Having the purpose of making it as quick to apply as it can be, we made our PDF editor. The entire process of filling the mass mutual cash surrender form can be straightforward in case you keep to the following actions.

Step 1: Choose the "Get Form Here" button.

Step 2: Now you are on the form editing page. You may edit, add content, highlight certain words or phrases, put crosses or checks, and put images.

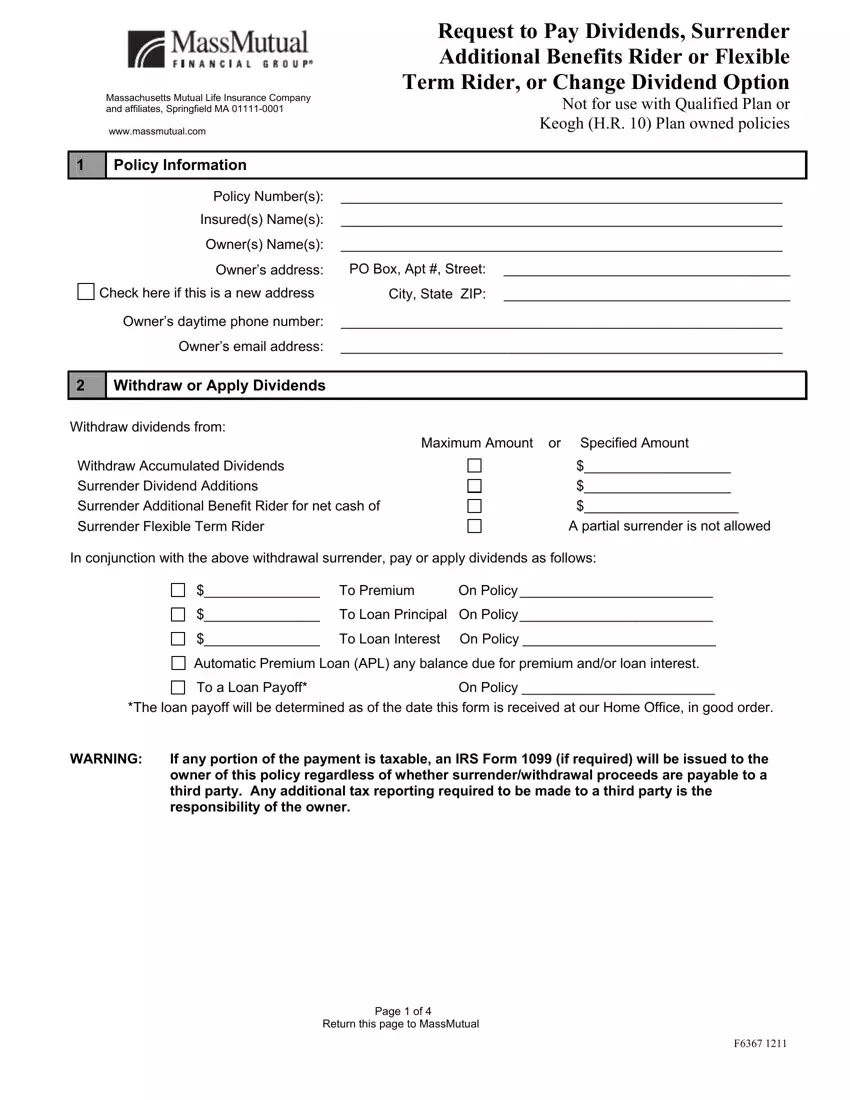

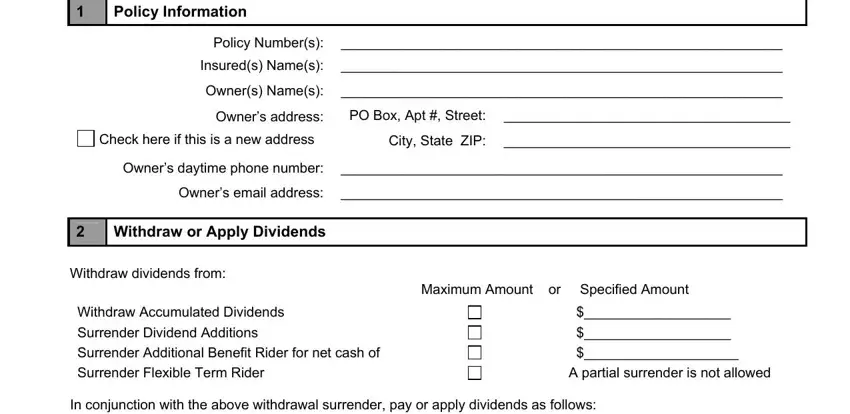

Create the mass mutual cash surrender form PDF by typing in the text needed for each individual section.

In the To Premium On Policy, To Loan Principal On Policy, To Loan Interest On Policy, Automatic Premium Loan APL any, To a Loan Payoff, On Policy, The loan payoff will be determined, WARNING, If any portion of the payment is, and Page of Return this page to field, write down the information you have.

