

Doctor’s Name

Doctor’s Address

Name of Hospital

Hospital’s Address

Doctor’s Specialty |

|

Telephone ( |

) |

|

|

Fax ( |

) |

|

|

|

|

Date(s) you were seen by this doctor |

|

From ____________ To ____________ |

Doctor’s Specialty |

|

Telephone ( |

) |

|

|

|

Fax ( |

) |

|

|

|

|

Date(s) you were seen by this doctor |

|

From ____________ To ____________ |

Department of Treatment |

|

Telephone ( |

) |

|

|

|

Fax ( |

) |

|

|

|

|

Date(s) you were treated at the hospital |

|

From ____________ To ____________ |

|

|

|

|

Have you ever had the same or a similar condition in the past? n Yes |

n No If Yes, provide the following information concerning past treatments. |

|

|

|

|

|

|

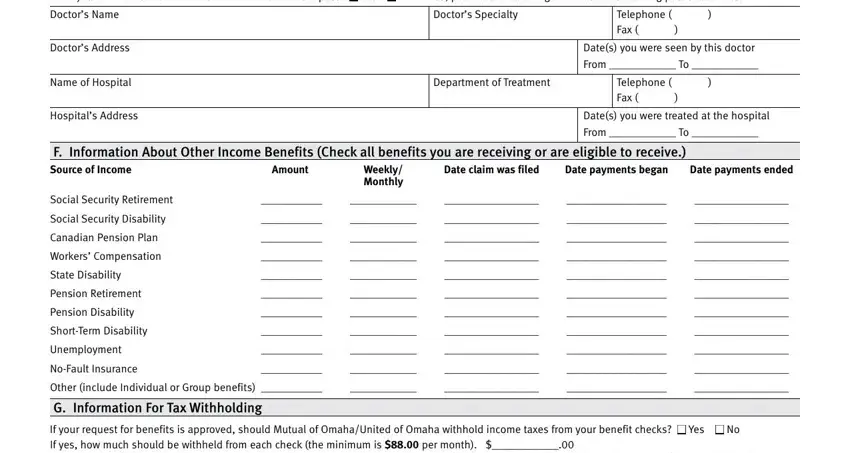

Doctor’s Name |

|

Doctor’s Specialty |

|

Telephone ( |

) |

|

|

|

|

Fax ( |

) |

|

|

|

|

|

Doctor’s Address |

|

|

Date(s) you were seen by this doctor |

|

|

|

From ____________ To ____________ |

|

|

|

|

|

|

Name of Hospital |

|

Department of Treatment |

|

Telephone ( |

) |

|

|

|

|

Fax ( |

) |

|

|

|

|

|

Hospital’s Address |

|

|

Date(s) you were treated at the hospital |

|

|

|

From ____________ To ____________ |

|

|

|

|

|

|

F. Information About Other Income Benefits (Check all benefits you are receiving or are eligible to receive.)

Source of Income |

Amount |

Weekly/ |

Date claim was filed |

Date payments began |

Date payments ended |

|

|

Monthly |

|

|

|

Social Security Retirement |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

Social Security Disability |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

Canadian Pension Plan |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

Workers’ Compensation |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

State Disability |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

Pension Retirement |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

Pension Disability |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

Short-Term Disability |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

Unemployment |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

No-Fault Insurance |

___________ |

____________ |

_________________ |

__________________ |

_________________ |

Other (include Individual or Group benefits) ___________ |

____________ |

_________________ |

__________________ |

_________________ |

G. Information For Tax Withholding

If your request for benefits is approved, should Mutual of Omaha/United of Omaha withhold income taxes from your benefit checks? If yes, how much should be withheld from each check (the minimum is $88.00 per month). $____________.00

Overpayment Notice: Should you become overpaid at anytime during the duration of this claim we, Mutual of Omaha Insurance Company (Mutual) or United of Omaha Life Insurance Company (United), will request reimbursement of the overpaid amount. This amount is equal to the net benefit you received and any Federal Income Tax paid on your behalf for any time prior to current tax year. Your signature on the claim form authorizes Mutual or United to recover any overpaid Medicare and/or Social Security Tax that was paid on your behalf and certifies you will not attempt to recover a refund or credit of the Medicare and/or Social Security Tax with any Form W-2C that is furnished to you based on recoveries received.

