Preparers can be filled out very easily. Just make use of FormsPal PDF tool to get it done without delay. Our team is constantly working to enhance the tool and ensure it is even better for clients with its many features. Take your experience to a higher level with constantly improving and interesting possibilities we offer! If you are looking to get started, here's what it's going to take:

Step 1: First, open the tool by clicking the "Get Form Button" in the top section of this webpage.

Step 2: This tool will give you the ability to work with almost all PDF forms in various ways. Improve it with personalized text, correct what is originally in the document, and put in a signature - all close at hand!

Pay close attention when completing this pdf. Make sure that every field is done properly.

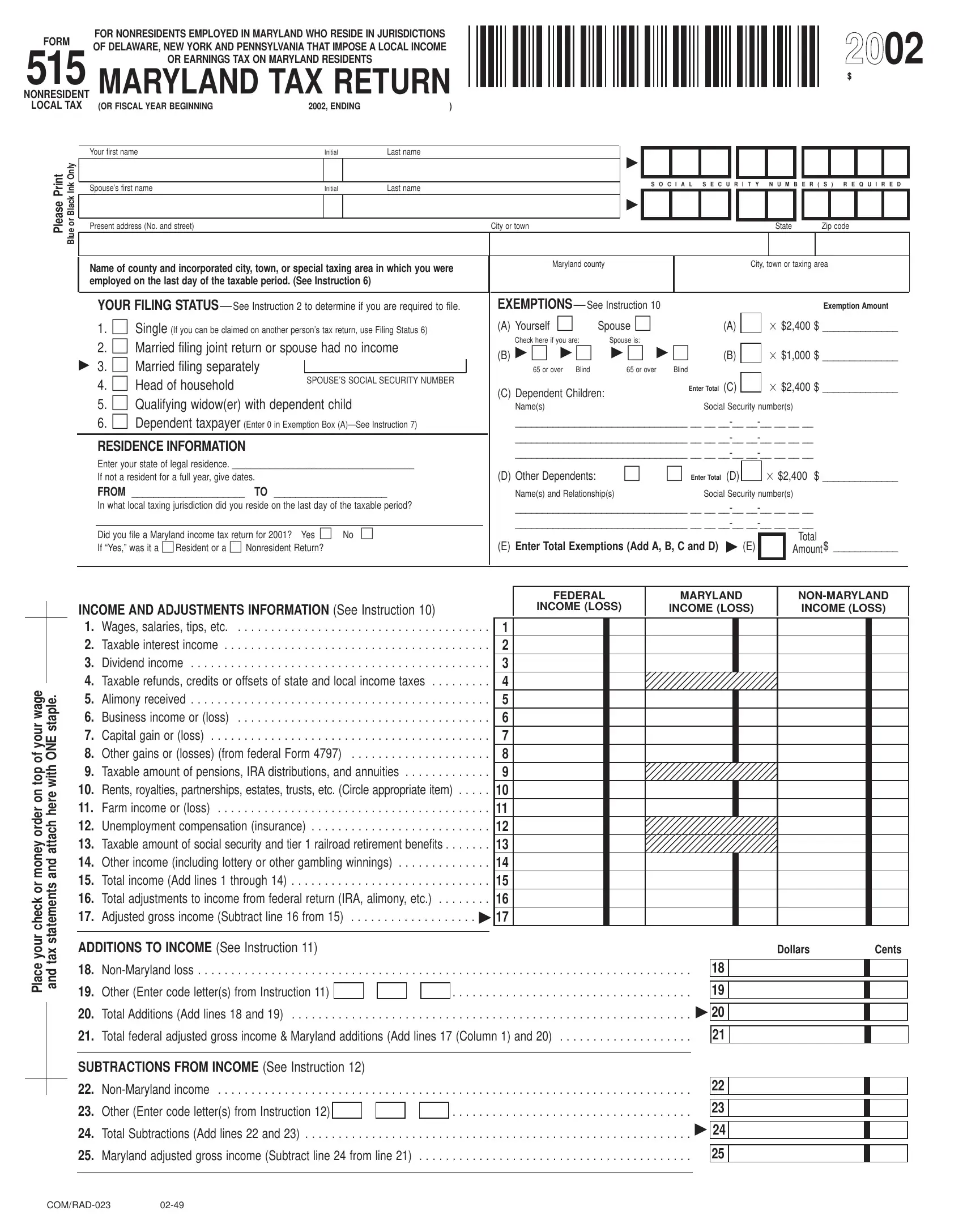

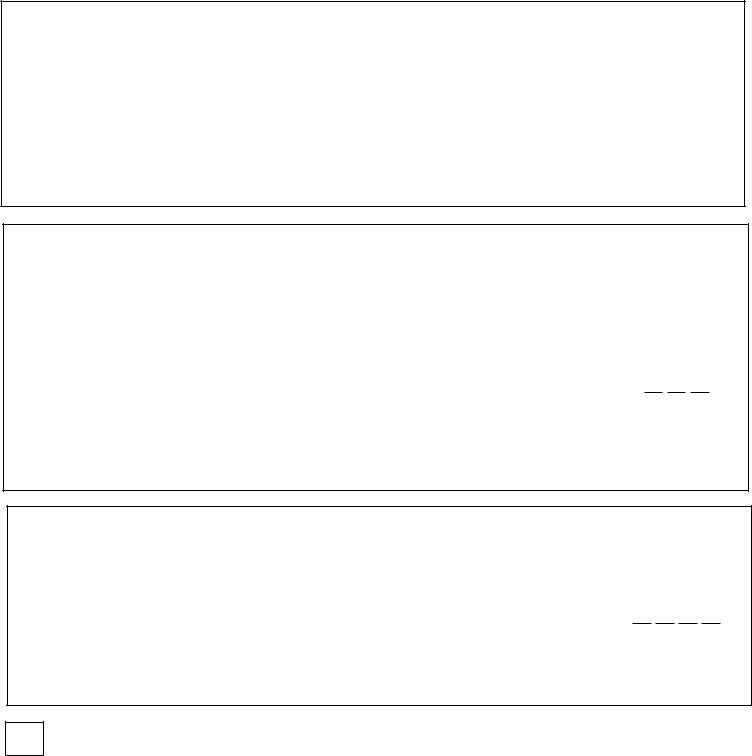

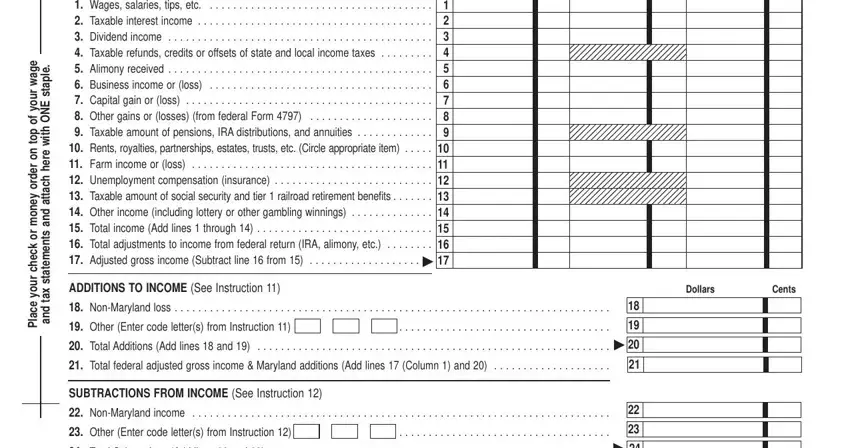

1. When filling out the Preparers, make certain to complete all of the essential blank fields in their corresponding part. This will help to expedite the work, allowing your information to be handled swiftly and accurately.

