Michigan Department of Treasury 2796 (Rev. 08-12)

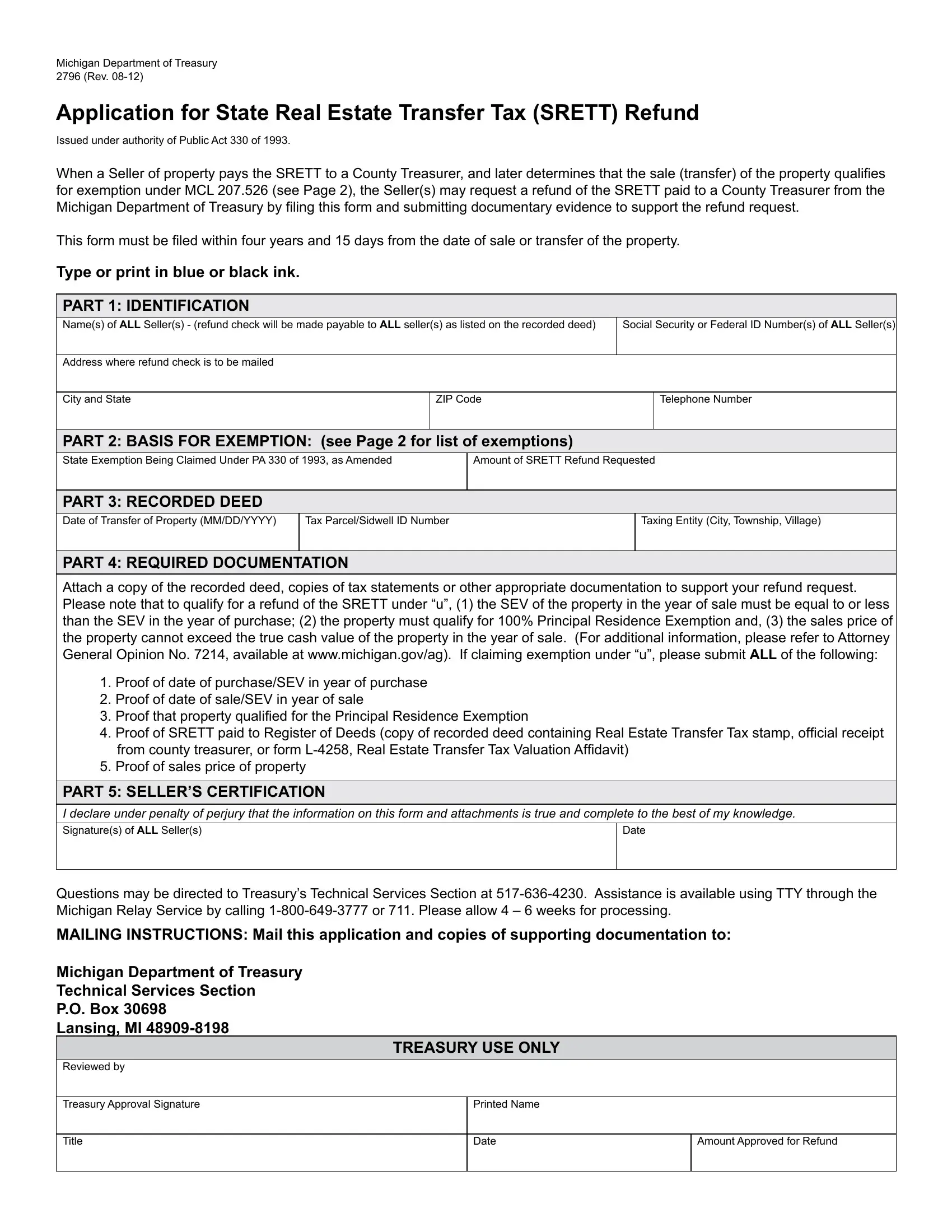

Application for State Real Estate Transfer Tax (SRETT) Refund

Issued under authority of Public Act 330 of 1993.

When a Seller of property pays the SRETT to a County Treasurer, and later determines that the sale (transfer) of the property qualiies

for exemption under MCL 207.526 (see Page 2), the Seller(s) may request a refund of the SRETT paid to a County Treasurer from the

Michigan Department of Treasury by iling this form and submitting documentary evidence to support the refund request. This form must be iled within four years and 15 days from the date of sale or transfer of the property.