H. Signature (Required for all claims.)

Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

The above statements are true and complete to the best of my knowledge and belief.

X ____________________________________________________ |

_________________________ |

|

Signature of Employee |

Date |

MUG1710A_0212 |

Page 2 of 10 |

Form continued on Page 3 |

EMPLOYEE: ________________________________________________________________ |

Page 3 of 10 |

FAX NUMBER (402) 997-1865 |

|

|

Form must be completed in full at no expense to Mutual of Omaha |

|

|

|

Education, Training and Work Experience |

|

|

Name_________________________________________________________________________________________________________________________________ |

Policy No. ______________________________________________________ |

Claim No. _______________________________________________ |

|

|

|

|

|

Educational Background |

|

|

|

|

High School Graduate |

n Yes |

n No |

If No, what was the last grade completed? ________________ Last date attended ________________ |

|

GED n Yes n No |

Field of Study n General n Business n Vocational |

n Other |

|

Did you attend college? n Yes |

n No |

Last Date Attended ________________ |

|

|

Name and Address of College: ___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Major(s): ______________________________________________________________________________________________________________________________

Final Status: n Freshman n Sophomore n Junior n Senior n Undergraduate Degree n Graduate School

Degree(s) earned: ______________________________________________________________________________________________________________________

Other formal training: ___________________________________________________________________________________________________________________

Certification(s):_________________________________________________________________________________________________________________________

Computer Skills: ________________________________________________________________________________________________________________________

Military Service n Yes n No If Yes, in which branch did you serve? __________________________________________________________________________

Rank: _________________________________________________________________________________________________________________________________

Specialty: _____________________________________________________________________________________________________________________________

What computer programs are you able to use?_______________________________________________________________________________________________

List all languages spoken fluently: _________________________________________________________________________________________________________

Work Experience

Please fill out completely. Start with your most recent employment and list chronologically.

Dates: From ___________________ To ___________________

Employer: _____________________________________________________________________________________________________________________________

Job Title: ______________________________________________________________________________________________________________________________

List job duties: _________________________________________________________________________________________________________________________

List physical requirements of job: _________________________________________________________________________________________________________

Product/service produced: _______________________________________________________________________________________________________________

Did you supervise others? n Yes n No

Reason for leaving? _____________________________________________________________________________________________________________________

Dates: From ___________________ To ___________________

Employer: _____________________________________________________________________________________________________________________________

Job Title: ______________________________________________________________________________________________________________________________

List job duties: _________________________________________________________________________________________________________________________

List physical requirements of job: _________________________________________________________________________________________________________

Product/service produced: _______________________________________________________________________________________________________________

Did you supervise others? n Yes n No

Reason for leaving? _____________________________________________________________________________________________________________________

MUG1710A_0212 |

Page 3 of 10 |

Form continued on Page 4 |

|

|

|

EMPLOYEE: ________________________________________________________________ |

Page 4 of 10 |

FAX NUMBER (402) 997-1865 |

Form must be completed in full at no expense to Mutual of Omaha |

Dates: From ___________________ To ___________________

Employer: _____________________________________________________________________________________________________________________________

Job Title: ______________________________________________________________________________________________________________________________

List job duties: _________________________________________________________________________________________________________________________

List physical requirements of job: _________________________________________________________________________________________________________

Product/service produced: _______________________________________________________________________________________________________________

Did you supervise others? n Yes n No

Reason for leaving? _____________________________________________________________________________________________________________________

Dates: From ___________________ To ___________________

Employer: _____________________________________________________________________________________________________________________________

