With the help of the online PDF editor by FormsPal, it is easy to fill out or modify 597 w withholding exemption form right here. To make our editor better and easier to utilize, we consistently develop new features, considering suggestions coming from our users. To get the ball rolling, take these basic steps:

Step 1: Click on the orange "Get Form" button above. It'll open our pdf editor so you can start filling out your form.

Step 2: Using this advanced PDF editor, it is possible to do more than just complete blank form fields. Express yourself and make your forms appear professional with customized textual content added in, or optimize the original content to excellence - all that backed up by an ability to add any type of photos and sign the PDF off.

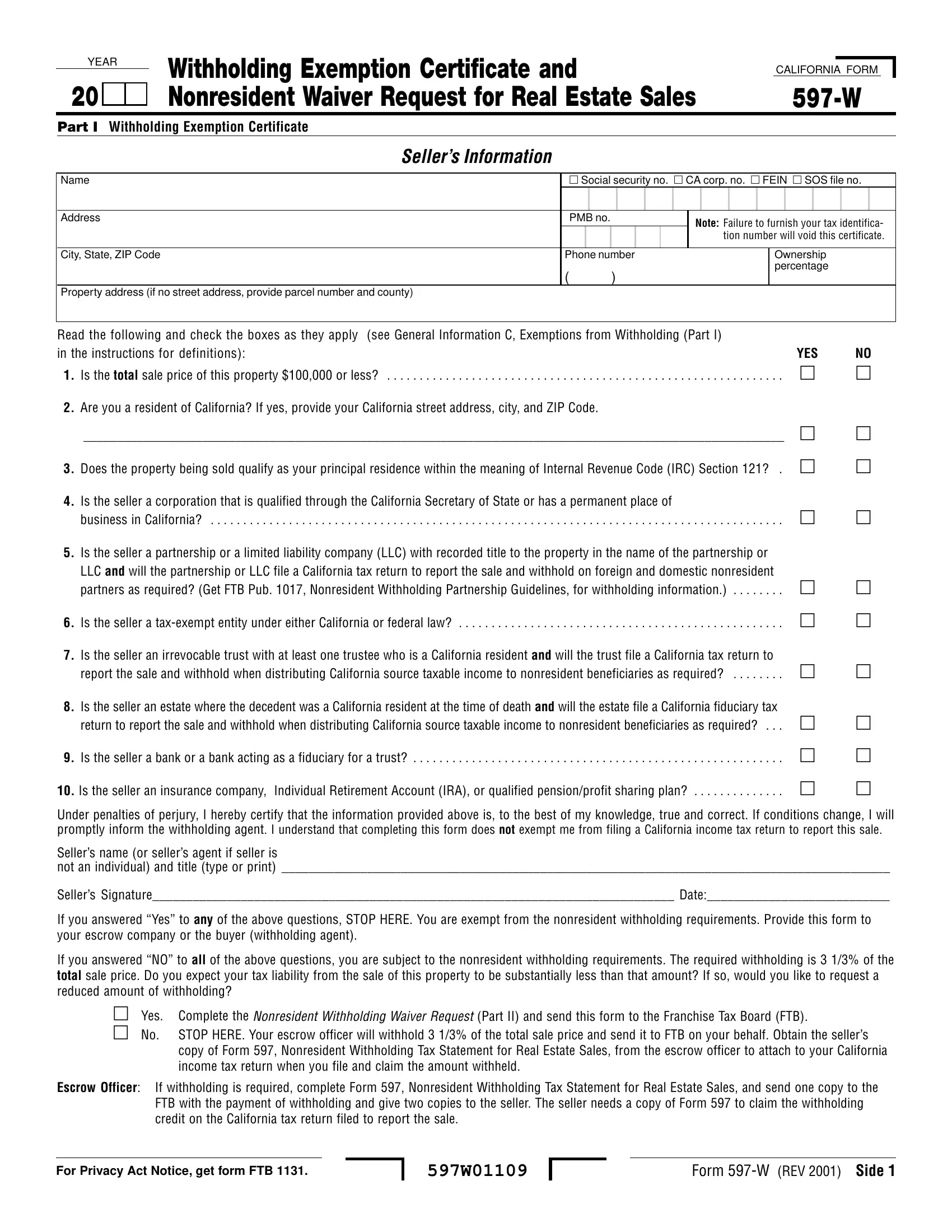

To be able to finalize this PDF document, be sure you enter the right details in each field:

