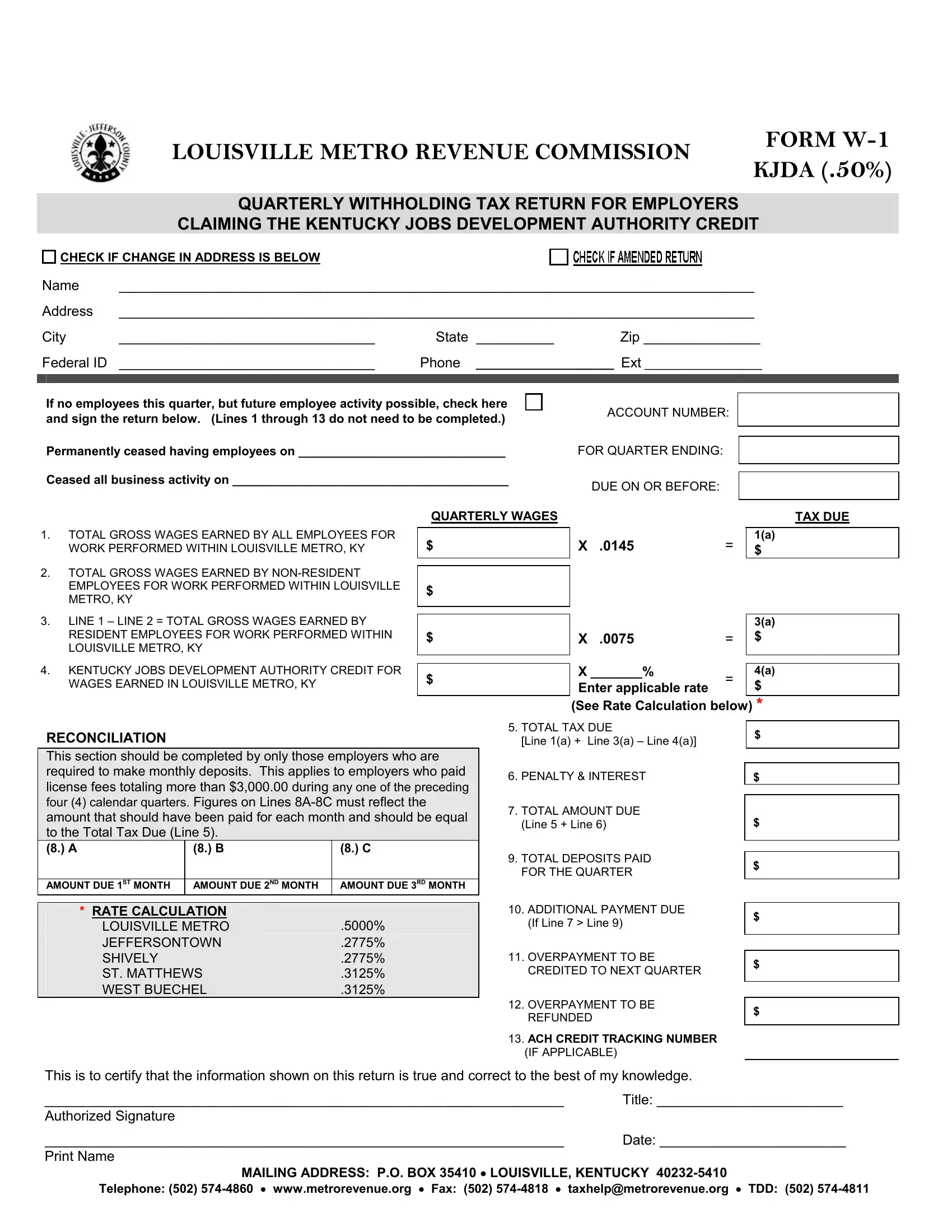

LOUISVILLE METRO REVENUE COMMISSION

KJDA (.50%)