Job Title: ______________________________________________________________________________________________________________________________

List job duties: _________________________________________________________________________________________________________________________

List physical requirements of job: _________________________________________________________________________________________________________

Product/service produced: _______________________________________________________________________________________________________________

Did you supervise others? n Yes n No

Reason for leaving? _____________________________________________________________________________________________________________________

Dates: From ___________________ To ___________________

Employer: _____________________________________________________________________________________________________________________________

Job Title: ______________________________________________________________________________________________________________________________

List job duties: _________________________________________________________________________________________________________________________

List physical requirements of job: _________________________________________________________________________________________________________

Product/service produced: _______________________________________________________________________________________________________________

Did you supervise others? n Yes n No

Reason for leaving? _____________________________________________________________________________________________________________________

Additional courses taken, hobbies and special skills. Please be specific such as computer skills either personal or professional, sales, carpentry, auto repair, etc.

______________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________

Are you currently involved in a vocational rehabilitation program? n Yes n No

If yes, please provide the name, address and phone # of the rehabilitation case worker ___________________________________________________________

______________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________________

Are you interested in learning about our vocational rehabilitation program? n Yes n No

What is your employment goal or other work that you would be interested in doing? _______________________________________________________________

Date: ______________________________ Signature: _________________________________________________________________________________________

MUG1710A_0212 |

Page 4 of 10 |

Form continued on Page 5 |

AUTHORIZATION TO DISCLOSE PERSONAL INFORMATION

1.I authorize any physician, medical or dental practitioner, hospital, clinic, pharmacy benefit manager, other medical care facility, health maintenance organization, insurer, employer, consumer reporting agency and any other provider of medical or dental services to release records containing the personal information of:

Claimant/Patient Name: __________________________________________________________

2.Personal information includes medical history, mental and physical condition, prescription drug records, alcohol or drug use, financial and occupational information.

3.You may release information to:

Group Disability Management Services

Mutual of Omaha Insurance Company/United of Omaha Life Insurance Company

Mutual of Omaha Plaza

Omaha, NE 68175-0001

or

Fax 402-997-1865

4.I understand that the personal information that is disclosed will be used by Mutual of Omaha Insurance Company and United of Omaha Life Insurance Company to evaluate my claim for disability benefit plan reimbursement and that if I refuse to sign this authorization my claim for benefits may not be paid.

5.I understand that if the person or entity to whom information is disclosed is not a health care provider or health plan subject to federal privacy regulations, the personal information may be redisclosed without the protection of the federal privacy regulations.

6.This authorization will expire 24 months after the date signed.

7.I understand that I may revoke this authorization at any time by providing a written request to Mutual of Omaha Insurance Company and United of Omaha Life Insurance Company at the address above. If I revoke this authorization, it will not affect any use or disclose of personal information that occurred prior to the receipt of my revocation.

8.I understand that I am entitled to receive a copy of this authorization and that a copy is as valid as the original.

RETAIN A SIGNED COPY FOR YOUR RECORDS

Name(s) used for records (if different than the name below): ________________________________

________________________________________________________________________________

_______________________________________________________________ |

________________ |

Signature of Claimant |

Date |

If Applicable: I am the legal representative of the claimant and I am authorized to grant permission on behalf of the claimant.

Printed Name of Legal Representative:_______________________________________________

Signature of Legal Representative: __________________________________________________

Type of Legal Representative: ______________________________________________________

THIS AUTHORIZATION COMPLIES WITH HIPAA AND OTHER FEDERAL AND STATE LAWS

MUG2854_0212

MUG1710A_0212 |

Page 5 of 10 |

Form continued on Page 6 |

|

|

|

EMPLOYEE: ________________________________________________________________ |

Page 6 of 10 |

FAX NUMBER (402) 997-1865 |

Form must be completed in full at no expense to Mutual of Omaha |

Section 2 – Employer’s Statement (Answer all questions to avoid delay.)