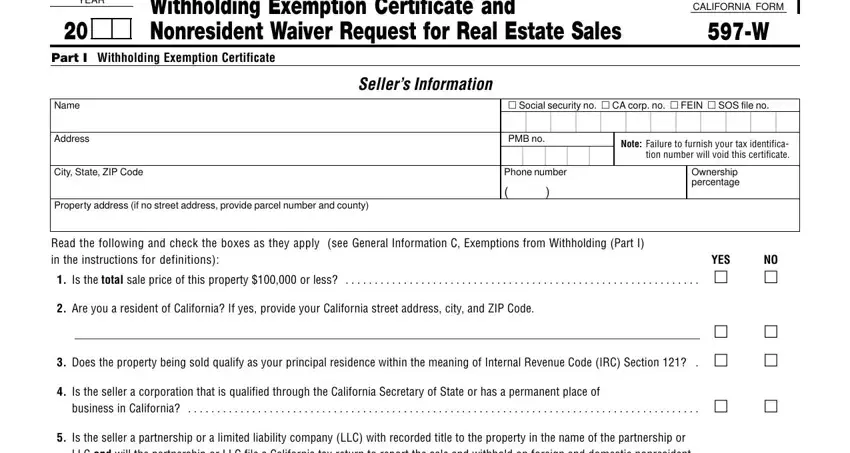

1. Begin filling out the 597 w withholding exemption form with a group of major fields. Consider all of the necessary information and make certain there's nothing neglected!

2. The subsequent part is usually to complete these particular fields: Is the seller a partnership or a, Is the seller a taxexempt entity, Is the seller an irrevocable, report the sale and withhold when, Is the seller an estate where the, return to report the sale and, Is the seller a bank or a bank, Is the seller an insurance, Under penalties of perjury I, Sellers name or sellers agent if, Sellers Signature Date, If you answered Yes to any of the, and If you answered NO to all of the.

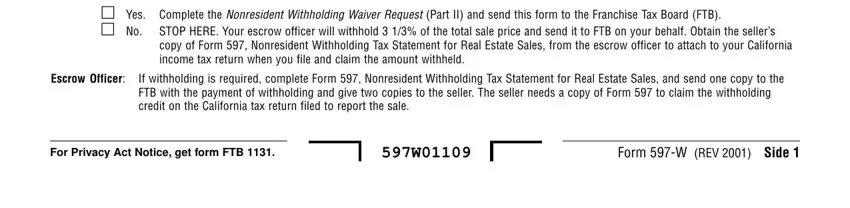

3. Within this step, review Yes No, Complete the Nonresident, Escrow Officer, If withholding is required, For Privacy Act Notice get form, and Form W REV Side . Each of these will need to be completed with highest accuracy.

