If you would like to fill out QI, you don't need to install any kind of software - simply give a try to our online PDF editor. Our tool is continually evolving to give the very best user experience possible, and that's because of our commitment to constant improvement and listening closely to comments from customers. To get the process started, go through these simple steps:

Step 1: Hit the "Get Form" button in the top area of this page to access our PDF editor.

Step 2: With our online PDF editor, it is possible to do more than merely complete forms. Edit away and make your documents appear sublime with custom text added in, or adjust the original content to perfection - all backed up by an ability to incorporate any kind of images and sign the PDF off.

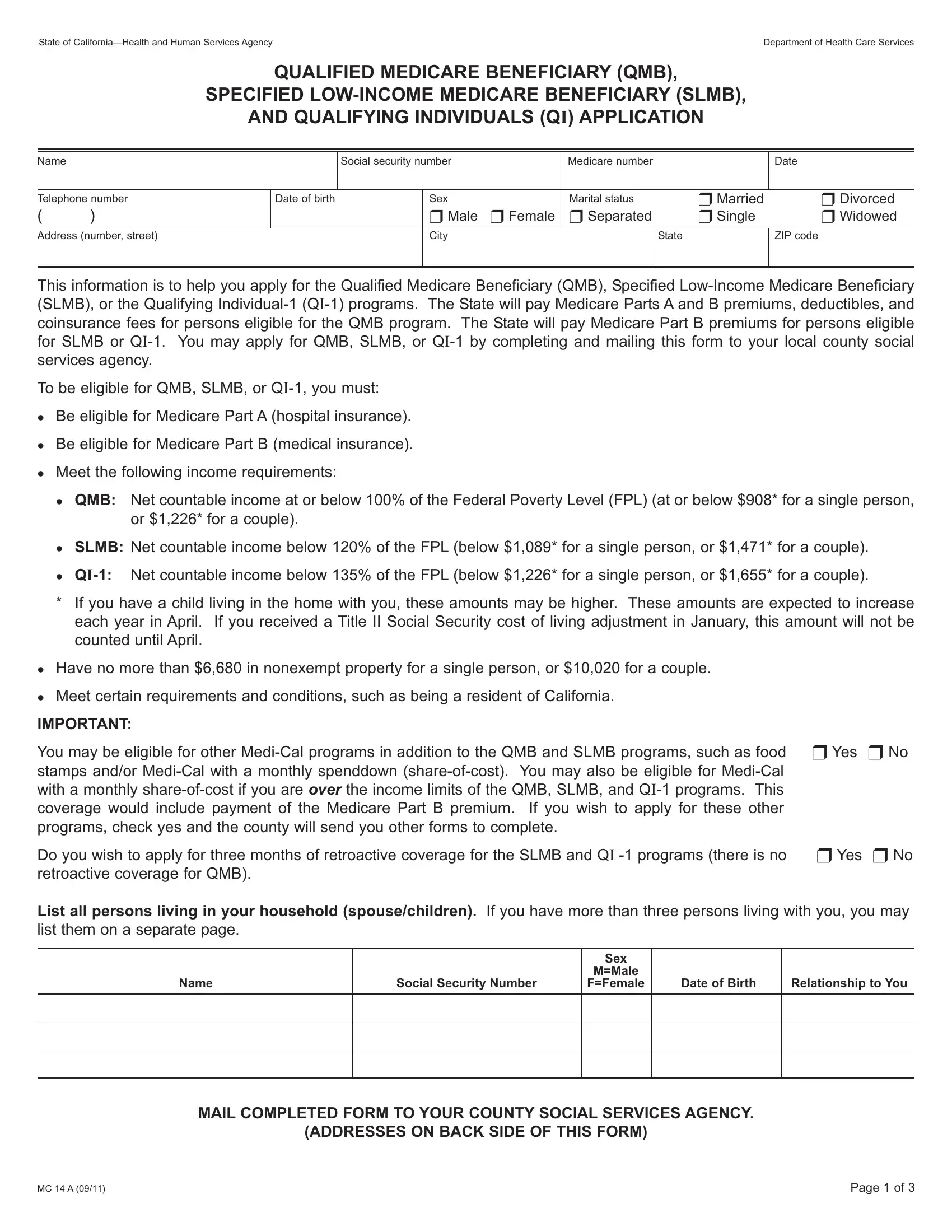

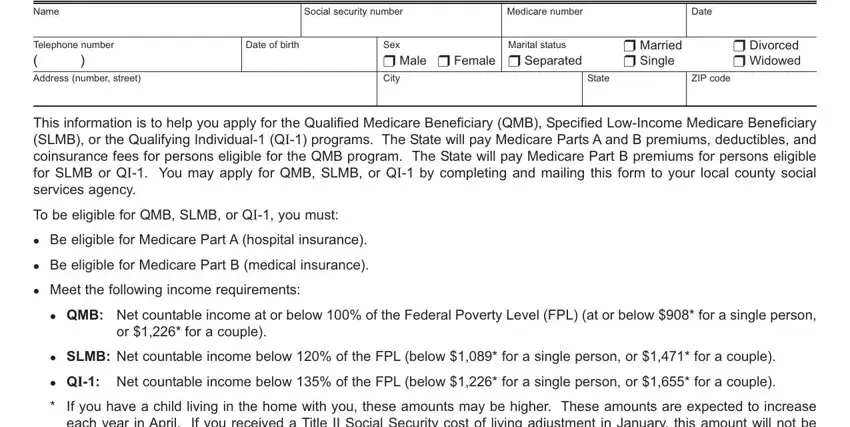

When it comes to blank fields of this particular document, here's what you need to know:

1. Firstly, when filling in the QI, start out with the section that has the subsequent fields:

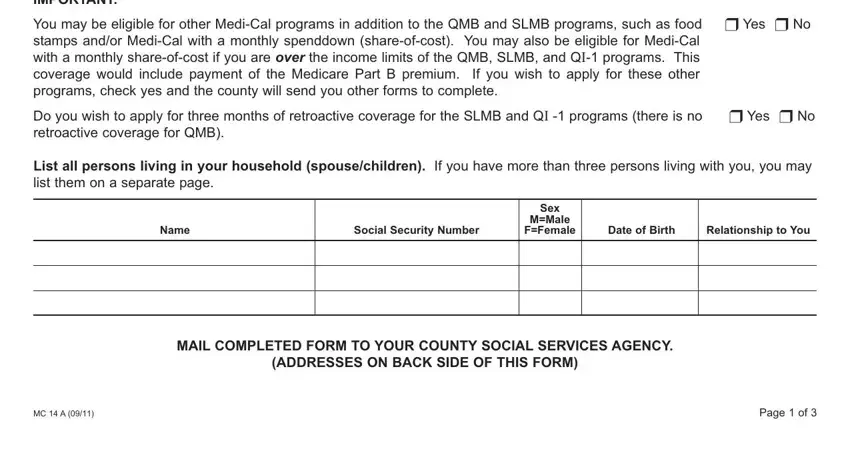

2. The subsequent part would be to fill in these blanks: IMPORTANT You may be eligible for, List all persons living in your, Name, Social Security Number, Sex, MMale, FFemale, Date of Birth, Relationship to You, MAIL COMPLETED FORM TO YOUR COUNTY, ADDRESSES ON BACK SIDE OF THIS FORM, MC A, and Page of.

Be extremely careful when filling out MC A and Date of Birth, since this is the section in which many people make errors.

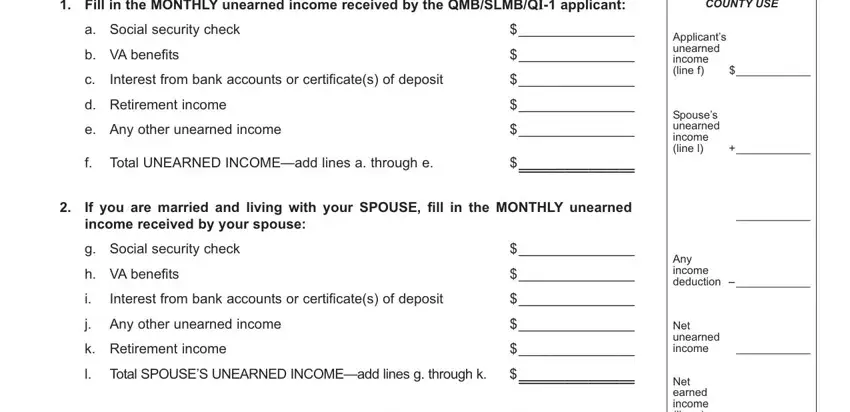

3. In this stage, look at Fill in the MONTHLY unearned, COUNTY USE, a Social security check, b VA benefits, Interest from bank accounts or, d Retirement income, e Any other unearned income, f Total UNEARNED INCOMEadd lines a, Applicants unearned income line f, Spouses unearned income line l, If you are married and living with, g Social security check, h VA benefits, Any income deduction, and Interest from bank accounts or. All of these will need to be filled in with utmost precision.