Type or print in blue or black ink.

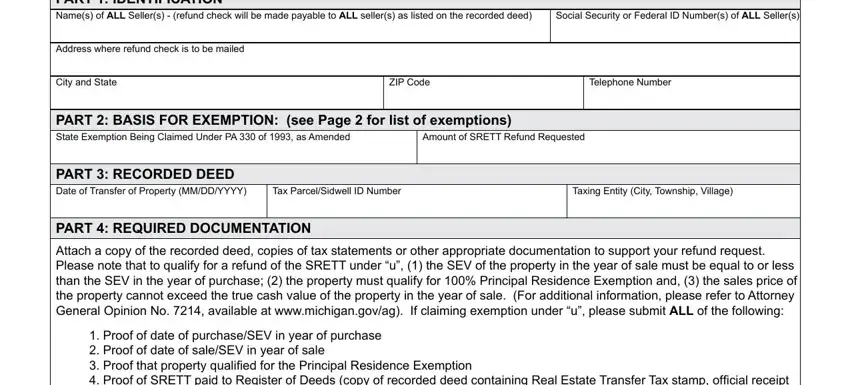

PART 1: IDENTIFICATION

Name(s) of ALL Seller(s) - (refund check will be made payable to ALL seller(s) as listed on the recorded deed)

Social Security or Federal ID Number(s) of ALL Seller(s)

Address where refund check is to be mailed

PART 2: BASIS FOR EXEMPTION: (see Page 2 for list of exemptions)

State Exemption Being Claimed Under PA 330 of 1993, as Amended

Amount of SRETT Refund Requested

Date of Transfer of Property (MM/DD/YYYY)

Tax Parcel/Sidwell ID Number

Taxing Entity (City, Township, Village)

PART 4: REQUIRED DOCUMENTATION

Attach a copy of the recorded deed, copies of tax statements or other appropriate documentation to support your refund request.

Please note that to qualify for a refund of the SRETT under “u”, (1) the SEV of the property in the year of sale must be equal to or less than the SEV in the year of purchase; (2) the property must qualify for 100% Principal Residence Exemption and, (3) the sales price of

the property cannot exceed the true cash value of the property in the year of sale. (For additional information, please refer to Attorney

General Opinion No. 7214, available at www.michigan.gov/ag). If claiming exemption under “u”, please submit ALL of the following:

1.Proof of date of purchase/SEV in year of purchase

2.Proof of date of sale/SEV in year of sale

3.Proof that property qualiied for the Principal Residence Exemption

4.Proof of SRETT paid to Register of Deeds (copy of recorded deed containing Real Estate Transfer Tax stamp, oficial receipt from county treasurer, or form L-4258, Real Estate Transfer Tax Valuation Afidavit)

5.Proof of sales price of property

PART 5: SELLER’S CERTIFICATION

I declare under penalty of perjury that the information on this form and attachments is true and complete to the best of my knowledge.

Signature(s) of ALL Seller(s)

Questions may be directed to Treasury’s Technical Services Section at 517-636-4230. Assistance is available using TTY through the

Michigan Relay Service by calling 1-800-649-3777 or 711. Please allow 4 – 6 weeks for processing.

MAILING INSTRUCTIONS: Mail this application and copies of supporting documentation to:

Michigan Department of Treasury

Technical Services Section

P.O. Box 30698

Lansing, MI 48909-8198

TREASURY USE ONLY

Reviewed by

Treasury Approval Signature

Amount Approved for Refund

2796, Page 2 |

Exemptions to State Real Estate Transfer Tax (SRETT) |

|

Under Section 6 of PA 330 of 1993, as amended, you may claim an exemption from the SRETT for one of the reasons listed below. Enter the section number for the exemption you are claiming in Part 2 of form 2796.

(a)A written instrument in which the value of the consideration for the property is less than $100.00.

(b)A written instrument evidencing a contract or transfer that is not to be performed wholly within this state only to the extent the written instrument includes land lying outside of this state.

(c)A written instrument that this state is prohibited from taxing under the United States constitution or federal statutes.

(d)A written instrument given as security or an assignment or discharge of the security interest.

(e)A written instrument evidencing a lease, including an oil and gas lease, or a transfer of a leasehold interest.