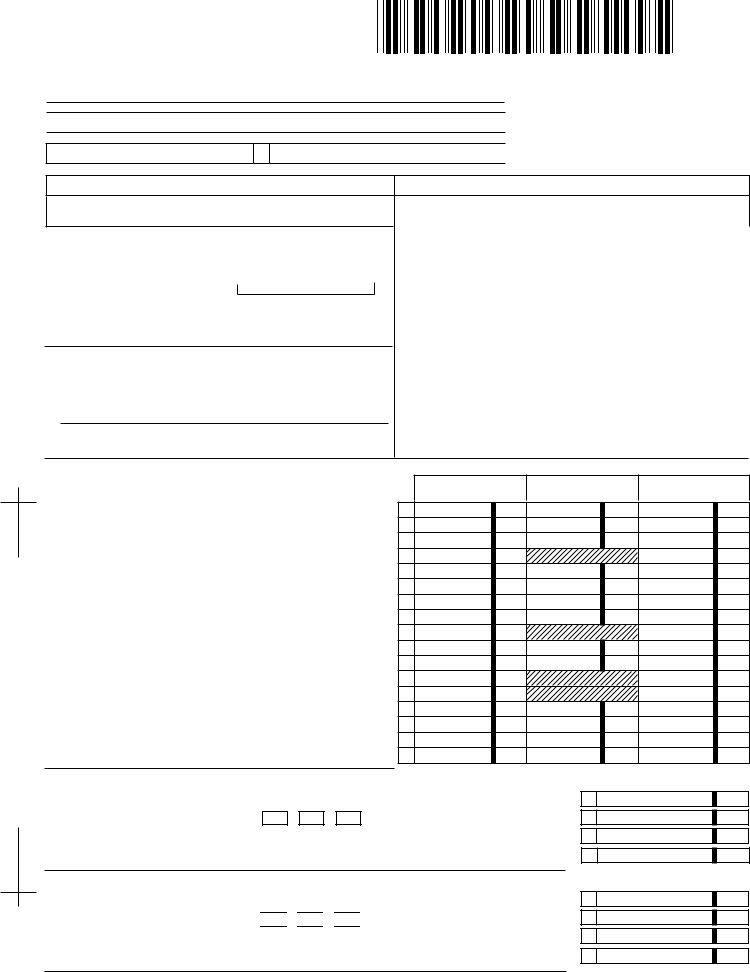

2. Once your current task is complete, take the next step – fill out all of these fields - e g a w, r u o y f o, p o t, n o, r e d r o, y e n o m, r o, k c e h c, r u o y, e c a P, e l p a t s E N O h t i, w e r e h, h c a t t a, d n a, and s t n e m e t a t s with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

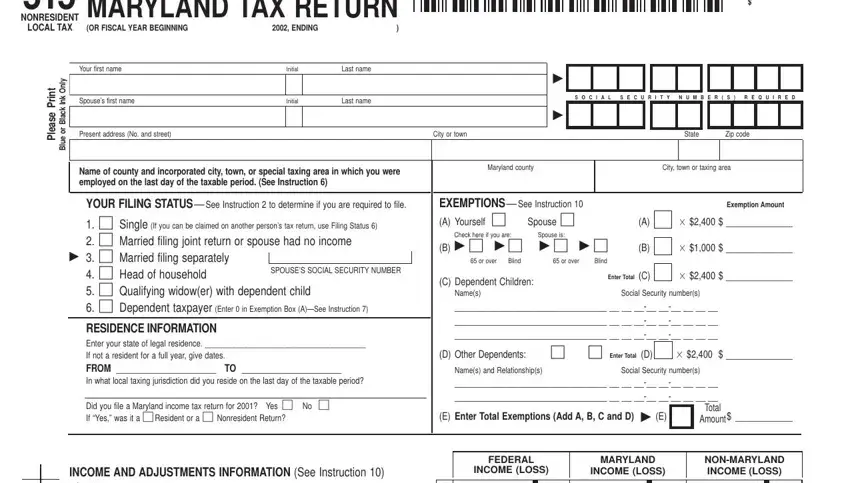

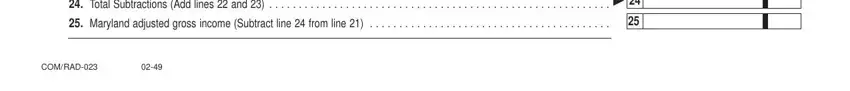

3. The following section focuses on Total Subtractions Add lines and, Maryland adjusted gross income, and COMRAD - type in all of these blank fields.

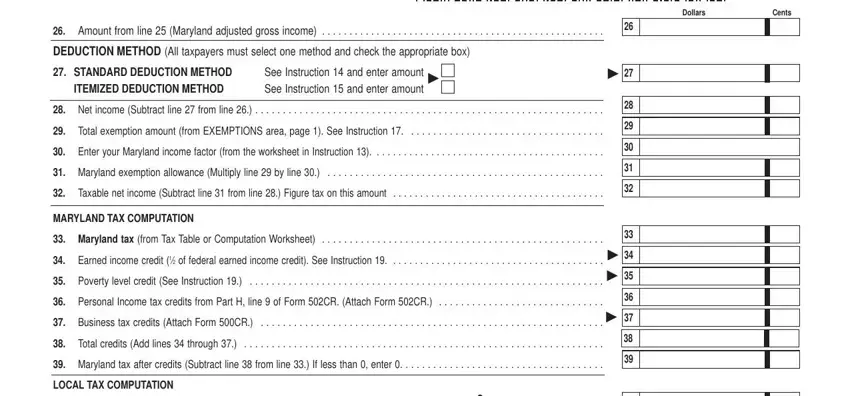

4. The following section requires your details in the following places: Amount from line Maryland, DEDUCTION METHOD All taxpayers, STANDARD DEDUCTION METHOD, ITEMIZED DEDUCTION METHOD, See Instruction and enter amount, Net income Subtract line from, Total exemption amount from, Enter your Maryland income factor, Maryland exemption allowance, Taxable net income Subtract line, MARYLAND TAX COMPUTATION, Maryland tax from Tax Table or, Earned income credit of federal, Poverty level credit See, and Personal Income tax credits from. Remember to provide all requested information to go forward.

