It is possible to fill out form 5107 disabled vet instantly with the help of our PDFinity® PDF editor. Our editor is constantly evolving to grant the very best user experience achievable, and that's because of our commitment to constant improvement and listening closely to user feedback. Should you be seeking to start, here is what it requires:

Step 1: Simply click the "Get Form Button" at the top of this page to start up our pdf form editing tool. Here you will find everything that is required to fill out your document.

Step 2: With our online PDF file editor, it is possible to do more than just complete forms. Try all of the functions and make your documents look professional with customized text put in, or fine-tune the original content to excellence - all that backed up by the capability to add almost any graphics and sign the file off.

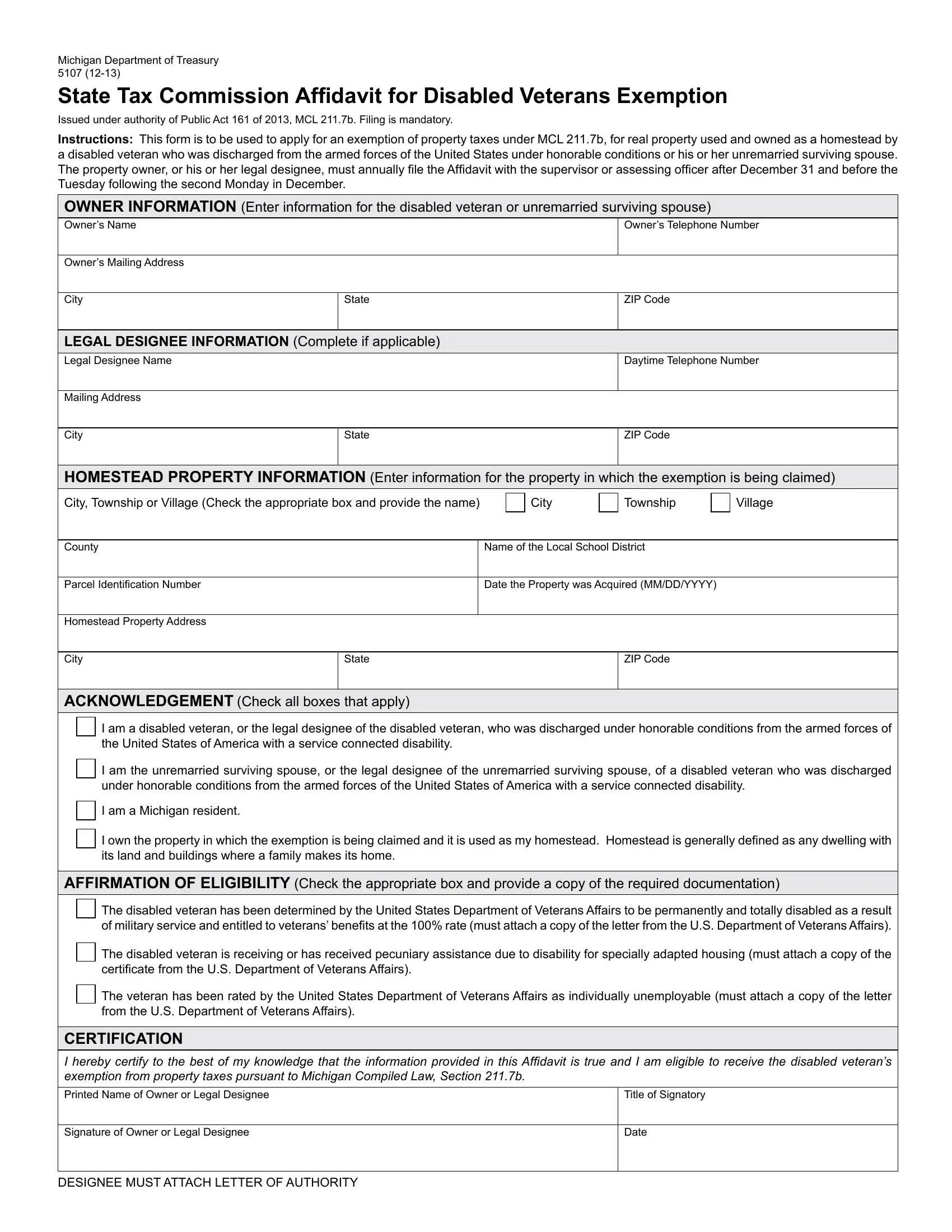

This PDF doc will require you to provide specific details; to guarantee accuracy and reliability, take the time to consider the suggestions down below:

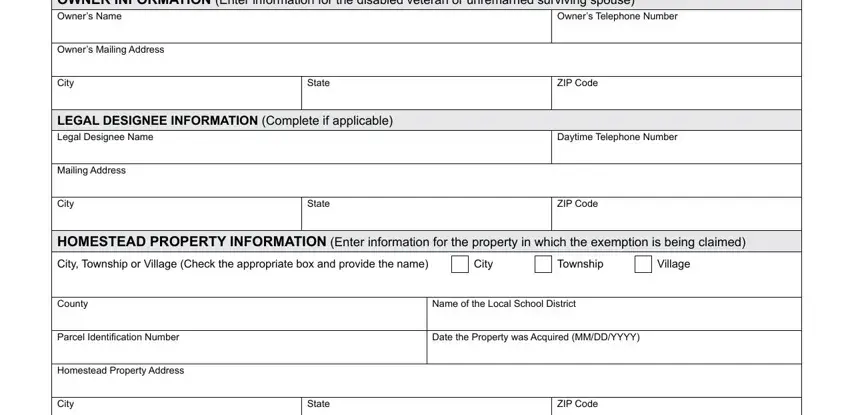

1. Start completing the form 5107 disabled vet with a number of necessary blank fields. Collect all of the necessary information and make sure absolutely nothing is forgotten!

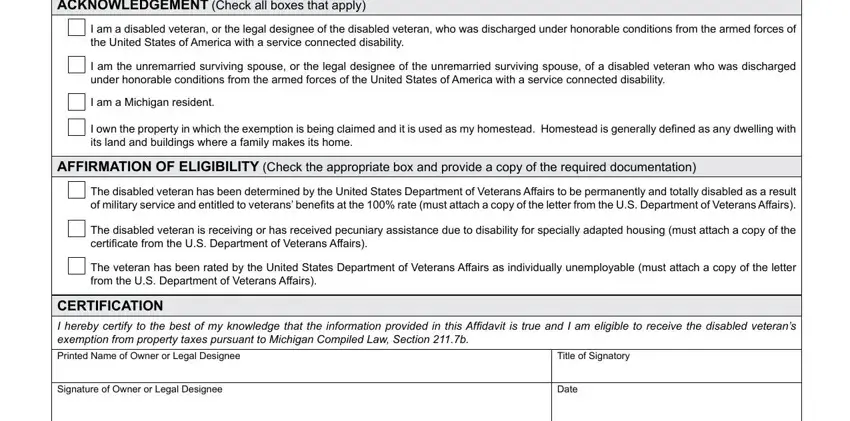

2. The next stage is to fill out the next few blanks: ACKNOWLEDGEMENT Check all boxes, I am a disabled veteran or the, I am the unremarried surviving, I am a Michigan resident, I own the property in which the, AFFIRMATION OF ELIGIBILITY Check, The disabled veteran has been, The disabled veteran is receiving, The veteran has been rated by the, CERTIFICATION I hereby certify to, Title of Signatory, Signature of Owner or Legal, and Date.

It is easy to make errors when filling out your I am a Michigan resident, hence you'll want to go through it again before you decide to finalize the form.

Step 3: As soon as you've reviewed the information in the blanks, press "Done" to conclude your form. Try a 7-day free trial option at FormsPal and get immediate access to form 5107 disabled vet - download, email, or edit in your FormsPal cabinet. FormsPal provides protected document editing without personal data recording or distributing. Rest assured that your data is secure with us!