Our best developers have worked together to get the PDF editor that you'll use. This specific software makes it easy to complete form 2019 mass documentation shortly and with ease. This is certainly all you should undertake.

Step 1: Search for the button "Get Form Here" and select it.

Step 2: Now you may enhance the form 2019 mass. You need to use the multifunctional toolbar to insert, delete, and alter the content material of the file.

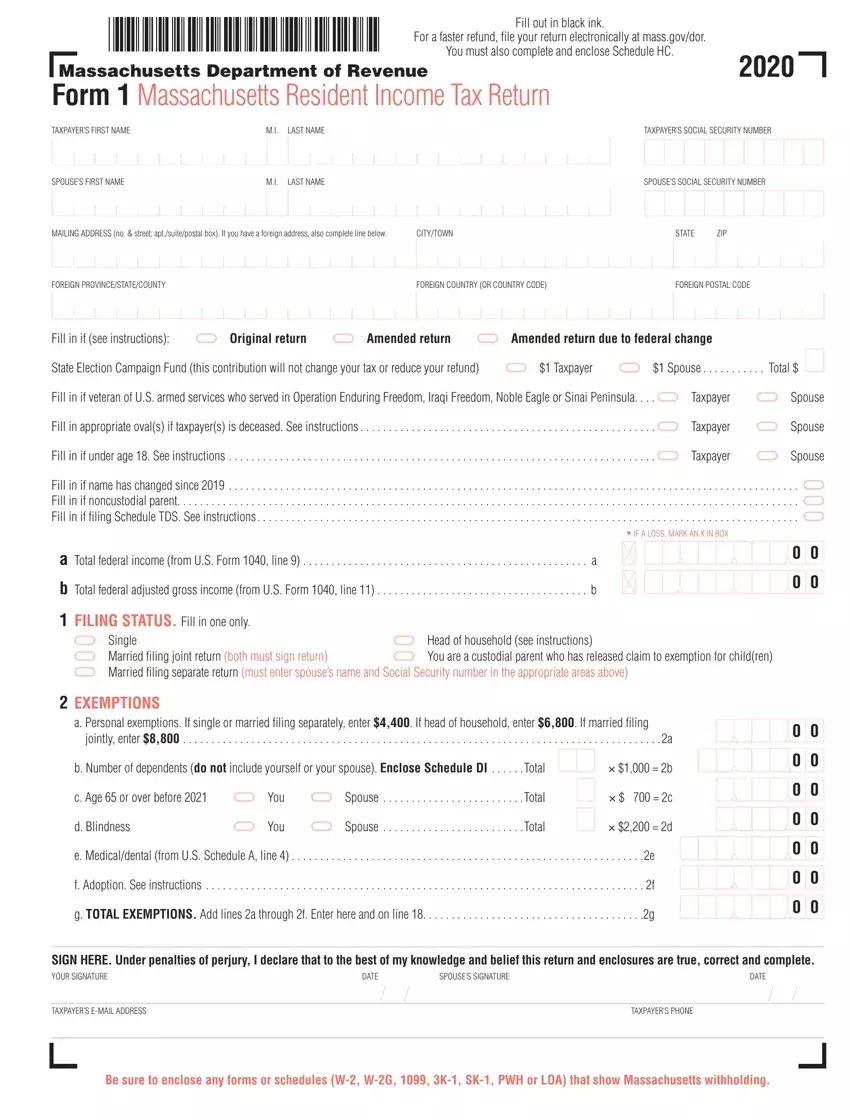

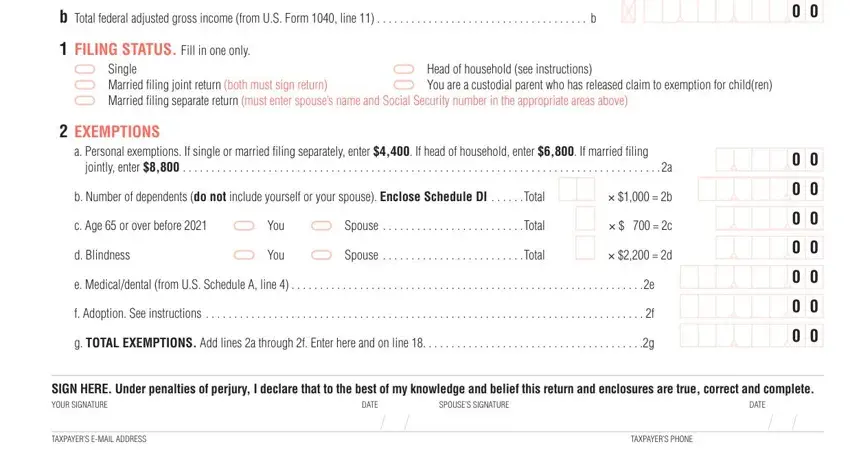

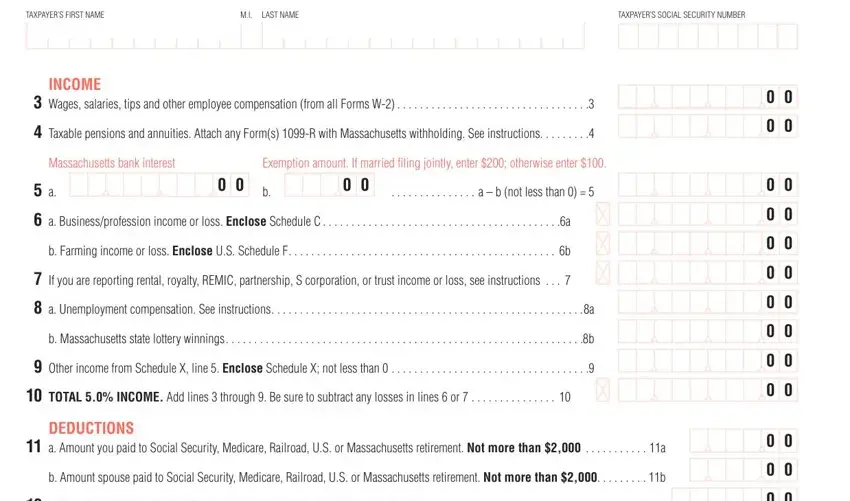

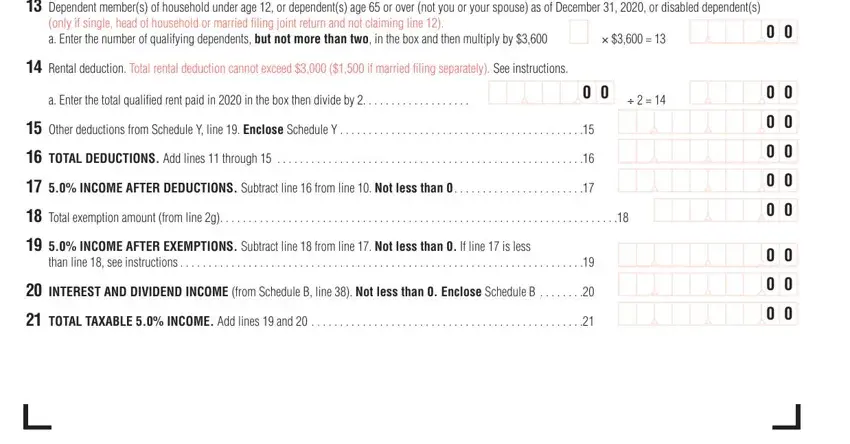

These areas are going to make up the PDF form:

Write down the expected information in the segment b Total federal adjusted gross, FILING STATUS Fill in one only, Single Married filing joint return, Head of household see instructions, EXEMPTIONS, a Personal exemptions If single or, jointly enter, b Number of dependents do not, c Age or over before, d Blindness, You, You, Spouse, Spouse, and e Medicaldental from US Schedule A.

Make sure you point out the essential particulars from the Be sure to enclose any forms or part.

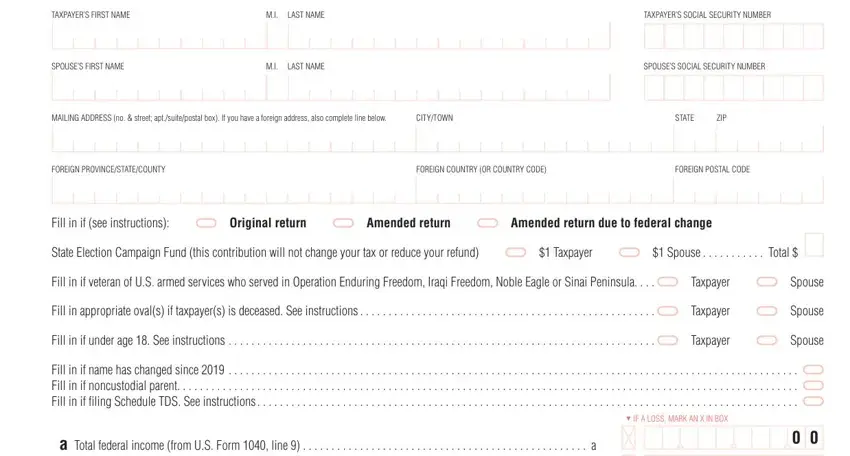

The space TAXPAYERS FIRST NAME, LAST NAME, TAXPAYERS SOCIAL SECURITY NUMBER, INCOME, Wages salaries tips and other, Taxable pensions and annuities, Massachusetts bank interest, Exemption amount If married filing, a b not less than, a Businessprofession income or, b Farming income or loss Enclose, If you are reporting rental, a Unemployment compensation See, b Massachusetts state lottery, and Other income from Schedule X line is where to put both parties' rights and obligations.

Check the sections Dependent members of household, only if single head of household, a Enter the number of qualifying, Rental deduction Total rental, a Enter the total qualified rent, Other deductions from Schedule Y, TOTAL DEDUCTIONS Add lines, INCOME AFTER DEDUCTIONS Subtract, Total exemption amount from line, INCOME AFTER EXEMPTIONS Subtract, than line see instructions, INTEREST AND DIVIDEND INCOME from, and TOTAL TAXABLE INCOME Add lines and next fill them in.

Step 3: As you choose the Done button, your ready file can be easily transferred to each of your devices or to electronic mail chosen by you.

Step 4: To protect yourself from any type of complications in the future, try to get as a minimum a few duplicates of the document.