Through the online PDF tool by FormsPal, you'll be able to fill out or edit 510D here and now. The editor is consistently improved by us, getting cool functions and growing to be even more convenient. To start your journey, take these simple steps:

Step 1: Click on the "Get Form" button above on this webpage to open our tool.

Step 2: As you access the online editor, you will see the document ready to be filled out. In addition to filling in various blanks, it's also possible to do other sorts of things with the file, particularly adding your own words, changing the initial text, adding illustrations or photos, placing your signature to the PDF, and more.

Pay close attention while filling in this pdf. Make certain every blank is filled out properly.

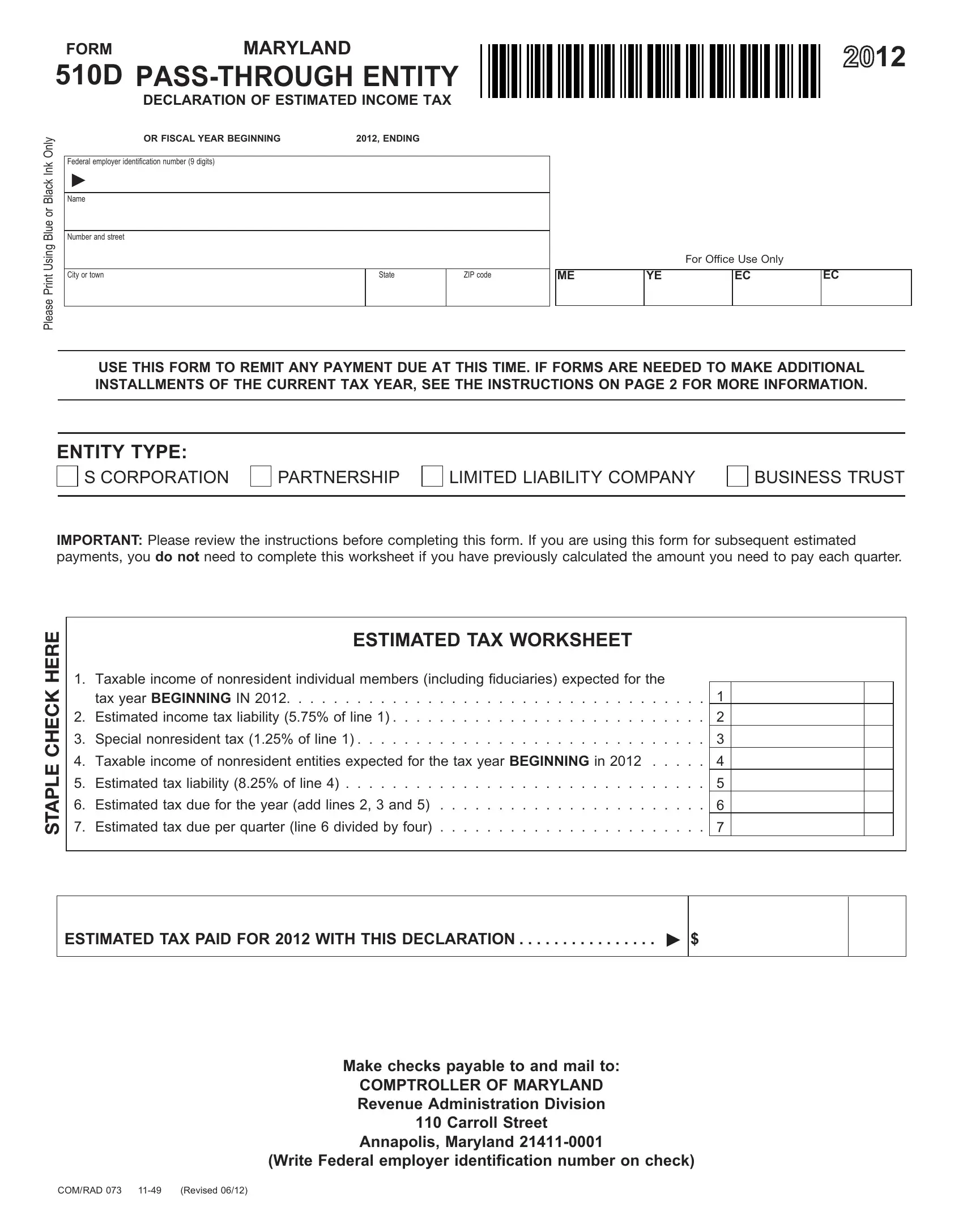

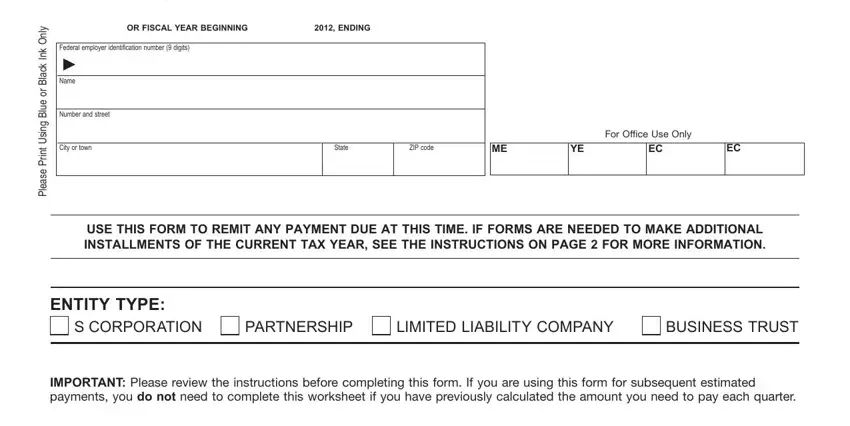

1. You will need to fill out the 510D properly, therefore be mindful when filling out the parts comprising these blank fields:

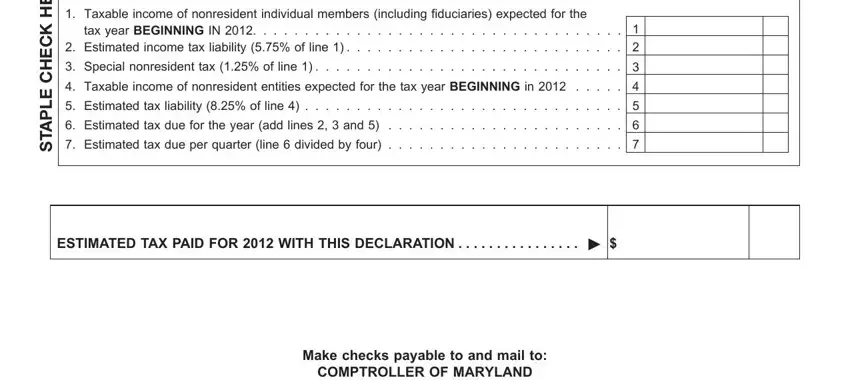

2. Once your current task is complete, take the next step – fill out all of these fields - E R E H K C E H C E L P A T S, Taxable income of nonresident, tax year BEGINNING IN, Special nonresident tax of line, Taxable income of nonresident, Estimated tax liability of line, Estimated tax due for the year, Estimated tax due per quarter, ESTIMATED TAX PAID FOR WITH THIS, and Make checks payable to and mail to with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It is possible to get it wrong when filling in the Estimated tax due per quarter, thus make sure that you go through it again before you decide to finalize the form.

Step 3: Spell-check all the information you have entered into the blank fields and then click the "Done" button. Try a free trial account with us and acquire instant access to 510D - downloadable, emailable, and editable in your FormsPal account page. FormsPal guarantees your data privacy with a secure system that never saves or shares any private data used. Be confident knowing your documents are kept safe every time you use our tools!