michigan 5156 form can be completed online without difficulty. Simply open FormsPal PDF editor to accomplish the job without delay. FormsPal is focused on giving you the best possible experience with our editor by regularly introducing new features and improvements. Our editor is now much more intuitive with the latest updates! At this point, working with PDF documents is a lot easier and faster than before. Starting is easy! All you should do is stick to the next simple steps directly below:

Step 1: Click the orange "Get Form" button above. It will open up our pdf editor so that you can start completing your form.

Step 2: Using our state-of-the-art PDF tool, you may accomplish more than just complete forms. Try all the features and make your docs look high-quality with custom textual content put in, or adjust the file's original input to excellence - all supported by an ability to incorporate stunning images and sign the PDF off.

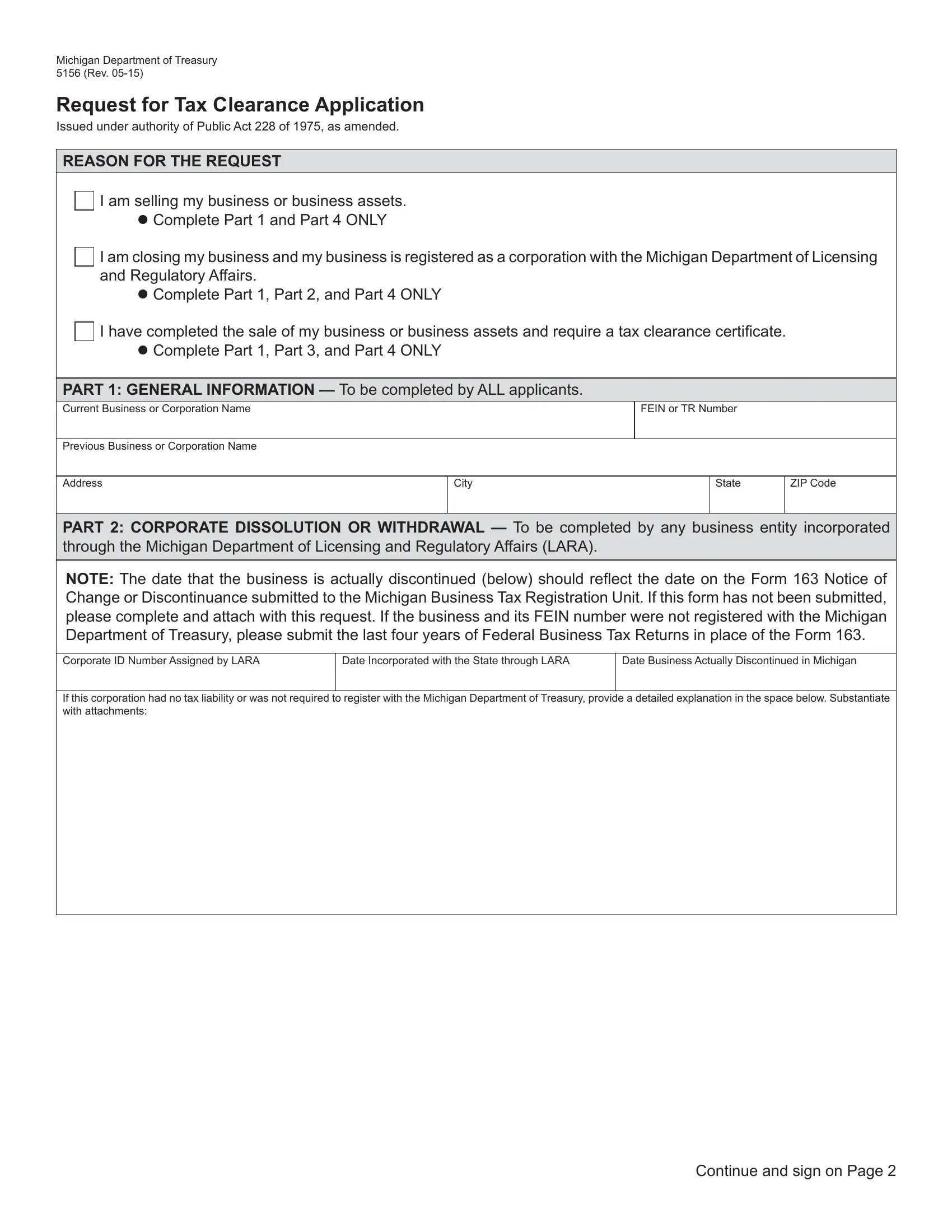

In order to complete this PDF document, be certain to provide the information you need in every field:

