Are you an elderly individual considering a Medigap 65 policy? If so, you’ve come to the right place! In this blog post, we’ll walk through everything you need to understand about applying for Medigap with policy number 65. From understanding how coverage works and your eligibility requirements to completing the application form – we’ll cover it all. Before getting started on the application process itself, let's take a few moments to discuss why Medicare beneficiaries benefit from purchasing additional coverage such as Medigap plan 65.

| Question | Answer |

|---|---|

| Form Name | Medigap 65 Application Form |

| Form Length | 13 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min 15 sec |

| Other names | myaccount, how to maryland medigap 65, MediGap-65, maryland 65 application |

Maryland Residents

For assistance completing this application,

CALL

CareFirst of Maryland, Inc. 10455 Mill Run Circle, Owings Mills, MD 21117 Group Hospitalization and Medical Services, Inc.

840 First Street, NE, Washington, DC 20065

inStructionS

1.Please fill out all applicable spaces on this application. Print or type all information.

2.Sign this application on page 13 and return it in the

CareFirst BlueCross BlueShield Mailroom Administrator

P.O. Box 14651 Lexington, KY 40512

3.Send no money with this application. You will be notified by mail of the amount due if this application is accepted.

Give careful attention to all questions in this application. Accurate, complete information is necessary before your application can be processed. If incomplete, the application will be returned and delay your coverage.

pleASe reAd And check the ApplicAble box

If you live in Baltimore City or any other county in the State of Maryland, besides Prince George’s or Montgomery County, please check the CareFirst of Maryland, Inc.

box above. If you live in Prince George’s or Montgomery county, please check the Group Hospitalization and Medical Services, Inc. box above. Please check only one box.

Last Name |

First Name |

Middle Initial |

Residence Address (Number and Street)

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

Note: Please consider retaining your existing plan coverage until it is determined that you have passed Medical Underwriting.

Section 1. ApplicAnt informAtion ▼ |

|

|

|

|

|

|

|

|||

1A. PERSONAL INFORMATION |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Social Security (or Railroad Retirement) Number: |

|

Date of Birth: ________ / ________ / _______ |

||||||||

________ — ________ — ____________ |

|

|

||||||||

|

|

|

|

Month |

Day |

Year |

||||

|

|

|

|

|

|

|

|

|

||

Billing Address (if different from Resident Address): |

|

|

|

|

|

|

|

|||

Number and Street: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City: |

|

|

|

|

|

State: |

Zip Code |

|||

|

|

|

|

|

|

|

|

|

|

|

Sex: |

|

|

|

|

|

|

Height: |

|

Weight: |

|

Male |

Female |

Home Phone ( |

|

) |

|

|

___ ft. ___ in. |

________ lbs. |

||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

1B. PLAN OPTIONS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Please check the |

|

|

|

|||||||

PLAN A* |

PLAN B |

PLAN F |

High Deductible PLAN F |

|

|

|

|

|||

PLAN G |

PLAN L |

PLAN M |

PLAN N |

|

|

|

|

|

|

|

*If you are under age 65 and have Medicare, you may apply for PLAN A only.

A private not

MDSUPPAPP (8/12) |

1 |

Section 1. ApplicAnt informAtion (continued) ▼

1C. EFFECTIVE DATE

Your coverage becomes effective on the first day of the month following receipt and approval of this application. You will receive a Policy confirming the following effective date.

Requested Effective Date of Coverage: ________ / ________ / _______

Month Day Year

Section 2. medicAre coverAGe informAtion ▼

Please provide the following Medicare Information as printed on your red, white and blue Medicare identification card. You must have both Medicare Part A (hospital) and Medicare Part B (medical/surgical) coverage or will obtain Medicare coverage before the effective date of this

Health Insurance Claim Number:

Medicare Hospital (PART A) Effective Date:

________ / ________ / _______

Month Day Year

Medicare Medical/Surgical (PART B) Effective Date:

________ / ________ / _______

Month Day Year

Section 3. eliGibilitY informAtion ▼

Please answer the following question regarding your eligibility:

3A. Did you turn age 65 in the last 6 months? |

Yes |

No |

|

|

|

3B. Are you age 65 or older and have you enrolled in Medicare Part B within the last |

|

|

6 months? |

Yes |

No |

|

|

|

3C. Are you under age 65, eligible for Medicare due to a disability, AND did you |

|

|

enroll in Medicare Part B within the last 6 months? OR, Are you under age 65, |

|

|

eligible for Medicare due to a disability, AND have you been terminated from |

|

|

the Maryland Health Insurance Plan as a result of enrollment in Medicare Part B |

|

|

within the last 6 months? |

Yes |

No |

|

|

|

3D. At the time of this application, are you within 6 months from the first day of the |

|

|

month in which you first enrolled or will enroll in Medicare Part B? |

Yes |

No |

NOTE:

•If you answered YES to 3A, 3B, 3C or 3D, your acceptance is guaranteed. If you are applying for plans A, B, F,

•If you answered NO to 3A, 3B, 3C AND 3D, continue to question 3E.

3E. Please answer questions |

|

|

1. Were you enrolled under an employer group health plan or union coverage |

|

|

that pays after Medicare pays (Medicare Supplemental Plan) and that plan is |

|

|

ending or will no longer provide you with supplemental health benefits, and |

|

|

the applicable coverage was terminated or ceased within the past 63 days? |

|

|

OR, Did you receive a notice of termination or cessation of all supplemental |

|

|

health benefits within the past 63 days (if you did not receive the notice, |

|

|

did the date you received notice that a claim has been denied because of a |

|

|

termination or cessation of all supplemental health benefits occur within the |

|

|

past 63 days)? |

Yes |

No |

MDSUPPAPP (8/12) |

2 |

Section 3. eliGibilitY informAtion (continued) ▼

WITHIN THE PAST 63 DAY PERIOD WERE YOU ENROLLED UNDER:

2. A Medicare Health Plan* such as a Medicare Advantage Plan or you are 65 years of age or older and enrolled with a Program of

a.The Plan was terminated, no longer provides or has discontinued the Plan in the service area where you live

b.You were not able to continue coverage with the Plan because you moved out of the plan’s service area or other change in circumstances specified by the Secretary of the Department of Health and Human Services. This does not include failure to pay premiums on a timely basis

c.You are leaving because you can show that the Plan substantially violated a material provision of the policy including not providing medically necessary care on a timely basis or in accordance with medical standards

d.You are leaving because you can show that the Plan or its agent misled you in marketing the policy

e.The certification of the organization was terminated

3.A Medicare Supplemental policy and your enrollment ended and at least one of the following was met:............................................................................................

a.Through no fault of your own or because your insurance company has gone bankrupt and you lost coverage, or is going bankrupt and you will be losing your coverage

b.You are leaving because you can show that the company substantially violated a material provision of the policy

c.You are leaving because you can show that the company or its agent misled you in marketing the policy

4. A Medicare Health Plan* such as a Medicare Advantage or PACE plan that you joined when you first enrolled under Medicare Part B at age 65 or older, and within 12 months of enrolling you decided to switch back to a Medicare Supplement policy. ..................................................................................................

5. A Medicare Supplemental plan that you dropped and subsequently enrolled for the first time with a Medicare Health Plan* such as Medicare Advantage or PACE plan; and you have been in the plan less than 12 months and want to return to a Medicare Supplemental plan...................................................................................

6. A Medicare Part D plan, and ALSO were enrolled under a Medicare Supplement plan that covers outpatient prescription drugs. When you enrolled in Medicare Part D, you terminated enrollment in the Medicare Supplement Plan that covered outpatient prescription drug coverage. ...................................................................

