GENERAL INSTRUCTIONS

Explanation of Occupational Taxes: The Louisville Metro Revenue Commission (hereinafter referred to as the “Revenue Commission”) collects Occupational License Fees/Taxes (hereinafter referred to as “Occupational Taxes”) on all income resulting from transacting business within Louisville Metro, Kentucky. There is no minimum earned income amount before you are liable for filing a tax return. The occupational tax is imposed upon the privilege of engaging in a business, profession, occupation, or trade within Louisville Metro, Kentucky, regardless of the legal residence of the person so engaged. Louisville Metro includes the area within the boundaries of Jefferson County, Kentucky. The current rate for Occupational Taxes totals 2.2% (.0220). This total is distributed as follows: 1.25% (.0125) to Louisville Metro Government;

.2% (.0020) to Transit Authority of River City (TARC); and .75% (.0075) to the Louisville or Anchorage Public School Boards. The occupational license tax rate is applicable to the “net profits” of business entities, independent contractors and self- employed individuals, and to the gross employee compensation of employed individuals. Individuals who reside outside Louisville Metro, Kentucky, are exempt from the School Board tax.

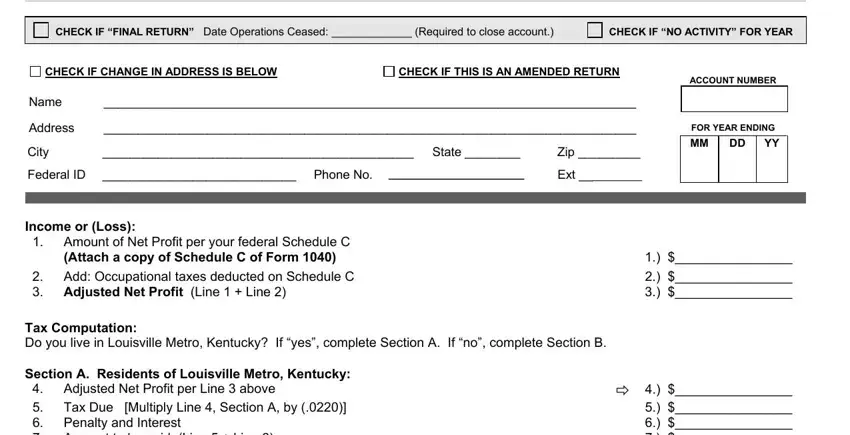

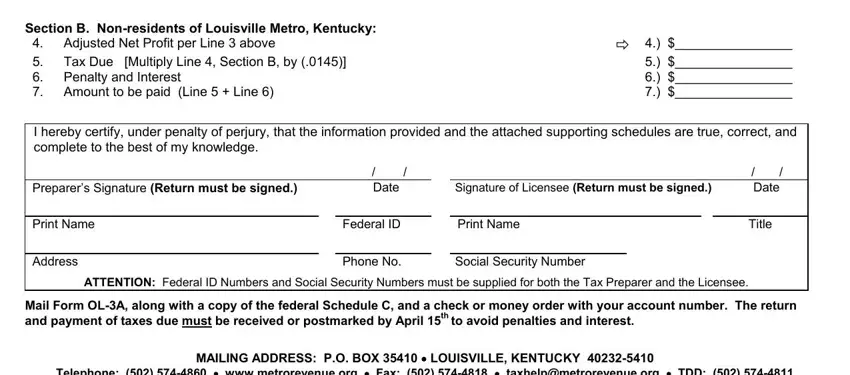

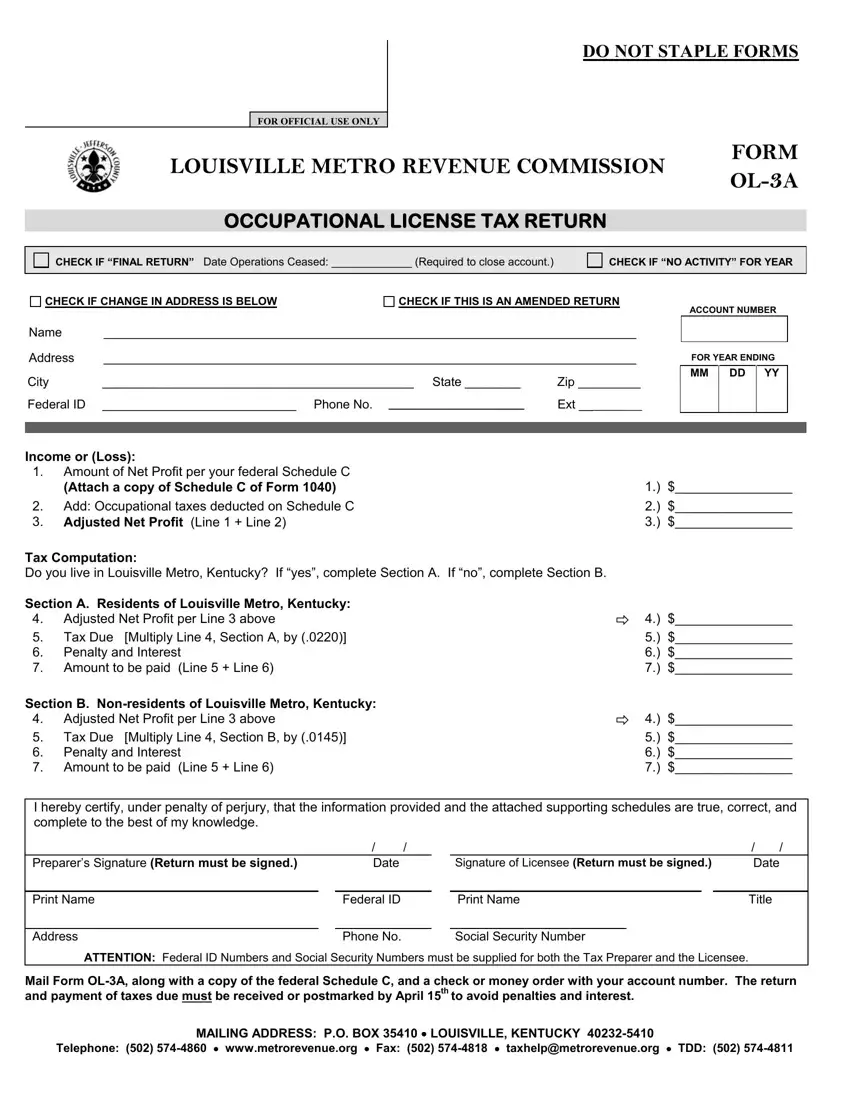

Who May Use This Form: This return may be used only if all of the following apply:

(a)You are an individual (not a corporation or a partnership).

(b)You had no employees for the calendar year.

(c)You are not a domestic servant or a minister.

(d)You were not engaged in the activity of selling alcoholic beverages.

(e)All of your income per Schedule C was earned in Louisville Metro, Kentucky.

(f)You were either a resident for the entire year or a non-resident for the entire year.

NOTE: If you meet the conditions above and you had no business expenses, you should file Form OL-3EZ.

