By using the online PDF editor by FormsPal, you may fill in or edit state of maine transfer tax form here and now. Our expert team is ceaselessly endeavoring to expand the tool and ensure it is even easier for people with its cutting-edge features. Enjoy an ever-evolving experience today! With a few basic steps, you are able to start your PDF journey:

Step 1: Hit the "Get Form" button above on this page to access our PDF editor.

Step 2: The tool offers you the capability to modify your PDF document in many different ways. Change it with any text, adjust what is already in the PDF, and place in a signature - all when it's needed!

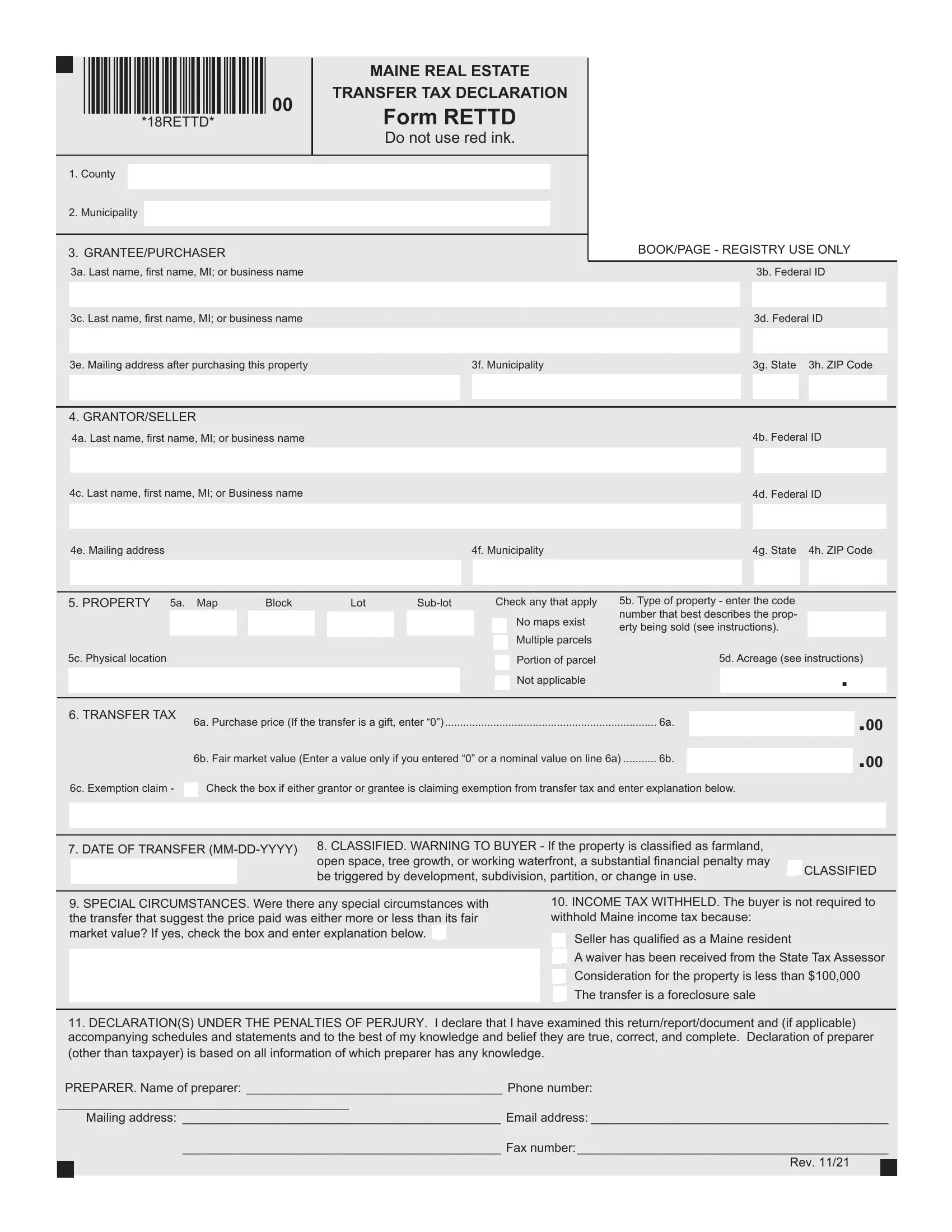

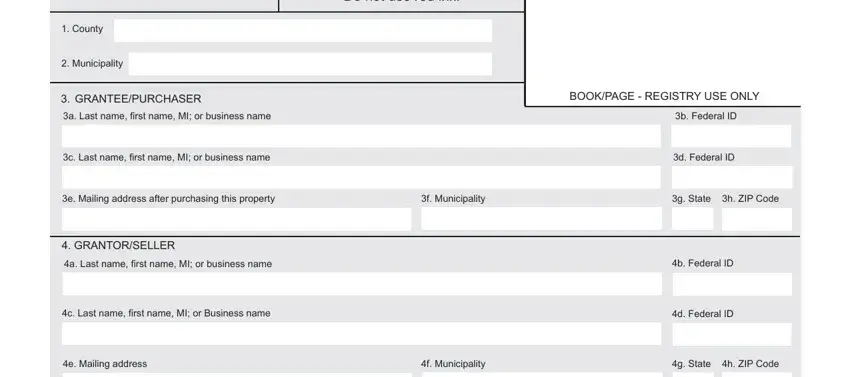

For you to complete this document, ensure that you provide the required information in each and every field:

1. Before anything else, once filling in the state of maine transfer tax form, beging with the section that includes the subsequent blank fields:

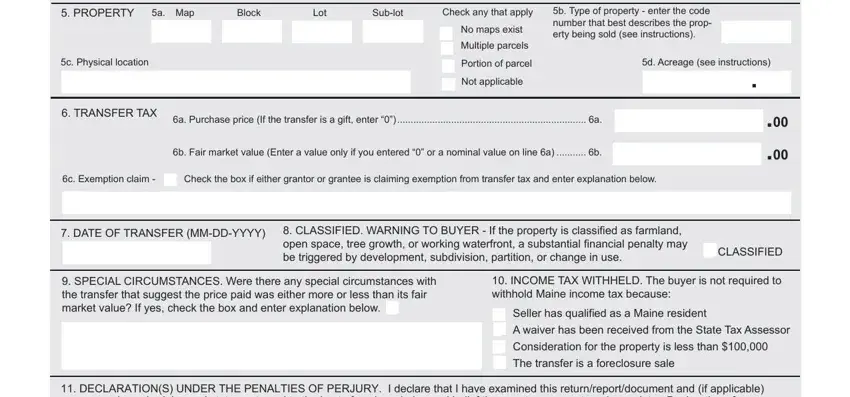

