Maryland Form 510 can be filled in online easily. Simply open FormsPal PDF tool to do the job promptly. Our expert team is always endeavoring to enhance the editor and insure that it is much easier for people with its handy functions. Bring your experience one step further with continuously improving and interesting opportunities available today! For anyone who is looking to begin, here is what it will take:

Step 1: First of all, open the pdf tool by pressing the "Get Form Button" at the top of this webpage.

Step 2: Using our online PDF tool, you are able to accomplish more than simply fill in blank form fields. Edit away and make your forms seem sublime with custom text put in, or optimize the original content to perfection - all that comes along with an ability to incorporate stunning photos and sign it off.

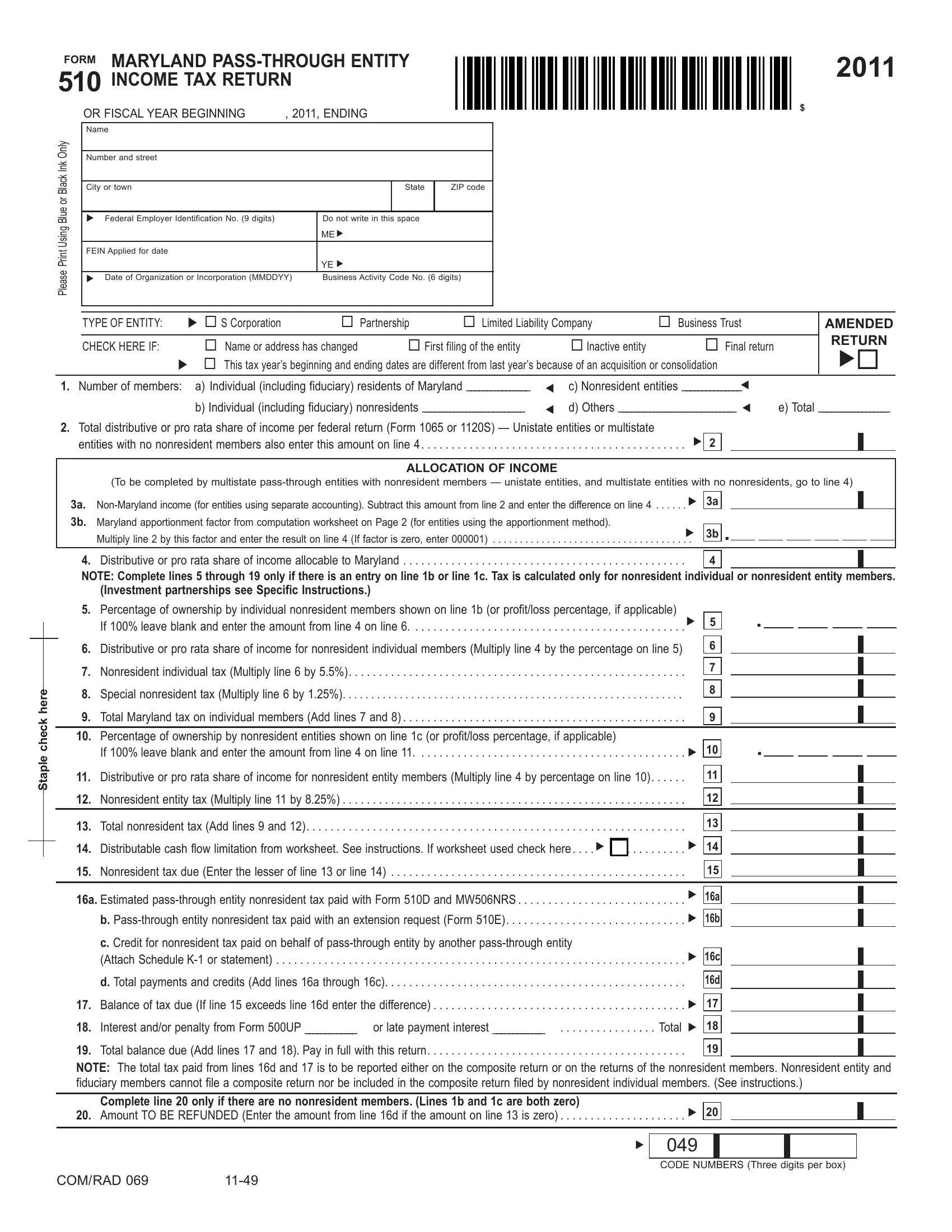

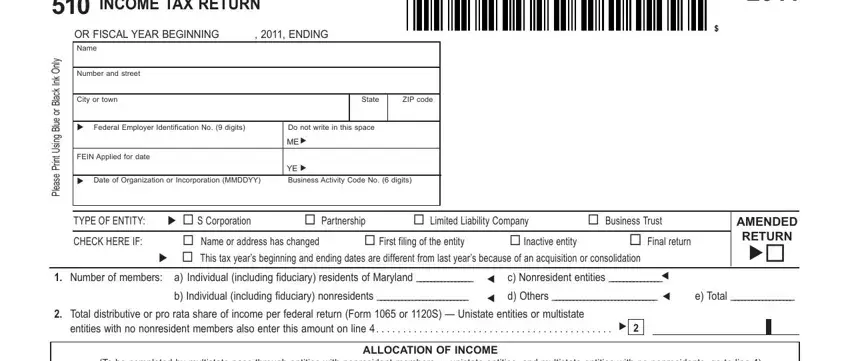

If you want to complete this form, make sure you type in the information you need in each and every blank field:

1. The Maryland Form 510 needs certain information to be typed in. Make sure the subsequent blanks are completed:

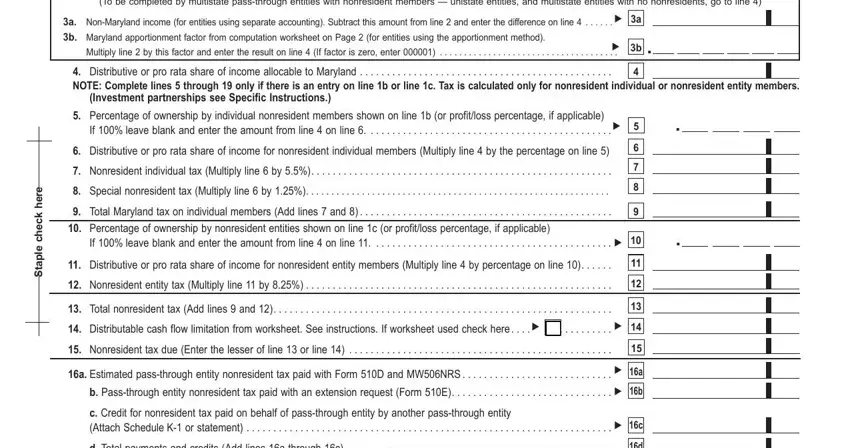

2. Soon after completing the last step, go to the subsequent part and enter the essential details in these blank fields - To be completed by multistate, a NonMaryland income for entities, Multiply line by this factor and, Distributive or pro rata share of, Investment partnerships see, e r e h, k c e h c, e p a t S, Percentage of ownership by, If leave blank and enter the, Distributive or pro rata share of, Nonresident individual tax, Special nonresident tax Multiply, Total Maryland tax on individual, and If leave blank and enter the.

3. Completing d Total payments and credits Add, Balance of tax due If line, Interest andor penalty from Form, Total balance due Add lines and, Complete line only if there are, COMRAD, and CODE NUMBERS Three digits per box is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Regarding COMRAD and CODE NUMBERS Three digits per box, be certain you don't make any mistakes here. Those two are the most significant fields in the page.