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

MDSUPPAPP (8/12) |

3 |

Section 3. eliGibilitY informAtion (continued) ▼

7. An employer group health plan or union coverage that provides health benefits and the plan terminated, and solely because of your Medicare eligibility, you are not eligible for the tax credit for health insurance costs (under 35 of the Internal Revenue Code) and enrollment in the Maryland Health Insurance Plan (under

Yes

No

*Medicare Health Plan includes a Medicare Advantage Plan; a Medicare Cost plan (under 1876 of the federal Social Security Act); a similar organization operating under demonstration project authority effective for periods before April 1, 1999); a Health Care Prepayment Plan (under an agreement under 1833 (a)(1)(A) of the federal Social Security Act), a Medicare Select policy, HCFA certified provider sponsored organization, or a Program of

NOTE:

•If you answered YES to questions 3A, 3B, 3C or 3D, your acceptance is guaranteed. Skip Section 4 and go directly to Section 5.

•If you answered YES to any question in Section 3E you will NOT have to meet the

Skip Section 4 and go directly to Section 5.

•

•If you answered NO to ALL questions in Section 3 (3A, 3B, 3C, 3D AND 3E) continue to Section 4.

MDSUPPAPP (8/12) |

4 |

Section 4. heAlth evAluAtion ▼

Please complete Section 4A. If you answer “Yes” to any of the questions in Section 4A, you are not required to complete Sections 4B - 4E.

Have you had a physical exam within the past 5 years?

Have you used tobacco products within the last 5 years?

Yes

Yes

No

No

4A. PLEASE ANSWER THE FOLLOWING HEALTH QUESTIONS TO HELP DETERMINE WHETHER OR NOT YOU ARE ELIGIBLE.

To the best of your knowledge and belief, in the last five years, have you consulted a physician, licensed medical provider, been diagnosed, treated, OR advised by a medical practitioner to have treatment for known symptoms or known indications of the following conditions:

NOTE: ALL QUESTIONS MUST BE CHECKED “YES” OR “NO” OR YOUR APPLICATION WILL BE RETURNED.

1. Cancer (except skin or thyroid).....................................................................................

2. Melanoma, Hodgkin’s Disease, Leukemia, or Multiple Myeloma .................................

3. Kidney Disease or Disorder: Including Kidney Failure, Kidney Dialysis ........................

4. Amyotrophic Lateral Sclerosis or Anterior Horn Disease..............................................

5. Alzheimer’s, Senile Dementia, or other organic brain disorders, including

alcoholic psychosis .......................................................................................................

6. An Organ Transplant (kidney, liver, heart, lung, or bone marrow), or are on a waiting

list for a transplant .......................................................................................................

7. Have you tested positive for exposure to the HIV infection or been diagnosed as

having Acquired Immune Deficiency Syndrome (AIDS) caused by the HIV infection,

or other sickness or condition derived from such infection?........................................

Yes

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

No

No

If you answered YES to any of the questions in Section 4A, you are NOT eligible for these plans at this time. If your health status changes in the future, allowing you to answer NO to all of the questions in this section, please submit an application at that time. For information regarding plans that may be available, contact your local state department on aging.

If you answered NO to ALL the questions in Section 4A, please continue to Section 4B.

4B. MEDiCATioNs

If you are presently using or have used medication or prescription drugs in the past 12 months (1 year), please provide details below. If more space is needed, attach a separate sheet of paper.

Illness or Condition: |

Medication: |

Dosage: |

How Often Taken: |

|

|

|

|

Date of Last Treatment: |

Attending Physician Name and Address: |

|

|

________ / ________ / _______ |

|

|

|

|

|

|

|

Illness or Condition: |

Medication: |

Dosage: |

How Often Taken: |

|

|

|

|

Date of Last Treatment: |

Attending Physician Name and Address: |

|

|

________ / ________ / _______ |

|

|

|

|

|

|

|

Illness or Condition: |

Medication: |

Dosage: |

How Often Taken: |

|

|

|

|

Date of Last Treatment: |

Attending Physician Name and Address: |

|

|

________ / ________ / _______ |

|

|

|

|

|

|

|

MDSUPPAPP (8/12) |

5 |

Section 4. heAlth evAluAtion (continued) ▼

4C. HEALTH QUESTIONNAIRE

To the best of your knowledge and belief, in the last five years, have you consulted a physician, licensed medical provider, been diagnosed, treated, OR advised by a medical practitioner to have treatment for known symptoms or known indications of the following conditions:

NOTE: ALL QUESTIONS MUST BE CHECKED “YES” OR “NO” OR YOUR APPLICATION WILL BE RETURNED.