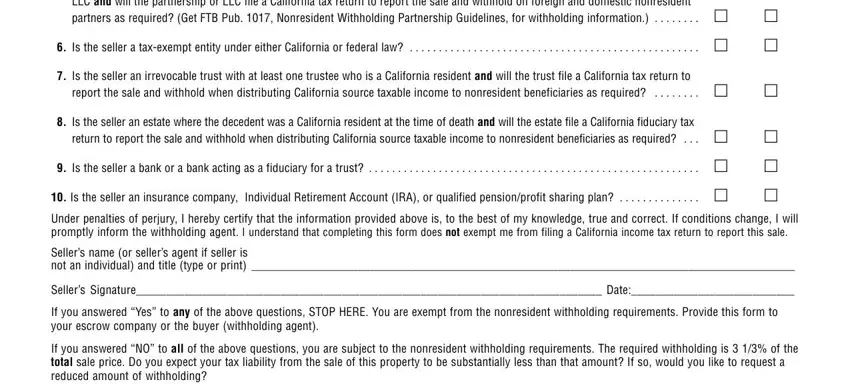

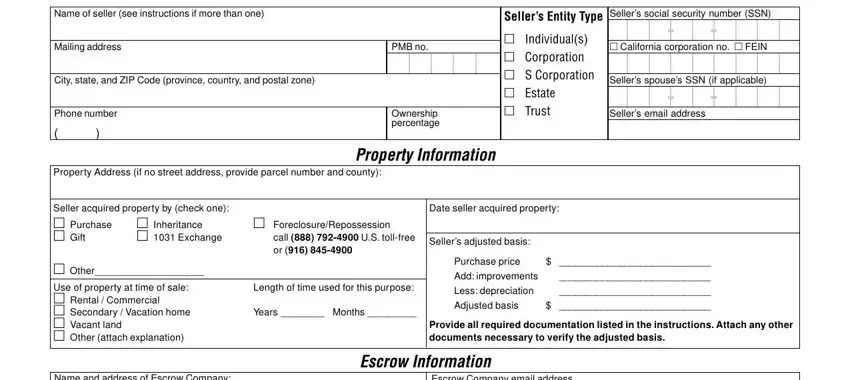

4. This next section requires some additional information. Ensure you complete all the necessary fields - Name of seller see instructions if, Sellers Information, Mailing address, PMB no, City state and ZIP Code province, Phone number, Ownership percentage, Property Information, Property Address if no street, Sellers Entity Type, Individuals Corporation S, Sellers social security number SSN, California corporation no FEIN, Sellers spouses SSN if applicable, and Sellers email address - to proceed further in your process!

Regarding Phone number and Name of seller see instructions if, ensure that you don't make any errors in this current part. These are certainly the most important ones in the document.

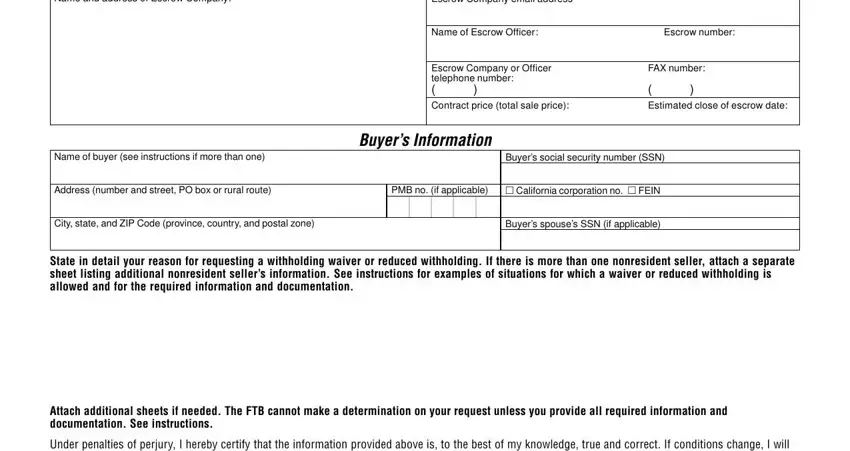

5. When you come near to the conclusion of this form, there are actually just a few extra requirements that should be satisfied. Particularly, Name and address of Escrow Company, Escrow Company email address, Name of Escrow Officer, Escrow number, Escrow Company or Officer, FAX number, Estimated close of escrow date, Name of buyer see instructions if, Buyers social security number SSN, Buyers Information, Address number and street PO box, PMB no if applicable, California corporation no FEIN, City state and ZIP Code province, and Buyers spouses SSN if applicable must all be done.

Step 3: Check all the details you have inserted in the blank fields and hit the "Done" button. Get your 597 w withholding exemption form after you join for a free trial. Instantly view the pdf form in your personal account page, along with any edits and changes being all preserved! FormsPal is invested in the personal privacy of all our users; we ensure that all personal data going through our editor is kept confidential.