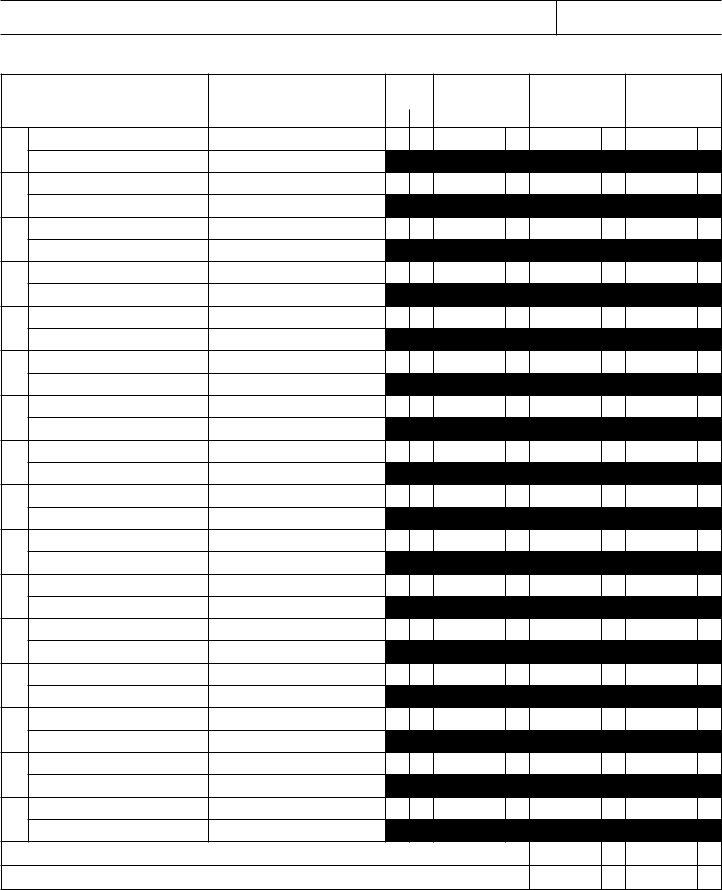

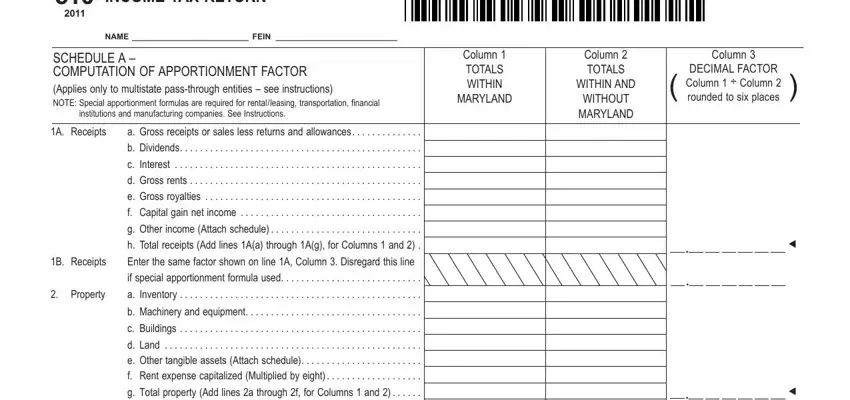

4. This next section requires some additional information. Ensure you complete all the necessary fields - MARYLAND PASSTHROUGH ENTITY INCOME, NAME FEIN, Column TOTALS WITHIN, MARYLAND, Column TOTALS, WITHIN AND, WITHOUT MARYLAND, Column, DECIMAL FACTOR Column Column, SCHEDULE A COMPUTATION OF, institutions and manufacturing, A Receipts, a Gross receipts or sales less, b Dividends, and c Interest - to proceed further in your process!

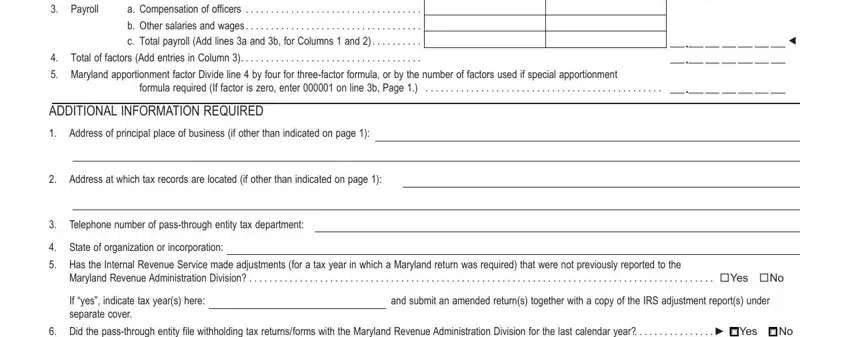

5. When you get close to the completion of the form, you'll notice a few more requirements that have to be satisfied. Notably, Payroll, a Compensation of officers, b Other salaries and wages, Total of factors Add entries in, Maryland apportionment factor, formula required If factor is zero, ADDITIONAL INFORMATION REQUIRED, Address of principal place of, Address at which tax records are, Telephone number of passthrough, State of organization or, Has the Internal Revenue Service, If yes indicate tax years here and, and Did the passthrough entity file must be filled out.

Step 3: Prior to submitting your document, make sure that blanks were filled in correctly. The moment you determine that it's good, press “Done." Sign up with FormsPal today and easily use Maryland Form 510, set for downloading. Every single modification you make is conveniently preserved , letting you modify the pdf at a later time as needed. At FormsPal, we aim to make sure that your information is maintained private.