1. Insulin Dependent Diabetes Mellitus (Diabetes for which you take Insulin) ................

2. Liver Disease or Disorder: including Cirrhosis of Liver, Hepatitis C..............................

3. Lung Disease or Disorder: including Chronic Obstructive Pulmonary Disease,

Emphysema or required use of oxygen therapy to assist in breathing ........................

4. Heart or circulatory surgery of any type, including angioplasty, bypass,

stent placement or replacement, valve placement or replacement ..............................

5. Heart conditions including congestive heart failure, heart attack, cardiomyopathy,

heart rhythm disorders including pacemakers or defibrillator ....................................

6. Coronary Artery Disease (CAD) including hypertension or elevated

or high cholesterol .......................................................................................................

7. Stroke (CVA).................................................................................................................

8. Transient Ischemic Attack (TIA) ...................................................................................

9. Multiple sclerosis, Parkinson’s Disease, Muscular Dystrophy or paralysis of any type...

10. Auto Immune conditions including Systemic Lupus, Scleroderma, other connective

tissue conditions..........................................................................................................

11. Nervous or Mental Disorder requiring psychiatric care or hospitalization, including

substance or alcohol abuse .........................................................................................

12. Thyroid cancer .............................................................................................................

Yes Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes Yes

No No

No

No

No

No

No

No

No

No

No No

4D. ADDiTioNAL HEALTH QUEsTioNs

Please answer the following questions regarding your most recent medical history, to the best of your knowledge and belief.

NOTE: ALL QUESTIONS MUST BE CHECKED “YES” OR “NO” OR YOUR APPLICATION WILL BE RETURNED.

1. Are you currently hospitalized, bedridden, confined to a nursing facility, require the |

Yes |

No |

|

use of a wheelchair, or received home health care in the last 90 days? |

|||

|

|

|

|

2. Have you been advised by a medical practitioner that you will need to be |

|

|

|

hospitalized, bedridden, confined to a nursing facility, require the use of a |

Yes |

No |

|

wheelchair, or receive home health care within the next six months? |

|||

|

|

|

|

3. Have you been advised by a medical practitioner to have surgery within the next |

Yes |

No |

|

six months? |

|||

|

|

|

|

4. Have you had medical tests in the last year for which you have not yet |

Yes |

No |

|

received results? |

|||

|

|

|

|

5. Have you ever been hospitalized or had a condition that required hospitalization that |

Yes |

No |

|

occurred during the past seven years immediately before the date of this application? |

|||

|

|

||

Duration Dates: From: _______ / _______ / ______ To: _______ / _______ / ______ |

|

|

|

Condition: ___________ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ __ |

|

|

MDSUPPAPP (8/12) |

6 |

Section 4. heAlth evAluAtion (continued) ▼

4E. EXPLANATioN oF DiAGNosis AND TREATMENTs

If you have checked “Yes” to any part of SECTION 4C or 4D, for each box checked, please provide complete information regarding diagnosis or condition, treatment (including all medications, hospitalizations, surgeries and diagnostic testing results) and dates. If more space is needed, attach a separate sheet of paper.

|

|

|

Explain treatment (including all |

Recovery |

Question |

Diagnosis or Condition |

Duration |

medications, hospitalizations, surgery |

|

Number |

Dates |

and diagnostic test results and |

(check |

|

|

one box) |

|||

|

|

|

physician/hospital name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

From: |

|

Full |

|

|

To: |

|

Partial |

|

|

|

|

|

|

|

From: |

|

Full |

|

|

To: |

|

Partial |

|

|

|

|

|

|

|

From: |

|

Full |

|

|

To: |

|

Partial |

|

|

|

|

|

|

|

From: |

|

Full |

|

|

To: |

|

Partial |

|

|

|

|

|

|

|

From: |

|

Full |

|

|

To: |

|

Partial |

|

|

|

|

|

|

|

From: |

|

Full |

|

|

To: |

|

Partial |

|

|

|

|

|

|

|

From: |

|

Full |

|

|

To: |

|

Partial |

|

|

|

|

|

|

|

From: |

|

Full |

|

|

To: |

|

Partial |

|

|

|

|

|

Section 5. pASt And current coverAGe ▼

Please review the statements below, then answer all questions to the best of your knowledge.