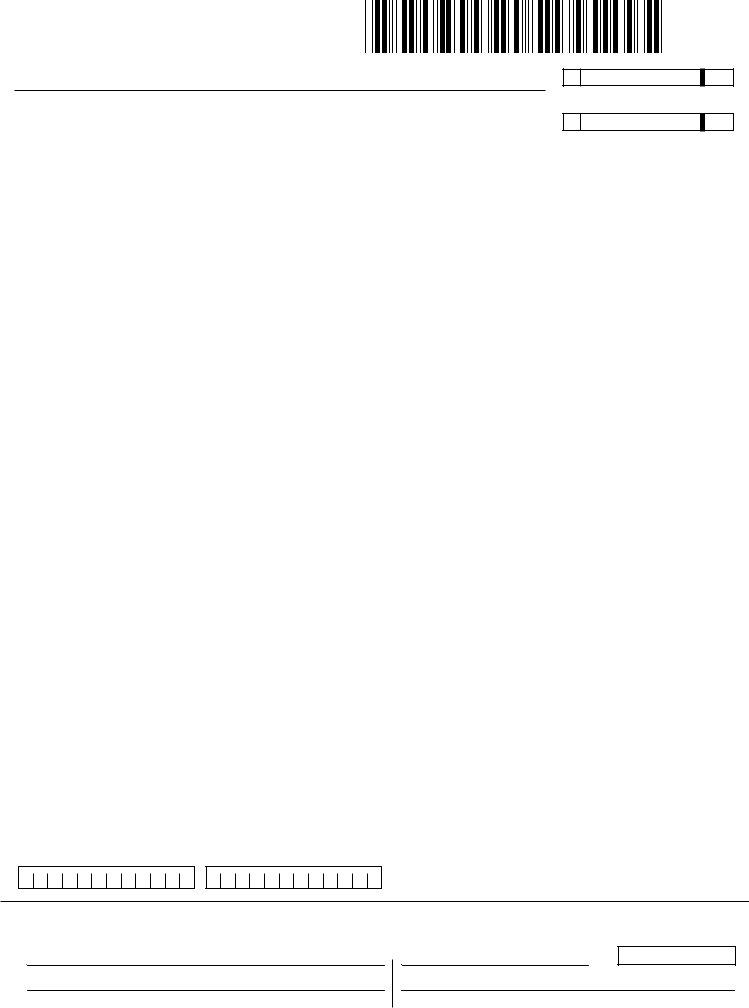

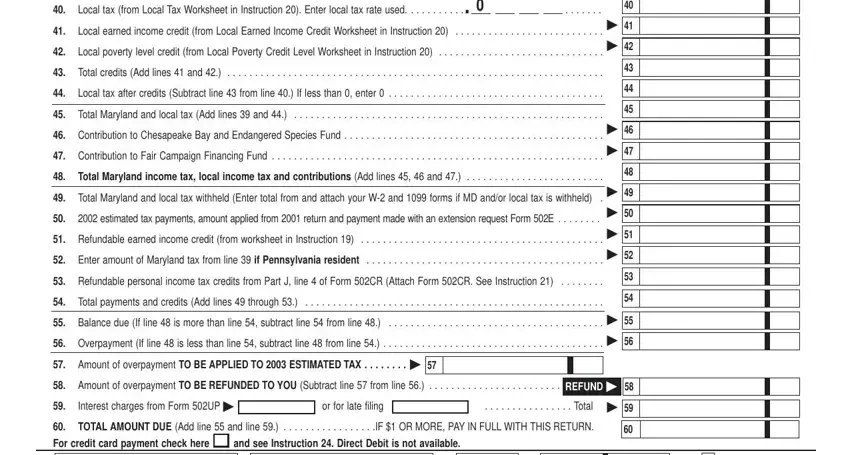

5. As a final point, the following last section is what you need to wrap up before finalizing the PDF. The fields in this instance are the following: Local tax from Local Tax Worksheet, Local earned income credit from, Local poverty level credit from, Total credits Add lines and, Local tax after credits Subtract, Total Maryland and local tax Add, Contribution to Chesapeake Bay, Contribution to Fair Campaign, Total Maryland income tax local, Total Maryland and local tax, estimated tax payments amount, Refundable earned income credit, Enter amount of Maryland tax from, Refundable personal income tax, and Total payments and credits Add.

Be extremely mindful when filling in Refundable personal income tax and Local poverty level credit from, as this is the section where a lot of people make mistakes.

Step 3: After double-checking the fields and details, click "Done" and you are done and dusted! Download the Preparers as soon as you join for a 7-day free trial. Easily view the document from your FormsPal cabinet, along with any modifications and adjustments conveniently kept! FormsPal is committed to the privacy of our users; we make sure that all information entered into our tool is kept confidential.