Through the online tool for PDF editing by FormsPal, you can easily fill out or change maryland amended tax forms here. Our professional team is relentlessly endeavoring to develop the editor and ensure it is even better for users with its many functions. Bring your experience to a higher level with continually growing and amazing possibilities available today! It just takes several easy steps:

Step 1: Access the form inside our editor by pressing the "Get Form Button" at the top of this page.

Step 2: With our handy PDF file editor, you're able to accomplish more than simply fill out forms. Try each of the functions and make your documents seem sublime with customized text added, or fine-tune the original input to perfection - all comes along with an ability to incorporate just about any images and sign the document off.

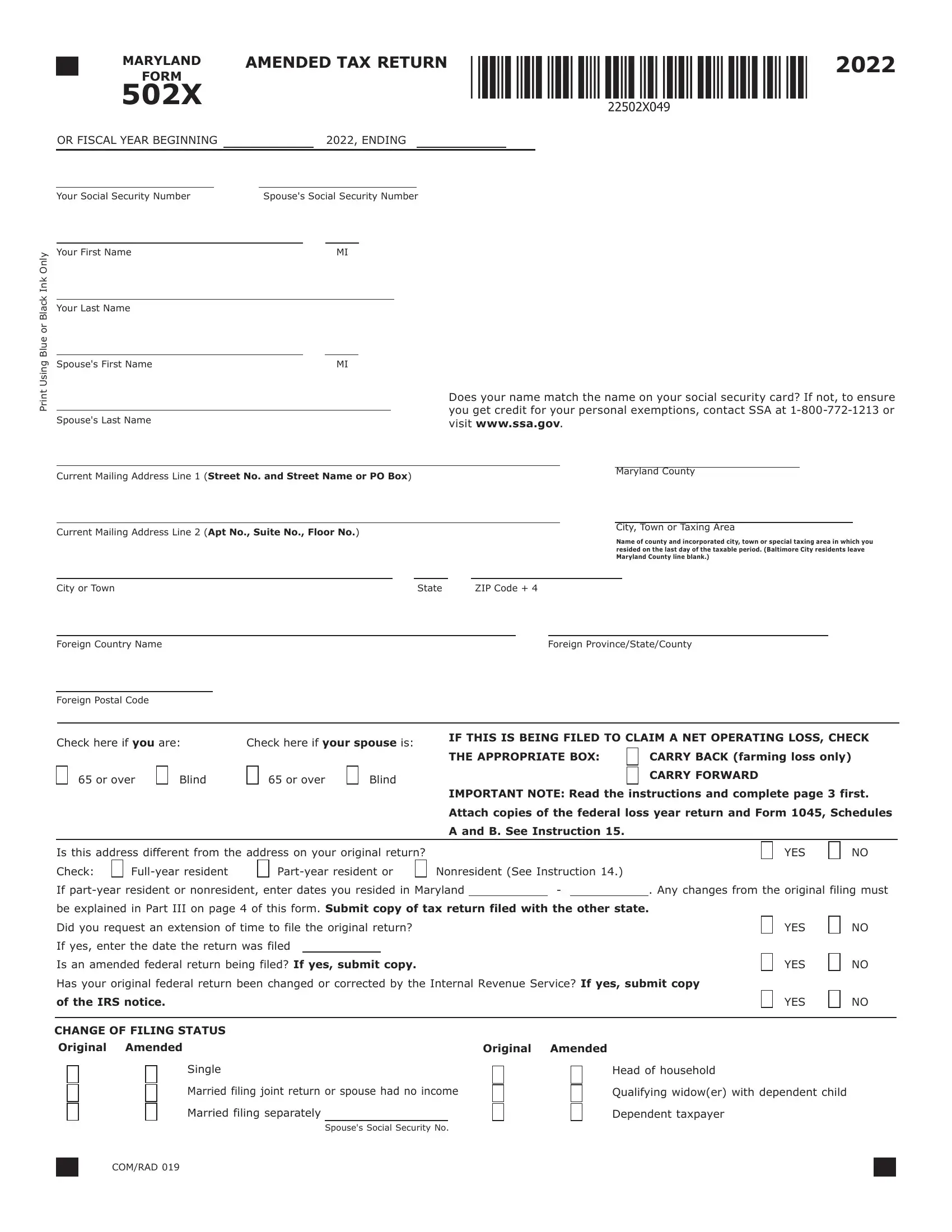

As for the fields of this particular document, here is what you need to know:

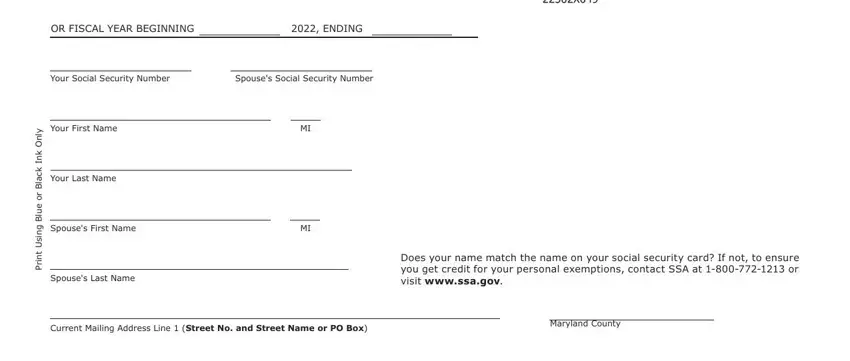

1. It's important to fill out the maryland amended tax forms accurately, thus pay close attention while filling in the sections containing these specific blanks:

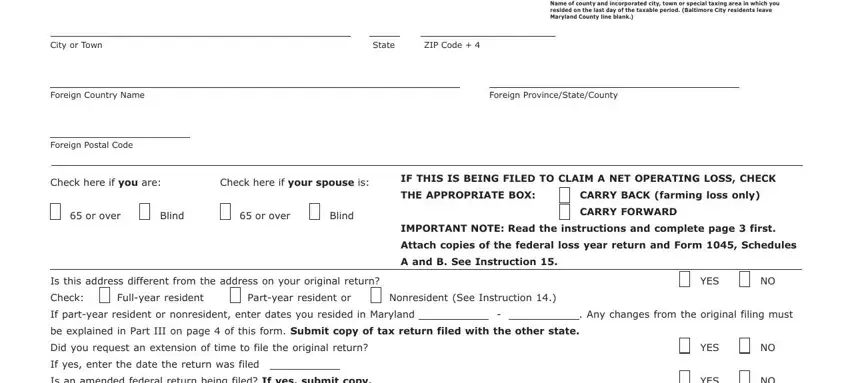

2. Soon after filling in the previous section, go on to the next part and fill in the essential particulars in these fields - Current Mailing Address Line Apt, Name of county and incorporated, City or Town, State, ZIP Code, Foreign Country Name, Foreign ProvinceStateCounty, Foreign Postal Code, Check here if you are, Check here if your spouse is, IF THIS IS BEING FILED TO CLAIM A, THE APPROPRIATE BOX, CARRY BACK farming loss only, or over, and Blind.

As to Current Mailing Address Line Apt and Foreign Postal Code, be sure you don't make any mistakes here. The two of these are surely the key ones in the page.

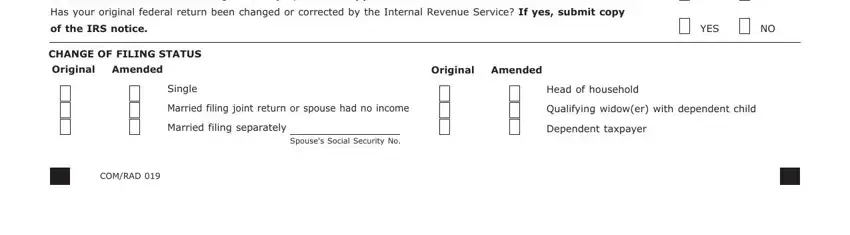

3. The next segment should also be rather easy, Is an amended federal return being, YES, Has your original federal return, of the IRS notice, CHANGE OF FILING STATUS, Original Amended, Single, YES, Original Amended, Head of household, Married filing joint return or, Qualifying widower with dependent, Married filing separately, Dependent taxpayer, and Spouses Social Security No - all of these form fields has to be filled in here.