•You do not need more than one Medicare supplement insurance policy.

•If you purchase this policy, you may want to evaluate your existing health coverage and decide if you need multiple coverages.

•You may be eligible for benefits under Medicaid and may not need a Medicare supplement policy.

•If, after purchasing this policy, you become eligible for Medicaid, the benefits and premiums under your Medicare supplement policy can be suspended, if requested, during you entitlement to benefits under Medicaid for 24 months. You must request this suspension within 90 days of becoming eligible for Medicaid. If you are no longer entitled to Medicaid, your suspended Medicare supplement policy (or, if that is no longer available, a substantially equivalent policy) will be reinstituted if requested within 90 days of losing Medicaid eligibility. If the Medicare supplement policy provided coverage for outpatient prescription drugs and you enrolled in Medicare Part D while your policy was suspended, the reinstituted policy will not have outpatient prescription drug coverage, but will otherwise be substantially equivalent to your coverage before the date of the suspension.

MDSUPPAPP (8/12) |

7 |

Section 5. pASt And current coverAGe (continued) ▼

•If you are eligible for, and have enrolled in, a Medicare supplement policy by reason of disability, and you later become covered by an employer or

•Counseling services may be available in your state to provide advice concerning your purchase of Medicare supplement insurance and concerning medical assistance through the state Medicaid program, including benefits as through the state Medicaid program, including benefits as a Qualified Medical Beneficiary (QMB) and a Specified

For your protection, you are required to answer all of the questions below (5A through 5M).

You are only required to answer questions 5N and 5O if you are applying for Plans A, B, F,

5A. Did you turn age 65 in the last 6 months? |

Yes |

No |

||

|

|

|

||

5B. Did you enroll in Medicare Part B in the last 6 months? |

Yes |

No |

||

|

|

|

||

5C. If Yes, what is the effective date? _______ / ________ / _______ |

|

|

||

|

|

|

||

5D. Are you covered for medical assistance through the State Medicaid program? |

|

|

||

|

(Medicaid is not the same as Federal Medicare. Medicaid is a program run by the |

|

|

|

|

state to assist with medical costs for lower or |

Yes |

No |

|

|

NOTE TO APPLICANT: If you are participating in a |

|

|

|

|

have not met your “Share of Cost”, please answer “NO” to this question. |

|

|

|

|

If NO, skip to question 5G. |

|

|

|

|

If YES, continue to 5E. |

|

|

|

|

|

|

||

5E. Will Medicaid pay your premiums for this Medicare supplement policy? |

Yes |

No |

||

|

|

|

|

|

5F. |

Do you receive any benefits from Medicaid OTHER THAN payments toward your |

|

|

|

|

Medicare Part B premium? |

Yes |

No |

|

|

|

|

||

5G. Have you had coverage from any Medicare plan other than original Medicare |

|

|

||

|

within the past 63 days (for example, a Medicare Advantage Plan, or a Medicare |

|

|

|

|

HMO or PPO)? |

Yes |

No |

|

|

If NO, skip to question 5K. |

|

|

|

|

If YES, fill in your start and end dates below. If you are still covered under this |

|

|

|

|

plan, leave “END” blank. |

|

|

|

|

START ________ / ________ / _______ |

END ________ / ________ / _______ |

|

|

|

|

|

||

5H. If you are still covered under the Medicare plan, do you intend to replace your |

|

|

||

|

current coverage with this new Medicare supplement policy? |

Yes |

No |

|

|

|

|

|

|

5I. |

Was this your first time in this type of Medicare plan? |

Yes |

No |

|

|

|

|

|

|

5J. |

Did you drop a Medicare supplement policy to enroll in the Medicare plan? |

Yes |

No |

|

MDSUPPAPP (8/12) |

8 |

Section 5. pASt And current coverAGe (continued) ▼

5K. Do you have another Medicare supplement policy in force? .....................................

