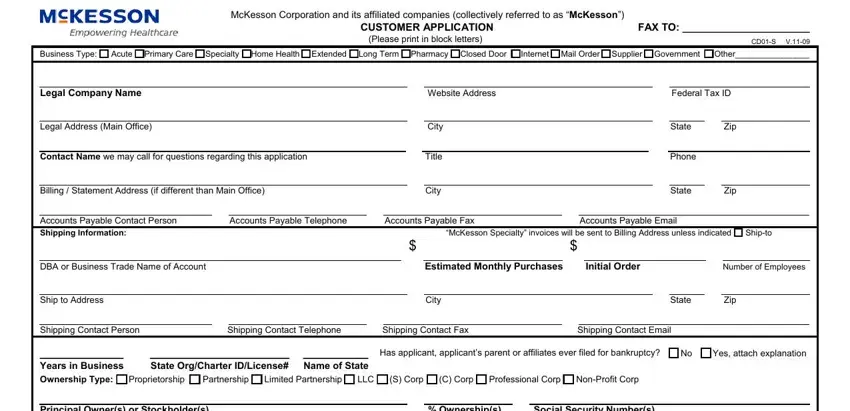

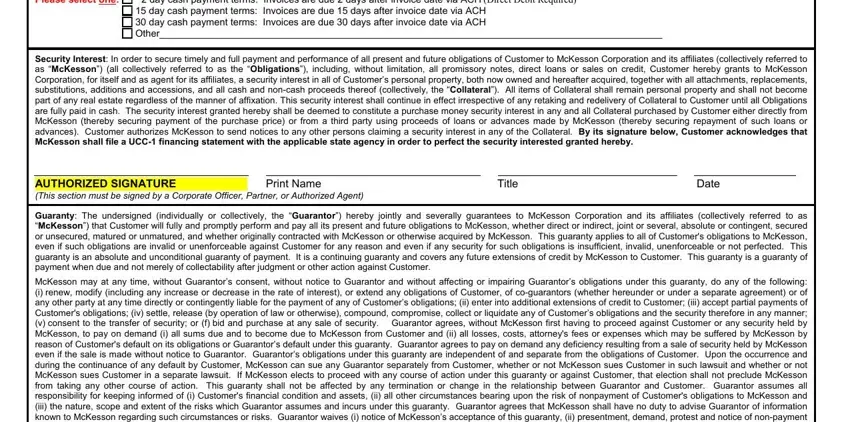

McKesson Corporation and its affiliated companies (collectively referred to as “McKesson”)

CUSTOMER APPLICATION |

FAX TO: ______________________ |

(Please print in block letters) |

CD01-S V.11-09 |

Business Type: Acute Primary Care Specialty Home Health

Long Term Pharmacy Closed Door |

Internet Mail Order Supplier Government |

Other________________ |

|

Legal Company Name |

|

|

|

|

|

|

|

|

Website Address |

|

|

|

|

|

Federal Tax ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Legal Address (Main Office) |

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Name we may call for questions regarding this application |

|

|

|

|

|

|

Title |

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Billing / Statement Address (if different than Main Office) |

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts Payable Contact Person |

|

Accounts Payable Telephone |

|

Accounts Payable Fax |

|

Accounts Payable Email |

|

|

|

|

|

|

Shipping Information: |

|

|

|

|

|

|

|

|

“McKesson Specialty” invoices will be sent to Billing Address unless indicated |

|

Ship-to |

|

|

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DBA or Business Trade Name of Account |

|

|

|

|

|

|

|

|

Estimated Monthly Purchases |

|

|

Initial Order |

|

Number of Employees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ship to Address |

