Any time you would like to fill out maryland form 502cr, you don't have to download and install any kind of software - just try using our PDF editor. The tool is continually improved by us, getting awesome features and turning out to be better. With just a few easy steps, you are able to begin your PDF editing:

Step 1: First, open the pdf editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: This tool allows you to work with nearly all PDF forms in a variety of ways. Improve it with your own text, adjust what is already in the file, and include a signature - all at your fingertips!

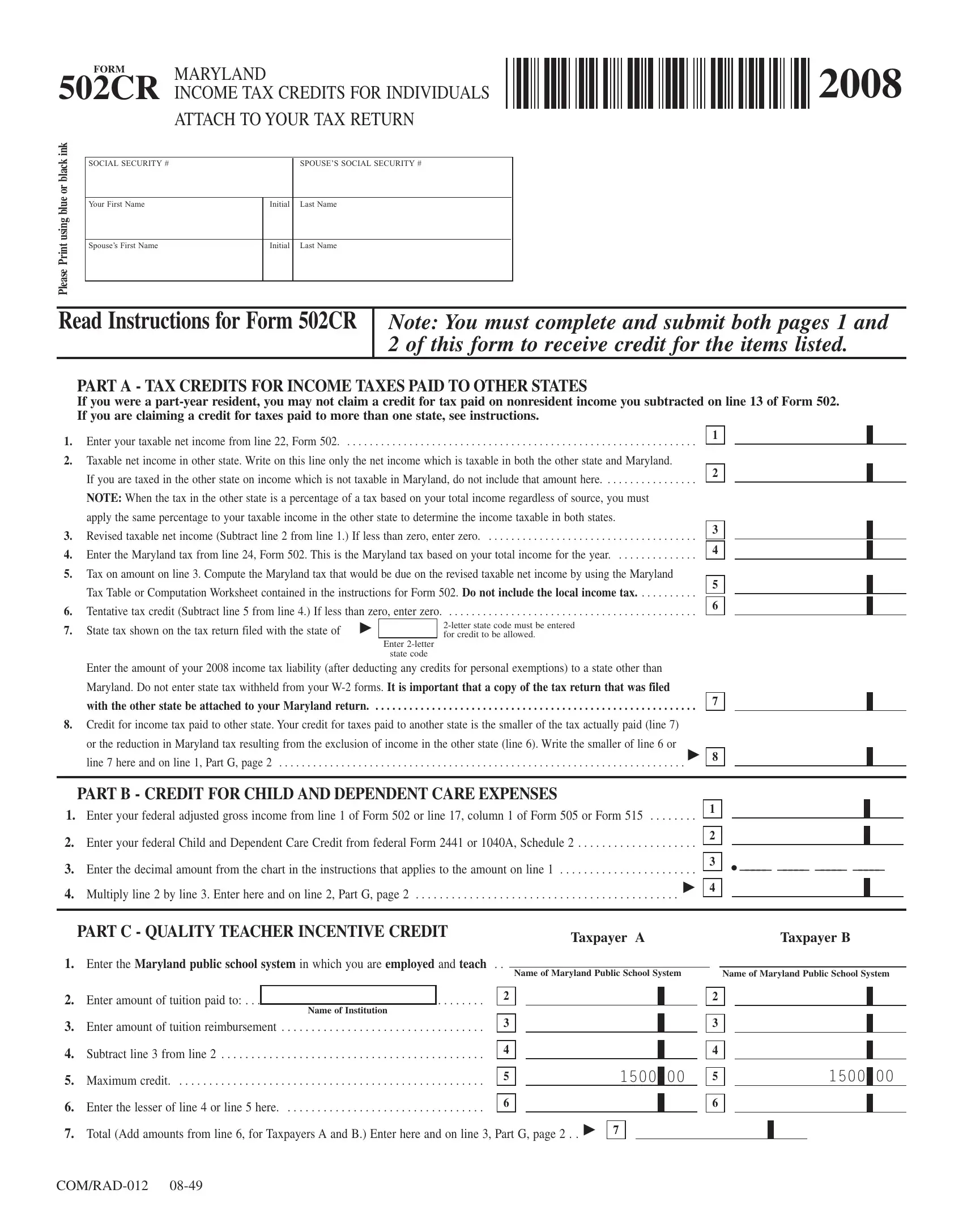

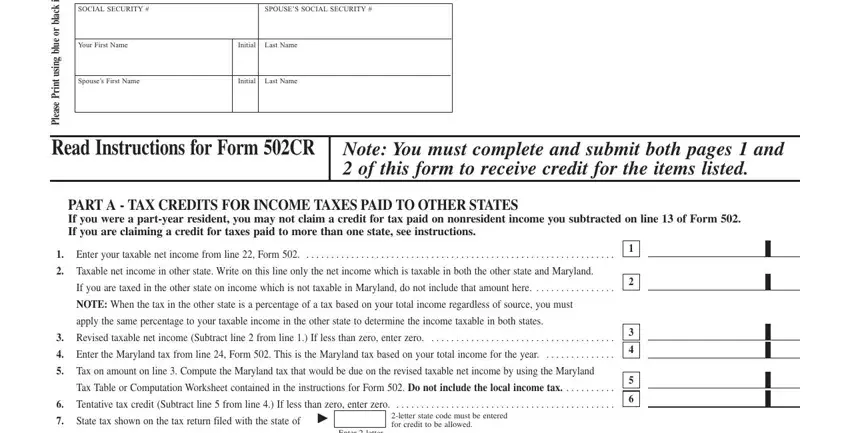

If you want to complete this PDF document, ensure you provide the right information in each and every blank:

1. When filling in the maryland form 502cr, make certain to complete all of the necessary blanks in their associated form section. It will help to facilitate the work, allowing for your information to be processed efficiently and accurately.

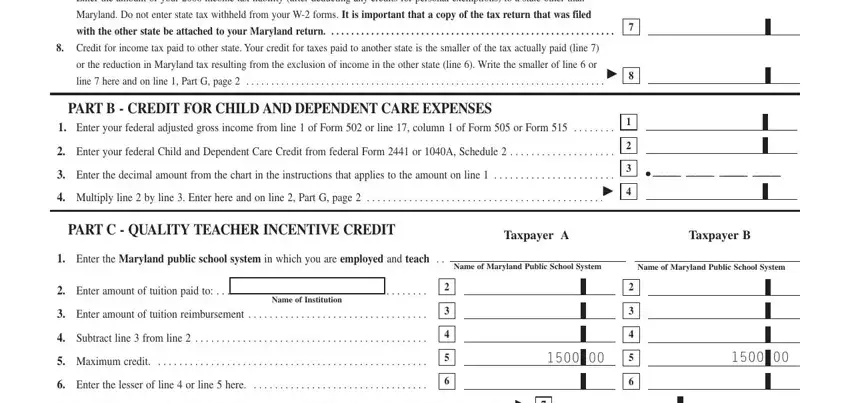

2. Once your current task is complete, take the next step – fill out all of these fields - Enter the amount of your income, Maryland Do not enter state tax, with the other state be attached, Credit for income tax paid to, or the reduction in Maryland tax, line here and on line Part G, PART B CREDIT FOR CHILD AND, Enter your federal adjusted gross, Enter your federal Child and, Enter the decimal amount from the, PART C QUALITY TEACHER INCENTIVE, Taxpayer A, Taxpayer B, Enter the Maryland public school, and Name of Maryland Public School with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