QUARTERLY WITHHOLDING TAX RETURN FOR EMPLOYERS

CLAIMING THE KENTUCKY JOBS DEVELOPMENT AUTHORITY CREDIT

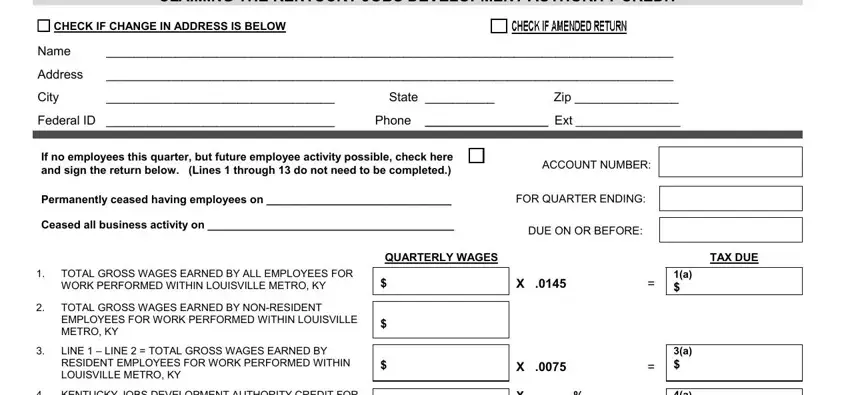

CHECK IF CHANGE IN ADDRESS IS BELOW |

|

|

Name |

__________________________________________________________________________________ |

Address |

__________________________________________________________________________________ |

City |

_________________________________ |

State __________ |

Zip _______________ |

Federal ID |

_________________________________ |

Phone ____________________ Ext _________________ |

|

|

|

|

|

|

|

|

If no employees this quarter, but future employee activity possible, check here and sign the return below. (Lines 1 through 13 do not need to be completed.)

Permanently ceased having employees on ______________________________

Ceased all business activity on ________________________________________

ACCOUNT NUMBER:

FOR QUARTER ENDING:

DUE ON OR BEFORE:

1.TOTAL GROSS WAGES EARNED BY ALL EMPLOYEES FOR WORK PERFORMED WITHIN LOUISVILLE METRO, KY

2.TOTAL GROSS WAGES EARNED BY NON-RESIDENT EMPLOYEES FOR WORK PERFORMED WITHIN LOUISVILLE METRO, KY

3.LINE 1 – LINE 2 = TOTAL GROSS WAGES EARNED BY RESIDENT EMPLOYEES FOR WORK PERFORMED WITHIN LOUISVILLE METRO, KY

4.KENTUCKY JOBS DEVELOPMENT AUTHORITY CREDIT FOR WAGES EARNED IN LOUISVILLE METRO, KY

X .0075 |

= |

X _______% |

= |

Enter applicable rate |

TAX DUE

1(a)

$

3(a)

$

4(a)

$

(See Rate Calculation below) *

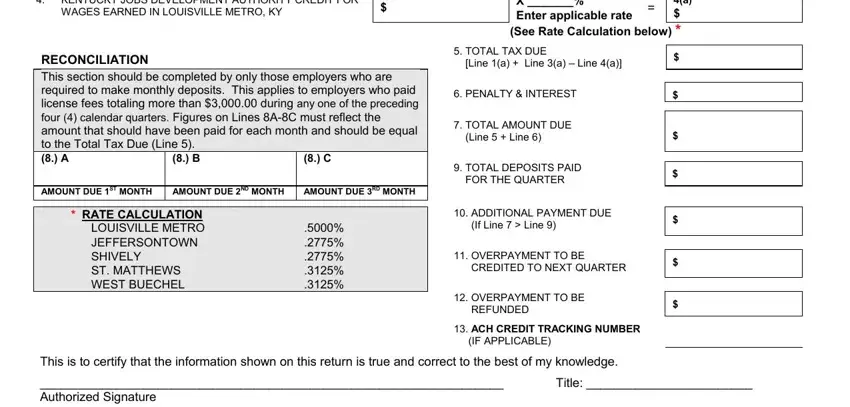

RECONCILIATION

This section should be completed by only those employers who are required to make monthly deposits. This applies to employers who paid license fees totaling more than $3,000.00 during any one of the preceding four (4) calendar quarters. Figures on Lines 8A-8C must reflect the amount that should have been paid for each month and should be equal to the Total Tax Due (Line 5).