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shipping Contact Person |

Shipping Contact Telephone |

Shipping Contact Fax |

Shipping Contact Email |

|

|

|

|

|

_________ |

_______________ |

_______ Has applicant, applicant’s parent or affiliates ever filed for bankruptcy? |

Years in Business |

State Org/Charter ID/License# |

Name of State |

Partnership |

Limited Partnership |

LLC |

(S) Corp |

(C) Corp Professional Corp Non-Profit Corp

|

Principal Owner(s) or Stockholder(s) |

|

|

|

|

|

% Ownership(s) |

Social Security Number(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

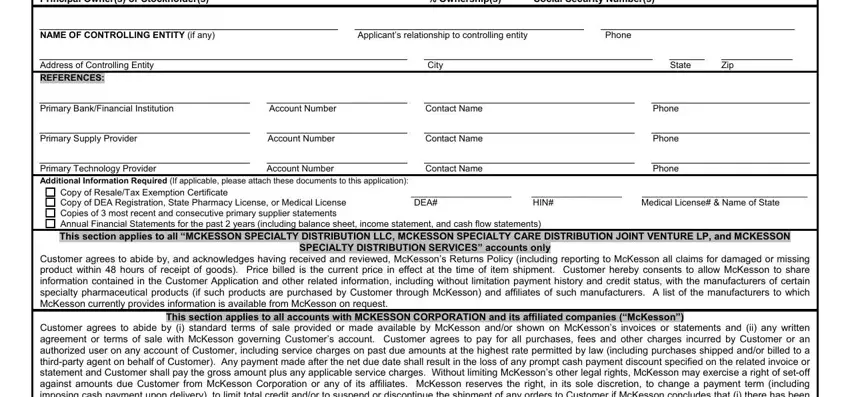

NAME OF CONTROLLING ENTITY (if any) |

|

|

|

Applicant’s relationship to controlling entity |

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of Controlling Entity |

|

|

|

|

|

City |

|

|

|

|

|

|

State |

Zip |

|

REFERENCES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Bank/Financial Institution |

|

Account Number |

|

|

Contact Name |

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Supply Provider |

|

Account Number |

|

|

Contact Name |

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Primary Technology Provider |

|

Account Number |

|

|

Contact Name |

|

|

|

|

|

Phone |

|

|

|

|

|

|

Additional Information Required (If applicable, please attach these documents to this application): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Copy of Resale/Tax Exemption Certificate |

|

|

|

____________________ |

__________________ |

_________________________________ |

|

|

Copy of DEA Registration, State Pharmacy License, or Medical License |

|

DEA# |

HIN# |

Medical License# & Name of State |

|

Copies of 3 most recent and consecutive primary supplier statements |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Financial Statements for the past 2 years (including balance sheet, income statement, and cash flow statements) |

|

|

|

|

|

|

|

|

|

This section applies to all “MCKESSON SPECIALTY DISTRIBUTION LLC, MCKESSON SPECIALTY CARE DISTRIBUTION JOINT VENTURE LP, and MCKESSON

SPECIALTY DISTRIBUTION SERVICES” accounts only

Customer agrees to abide by, and acknowledges having received and reviewed, McKesson’s Returns Policy (including reporting to McKesson all claims for damaged or missing product within 48 hours of receipt of goods). Price billed is the current price in effect at the time of item shipment. Customer hereby consents to allow McKesson to share information contained in the Customer Application and other related information, including without limitation payment history and credit status, with the manufacturers of certain specialty pharmaceutical products (if such products are purchased by Customer through McKesson) and affiliates of such manufacturers. A list of the manufacturers to which McKesson currently provides information is available from McKesson on request.

This section applies to all accounts with MCKESSON CORPORATION and its affiliated companies (“McKesson”)

Customer agrees to abide by (i) standard terms of sale provided or made available by McKesson and/or shown on McKesson’s invoices or statements and (ii) any written agreement or terms of sale with McKesson governing Customer’s account. Customer agrees to pay for all purchases, fees and other charges incurred by Customer or an authorized user on any account of Customer, including service charges on past due amounts at the highest rate permitted by law (including purchases shipped and/or billed to a third-party agent on behalf of Customer). Any payment made after the net due date shall result in the loss of any prompt cash payment discount specified on the related invoice or statement and Customer shall pay the gross amount plus any applicable service charges. Without limiting McKesson’s other legal rights, McKesson may exercise a right of set-off against amounts due Customer from McKesson Corporation or any of its affiliates. McKesson reserves the right, in its sole discretion, to change a payment term (including imposing cash payment upon delivery), to limit total credit and/or to suspend or discontinue the shipment of any orders to Customer if McKesson concludes that (i) there has been a material adverse change in the Customer’s financial condition or payment performance or (ii) Customer has ceased or is likely to cease to meet McKesson’s credit requirements.