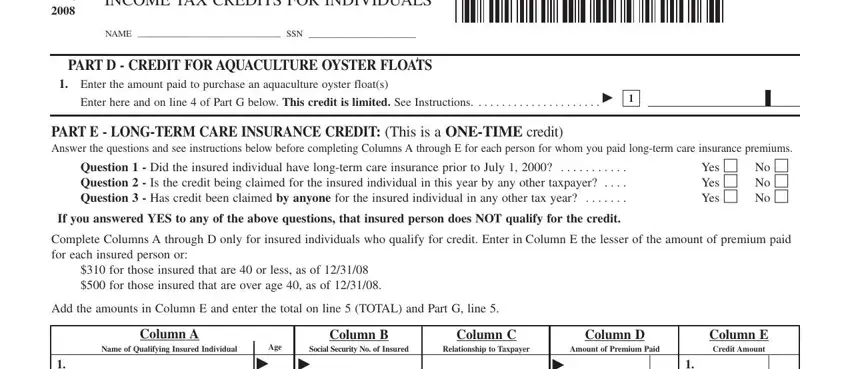

3. This third section should also be rather uncomplicated, FORM CR, MARYLAND INCOME TAX CREDITS FOR, NAME SSN, PART D CREDIT FOR AQUACULTURE, Enter the amount paid to purchase, Enter here and on line of Part G, PART E LONGTERM CARE INSURANCE, Question Did the insured, If you answered YES to any of the, Complete Columns A through D only, for those insured that are or, Add the amounts in Column E and, Column A, Column B, and Column C - each one of these form fields has to be filled in here.

People generally get some points wrong when filling in Enter the amount paid to purchase in this part. Don't forget to review everything you type in right here.

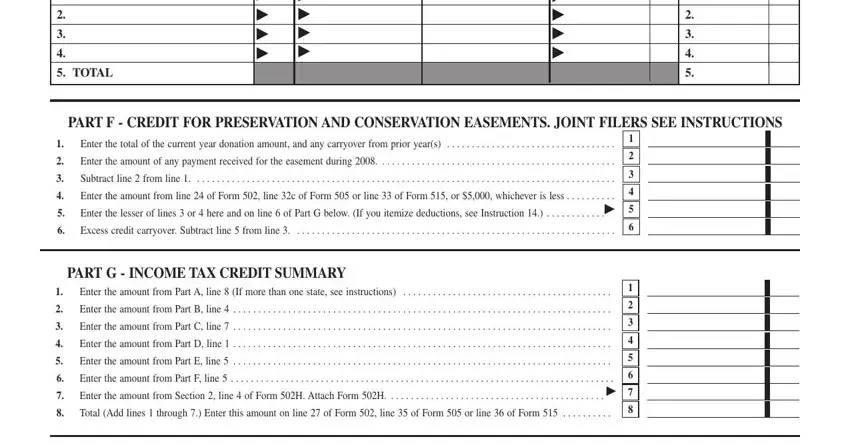

4. Filling in TOTAL, PART F CREDIT FOR PRESERVATION, Enter the total of the current, Enter the amount of any payment, Subtract line from line, Enter the amount from line of, Excess credit carryover Subtract, PART G INCOME TAX CREDIT SUMMARY, Enter the amount from Part A line, Enter the amount from Part B line, Enter the amount from Part C line, Enter the amount from Part D line, Enter the amount from Part E line, Enter the amount from Part F line, and Total Add lines through Enter is key in this next stage - don't forget to invest some time and fill in every empty field!

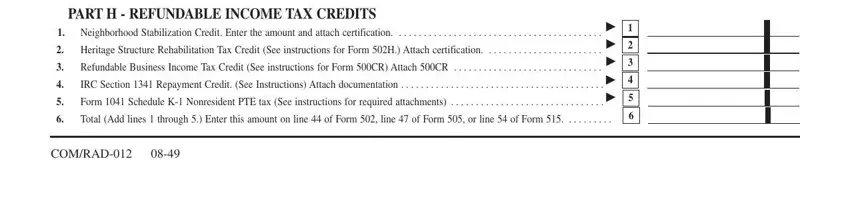

5. The very last notch to finish this form is integral. You must fill in the necessary fields, such as PART H REFUNDABLE INCOME TAX, Neighborhood Stabilization Credit, Total Add lines through Enter, and COMRAD, prior to using the form. If not, it might generate an incomplete and possibly incorrect paper!

Step 3: Revise all the details you have entered into the blanks and then hit the "Done" button. After creating afree trial account with us, you'll be able to download maryland form 502cr or send it via email promptly. The PDF file will also be readily accessible via your personal cabinet with all your changes. At FormsPal, we endeavor to be certain that all of your details are stored private.