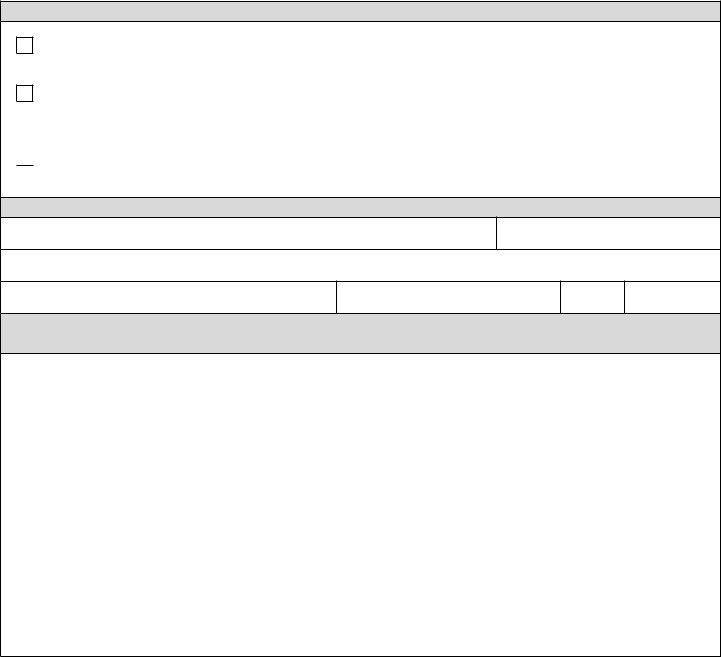

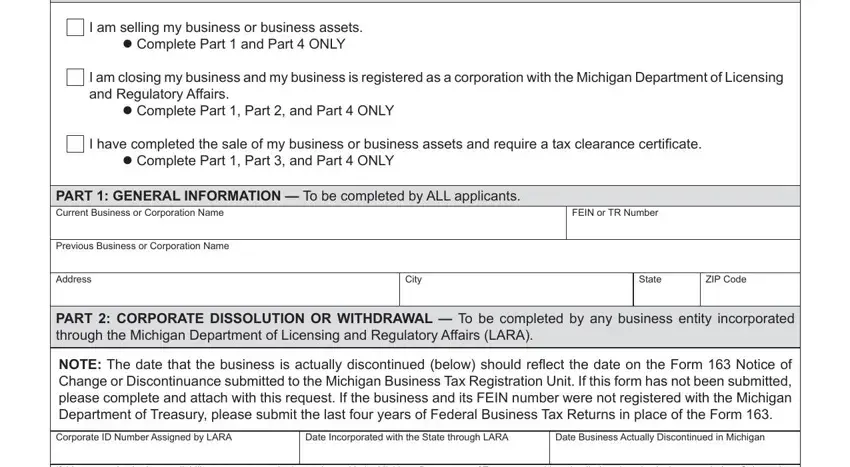

1. The michigan 5156 form involves certain details to be entered. Make certain the next blank fields are complete:

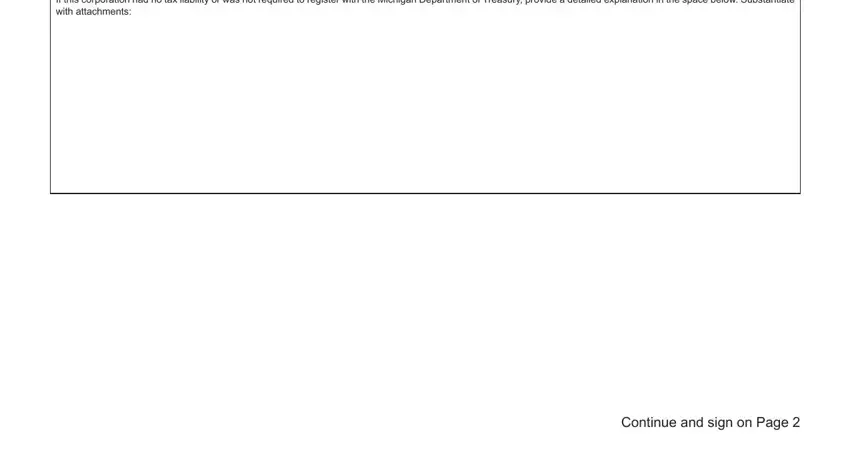

2. Right after filling in the last section, head on to the subsequent part and enter the essential particulars in these fields - If this corporation had no tax, and Continue and sign on Page.