Customer represents that it is entitled to discounted prices from manufacturers as it has notified McKesson (“Contract Prices”). In consideration of McKesson allowing Customer to purchase products at Contract Prices, Customer represents that McKesson will be paid by the appropriate manufacturer the difference between McKesson’s acquisition price and the Contract Price (“Chargeback”) and Customer will be liable to McKesson for any unpaid Chargeback if any manufacturer (i) denies a Chargeback for any reason, (ii) makes an assignment for the benefit of creditors, files a petition in bankruptcy, is adjudicated insolvent or bankrupt, or if a receiver or trustee is appointed with respect to a substantial part of its property or a proceeding is begun which will substantially impair its ability to pay Chargebacks or (iii) fails to pay McKesson Chargebacks for any reason other than McKesson’s gross negligence.

The Federal Equal Credit Opportunity Act prohibits creditors from discriminating due to race, color, religion, national origin, sex, marital status, age; or because all or part of the Customer’s income is from any public assistance program; or the Customer, in good faith, exercises any right under the Consumer Credit Protection Act. The Federal Trade Commission, Equal Credit Opportunity, Washington, DC 20580 administers compliance with this law. Customer represents and warrants that Customer has read and understands this form and has reviewed the information provided in its entirety, including responses completed for Customer by a McKesson representative, and that all information is complete and correct. Customer agrees that McKesson will be relying on such information and will notify McKesson of any material changes to such information.

Customer agrees to provide McKesson with financial statements upon request. Customer authorizes McKesson, its employees, representatives, and agents to (i) investigate information provided and Customer’s credit, financial and banking records, (ii) obtain Customer’s credit bureau report and (iii) share with its affiliates experiential and transactional information regarding Customer and Customer’s account. McKesson is authorized to retain information obtained as part of the application process whether or not the requested account and/or credit is granted. Customer agrees to pay all reasonable attorney fees and expenses or cost incurred by McKesson in enforcing its rights to collect amounts due from Customer. This form and any account opened in favor of Customer are subject to credit approval by McKesson.

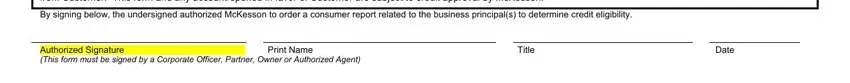

By signing below, the undersigned authorized McKesson to order a consumer report related to the business principal(s) to determine credit eligibility.

Authorized Signature |

Print Name |

Title |

Date |

(This form must be signed by a Corporate Officer, Partner, Owner or Authorized Agent)

