It is possible to fill in maryland form 4b 4c without difficulty with our PDFinity® online PDF tool. To keep our editor on the cutting edge of practicality, we work to implement user-driven capabilities and improvements regularly. We are routinely grateful for any suggestions - join us in reshaping PDF editing. For anyone who is looking to start, here's what it takes:

Step 1: Press the orange "Get Form" button above. It will open up our pdf tool so that you could start filling in your form.

Step 2: With our advanced PDF editing tool, you can accomplish more than just complete forms. Edit away and make your docs look great with customized text put in, or tweak the original input to excellence - all that comes along with the capability to incorporate stunning photos and sign the document off.

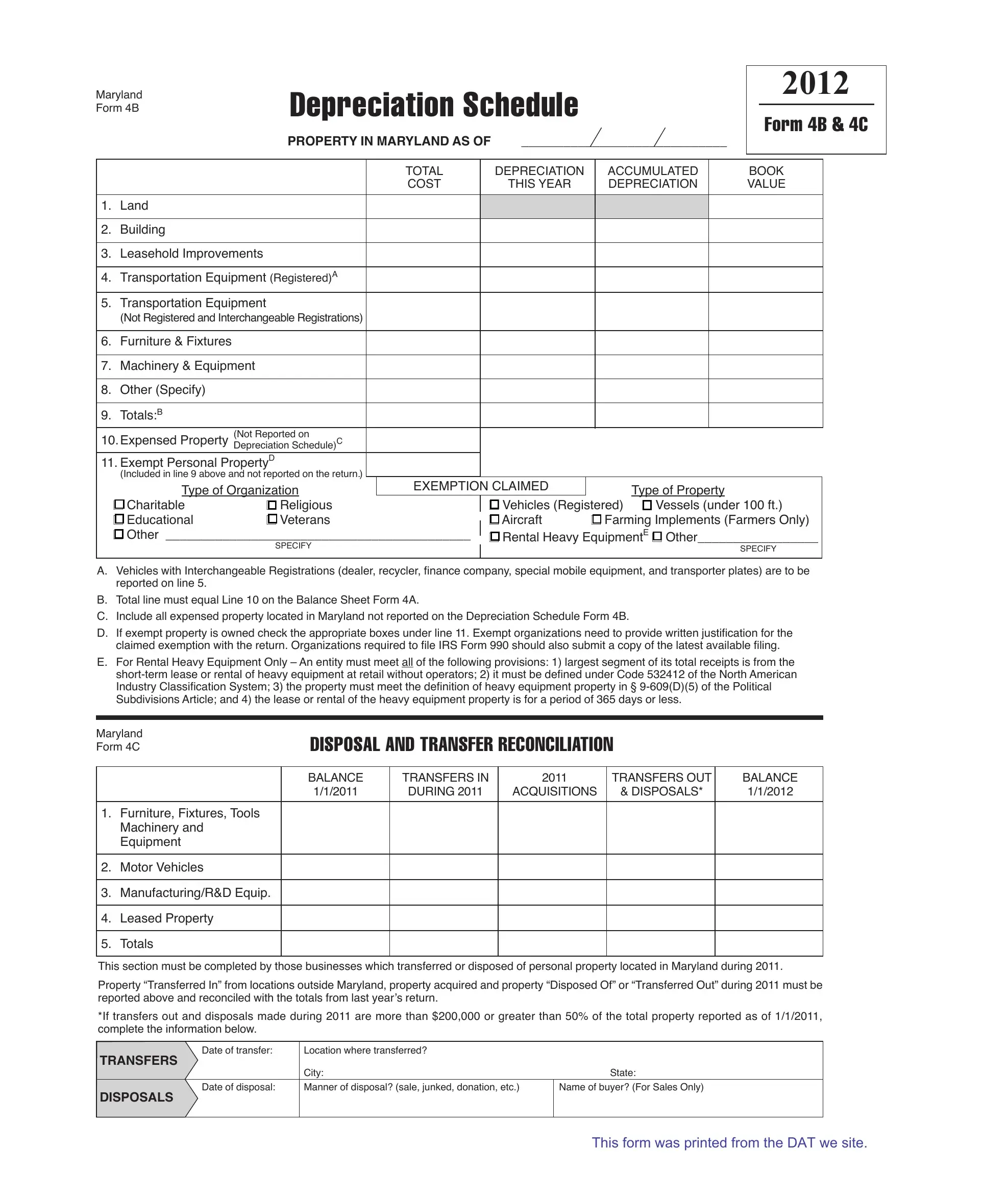

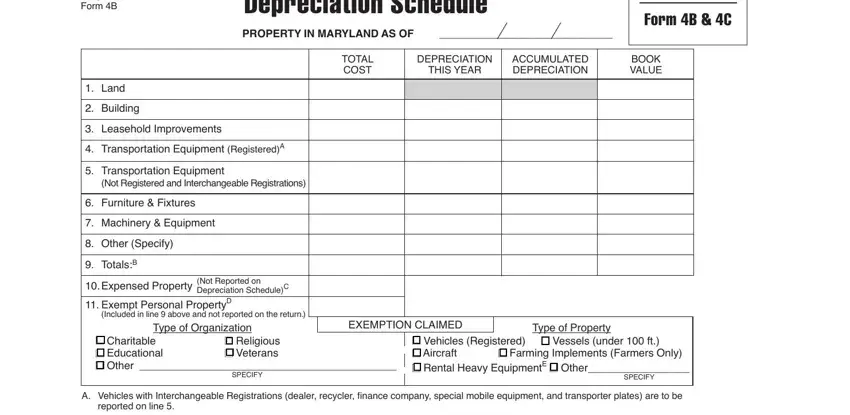

With regards to the blank fields of this specific document, this is what you want to do:

1. The maryland form 4b 4c involves particular details to be typed in. Ensure that the next blanks are finalized:

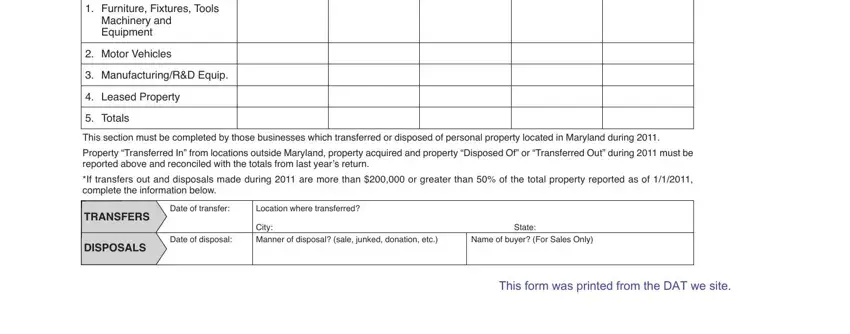

2. After this part is completed, go to enter the suitable details in all these - Furniture Fixtures Tools, Machinery and Equipment, Motor Vehicles, ManufacturingRD Equip, Leased Property, Totals, This section must be completed by, Property Transferred In from, If transfers out and disposals, TRANSFERS, DISPOSAlS, Date of transfer, Location where transferred, Date of disposal, and City Manner of disposal sale.

It's very easy to make errors while completing your Motor Vehicles, thus make sure to look again before you submit it.

Step 3: As soon as you've reviewed the details you given, just click "Done" to finalize your FormsPal process. Create a free trial subscription with us and get instant access to maryland form 4b 4c - which you are able to then begin using as you wish inside your personal account page. With FormsPal, you'll be able to fill out forms without the need to worry about database leaks or data entries being shared. Our protected platform ensures that your personal data is kept safely.