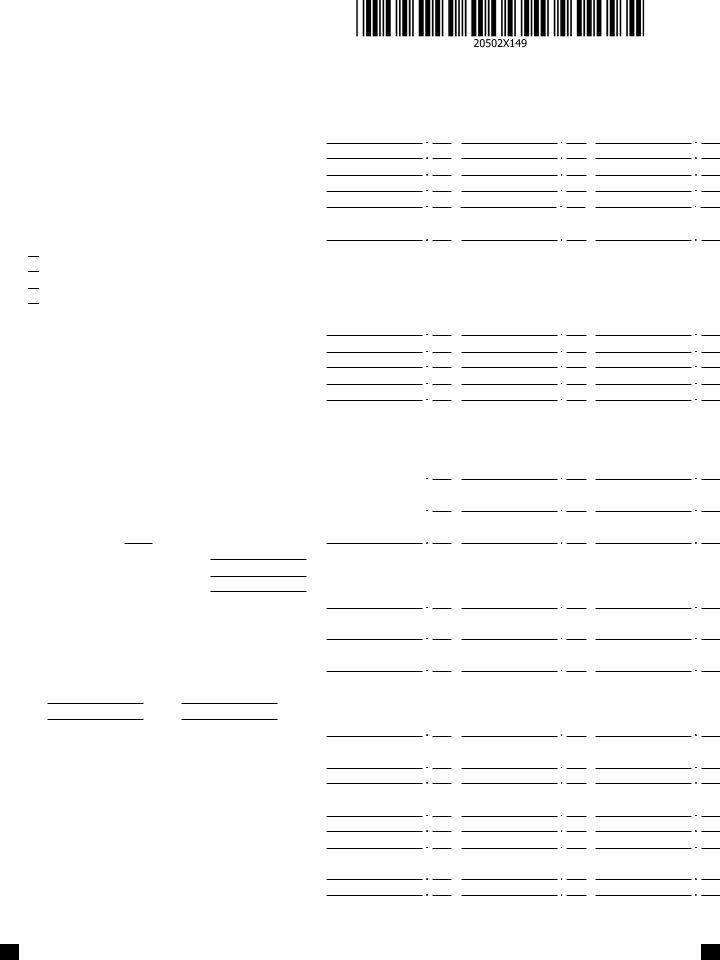

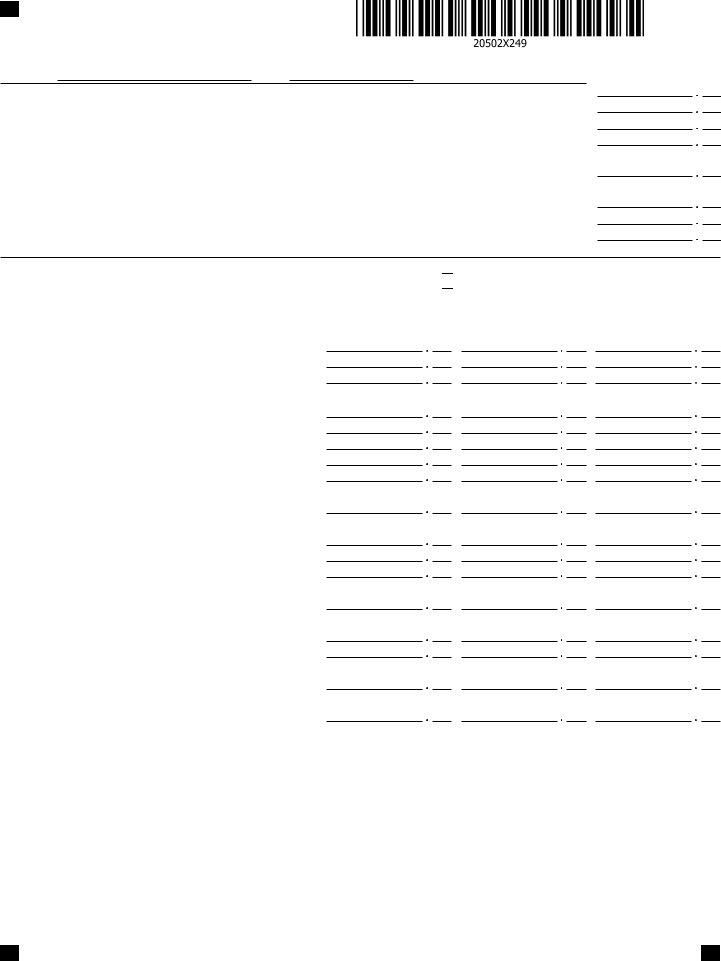

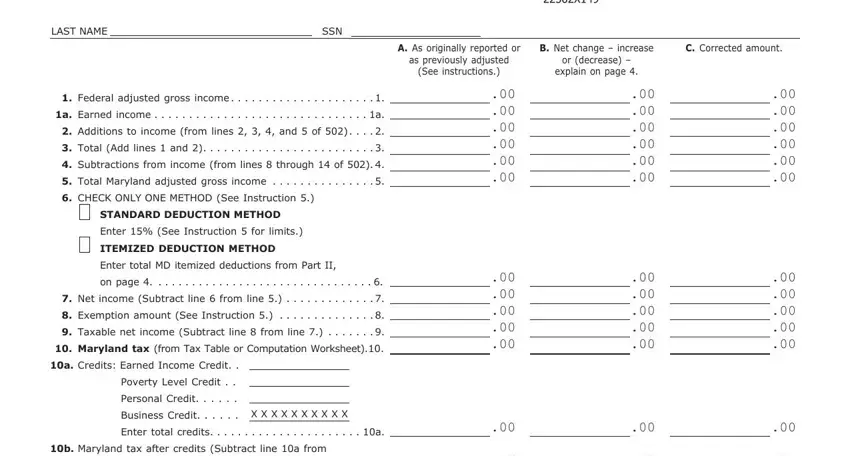

4. It's time to fill in this next form section! Here you've got all these LAST NAME, SSN, A As originally reported or, B Net change increase, C Corrected amount, as previously adjusted, See instructions, or decrease explain on page, Federal adjusted gross income, a Earned income, Additions to income from lines, Total Add lines and, Subtractions from income from, Total Maryland adjusted gross, and CHECK ONLY ONE METHOD See blank fields to complete.

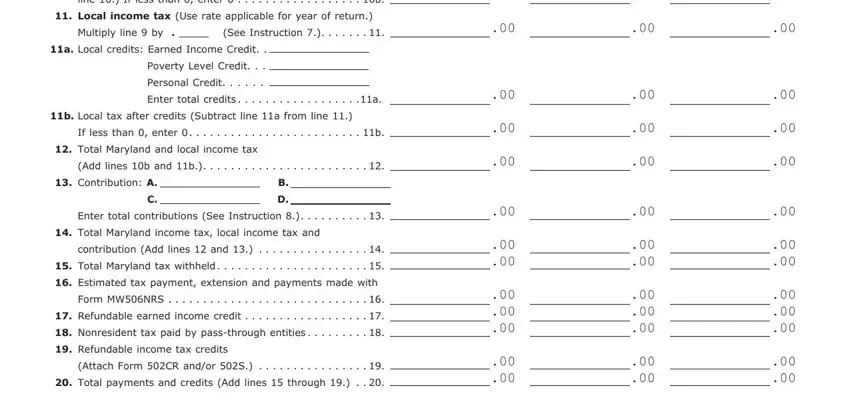

5. This pdf needs to be completed by filling in this segment. Here you can see an extensive listing of form fields that have to be filled out with correct information for your form submission to be faultless: line If less than enter, Local income tax Use rate, Multiply line by See Instruction, a Local credits Earned Income, Poverty Level Credit, Personal Credit, Enter total credits, b Local tax after credits Subtract, If less than enter, Total Maryland and local income, Add lines b and b, Contribution A, Enter total contributions See, Total Maryland income tax local, and contribution Add lines and.

Step 3: Make sure that your details are correct and press "Done" to proceed further. Sign up with us today and easily gain access to maryland amended tax forms, set for downloading. Every change made is handily preserved , meaning you can modify the file at a later time if needed. FormsPal guarantees protected form completion with no data recording or distributing. Rest assured that your information is secure with us!