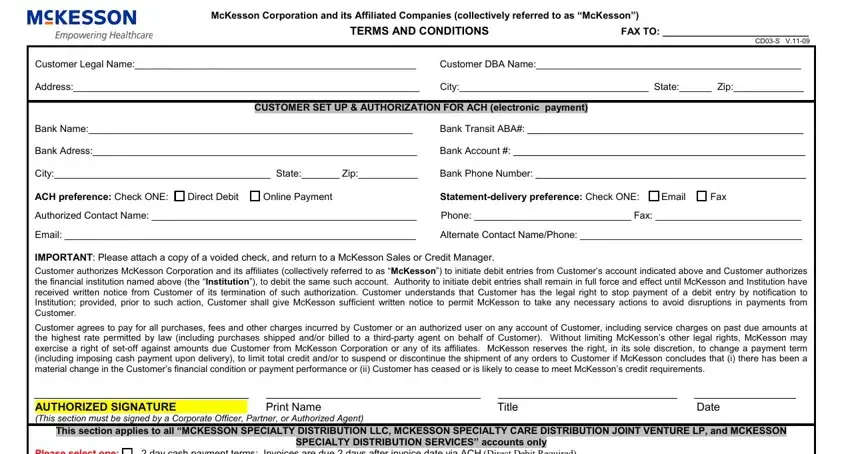

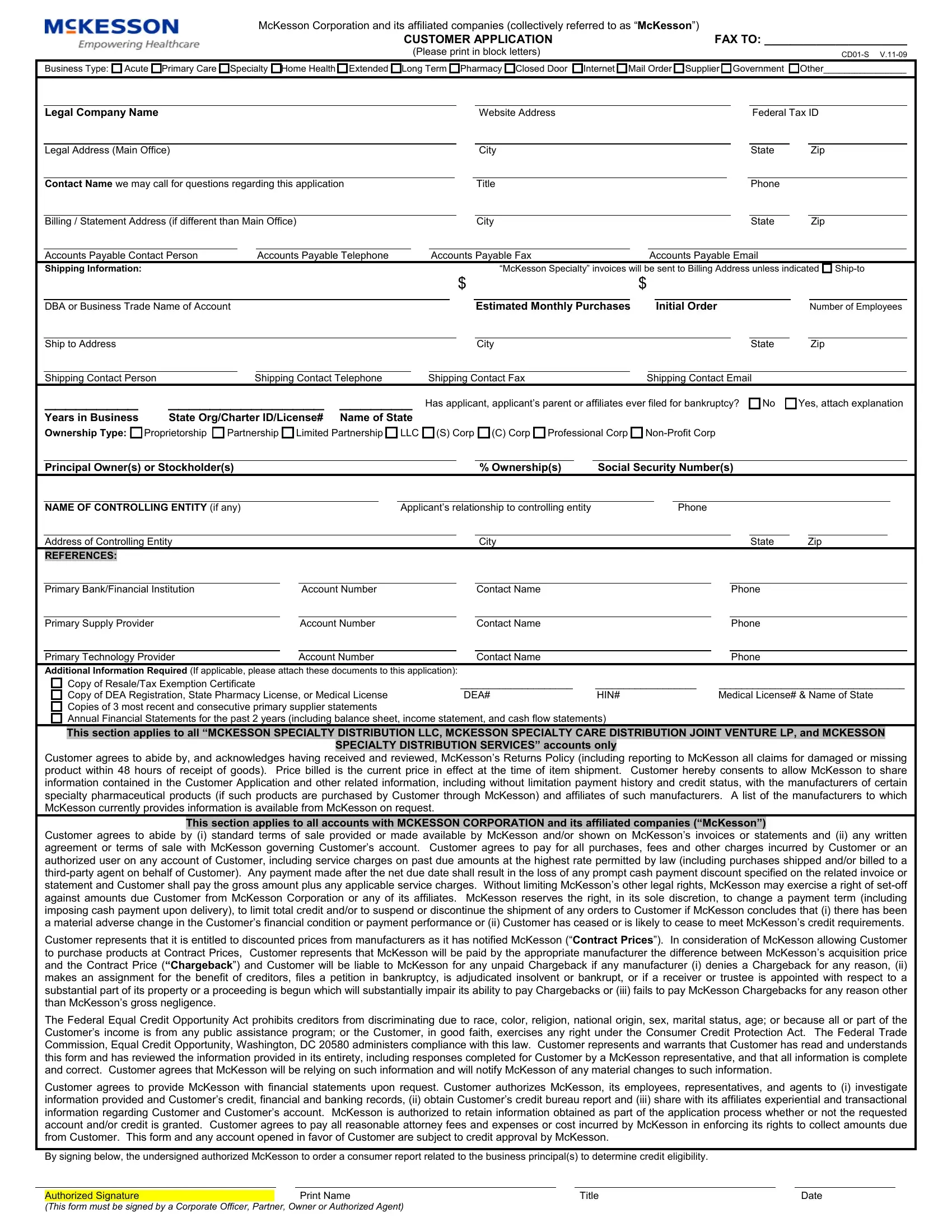

McKesson Corporation and its Affiliated Companies (collectively referred to as “McKesson”)

TERMS AND CONDITIONS |

FAX TO: ___________________________ |

|

|

CD03-S V.11-09 |

Customer Legal Name:____________________________________________________ |

Customer DBA Name:_________________________________________________ |

Address:________________________________________________________________ |

City:___________________________________ State:______ Zip:_____________ |

CUSTOMER SET UP & AUTHORIZATION FOR ACH (electronic payment)