If NO, skip to question 5M. If YES, indicate the company and plan name (i.e. Medigap Plan A, B, etc.) and then continue to 5L.

Company Name ___________________________________________________________

Plan Name ______________________________________________________________

Yes

No

5L. Since you have another Medicare supplement policy in force, do you intend to replace your current Medicare supplement policy with this policy?

Yes

No

5M. Have you had coverage under any other health insurance within the past 63 days? (For example, an employer, union, or individual plan)

If YEs:

What company and what kind of policy?

Company Name _______________________________________________________

Membership number IF a CareFirst BlueCross BlueShield Policy ______________

Policy Type: (Please select only ONE BOX)

HMO/PPO |

Major Medical |

Employer Plan |

Union Plan |

Other |

|

What are you dates of coverage under the policy listed in 5M? (If you are still covered under the other policy, leave “END” blank.)

START ________ / ________ / _______ |

END ________ / ________ / _______ |

Yes

No

Please ONLY answer Questions 5N and 5o if you are applying for Plans A, B, F,

5N. At the time of this application, have you had continuous creditable coverage* of at |

|

|

least 6 months, without a break in this coverage of more than 63 consecutive days?.... |

Yes |

No |

|

|

|

If NO, please continue to question 50. |

|

|

If you answered YES and are applying for Plans A, B, F, |

|

|

submit evidence of Creditable Coverage along with this application. However, you will NOT |

|

|

have to meet the |

|

|

|

|

|

50. At the time of this application, have you had continuous creditable coverage* of less |

|

|

than 6 months, without a break in this coverage of more than 63 consecutive days? ... |

Yes |

No |

If you answered YES and applied for Plans A, B, F, |

|

|

MUsT submit evidence of Creditable Coverage along with this application and |

|

|

the |

|

|

of days you had creditable coverage. However, there is one exception. If you |

|

|

answered YES to any question in Section 3E, you will NOT have to meet the pre- |

|

|

existing condition waiting period. |

|

|

*Creditable coverage means coverage under any of the following plans: 1) a group health plan; 2) health insurance coverage;

3)Medicare Part A or Part B; 4) Medicaid 5) CHAMPUS; 6) a medical care program of the Indian Health Service or of a tribal organization; 7) a State health benefit risk pool; 8) the Federal Employees Health Benefit Plan; 9) a public health plan as defined in federal regulations; or 10) a health benefit plan defined under the Peace Corp Act.

Documents that may be used as evidence of “creditable coverage,” include:

• a certificate of “creditable coverage;” |

• |

• paystubs showing a payroll deduction for health coverage; |

• and any other relevant documents that evidence periods |

• a health insurance identification card; |

of health coverage. |

MDSUPPAPP (8/12) |

9 |

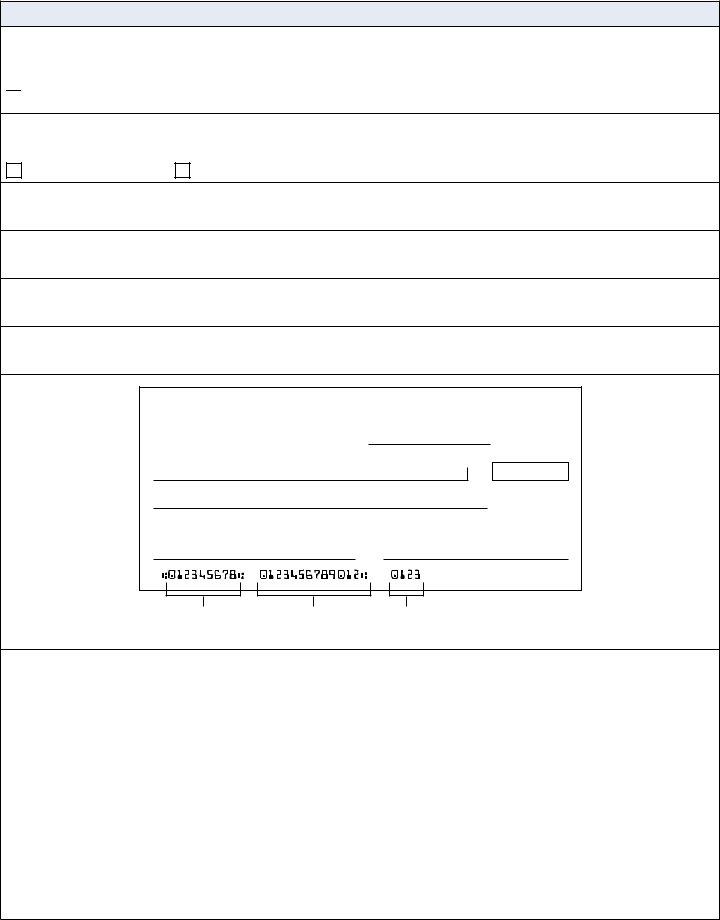

Section 6. premium pAYment ▼

CareFirst BlueCross BlueShield wants to help you save time! Our standard method of payment is automated payment via bank withdrawal.

Please check this box if you do not wish to set up an automated payment account and intend to pay by submitting paper checks or by credit card.

Otherwise, to take advantage of this time saving option, please fill out the information below. Choose either:

Checking Account |

Savings Account |

Bank Name:

Bank Routing Number:

Bank Account Number:

Name that appears on the Account:

NAME

ADDRESS

CITY, STATE ZIP

DATE

PAY TO THE

ORDER OF

BANK NAME

ADDRESS

CITY, STATE ZIP

FOR

0123

$

DOLLARS

Bank Routing |

Bank Account |

Check |

Number |

Number |

Number |

I hereby authorize CareFirst BlueCross BlueShield to charge my account for the payment of premiums due for an unpaid invoice. If any check draft is dishonored for any reason, or drawn after the depositor’s authorization has been withdrawn, CareFirst agrees that the financial institution will not be held liable. I understand that

Signature of Account Holder: X_______________________________________ Date:________ / ________ / _______

MDSUPPAPP (8/12) |

10 |

Section 7. electronic communicAtion conSent ▼

CareFirst BlueCross BlueShield (CareFirst) wants to help you manage your health care information and protect the environment by offering you the option of electronic communication.

Instead of paper delivery, you can receive electronic notices about your CareFirst health care coverage through email and/or text messaging by providing your email address and/or cell phone number and consent below.

Electronic notices regarding your CareFirst health care coverage include, but are not limited to:

nExplanation of Benefits alerts

nReminders

nNotice of HIPAA Privacy Practices

nCertification of Creditable Coverage

You may also receive information on programs related to your existing products and services along with new products and services that may be of interest to you.

Please Note: you may change your email and consent information anytime by logging into www.carefirst.com/ myaccount or by calling the customer service phone number on your ID card. You can also request a paper copy of electronic notices at any time by calling the customer service phone number on your ID card.

I understand that to access the information provided electronically through email, I must have the following:

nInternet access;

nAn email account that allows me to send and receive emails; and

nMicrosoft Explorer 7.0 (or higher) or Firefox 3.0 (or higher), and Adobe Acrobat Reader 4 (or higher).

I understand that to receive notices through text messaging:

nA text messaging plan with my cell phone provider is required; and

nStandard text messaging rates will apply.

By checking below, I hereby agree to electronic delivery of notices, instead of paper delivery by:

Email only

Cell phone text messaging only Email and cell phone text messaging

Applicant Name

Email Address

Cell Phone Number

CareFirst BlueCross BlueShield will not sell your email or phone number to any third party and we do not share it with third parties except for CareFirst business associates that perform functions on our behalf or to comply with the law.

MDSUPPAPP (8/12) |

11 |

Section 8. conditionS of enrollment (pleASe reAd thiS Section cArefullY) ▼

IT IS UNDERSTOOD AND AGREED THAT:

A copy of this application is available to the Policyholder (or to a person authorized to act on his/her behalf), from CareFirst BlueCross BlueShield (CareFirst).

