This PDF editor was created to be as clear as possible. Since you stick to the following actions, the procedure for filling in the mass gov ltc masshealth forms form will be easy.

Step 1: Step one will be to select the orange "Get Form Now" button.

Step 2: At this point, you are on the form editing page. You can add content, edit current details, highlight certain words or phrases, put crosses or checks, add images, sign the template, erase unwanted fields, etc.

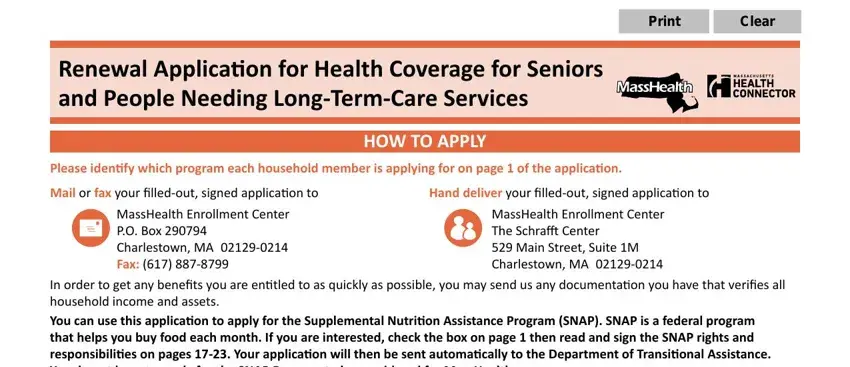

Create all of the following areas to fill out the template:

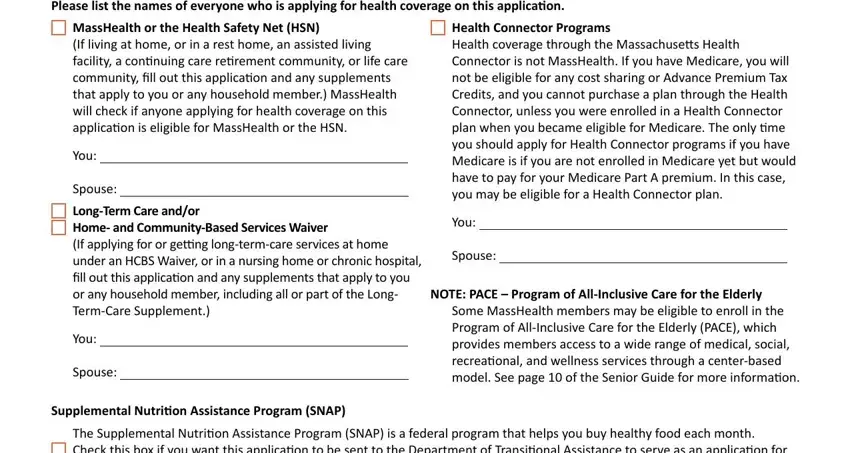

Complete the Please list the names of everyone, MassHealth or the Health Safety, You, Spouse LongTerm Care andor Home, You, Spouse, Health Connector Programs Health, You, Spouse, NOTE PACE Program of AllInclusive, Some MassHealth members may be, Supplemental Nutrition Assistance, and The Supplemental Nutrition areas with any data that will be required by the application.

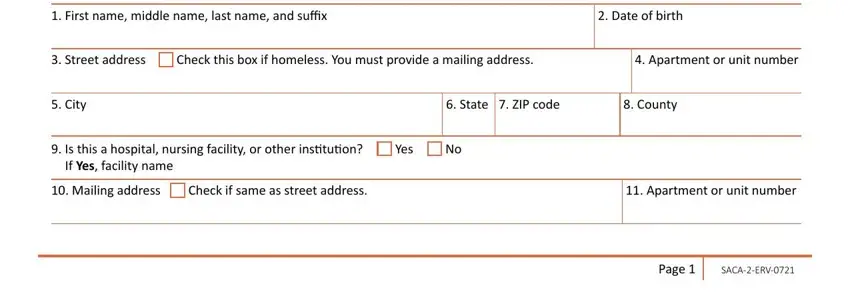

You'll have to insert some details inside the area First name middle name last name, Street address, Check this box if homeless You, City, State ZIP code County, Is this a hospital nursing, If Yes facility name, Mailing address, Check if same as street address, and Page.