Bank Name:____________________________________________________________ |

Bank Transit ABA#: ___________________________________________________ |

Bank Adress:____________________________________________________________ |

Bank Account #: ______________________________________________________ |

City:________________________________________ State:_______ Zip:___________ |

Bank Phone Number: __________________________________________________ |

ACH preference: Check ONE: |

Direct Debit |

Online Payment |

Statement-delivery preference: Check ONE: |

Email |

Fax |

Authorized Contact Name: _________________________________________________ |

Phone: _____________________________ Fax: ___________________________ |

Email: _________________________________________________________________ |

Alternate Contact Name/Phone: _________________________________________ |

IMPORTANT: Please attach a copy of a voided check, and return to a McKesson Sales or Credit Manager. |

|

|

Customer authorizes McKesson Corporation and its affiliates (collectively referred to as “McKesson”) to initiate debit entries from Customer’s account indicated above and Customer authorizes the financial institution named above (the “Institution”), to debit the same such account. Authority to initiate debit entries shall remain in full force and effect until McKesson and Institution have received written notice from Customer of its termination of such authorization. Customer understands that Customer has the legal right to stop payment of a debit entry by notification to Institution; provided, prior to such action, Customer shall give McKesson sufficient written notice to permit McKesson to take any necessary actions to avoid disruptions in payments from Customer.

Customer agrees to pay for all purchases, fees and other charges incurred by Customer or an authorized user on any account of Customer, including service charges on past due amounts at the highest rate permitted by law (including purchases shipped and/or billed to a third-party agent on behalf of Customer). Without limiting McKesson’s other legal rights, McKesson may exercise a right of set-off against amounts due Customer from McKesson Corporation or any of its affiliates. McKesson reserves the right, in its sole discretion, to change a payment term (including imposing cash payment upon delivery), to limit total credit and/or to suspend or discontinue the shipment of any orders to Customer if McKesson concludes that (i) there has been a material change in the Customer’s financial condition or payment performance or (ii) Customer has ceased or is likely to cease to meet McKesson’s credit requirements.

|

|

|

|

|

|

|

AUTHORIZED SIGNATURE |

|

Print Name |

Title |

|

Date |

(This section must be signed by a Corporate Officer, Partner, or Authorized Agent) |

|

|

|

|

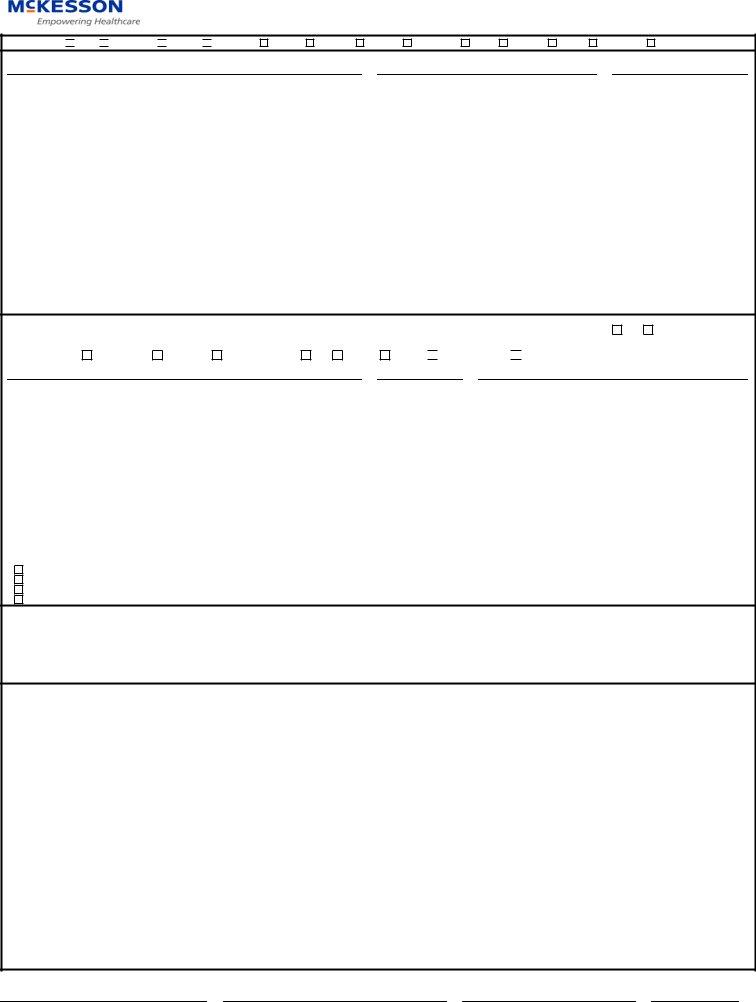

This section applies to all “MCKESSON SPECIALTY DISTRIBUTION LLC, MCKESSON SPECIALTY CARE DISTRIBUTION JOINT VENTURE LP, and MCKESSON