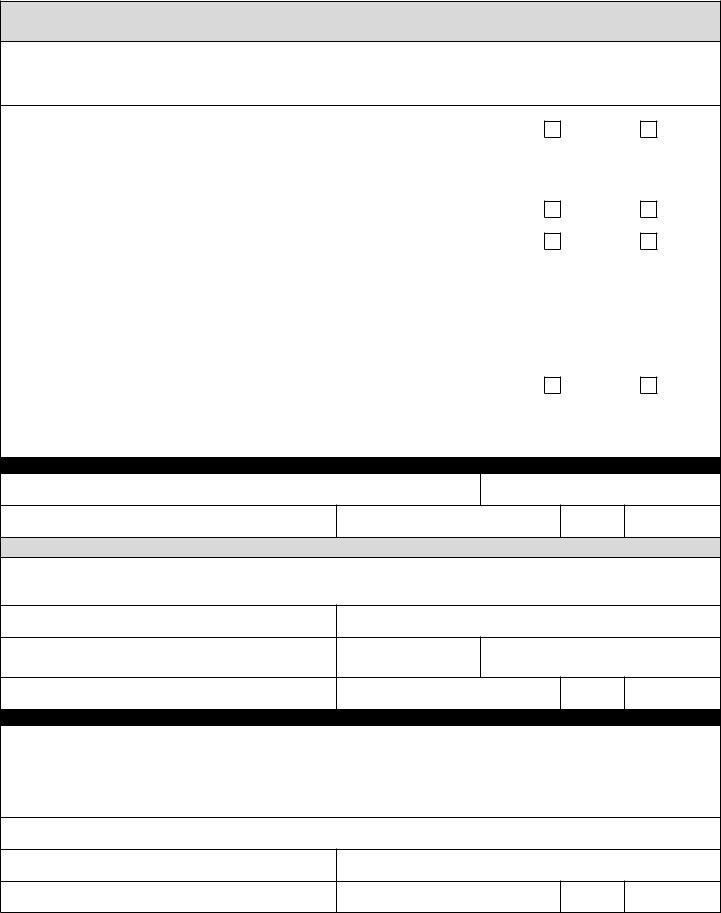

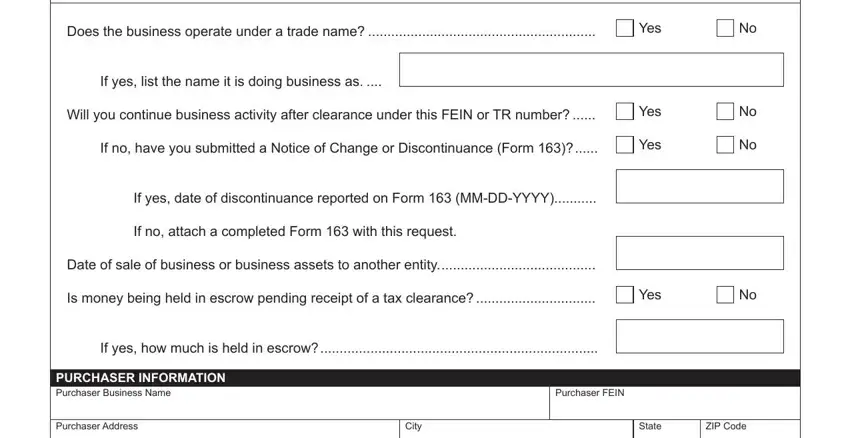

3. Completing Does the business operate under a, Yes, If yes list the name it is doing, Will you continue business, If no have you submitted a Notice, Yes, Yes, If yes date of discontinuance, If no attach a completed Form, Date of sale of business or, Is money being held in escrow, Yes, If yes how much is held in escrow, PuRChAseR InfoRmATIon Purchaser, and Purchaser FEIN is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

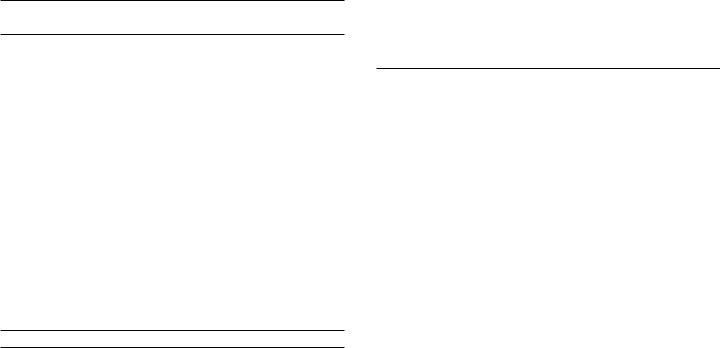

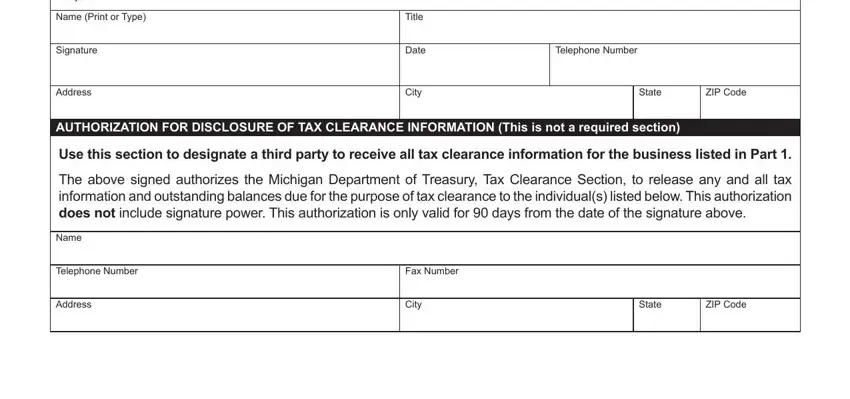

4. This subsection arrives with these form blanks to type in your specifics in: I declare under penalty of perjury, Name Print or Type, Signature, Address, Title, Date, City, Telephone Number, State, ZIP Code, AuThoRIzATIon foR DIsClosuRe of, use this section to designate a, The above signed authorizes the, Name, and Telephone Number.

Be extremely careful while filling in AuThoRIzATIon foR DIsClosuRe of and Address, because this is where a lot of people make errors.

Step 3: Prior to moving on, check that blanks are filled out as intended. The moment you think it's all fine, click “Done." Sign up with us today and instantly get access to michigan 5156 form, set for downloading. All alterations you make are saved , so that you can customize the document at a later time anytime. FormsPal ensures your information privacy by having a protected method that in no way saves or shares any sort of sensitive information involved. Feel safe knowing your paperwork are kept safe every time you work with our tools!