Dealing with PDF files online is actually a piece of cake using our PDF editor. Anyone can fill out JCWAA here and use several other functions we provide. FormsPal professional team is constantly working to enhance the tool and make it much easier for users with its handy functions. Bring your experience one step further with continually growing and amazing options we provide! This is what you would want to do to start:

Step 1: Hit the "Get Form" button at the top of this webpage to access our tool.

Step 2: With our state-of-the-art PDF tool, it's possible to do more than merely fill in blank form fields. Express yourself and make your forms seem professional with custom textual content incorporated, or adjust the original content to perfection - all comes along with the capability to add stunning pictures and sign the file off.

It is easy to fill out the pdf with this detailed tutorial! Here is what you need to do:

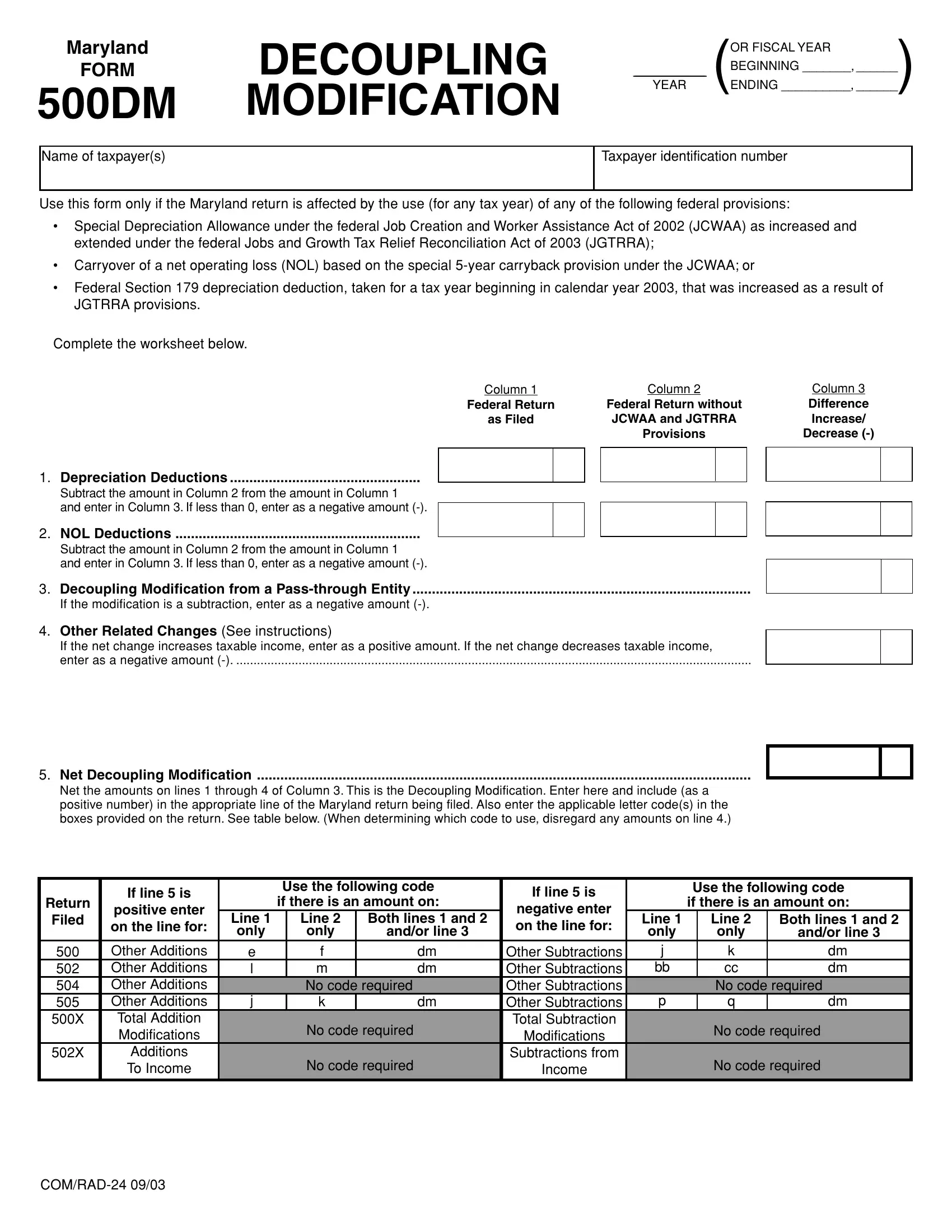

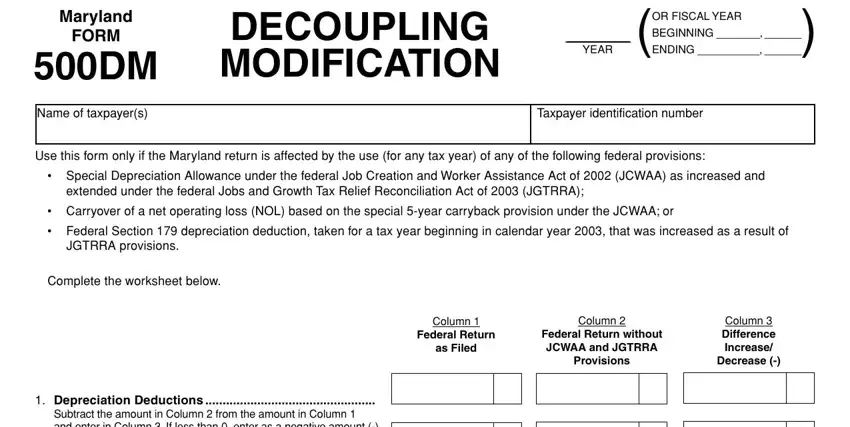

1. You'll want to fill out the JCWAA correctly, therefore pay close attention while working with the areas containing these specific fields:

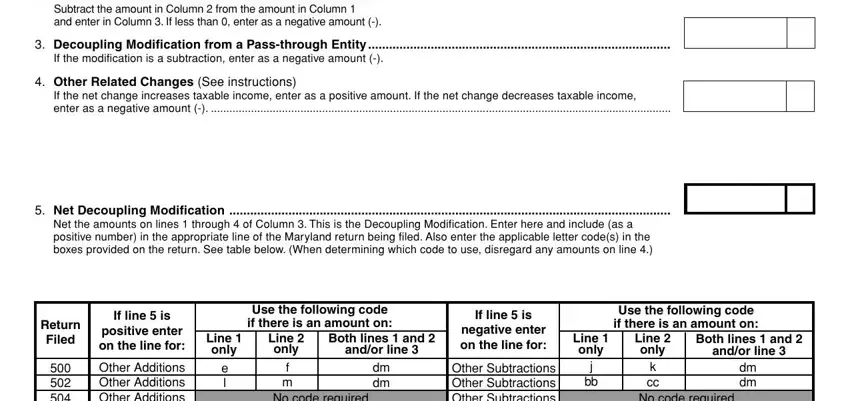

2. The subsequent step would be to fill in these blank fields: NOL Deductions, Subtract the amount in Column, Decoupling Modification from a, If the modification is a, Other Related Changes See, If the net change increases, Net Decoupling Modification, Net the amounts on lines through, Return Filed, If line is, positive enter on the line for, Other Additions Other Additions, Use the following code if there is, Line only, and Line only.

Concerning Net Decoupling Modification and If the net change increases, be sure that you do everything right here. These two are certainly the key ones in the file.

Step 3: Before moving forward, make sure that all blanks were filled in as intended. Once you determine that it is fine, press “Done." After starting afree trial account at FormsPal, you will be able to download JCWAA or email it immediately. The PDF will also be readily available from your personal account with your every single modification. With FormsPal, you can complete forms without worrying about data breaches or data entries getting distributed. Our protected system makes sure that your personal details are stored safe.