We were developing our PDF editor having the idea of making it as quick to apply as it can be. This is the reason the process of managing the michigan form 165 pdf is going to be easy carry out all of these steps:

Step 1: Click the orange button "Get Form Here" on the following page.

Step 2: The document editing page is presently available. It's possible to add information or modify current data.

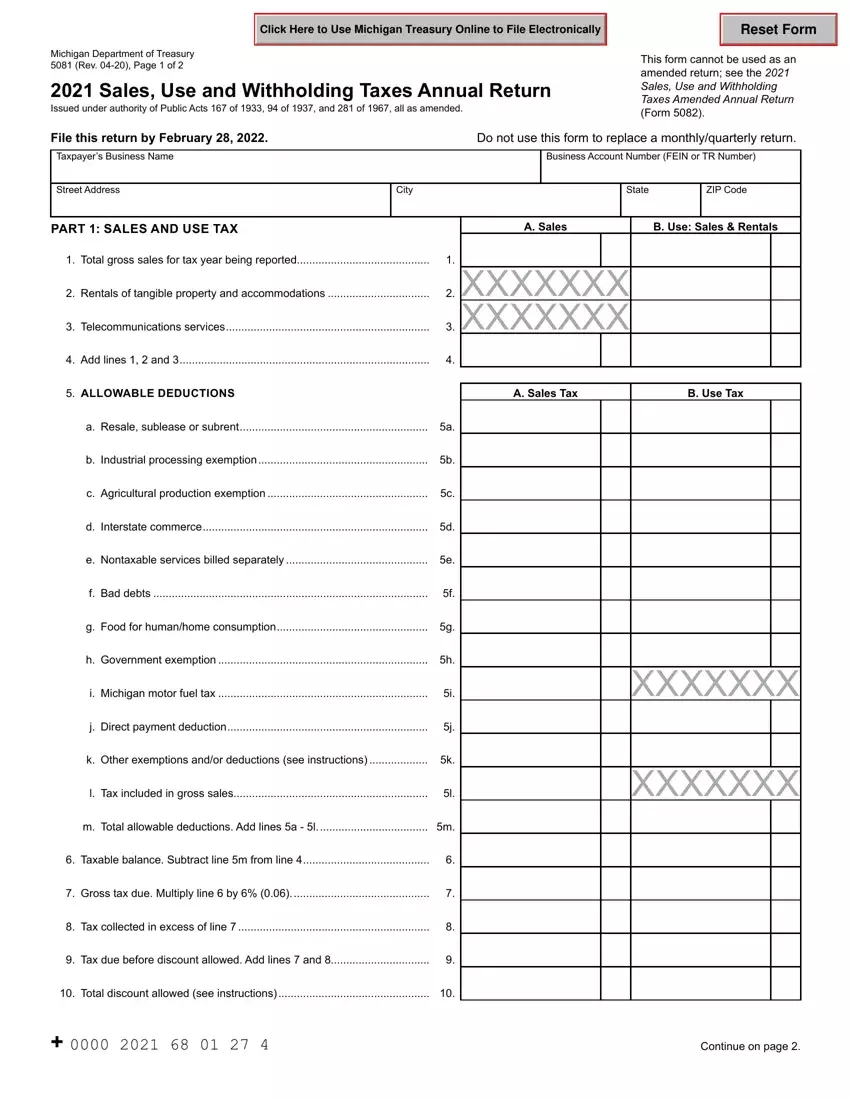

Fill in the michigan form 165 pdf PDF and enter the information for every area:

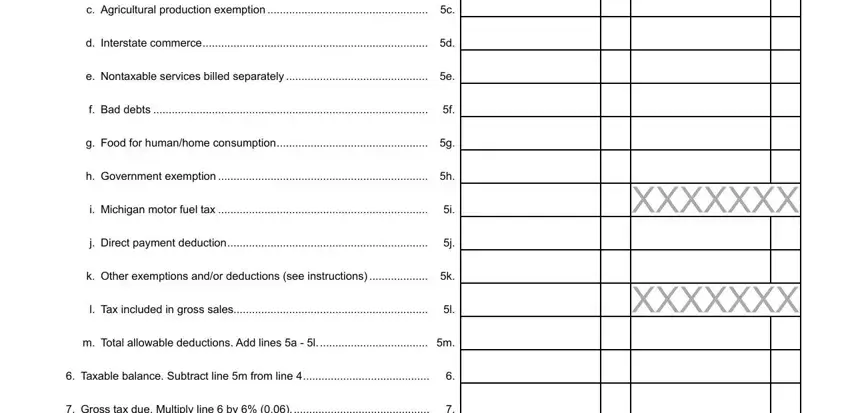

You need to provide the crucial information in the c Agricultural production, d Interstate commerce d, e Nontaxable services billed, f Bad debts f, g Food for humanhome consumption g, h Government exemption h, i Michigan motor fuel tax i, j Direct payment deduction j, k Other exemptions andor, l Tax included in gross sales l, m Total allowable deductions Add, Taxable balance Subtract line m, Gross tax due Multiply line by, XXXXXXX, and XXXXXXX space.

