Louisiana Small Estate Affidavit Form

A Louisiana small estate affidavit form is an effective legal tool for making the probate process easier for everyone involved. Probate is a financial and legal process of winding up the assets (estate) and affairs of a deceased individual.

Most estates will require the probate process. However, in some instances, such as with “small estates,” it can be avoided. This means that if the deceased did not have a will at the time of their death, the heirs can submit a small estate affidavit form to claim the assets.

Probate does not concern collecting the assets of the deceased exclusively. It has to do with many financial and property-related matters. Many assets, including bank accounts, art, and vehicles, can be included in the list submitted together with the affidavit form.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Louisiana Laws and Requirements

There is no single legal definition of what a small estate is. The state determines the size of the estate. Some states have relatively low thresholds, while others may have a higher bar. A small estate is also called “a small succession” in the Louisiana Code of Civil Procedure.

For a small estate affidavit form to be created, several conditions must be met:

- The estate should have a gross value of $125,000 or less at the time of death.

- The person should also not have a will at the time of death.

- There should be no immovable property in the estate.

Louisiana laws do not require individuals to wait a specific period after the deceased’s death before filling out the Louisiana small estate affidavit form. Remember that in Louisiana, such forms should be notarized.

The form should be used when there are no grounds for opening a small succession judicially. At least two people need to swear the affidavit form before a person authorized to administer oaths. The two people are usually the spouse of the deceased and their competent heir. In case the deceased did not have a spouse, two competent heirs should do it. If there is no other competent heir, the second person should know about the matters included in a small estate affidavit form. These matters include:

- Details of the death, such as the date and the place

- A confirmation of the fact that the deceased did not have a will

- The deceased person’s marital status and the name and details of the spouse

- Information about the heirs: personal details and whether they are available.

- Description of the property items, including their value.

Use our form building software to create a Louisiana small estate affidavit form quickly.

Louisiana Small Estate Affidavit Laws Details

| Max. Estate | $125,000 |

| Min. Time to Wait After Death | 90 days |

| Filing Fee | Not specified |

| State Laws | Louisiana Code of Civil Procedure, Articles 3421 to 3443 |

Need more Louisiana templates? We provide free templates and simple personalization experience to anybody who prefers less hassle when handling papers.

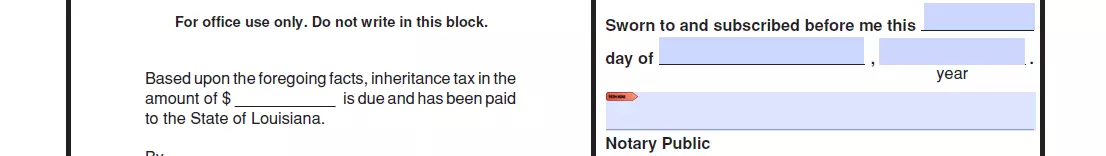

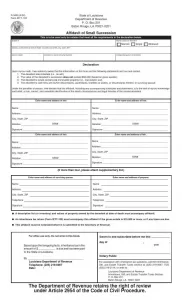

Filling Out the Louisiana Small Affidavit Form

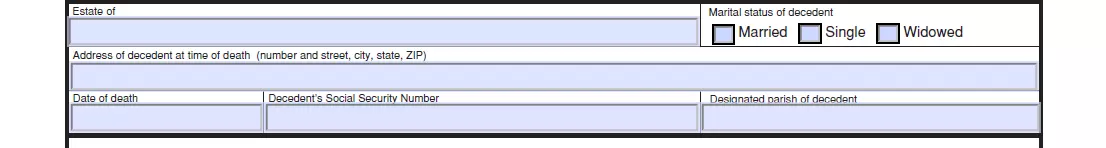

1. Provide Personal Information About the Deceased

Include their name, address at the time of death, and their marital status. Confirm the date of death, social security number, and state their parish.

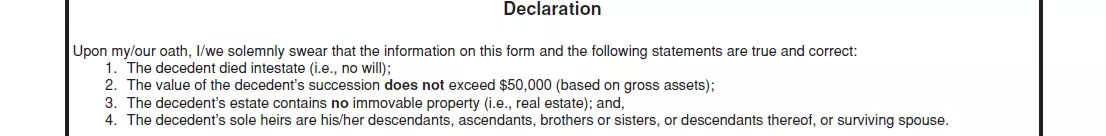

2. Read the Declaration

You need to read it carefully to make sure that such a form applies to your situation and declare that the information you are submitting is correct.

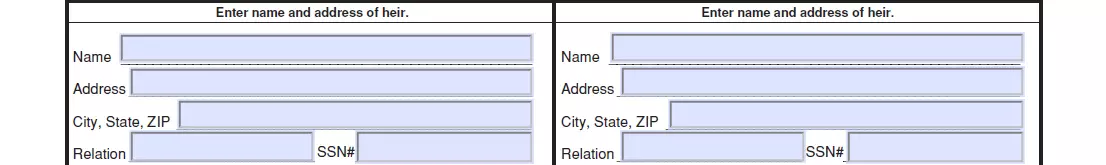

3. Enter the Details of the Heirs

You will need to state the names and addresses of each heir and the spouse.

4. Let the Heirs Sign the Form

Each list of details should be accompanied by the signature of the respective individuals.

![]()

5. Let a Notary Public Acknowledge the Form

This is the last step.