|

|

SPECIALTY DISTRIBUTION SERVICES” accounts only |

|

Please select one: |

2 day cash payment terms: Invoices are due 2 days after invoice date via ACH (Direct Debit Required) |

|

15 day cash payment terms: Invoices are due 15 days after invoice date via ACH |

|

30 day cash payment terms: Invoices are due 30 days after invoice date via ACH |

|

Other_____________________________________________________________________________________________ |

Security Interest: In order to secure timely and full payment and performance of all present and future obligations of Customer to McKesson Corporation and its affiliates (collectively referred to as “McKesson”) (all collectively referred to as the “Obligations”), including, without limitation, all promissory notes, direct loans or sales on credit, Customer hereby grants to McKesson Corporation, for itself and as agent for its affiliates, a security interest in all of Customer’s personal property, both now owned and hereafter acquired, together with all attachments, replacements, substitutions, additions and accessions, and all cash and non-cash proceeds thereof (collectively, the “Collateral”). All items of Collateral shall remain personal property and shall not become part of any real estate regardless of the manner of affixation. This security interest shall continue in effect irrespective of any retaking and redelivery of Collateral to Customer until all Obligations are fully paid in cash. The security interest granted hereby shall be deemed to constitute a purchase money security interest in any and all Collateral purchased by Customer either directly from McKesson (thereby securing payment of the purchase price) or from a third party using proceeds of loans or advances made by McKesson (thereby securing repayment of such loans or advances). Customer authorizes McKesson to send notices to any other persons claiming a security interest in any of the Collateral. By its signature below, Customer acknowledges that

McKesson shall file a UCC-1 financing statement with the applicable state agency in order to perfect the security interested granted hereby.

|

|

|

|

|

|

|

AUTHORIZED SIGNATURE |

|

Print Name |

Title |

|

Date |

(This section must be signed by a Corporate Officer, Partner, or Authorized Agent)

