Should you need to fill out seq, it's not necessary to download and install any programs - simply make use of our online tool. FormsPal professional team is ceaselessly endeavoring to expand the editor and insure that it is much easier for clients with its extensive functions. Bring your experience to a higher level with constantly improving and unique opportunities we offer! Should you be seeking to begin, here's what it requires:

Step 1: Press the "Get Form" button at the top of this webpage to open our PDF tool.

Step 2: As soon as you start the PDF editor, there'll be the document ready to be filled out. Other than filling in various blank fields, you might also do other actions with the Document, namely adding any textual content, editing the initial text, inserting graphics, signing the document, and much more.

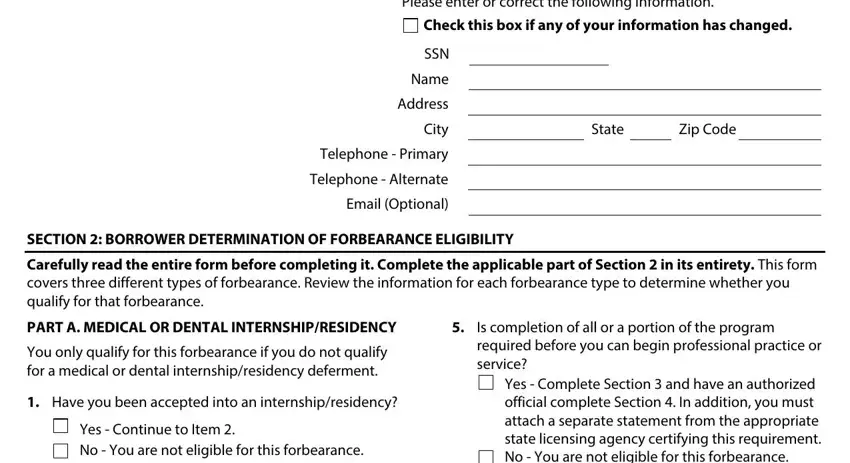

This PDF requires specific data to be filled out, thus be sure to take whatever time to provide precisely what is required:

1. To begin with, when completing the seq, start out with the part that includes the subsequent fields:

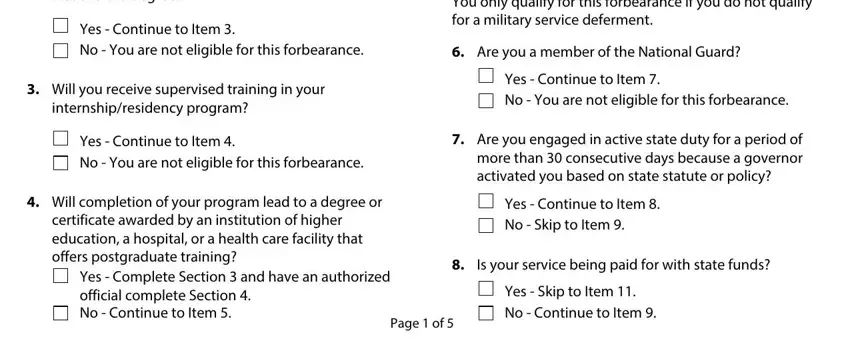

2. Once your current task is complete, take the next step – fill out all of these fields - a bachelors degree, Yes Continue to Item No You are, Will you receive supervised, internshipresidency program, You only qualify for this, Are you a member of the National, Yes Continue to Item No You are, Yes Continue to Item No You are, Are you engaged in active state, Will completion of your program, certificate awarded by an, Yes Complete Section and have an, Yes Continue to Item No Skip to, Is your service being paid for, and Yes Skip to Item No Continue to with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to make errors while filling in your Yes Continue to Item No You are, so ensure that you take another look before you decide to finalize the form.