(8.) A |

|

(8.) B |

(8.) C |

|

|

|

AMOUNT DUE 1ST MONTH |

AMOUNT DUE 2ND MONTH |

AMOUNT DUE 3RD MONTH |

|

|

|

|

|

|

|

* |

RATE CALCULATION |

|

|

LOUISVILLE METRO |

.5000% |

|

JEFFERSONTOWN |

.2775% |

|

SHIVELY |

.2775% |

|

ST. MATTHEWS |

.3125% |

|

WEST BUECHEL |

.3125% |

5.TOTAL TAX DUE

[Line 1(a) + Line 3(a) – Line 4(a)]

6.PENALTY & INTEREST

7.TOTAL AMOUNT DUE (Line 5 + Line 6)

9.TOTAL DEPOSITS PAID FOR THE QUARTER

10.ADDITIONAL PAYMENT DUE (If Line 7 > Line 9)

11.OVERPAYMENT TO BE CREDITED TO NEXT QUARTER

12.OVERPAYMENT TO BE REFUNDED

13.ACH CREDIT TRACKING NUMBER (IF APPLICABLE)

This is to certify that the information shown on this return is true and correct to the best of my knowledge.

___________________________________________________________________ |

Title: ________________________ |

Authorized Signature |

|

___________________________________________________________________ |

Date: ________________________ |

Print Name |

|

MAILING ADDRESS: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 • www.metrorevenue.org • Fax: (502) 574-4818 • taxhelp@metrorevenue.org • TDD: (502) 574-4811

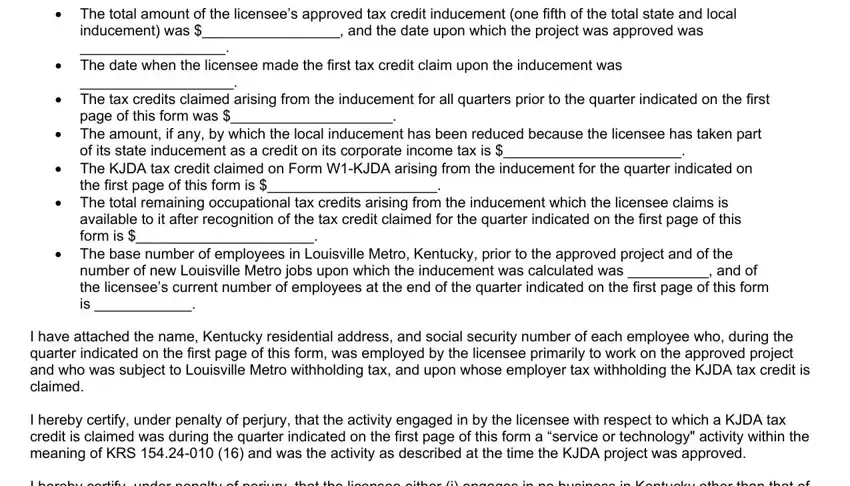

THIS FORM MUST BE COMPLETED AND SIGNED BY THE CHIEF FINANCIAL OFFICER

A licensee claiming a KJDA employer withholding occupational tax credit based upon an economic development inducement arising from an approved project, pursuant to KRS 154.24 shall file quarterly with the Louisville Metro Revenue Commission the following information:

•The total amount of the licensee’s approved tax credit inducement (one fifth of the total state and local inducement) was $_________________, and the date upon which the project was approved was

__________________.

•The date when the licensee made the first tax credit claim upon the inducement was

___________________.

•The tax credits claimed arising from the inducement for all quarters prior to the quarter indicated on the first page of this form was $____________________.

•The amount, if any, by which the local inducement has been reduced because the licensee has taken part of its state inducement as a credit on its corporate income tax is $______________________.

•The KJDA tax credit claimed on Form W1-KJDA arising from the inducement for the quarter indicated on the first page of this form is $_____________________.

•The total remaining occupational tax credits arising from the inducement which the licensee claims is available to it after recognition of the tax credit claimed for the quarter indicated on the first page of this form is $______________________.

•The base number of employees in Louisville Metro, Kentucky, prior to the approved project and of the number of new Louisville Metro jobs upon which the inducement was calculated was __________, and of the licensee’s current number of employees at the end of the quarter indicated on the first page of this form is ____________.