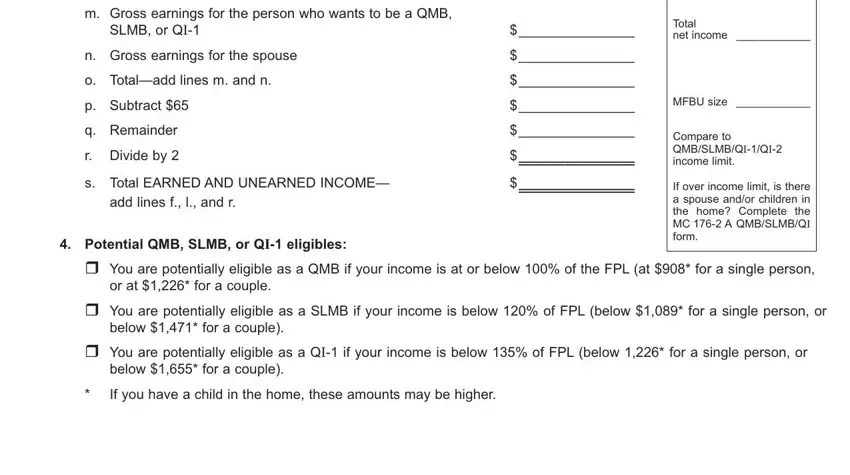

4. This next section requires some additional information. Ensure you complete all the necessary fields - m Gross earnings for the person, SLMB or QI, n Gross earnings for the spouse, o Totaladd lines m and n, p Subtract, q Remainder, r Divide by, s Total EARNED AND UNEARNED INCOME, add lines f l and r, Potential QMB SLMB or QI eligibles, Total net income, MFBU size, Compare to QMBSLMBQIQI income limit, If over income limit is there a, and You are potentially eligible as a - to proceed further in your process!

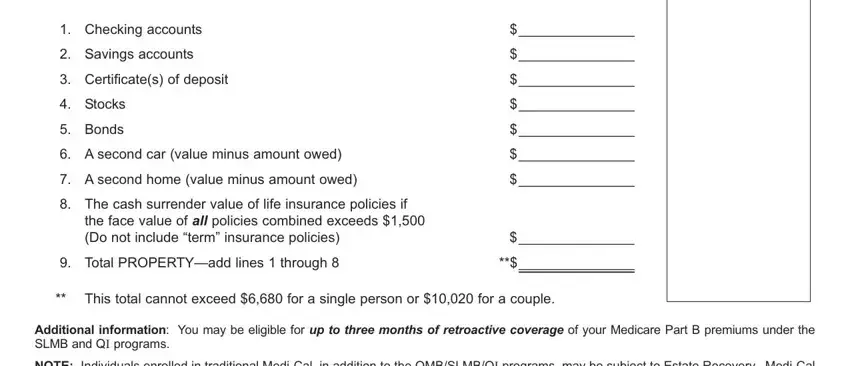

5. This very last step to conclude this form is pivotal. Ensure to fill in the displayed form fields, and this includes Checking accounts, Savings accounts, Certificates of deposit, Stocks, Bonds, A second car value minus amount, A second home value minus amount, The cash surrender value of life, the face value of all policies, Total PROPERTYadd lines through, This total cannot exceed for a, and Additional information You may be, before finalizing. Failing to do this can give you an unfinished and possibly incorrect paper!

Step 3: Before moving forward, ensure that all blanks are filled in the right way. When you verify that it's fine, press “Done." After creating afree trial account here, you will be able to download QI or email it promptly. The PDF document will also be readily accessible in your personal cabinet with your changes. FormsPal provides protected document tools with no data record-keeping or sharing. Feel at ease knowing that your information is in good hands here!