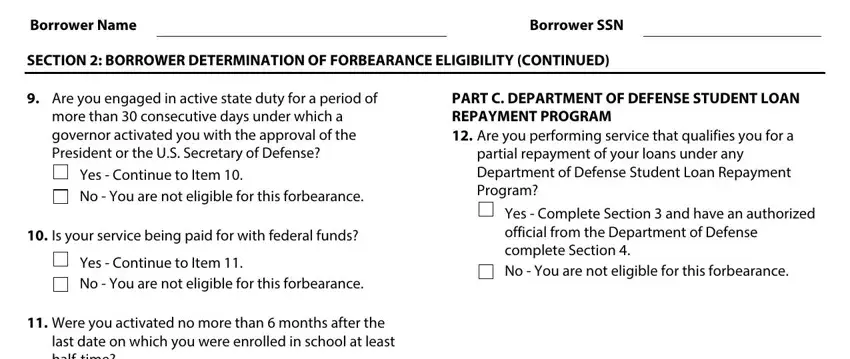

3. This next section is considered pretty uncomplicated, Borrower Name, Borrower SSN, SECTION BORROWER DETERMINATION OF, PART C DEPARTMENT OF DEFENSE, partial repayment of your loans, Yes Complete Section and have an, Are you engaged in active state, more than consecutive days under, Yes Continue to Item No You are, Is your service being paid for, Yes Continue to Item No You are, Were you activated no more than, and last date on which you were - these blanks will have to be filled out here.

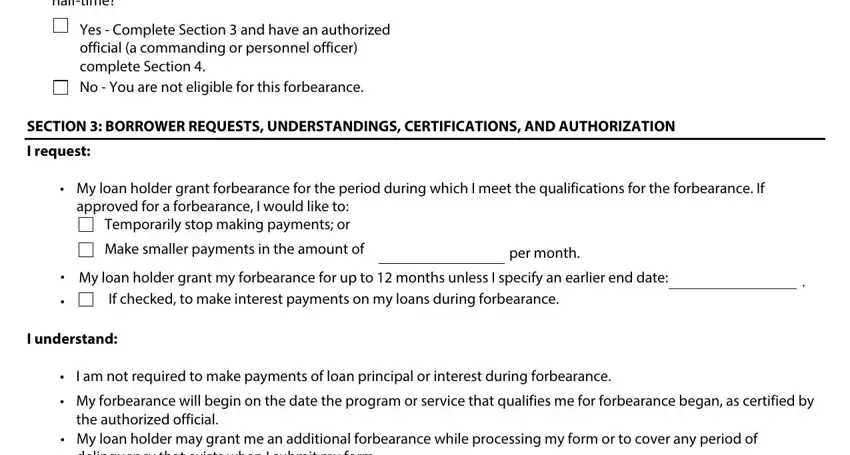

4. Filling out last date on which you were, Yes Complete Section and have an, SECTION BORROWER REQUESTS, I request, My loan holder grant forbearance, approved for a forbearance I would, Make smaller payments in the, per month, My loan holder grant my, If checked to make interest, I understand, I am not required to make payments, My forbearance will begin on the, and the authorized official My loan is paramount in the fourth part - always don't hurry and fill out every blank!

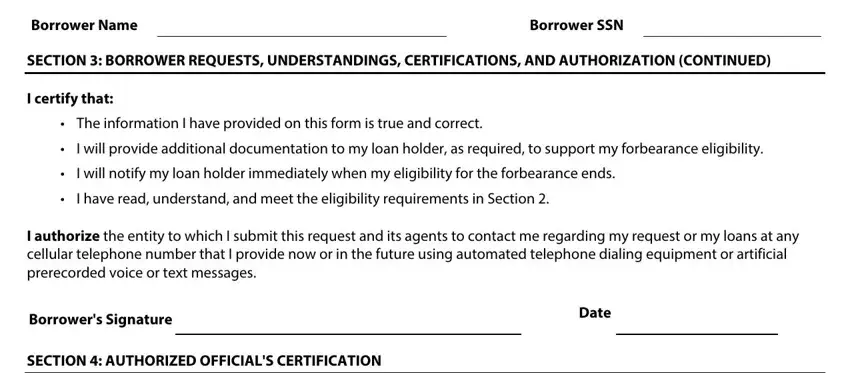

5. The form needs to be finished by going through this segment. Here one can find a detailed list of form fields that require accurate information in order for your form usage to be accomplished: Borrower Name, Borrower SSN, SECTION BORROWER REQUESTS, I certify that, The information I have provided, I will provide additional, I will notify my loan holder, I have read understand and meet, I authorize the entity to which I, Borrowers Signature, Date, and SECTION AUTHORIZED OFFICIALS.

Step 3: Check all the details you have typed into the form fields and then hit the "Done" button. Go for a free trial subscription at FormsPal and gain immediate access to seq - available from your personal account. FormsPal ensures your information privacy by having a protected system that in no way saves or shares any sort of private information typed in. Be confident knowing your documents are kept safe each time you use our editor!