A. Information About the Employer

Company’s Address (Number, Street, City, State, ZIP) |

|

Company’s Telephone ( |

) |

|

|

Company’s Fax ( |

|

) |

|

|

|

|

|

Name and Address of Location Where Employee Works |

Location No. |

Location Telephone ( |

|

) |

|

|

Location Fax ( |

) |

|

|

|

|

|

|

B. Information About Employee

Employee’s Hire Date |

Date Employee became insured under this plan: __________________ |

No. of hours Employee regularly works per day/per week? |

|

|

|

Date Employee became insured under prior plan: _________________ |

______ # of hours per/week ______ # of hours per/day |

|

|

|

C. Information For Tax Withholding

If this section is left blank, we will calculate FICA taxes based on the following assumption: 100% Employer contribution or any portion paid by Employee is paid with pre-tax dollars.

Does Employee contribute post-tax dollars toward the premium? n Yes n No If Yes, what percent is paid by Employee? ______% Post-Tax

D. Information About the Claim

Before Employee became fully disabled, were changes made to Employee’s job responsibilities due to the disabling condition? n Yes n No

If yes, please describe the changes and when they were made.

Date Employee Last Worked |

|

|

Did Employee work a full day? n Yes |

n No If No, how many hours were worked? |

|

|

|

|

|

What was Employee’s permanent job on his/her last day worked? |

|

How long had Employee been in this job? |

|

|

|

|

|

|

Why did Employee stop working? |

|

|

|

Has Employee returned to work? n Yes n No |

|

|

|

|

If Yes, when? |

|

|

|

|

|

|

Is Employee’s condition work related? n Yes |

n No |

Has a Workers’ Compensation claim been filed? n Yes n No |

|

|

|

If Yes, send initial report of illness/injury and award notice. |

|

|

|

|

|

|

Name of Workers’ Comp Carrier |

|

Address of Workers’ Comp Carrier |

Contact Person’s Name & Phone No. |

|

|

|

|

|

|

Name and Address of Medical Insurance Carrier

Is Employee covered under a Group Life policy with Mutual of Omaha? n Yes n No

E. Information For Life Waiver

Important Notice: If an Employee is age 60 or over, please refer to the policy provisions regarding group life continuation and conversion rights.

Is Employee covered under a Group Life policy with United of Omaha? n Yes |

n No If Yes, what is the effective date of the life insurance plan? |

|

|

What is Employee’s annual salary? |

Amount of Life insurance as of last day worked |

|

|

Date Life insurance terminated?

If not terminated, what is the “paid to date”?

Name of beneficiary (per your records)?

Relationship to Employee?

MUG1710A_0212 |

Page 6 of 10 |

Form continued on Page 7 |

|

|

|

EMPLOYEE: ________________________________________________________________ |

Page 7 of 10 |

FAX NUMBER (402) 997-1865 |

Form must be completed in full at no expense to Mutual of Omaha |

F. Information About Your Pension Plan (Do not complete for maternity.)

Do you have a pension plan? n Yes n No

n Defined Benefit

n Defined Contribution

Is Employee eligible for your pension plan? n Yes n No |

If eligible, does Employee participate? n Yes n No |

|

If Yes, when is Employee eligible for benefits under the pension plan? |

|

|

If Employee is eligible but does not participate, explain why. |

|

G. Information About Your Rehire or Return to Work Policies

Does your company have a rehire or return to work policy for disabled Employees? n Yes n No

Who should we contact if we identify a rehabilitation or return to work option? Name/Title:

Contact No.

H.Information About Employee’s Salary (Please attach supporting payroll documentation.)

