This PDF editor makes it simple to fill out forms. It's not necessary to undertake much to enhance maryland sales tax form forms. Basically comply with all of these steps.

Step 1: Click the button "Get Form Here".

Step 2: At the moment you're on the file editing page. You may modify and add content to the form, highlight specified content, cross or check particular words, insert images, put a signature on it, get rid of needless fields, or take them out completely.

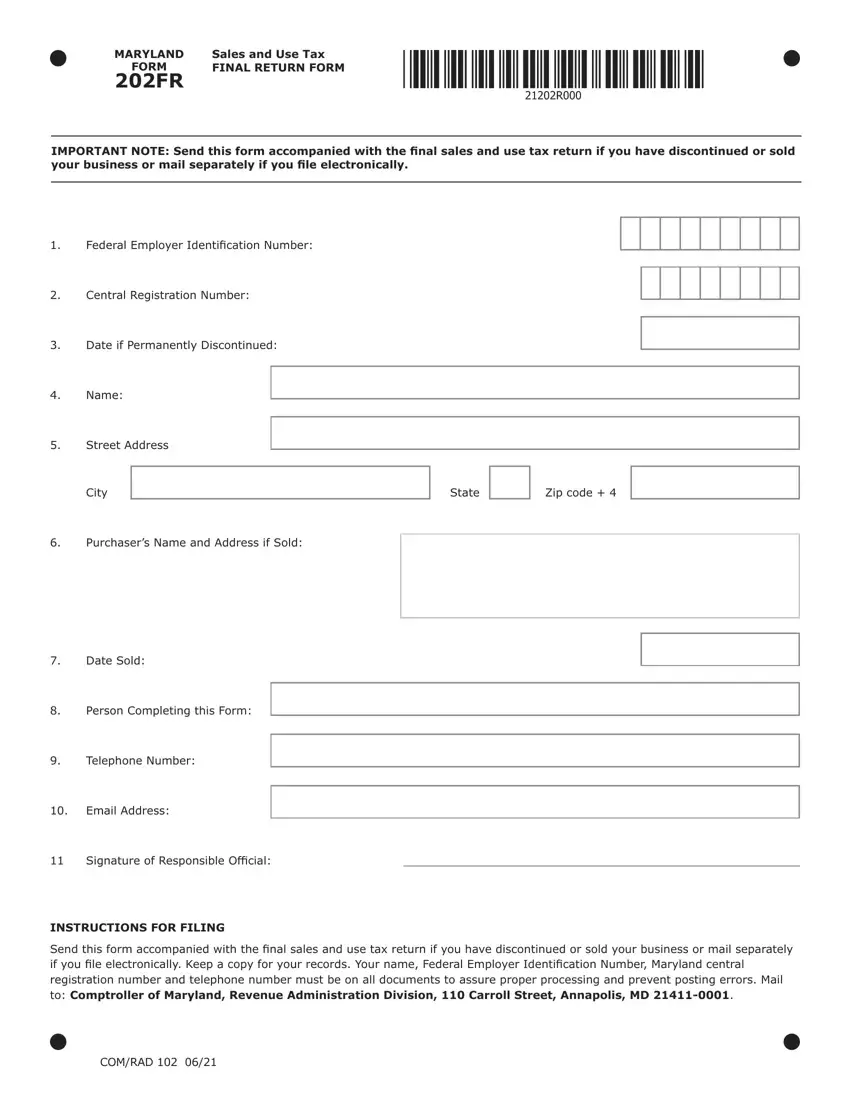

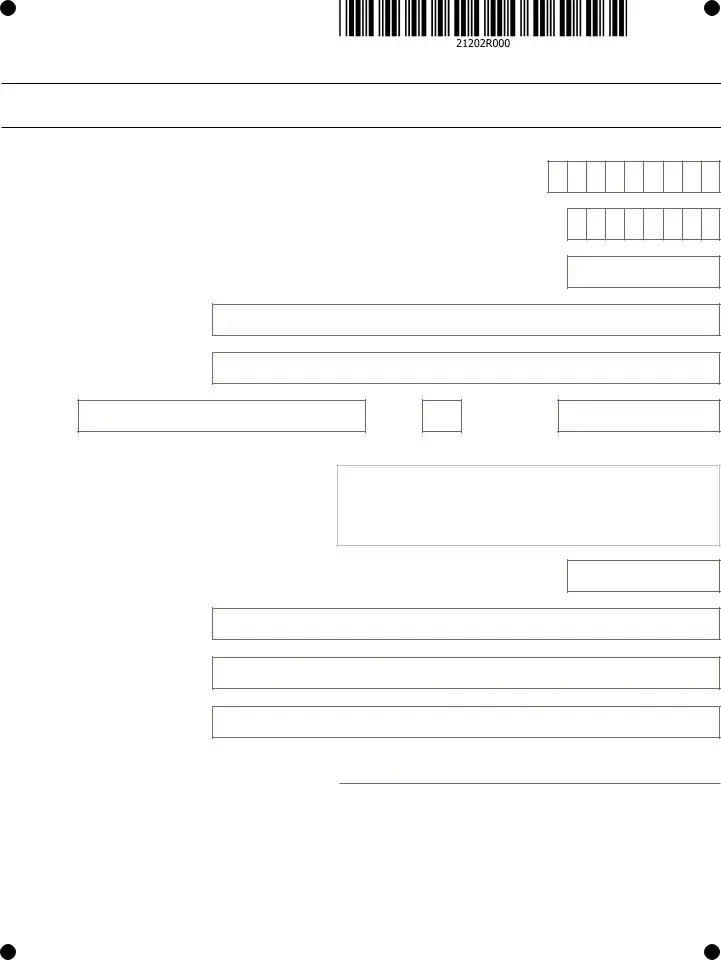

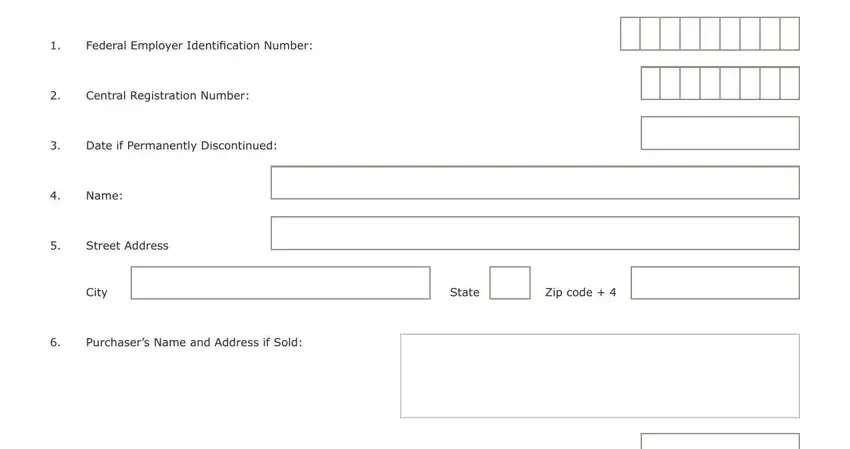

