You could complete remitting effortlessly with the help of our online PDF tool. Our tool is consistently developing to deliver the best user experience achievable, and that's because of our commitment to continual improvement and listening closely to comments from users. Here's what you will have to do to get going:

Step 1: Press the "Get Form" button above. It's going to open our pdf editor so that you could start filling out your form.

Step 2: The tool will let you change almost all PDF documents in a variety of ways. Change it by including any text, adjust original content, and place in a signature - all when it's needed!

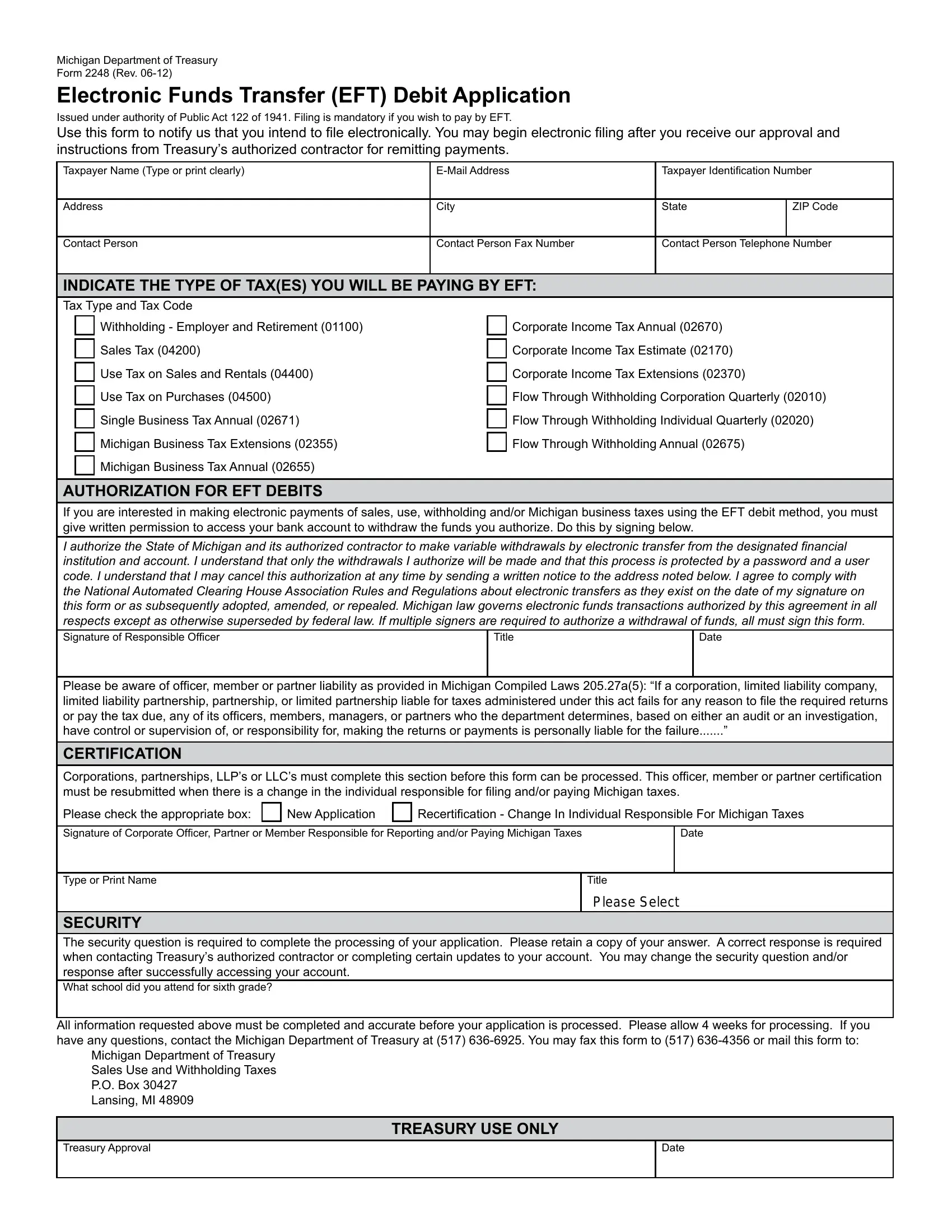

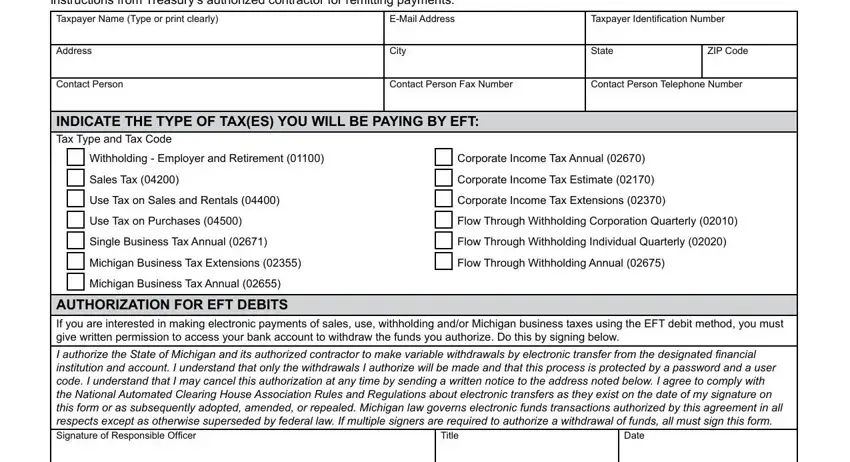

This form requires particular information to be typed in, thus you need to take some time to provide exactly what is requested:

1. To start off, once filling in the remitting, start in the section that includes the following blanks:

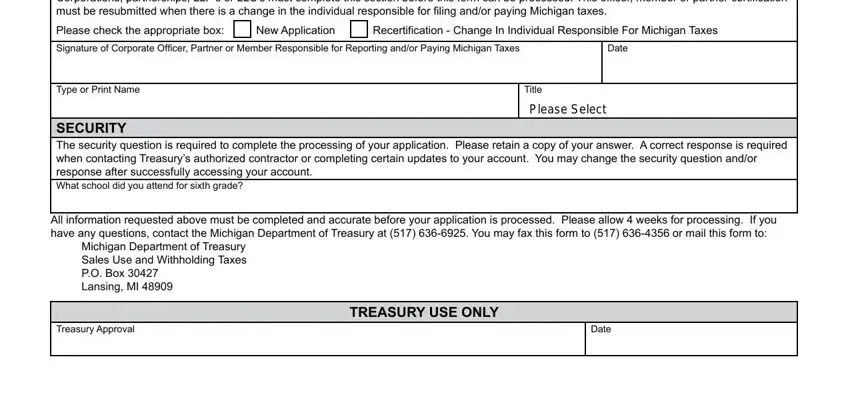

2. Once your current task is complete, take the next step – fill out all of these fields - CERTIFICATION Corporations, Recertification Change In, New Application, Date, Type or Print Name, Title, SECURITY The security question is, All information requested above, Treasury Approval, Date, and TREASURY USE ONLY with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

It's easy to make an error while completing your Recertification Change In, therefore you'll want to go through it again before you decide to finalize the form.

Step 3: Prior to moving forward, ensure that blank fields have been filled in properly. As soon as you believe it is all good, press “Done." Join us today and easily get access to remitting, prepared for download. Every last change you make is conveniently saved , helping you to change the form later on as needed. When you use FormsPal, you can complete forms without the need to be concerned about personal information leaks or data entries getting shared. Our protected platform ensures that your private information is stored safe.