2. Right after the prior array of fields is completed, go on to enter the relevant details in these: PROPERTY, a Map, Block, Lot, Sublot, Check any that apply, c Physical location, No maps exist, Multiple parcels, Portion of parcel, Not applicable, b Type of property enter the code, d Acreage see instructions, TRANSFER TAX, and a Purchase price If the transfer.

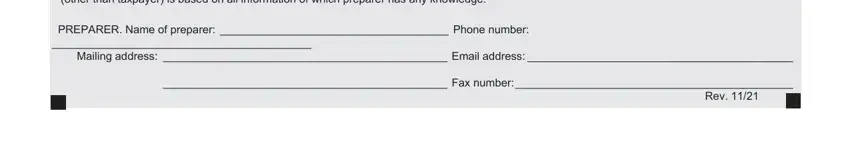

3. The following section should be quite easy, DECLARATIONS UNDER THE PENALTIES, PREPARER Name of preparer Phone, Mailing address Email address, Fax number, and Rev - all these fields needs to be completed here.

People who work with this PDF often get some points wrong when filling out DECLARATIONS UNDER THE PENALTIES in this part. You should definitely read again everything you type in here.

Step 3: When you've glanced through the details provided, simply click "Done" to complete your document creation. Get the state of maine transfer tax form the instant you subscribe to a 7-day free trial. Instantly get access to the document within your FormsPal account page, along with any edits and adjustments automatically preserved! FormsPal offers risk-free form completion devoid of data recording or sharing. Rest assured that your information is in good hands with us!