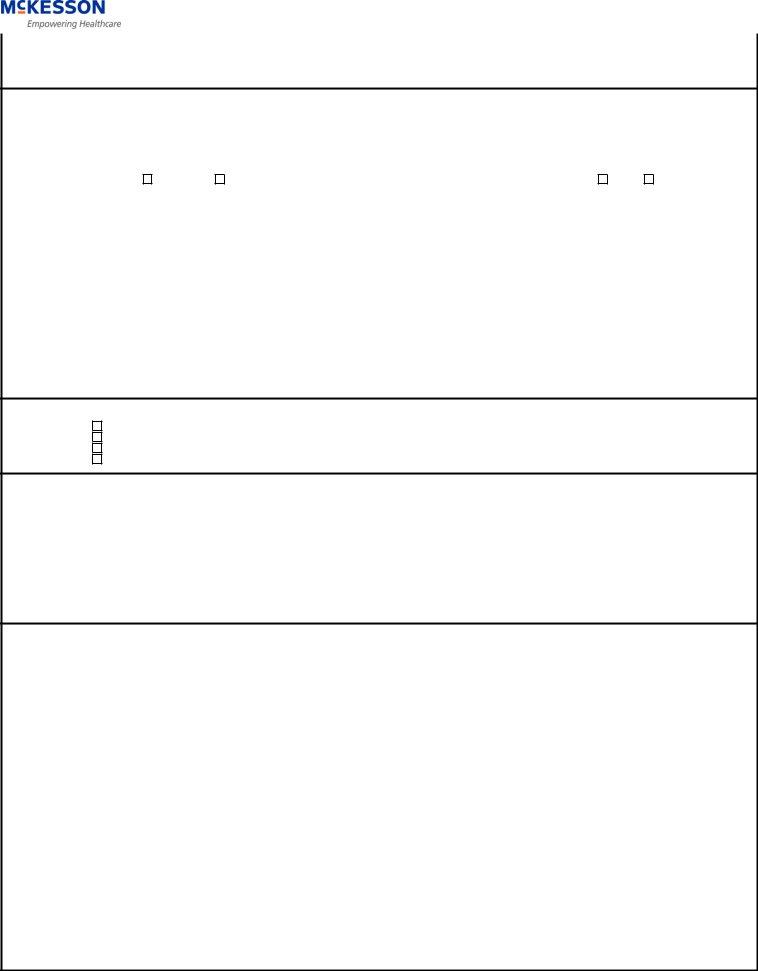

Guaranty: The undersigned (individually or collectively, the “Guarantor”) hereby jointly and severally guarantees to McKesson Corporation and its affiliates (collectively referred to as “McKesson”) that Customer will fully and promptly perform and pay all its present and future obligations to McKesson, whether direct or indirect, joint or several, absolute or contingent, secured or unsecured, matured or unmatured, and whether originally contracted with McKesson or otherwise acquired by McKesson. This guaranty applies to all of Customer's obligations to McKesson, even if such obligations are invalid or unenforceable against Customer for any reason and even if any security for such obligations is insufficient, invalid, unenforceable or not perfected. This guaranty is an absolute and unconditional guaranty of payment. It is a continuing guaranty and covers any future extensions of credit by McKesson to Customer. This guaranty is a guaranty of payment when due and not merely of collectability after judgment or other action against Customer.

McKesson may at any time, without Guarantor’s consent, without notice to Guarantor and without affecting or impairing Guarantor’s obligations under this guaranty, do any of the following:

(i)renew, modify (including any increase or decrease in the rate of interest), or extend any obligations of Customer, of co-guarantors (whether hereunder or under a separate agreement) or of any other party at any time directly or contingently liable for the payment of any of Customer’s obligations; (ii) enter into additional extensions of credit to Customer; (iii) accept partial payments of Customer's obligations; (iv) settle, release (by operation of law or otherwise), compound, compromise, collect or liquidate any of Customer’s obligations and the security therefore in any manner;

(v)consent to the transfer of security; or (f) bid and purchase at any sale of security. Guarantor agrees, without McKesson first having to proceed against Customer or any security held by McKesson, to pay on demand (i) all sums due and to become due to McKesson from Customer and (ii) all losses, costs, attorney's fees or expenses which may be suffered by McKesson by reason of Customer's default on its obligations or Guarantor’s default under this guaranty. Guarantor agrees to pay on demand any deficiency resulting from a sale of security held by McKesson even if the sale is made without notice to Guarantor. Guarantor’s obligations under this guaranty are independent of and separate from the obligations of Customer. Upon the occurrence and during the continuance of any default by Customer, McKesson can sue any Guarantor separately from Customer, whether or not McKesson sues Customer in such lawsuit and whether or not McKesson sues Customer in a separate lawsuit. If McKesson elects to proceed with any course of action under this guaranty or against Customer, that election shall not preclude McKesson from taking any other course of action. This guaranty shall not be affected by any termination or change in the relationship between Guarantor and Customer. Guarantor assumes all responsibility for keeping informed of (i) Customer's financial condition and assets, (ii) all other circumstances bearing upon the risk of nonpayment of Customer's obligations to McKesson and

(iii)the nature, scope and extent of the risks which Guarantor assumes and incurs under this guaranty. Guarantor agrees that McKesson shall have no duty to advise Guarantor of information known to McKesson regarding such circumstances or risks. Guarantor waives (i) notice of McKesson’s acceptance of this guaranty, (ii) presentment, demand, protest and notice of non-payment or protest as to any note or obligation signed, accepted, endorsed or assigned to McKesson by Customer, (iii) any other demands and notices required by law and (iv) all set-offs and counterclaims.

Name: ______________________________ Home Address: _________________________________________ City: ____________________ State: ______ Zip: __________

Guarantor Signature: ______________________________________________ Date: _______________________________ SSN#: ___________________________________

(This section must be signed by an owner/principal)

Name: ______________________________ Home Address: _________________________________________ City: ____________________ State: ______ Zip: __________

Guarantor Signature: ______________________________________________ Date: _______________________________ SSN#: ___________________________________

(This section must be signed by an owner/principal)