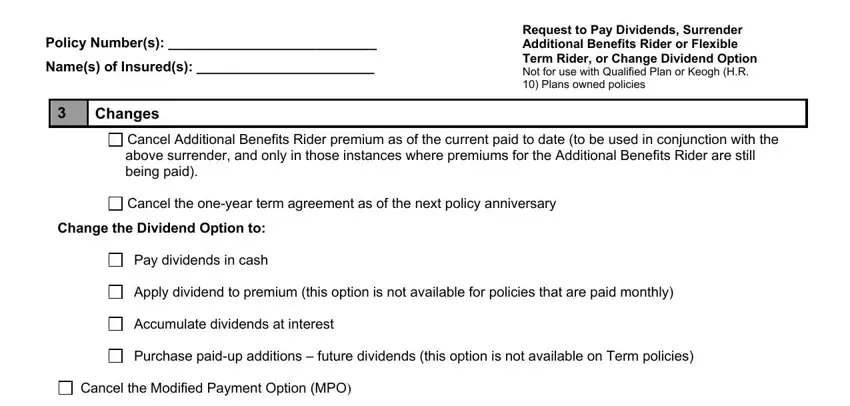

The software will request data to easily submit the section Policy Numbers, Names of Insureds, Changes, Request to Pay Dividends Surrender, Cancel Additional Benefits Rider, Cancel the oneyear term agreement, Change the Dividend Option to, Pay dividends in cash, Apply dividend to premium this, Accumulate dividends at interest, Purchase paidup additions future, and Cancel the Modified Payment Option.

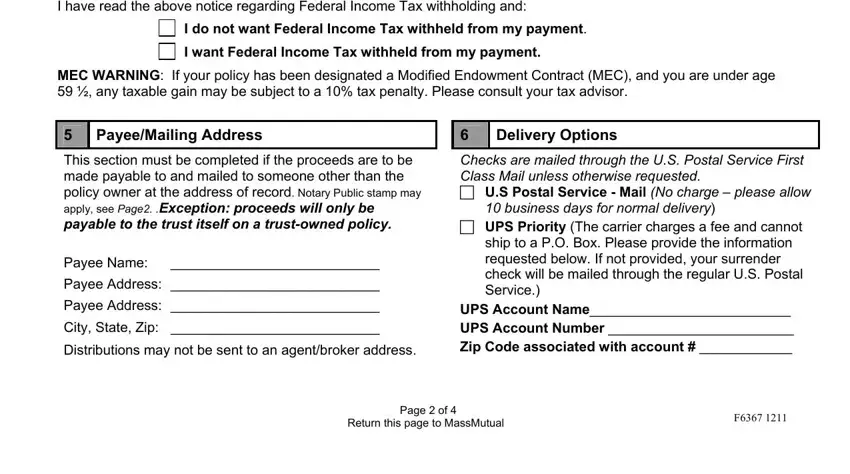

Please be sure to describe the rights and responsibilities of the sides inside the I have read the above notice, I do not want Federal Income Tax, I want Federal Income Tax withheld, MEC WARNING If your policy has, PayeeMailing Address, This section must be completed if, Payee Name, Payee Address, Payee Address, City State Zip, Distributions may not be sent to, Delivery Options, Checks are mailed through the US, Class Mail unless otherwise, and business days for normal delivery section.

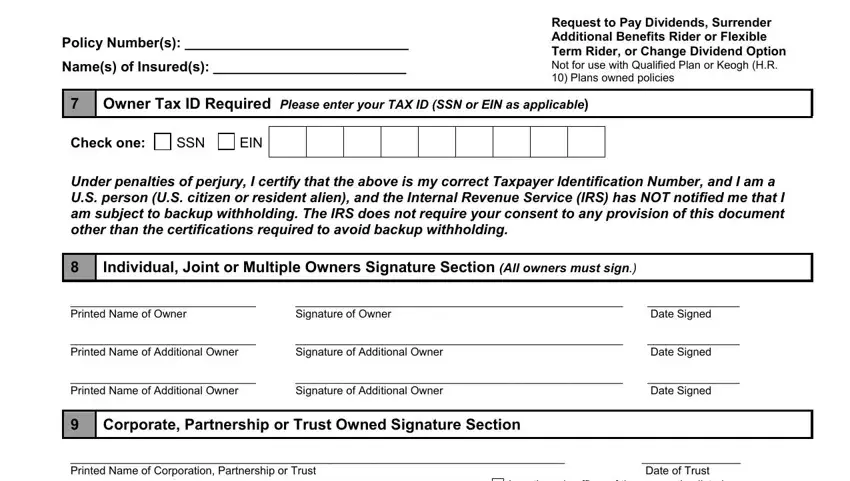

End by reviewing all of these sections and filling out the relevant particulars: Policy Numbers, Names of Insureds, Request to Pay Dividends Surrender, Owner Tax ID Required Please, Check one, SSN, EIN, Under penalties of perjury I, Individual Joint or Multiple, Printed Name of Owner, Signature of Owner, Date Signed, Printed Name of Additional Owner, Signature of Additional Owner, and Date Signed.

Step 3: When you have selected the Done button, your file is going to be accessible for export to any kind of device or email address you specify.

Step 4: Make copies of the form - it may help you refrain from upcoming challenges. And don't be concerned - we don't disclose or check your data.