The salaries and wages of domestic servants and duly ordained ministers of religion are exempt from all the local occupational taxes, except the (.0075) School Board’s tax. Domestic servants and ordained ministers must use Form OL-3. All other individuals whose earnings within Louisville Metro, Kentucky, were from salaries, wages, commissions, or other compensation received from one or more employers, and on which occupational license taxes were not withheld [deducted by the employer(s)], must file an annual return on Form OL-3, OL-3A, or OL-3EZ, whichever is applicable. If the taxpayer is deceased, the return(s) must be filed by his or her legal representative.

Period Covered: Form OL-3A is to be filed based upon a calendar year.

Extensions: If an extension of time for filing is required, a separate extension request to the Louisville Metro Revenue Commission is mandatory in all cases. You must file Form OL-3E or a copy of your federal extension application to request an automatic 6-month extension to file Form OL-3A. All extension requests should include your Revenue Commission account number. The extension must be postmarked or hand-delivered to the Revenue Commission, 617 West Jefferson Street, Louisville, Kentucky 40202, on or before the original due date. Any tax due must be paid by April

Penalty and Interest: There is a penalty of five percent (5%) per month or a fraction of a month to a maximum of twenty-five percent (25%) for failure to file a tax return by the regular or extended due date. There is an additional five percent (5%) penalty for late payment of the occupational tax. Interest is computed at twelve percent (12%) per annum from the original due date until the date of payment.

Failure to File Return and/or Pay Occupational Tax: Any person (including a corporation) who willfully fails to prepare or file a timely return, or who willfully prepares or files a false or inaccurate return, is subject, upon conviction, to a fine not exceeding $100.00. The failure of any person to receive a return shall not excuse him or her from filing a return or from paying the proper occupational tax.