I have attached the name, Kentucky residential address, and social security number of each employee who, during the quarter indicated on the first page of this form, was employed by the licensee primarily to work on the approved project and who was subject to Louisville Metro withholding tax, and upon whose employer tax withholding the KJDA tax credit is claimed.

I hereby certify, under penalty of perjury, that the activity engaged in by the licensee with respect to which a KJDA tax credit is claimed was during the quarter indicated on the first page of this form a “service or technology" activity within the meaning of KRS 154.24-010 (16) and was the activity as described at the time the KJDA project was approved.

I hereby certify, under penalty of perjury, that the licensee either (i) engages in no business in Kentucky other than that of the approved KJDA project, or (ii) keeps an account of receipts of the licensee arising from its approved KJDA project as distinct from all other receipts of the licensee.

I hereby certify, under penalty of perjury, that I have examined the above information and that it is true, correct and complete to the best of my knowledge, and that this company has met the requirements of the KJDA project.

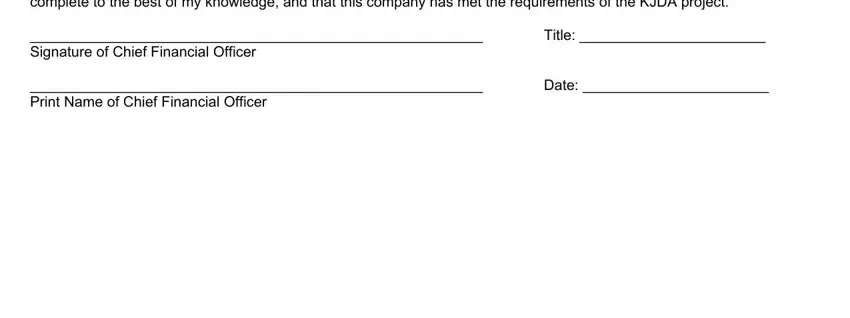

________________________________________________________ |

Title: _______________________ |

Signature of Chief Financial Officer |

|

________________________________________________________ |

Date: _______________________ |

Print Name of Chief Financial Officer |

|

GENERAL INFORMATION

Office Location: 617 WEST JEFFERSON Street, Louisville, KY 40202

Employers are required to withhold Occupational License Fees/Taxes from the gross salaries, wages, commissions and other forms of compensation earned by employees for work performed within Louisville Metro, Kentucky. Louisville Metro includes the area within the boundaries of Jefferson County, Kentucky. There are two basic tax rates that apply to wages earned within Louisville Metro, Kentucky.

1.Resident employees - Employees who work and live in Louisville Metro, Kentucky, are subject to a tax rate of 2.2% (.0220). The rate for resident employees is composed of:

Louisville Metro |

1.25% |

(.0125) |

Transit Authority |

.2% |

(.0020) |

School Boards Tax |

.75% |

(.0075) |

2.Non-resident employees - Employees who live outside Louisville Metro, Kentucky, are subject to a tax rate of 1.45% (.0145). The rate for non- resident employees is composed of:

Louisville Metro |

1.25% |

(.0125) |

Transit Authority |

.2% |

(.0020) |

REQUIREMENT FOR PAYMENT OF MONTHLY DEPOSITS: Every employer who was responsible for withholding occupational license fees/taxes of more than $3,000.00 during any one of the preceding four (4) calendar quarters must submit monthly deposits of the occupational license fees/taxes withheld to the Louisville Metro Revenue Commission. All monthly withholding tax deposits are due 15 days after the month end. * If this is the first time that you owed Occupational License Fees/Taxes exceeding $3,000.00, you may not receive deposit forms. You can obtain deposit forms from our website, www.metrorevenue.org, or obtain answers to your questions by sending an email to taxhelp@metrorevenue.org.

Failure to procure deposit forms or make deposits shall not be considered reasonable cause for abatement of penalty and interest charges that are assessed as a result of your failure to submit timely deposits.

Month That Wages |

Monthly Deposit |

Month That Wages |

Monthly Deposit |

Were Withheld |

Due Date |

Were Withheld |

Due Date |

January |

February 15 |

July |

August 15 |

February |

March 15 |

August |

September 15 |

March |

April 15 |

September |

October 15 |

April |

May 15 |

October |

November 15 |

May |

June 15 |

November |

December 15 |

June |

July 15 |

December |

January 15 |

|

(* Postmarked or Hand Delivered) |

|

(* Postmarked or Hand Delivered) |

Employers whose withholding tax liability for each of the preceding four (4) quarters was less than $3,000.00 will continue to file and pay withholding taxes quarterly. ALL employers will be required to file a quarterly withholding tax return (FORM W-1 KJDA) by the last day of the month following the close of the calendar quarter.

