exempts can be filled in without difficulty. Just open FormsPal PDF editing tool to complete the task right away. FormsPal is committed to providing you with the ideal experience with our tool by consistently adding new capabilities and upgrades. With these improvements, working with our editor gets better than ever before! Getting underway is effortless! All you have to do is stick to these basic steps below:

Step 1: Click the orange "Get Form" button above. It'll open up our pdf tool so that you can begin completing your form.

Step 2: The tool gives you the opportunity to change PDF files in various ways. Modify it by adding personalized text, correct existing content, and include a signature - all at your fingertips!

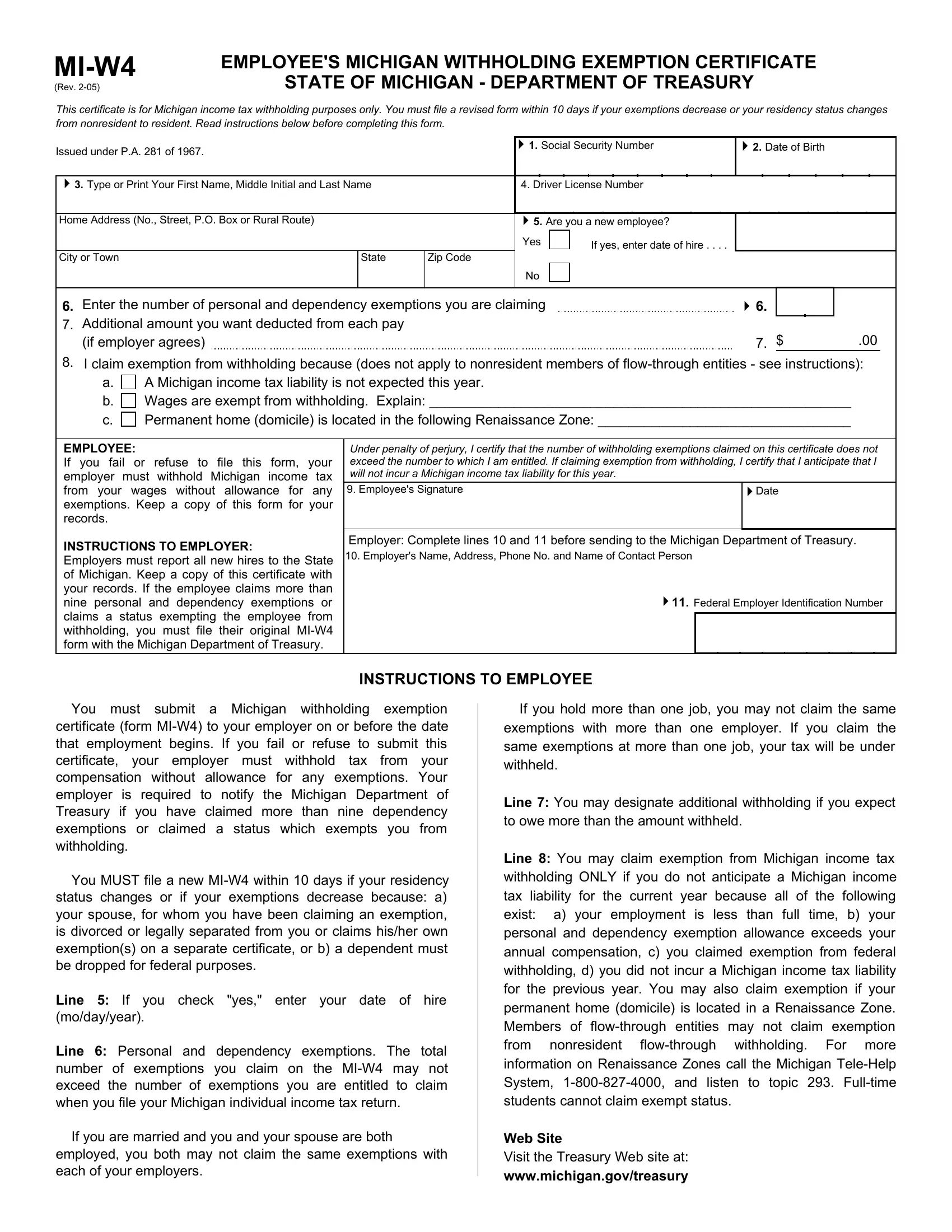

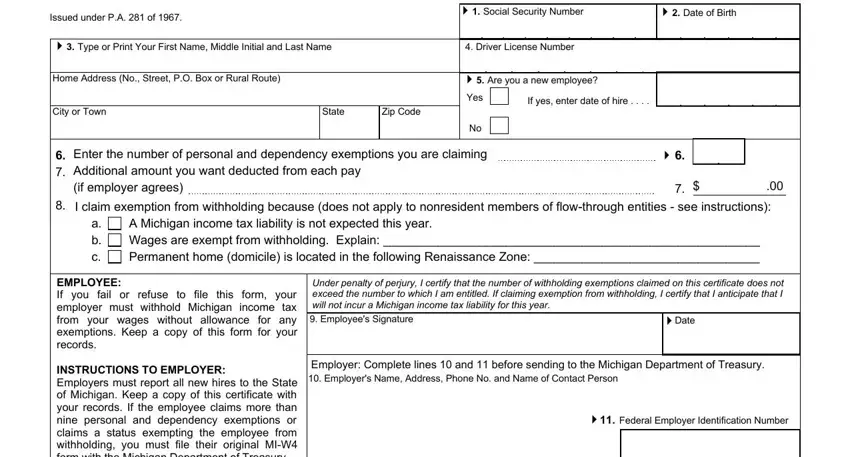

This form requires particular data to be typed in, hence ensure you take your time to fill in precisely what is requested:

1. The exempts involves certain details to be inserted. Ensure that the following blanks are filled out:

Step 3: Look through the information you've entered into the blanks and then click the "Done" button. After starting a7-day free trial account here, you will be able to download exempts or email it directly. The document will also be readily available via your personal account with all of your edits. We do not share any information you type in while dealing with forms at FormsPal.