This information is subject to verification. To do so I authorize any physician, hospital, pharmacy, pharmacy benefit manager or pharmacy related service organizations or any other medical or medically- related person or company including MIB, Inc. to release my “Medical Information” to CareFirst’s business associates or representatives. I further authorize any business associate who receives “Medical Information” from any physician, hospital pharmacy, pharmacy benefit manager or pharmacy related service organizations or any other medical or

This authorization shall include and apply to any and all protected health information related to treatments where I have requested a restriction to a health care provider to release information and/or for any health care item or service for which I have paid the health care provider in full. I understand this authorization will remain in effect for 30 months from the date signed.

I understand that I have the right to cancel this authorization at any time, in writing, except to the extent that CareFirst has already taken action in reliance on this authorization. I also understand that CareFirst’s Notice of Privacy Practices includes information pertaining to authorizations and to requirements of revocation. A copy of the Notice may be obtained by contacting the CareFirst’s Privacy Office. CareFirst will not use or disclose the Medical Information for any purposes other than those listed above except as may be required by law. CareFirst is required to tell you by law that information disclosed pursuant to this authorization may be subject to

If CareFirst determines that additional information is needed, I will receive an authorization to release that information. Failure to execute an authorization may result in the denial of my application for coverage. Additionally I understand that failure to complete any section of this application, including signing below, may delay the processing of my application.

To the best of my knowledge and belief, all statements made on this application are complete, true and correctly recorded. They are representations that are made to induce the issuance of, and form part of the consideration for a CareFirst policy. I understand that a medically underwritten policy is only issued under the conditions that the health of the applicant named on the application remains as stated above. Applicants who are permitted to skip Section 4 of this application are not issued a medically underwritten policy. I also understand that failure to enter accurate, complete and updated medical information may result in the denial of all benefits or cancellation of my policy. (This statement does not apply to applicants who are permitted to skip Section 4 of this application and are issued a policy under the Guaranteed Issue provisions.) CareFirst may rescind or void my coverage only if (1) I have performed an act, practice, or omission that constitutes fraud; or (2) I have made an intentional misrepresentation of material

fact. CareFirst will provide

I will update CareFirst if there have been any changes in health concerning the applicant listed in this application that occur prior to acceptance of this application by CareFirst. (This statement does not apply to applicants who are permitted to skip Section 4 of this application and are issued a policy under the Guaranteed Issue provisions.)

If you have any questions concerning the benefits and services that are provided by or excluded under this Policy, please contact a membership services representative before signing this application.

An applicant whose application is denied by CareFirst due to medical underwriting may not submit a new application for enrollment within ninety (90) days of the denial.

MDSUPPAPP (8/12) |

12 |

Section 8. conditionS of enrollment (continued) ▼

WARNING: ANY PERSON WHO KNOWINGLY OR WILLFULLY PRESENTS A FALSE OR FRAUDULENT CLAIM FOR PAYMENT OF A LOSS OR BENEFIT OR WHO KNOWINGLY OR WILLFULLY PRESENTS FALSE INFORMATION IN AN APPLICATION FOR INSURANCE IS GUILTY OF A CRIME AND MAY BE SUBJECT TO FINES AND CONFINEMENT IN PRISON.

Information regarding your insurability will be treated as confidential. CareFirst or its reinsurers may, however, make a brief report thereon to the MIB, Inc., a

a company, MIB, upon request, will supply such company with the information about you in its file. Regarding MIB: Upon receipt of a request from you, MIB will arrange disclosure of any information in your file. Please contact MIB at

X___________________________________________________________________ Date ________ / ________ / _______

Applicant’s Signature (PLEASE DO NOT PRINT)

FOR OFFICE USE ONLY:

Signature of Applicant: X_____________________________________________ Date ________ / ________ / _______

FoR BRoKER UsE oNLY: |

Name: |

SSN/Tax ID #: |

|

|

|

|

|

Contracted Broker: |

|

|

|

|

|

|

|

|

|

|

|

Writing Agent: |

|

|

|

|

|

|

|

MDSUPPAPP (8/12) |

13 |