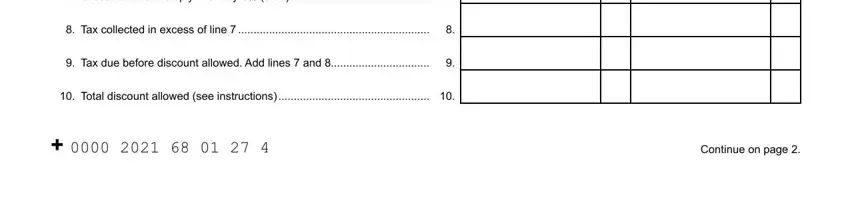

It is vital to provide some details inside the area Gross tax due Multiply line by, Tax collected in excess of line, Tax due before discount allowed, Total discount allowed see, and Continue on page.

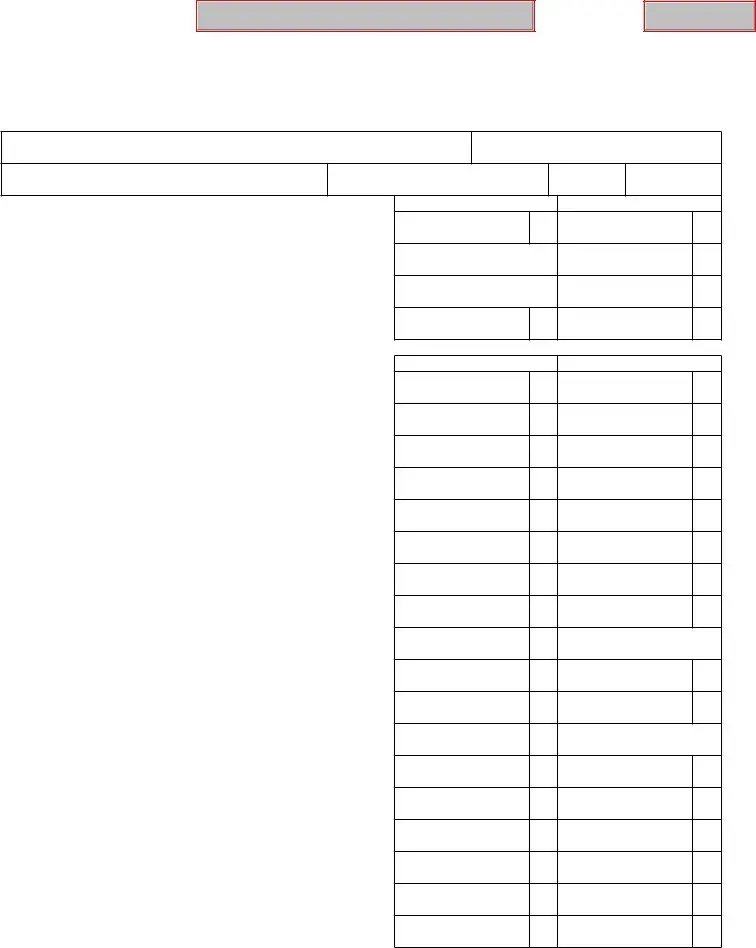

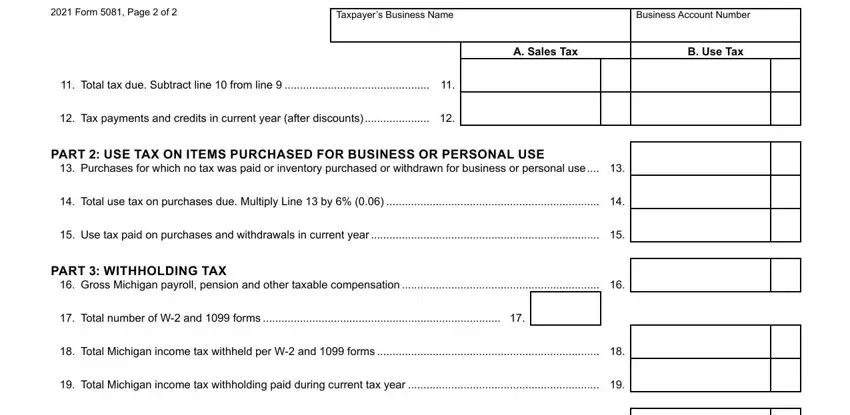

The Form Page of, Taxpayers Business Name, Business Account Number, A Sales Tax, B Use Tax, Total tax due Subtract line from, Tax payments and credits in, PART USE TAX ON ITEMS PURCHASED, Purchases for which no tax was, Total use tax on purchases due, Use tax paid on purchases and, PART WITHHOLDING TAX, Gross Michigan payroll pension, Total number of W and forms, and Total Michigan income tax field is the place to place the rights and obligations of each side.

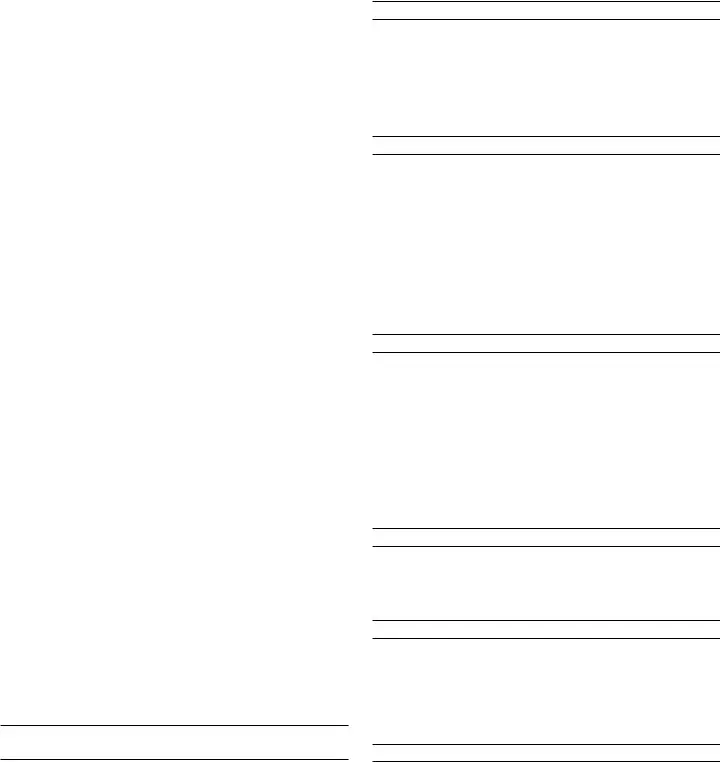

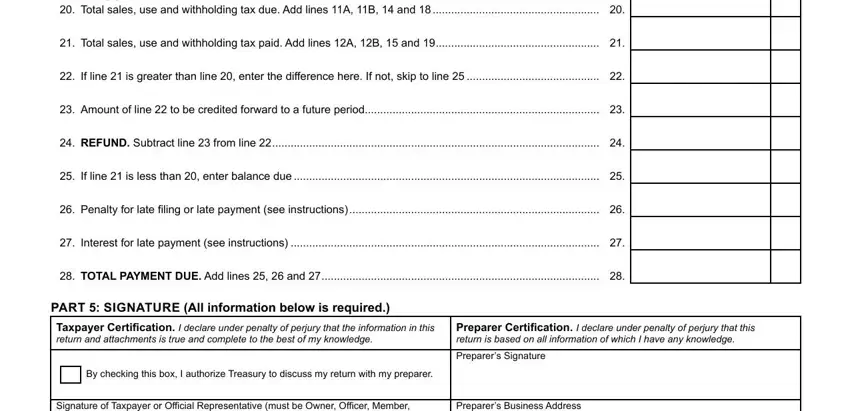

Finish by checking all of these sections and filling in the required data: PART SUMMARY, Total sales use and withholding, Total sales use and withholding, If line is greater than line, Amount of line to be credited, REFUND Subtract line from line, If line is less than enter, Penalty for late filing or late, Interest for late payment see, TOTAL PAYMENT DUE Add lines and, PART SIGNATURE All information, By checking this box I authorize, Preparer Certification I declare, Preparers Signature, and Signature of Taxpayer or Official.

Step 3: At the time you pick the Done button, your completed document is conveniently transferable to any of your devices. Or alternatively, it is possible to deliver it using email.

Step 4: In order to prevent all of the risks down the road, be sure to make a minimum of two or three copies of your file.