License Fee Return for: |

Filed by: |

1st quarter |

April 30 |

2nd quarter |

July 31 |

3rd quarter |

October 31 |

4th quarter |

January 31 |

|

(* Postmarked or Hand Delivered) |

INSTRUCTIONS FOR FORM W-1 KJDA

Quarterly Withholding Tax Return For Employers Claiming the Kentucky Jobs Development Authority Credit (Figures on Lines 1-4 should reflect payroll for the entire quarter.)

1.Enter the gross wages paid to all employees for work that was performed within Louisville Metro, KY. Multiply wages entered on Line 1 by .0145. Enter result in the “TAX DUE” column of Line 1(a).

2.Determine what portion of the total Louisville Metro, KY, wages (entry on Line 1) was paid to employees who did not live in Louisville Metro, KY, during the quarter. Enter the total on Line 2.

3.Subtract the entry on Line 2 from the entry on Line 1 and enter the result on Line 3. This figure represents the total wages paid to employees who lived in Louisville Metro, KY, for work that they performed in Louisville Metro, KY. Multiply wages entered on Line 3 by .0075. Enter the result in the “TAX DUE” column on Line 3(a).

4.Enter the gross wages paid to the employees who qualified for the Kentucky Jobs Development Authority (KJDA) credit for work that was performed in Louisville Metro, KY. Multiply the wages entered on Line 4 by the applicable Activation Rate. Enter the result in the “TAX DUE” column on Line 4(a). NOTE:

If the employees who qualified for the KJDA credit worked in the cities of Jeffersontown, St. Matthews, Shively, or West Buechel, the KJDA Activation rate is pro-rated between Louisville Metro, KY, and those cities.

5.Add the amounts entered in the column labeled “TAX DUE” on Lines 1(a) and 3(a), and then subtract the KJDA credit on Line 4(a). This is the total amount of tax due. NOTE: Employers are liable to pay the total amount of tax due, even if the full amount of tax was not withheld from the employees.

6.Employers are subject to a penalty of 5% per month, or a fraction of a month, such return remains unfiled, to a maximum of 25%. Failure to pay by the due date is an additional 5% penalty, plus interest at a rate of 12% per annum from the due date until paid. The above charges are assessed against amounts not paid by the due date. Failure to complete the information on the quarterly return may subject a licensee to a punitive penalty. If you have failed to file and/or pay on time, enter the penalty and/or interest amount on Line 7.

7.Add entries on Lines 5 and 6. Enter total on Line 7. This represents the total payment due.

QUARTERLY RECONCILIATION

Employers who pay tax on a quarterly basis (amount owed is $3,000.00 or less for each of the preceding four (4) calendar quarters) should not complete Lines 9-11. Employers who are required to make monthly deposits must complete Lines 8-12 inclusive.

8.Enter the amount of tax that should have been withheld during each month of the quarter on the appropriate lines (i.e., 8A, 8B, 8C).

9.Add the amount of the deposits that were made for the quarter. Enter the total of all deposits on Line 9.

10.- 12. Subtract the entry on Line 9 (total deposits for the quarter) from the entry on Line 7 (total amount due). If the amount on Line 7 is greater than the amount on Line 9, enter the additional amount due on Line 10. Submit payment of any additional amount due with the tax form. If Line 9 (total deposits for the quarter) is greater than Line 7 (total amount due), attach a detailed explanation of why the overpayment occurred, and enter the portion of the overpayment to be credited on Line 11. Enter the portion of the overpayment to be refunded on Line 12.

13. If the amount due is being paid through ACH Credit, enter the tracking number assigned to the payment by your financial institution.

For information on taxable compensation (Deferred Compensation, Section 125 Plans, Health Insurance over $50,000), please visit our website, www.metrorevenue.org, and read sections 2.1 through 2.8 of the Regulations of the Louisville Metro Revenue Commission.