(f)A written instrument evidencing an interest that is assessable as personal property.

(g)A written instrument evidencing the transfer of a right and interest for underground gas storage purposes.

(h)Any of the following written instruments:

(i)A written instrument in which the grantor is the United States, this state, a political subdivision or municipality of this state, or an oficer of the United States or of this state, or a political subdivision or municipality of this state, acting in his or her oficial capacity.

(ii)A written instrument given in foreclosure or in lieu of foreclosure of a loan made, guaranteed, or insured by the United States, this state, a political subdivision or municipality of this state, or an oficer of the United States or of this state, or a political subdivision or municipality of this state, acting in his or her oficial capacity.

(iii)A written instrument given to the United States, this state, or 1 of their oficers acting in an oficial capacity as grantee, pursuant to the terms or guarantee or insurance of a loan guaranteed or insured by the grantee.

(i)A conveyance from a husband or wife or husband and wife creating or disjoining a tenancy by the entireties in the grantors or the grantor and his or her spouse.

(j)A conveyance from an individual to that individual’s child, stepchild, or adopted child.

(k)A conveyance from an individual to that individual’s grandchild, step-grandchild, or adopted grandchild.

(l)A judgment or order of a court of record making or ordering a transfer, unless a speciic monetary consideration is speciied or ordered by the court for the transfer.

(m)A written instrument used to straighten boundary lines if no monetary consideration is given.

(n)A written instrument to conirm title already vested in a grantee, including a quitclaim deed to correct a law in title.

(o)A land contract in which the legal title does not pass to the grantee until the total consideration speciied in the contract has been paid.

(p)A conveyance that meets 1 of the following:

(i)A transfer between any corporation and its stockholders or creditors, between any limited liability company and its members or creditors, between any partnership and its partners or creditors, or between a trust and its beneiciaries or creditors when the transfer

is to effectuate a dissolution of the corporation, limited liability company, partnership, or trust and it is necessary to transfer the title of real property from the entity to the stockholders, members, partners, beneiciaries, or creditors.

(ii)A transfer between any limited liability company and its members if the ownership interests in the limited liability company are held by the same persons and in the same proportion as in the limited liability company prior to the transfer.

(iii)A transfer between any partnership and its partners if the ownership interests in the partnership are held by the same persons and in the same proportion as in the partnership prior to the transfer.

(iv)A transfer of a controlling interest in an entity with an interest in real property if the transfer of the real property would qualify for exemption if the transfer had been accomplished by deed to the real property between the persons that were parties to the transfer of the controlling interest.

(v)A transfer in connection with the reorganization of an entity and the beneicial ownership is not changed.

(q)A written instrument evidencing the transfer of mineral rights and interests.

(r)A written instrument creating a joint tenancy between 2 or more persons if at least 1 of the persons already owns the property.

(s)A transfer made pursuant to a bona ide sales agreement made before the date the tax is imposed under sections 3 and 4, if the sales agreement cannot be withdrawn or altered, or contains a ixed price not subject to change or modiication.

(t)A written instrument evidencing a contract or transfer of property to a person suficiently related to the transferor to be considered a single employer with the transferor under section 414(b) or (c) of the internal revenue code of 1986, 26 USC 414.

(u)A written instrument conveying an interest in property for which an exemption is claimed under section 7cc of the general property tax act,

1893 PA 206, MCL 211.7cc, if the state equalized valuation of that property is equal to or lesser than the state equalized valuation on the date of purchase or on the date of acquisition by the seller or transferor for that same interest in property. If after an exemption is claimed under this subsection, the sale or transfer of property is found by the treasurer to be at a value other than the true cash value, then a penalty equal to

20% of the tax shall be assessed in addition to the tax due under this act to the seller or transferor.

(v)A written instrument transferring an interest in property pursuant to a foreclosure of a mortgage including a written instrument given in lieu of foreclosure of a mortgage. This exemption does not apply to a subsequent transfer of the foreclosed property by the entity that foreclosed on the mortgage.

(w)A written instrument conveying an interest from a religious society in property exempt from the collection of taxes under section 7s of the general property tax act, 1893 PA 206, MCL 211.7s, to a religious society if that property continues to be exempt from the collection of taxes under section 7s of the general property tax act, 1893 PA 206, MCL 211.7s.