(Check all that apply) Employee n is paid hourly ($ |

hourly rate) |

Will Employee file for disability benefits provided by any Employer/Employee Labor Management, State Disability or Union Welfare plan? n Yes n No

If Yes, please answer the following questions. Weekly amount? |

Date benefits begin? |

Date benefits end? |

|

|

|

Is Employee eligible for Salary Continuation? |

n Yes |

n No If Yes, please answer the following questions. |

Weekly amount? |

|

Date benefits begin? |

|

Date benefits end? |

|

|

|

|

Is Employee eligible for Sick Leave? n Yes |

n No |

If Yes, please answer the following questions. |

|

Weekly amount? |

|

Date benefits begin? |

|

Date benefits end? |

|

|

|

|

|

Per the definition of Basic Monthly Earnings in your Policy, what are Employee’s pre-disability monthly earnings?

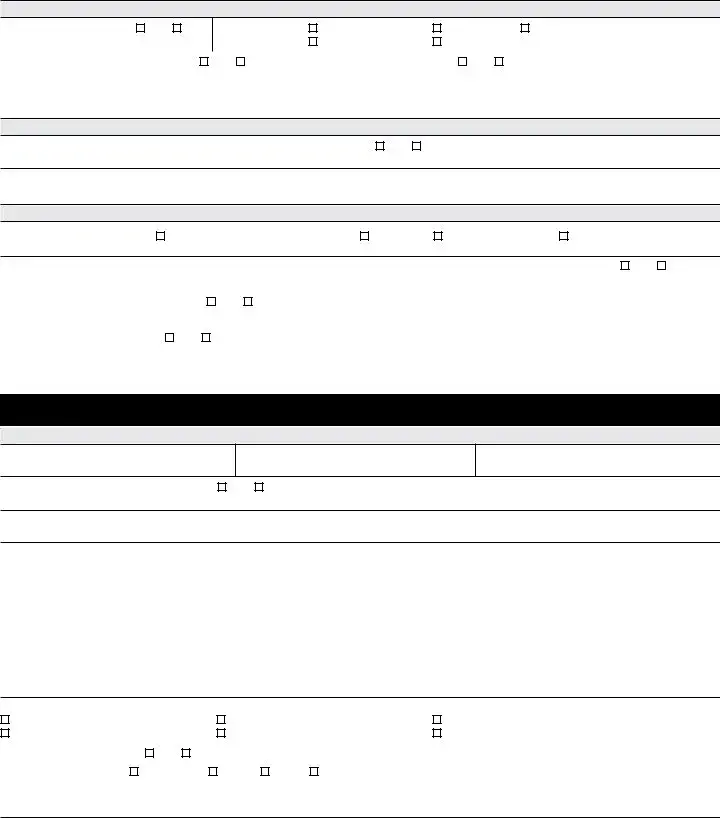

Section 3 – Job Analysis (To be completed by the Employee’s Supervisor or HR Department.

Answer all questions to avoid delay.)

A. Information About Employee’s Job

Minimum education or training required?

How long will Employee’s job be held open?

Does Employee perform supervisory functions?

n No If Yes, how many people are supervised?

Describe Employee’s job duties.

Indicate how each of the following related to Employee’s job. |

|

|

|

Occasionally (0%-33%) |

Frequently (34%-66%) |

Continuously (67%-100%) |

Computer use |

____________ |

____________ |

____________ |

Relate to others |

____________ |

____________ |

____________ |

Written and verbal communication |

____________ |

____________ |

____________ |

Reasoning, math and language |

____________ |

____________ |

____________ |

Make independent judgments |

____________ |

____________ |

____________ |

Which of the following describe Employee’s working environment? Check all that apply. |

|

n Unprotected heights |

n Changes in temperature |

n Exposure to dust, fumes and gases |

n Being near moving machinery |

n Driving automotive equipment |

n Other hazards (please explain) |

|

|

|

Is Employee required to travel? n Yes n No |

If Yes, please answer the following questions. |

|

How does Employee travel? n Automobile |

n Plane n Train n Other |

|

What percent of the time does Employee travel?

Where does Employee travel?

MUG1710A_0212 |

Page 7 of 10 |

Form continued on Page 8 |