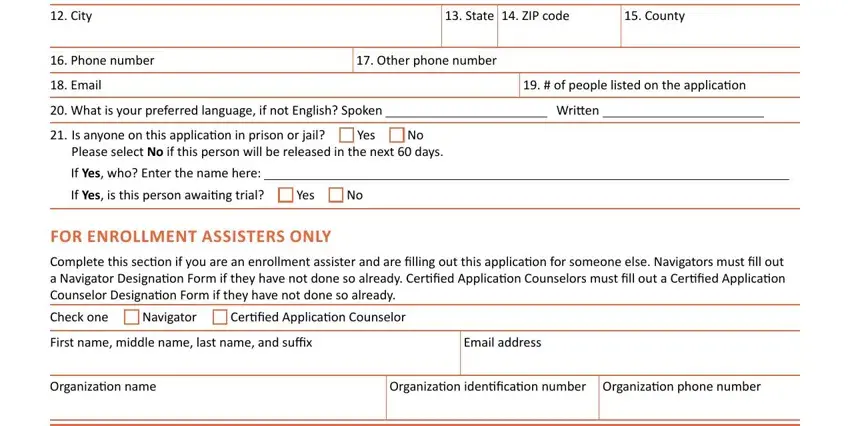

Please make sure to identify the rights and obligations of the parties in the City, State ZIP code County, Phone number Other phone number, Email of people listed on the, What is your preferred language, Written, Is anyone on this application in, Please select No if this person, If Yes is this person awaiting, FOR ENROLLMENT ASSISTERS ONLY, Check one, Navigator, Certified Application Counselor, First name middle name last name, and Organization name Organization paragraph.

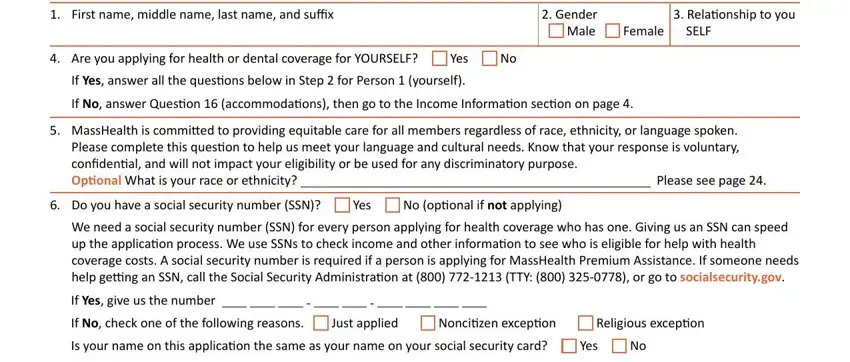

Finish by checking the next fields and filling out the appropriate information: First name middle name last name, Male, Female SELF, Are you applying for health or, If Yes answer all the questions, If No answer Question, MassHealth is committed to, Please see page, Do you have a social security, We need a social security number, If Yes give us the number, If No check one of the following, Just applied, Noncitizen exception, and Religious exception.

Step 3: Hit the button "Done". Your PDF document is available to be transferred. It's possible to download it to your laptop or send it by email.

Step 4: Be sure to prevent forthcoming challenges by making at least a pair of duplicates of your file.

MassHealth or the Health Safety Net (HSN)

MassHealth or the Health Safety Net (HSN)

Home- and

Home- and

Health Connector Programs

Health Connector Programs

Check this box if you want this application to be sent to the Department of Transitional Assistance to serve as an application for SNAP benefits. You must read the rights and responsibilities on pages

Check this box if you want this application to be sent to the Department of Transitional Assistance to serve as an application for SNAP benefits. You must read the rights and responsibilities on pages  Yes

Yes  No If

No If

Yes

Yes  No Please select

No Please select  Yes

Yes  No

No Yes

Yes  No If

No If  Yes

Yes  No (optional if

No (optional if

Yes

Yes  No If

No If  Yes

Yes  No

No

Yes

Yes

No If

No If  Yes

Yes  No

No Yes

Yes  No You will claim a personal exemption deduction on your federal income tax return for any individual listed on this application as a dependent who is enrolled in coverage through the Massachusetts Health Connector and whose premium for coverage is paid in whole or in part by advance payments. List name(s) and date(s) of birth of dependents.

No You will claim a personal exemption deduction on your federal income tax return for any individual listed on this application as a dependent who is enrolled in coverage through the Massachusetts Health Connector and whose premium for coverage is paid in whole or in part by advance payments. List name(s) and date(s) of birth of dependents. Yes

Yes  No

No

Yes

Yes

No

No

Yes

Yes

No

No

Yes

Yes

No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No Yes

Yes  No

No