Fill in the following areas to prepare the document:

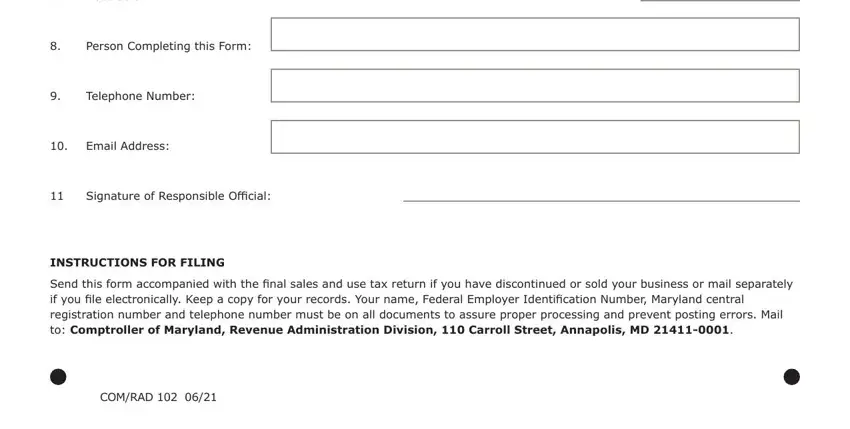

Enter the necessary data in the segment Date Sold, Person Completing this Form, Telephone Number, Email Address, Signature of Responsible Official, INSTRUCTIONS FOR FILING, and Send this form accompanied with.

Step 3: Click the Done button to save your file. So now it is readily available for upload to your gadget.

Step 4: Prepare copies of the form. This may prevent future challenges. We do not view or reveal your details, thus you can relax knowing it will be secure.