Using PDF documents online is actually very easy using our PDF editor. You can fill out Michigan Form 3924 here and use several other options available. FormsPal team is always endeavoring to expand the editor and insure that it is even better for people with its handy features. Enjoy an ever-evolving experience now! For anyone who is looking to get going, here's what it requires:

Step 1: Simply click on the "Get Form Button" above on this webpage to launch our pdf file editor. Here you'll find everything that is necessary to fill out your document.

Step 2: Once you access the tool, you will see the form prepared to be completed. Aside from filling in various blanks, you might also do other sorts of actions with the form, specifically writing custom textual content, changing the original text, adding graphics, putting your signature on the document, and much more.

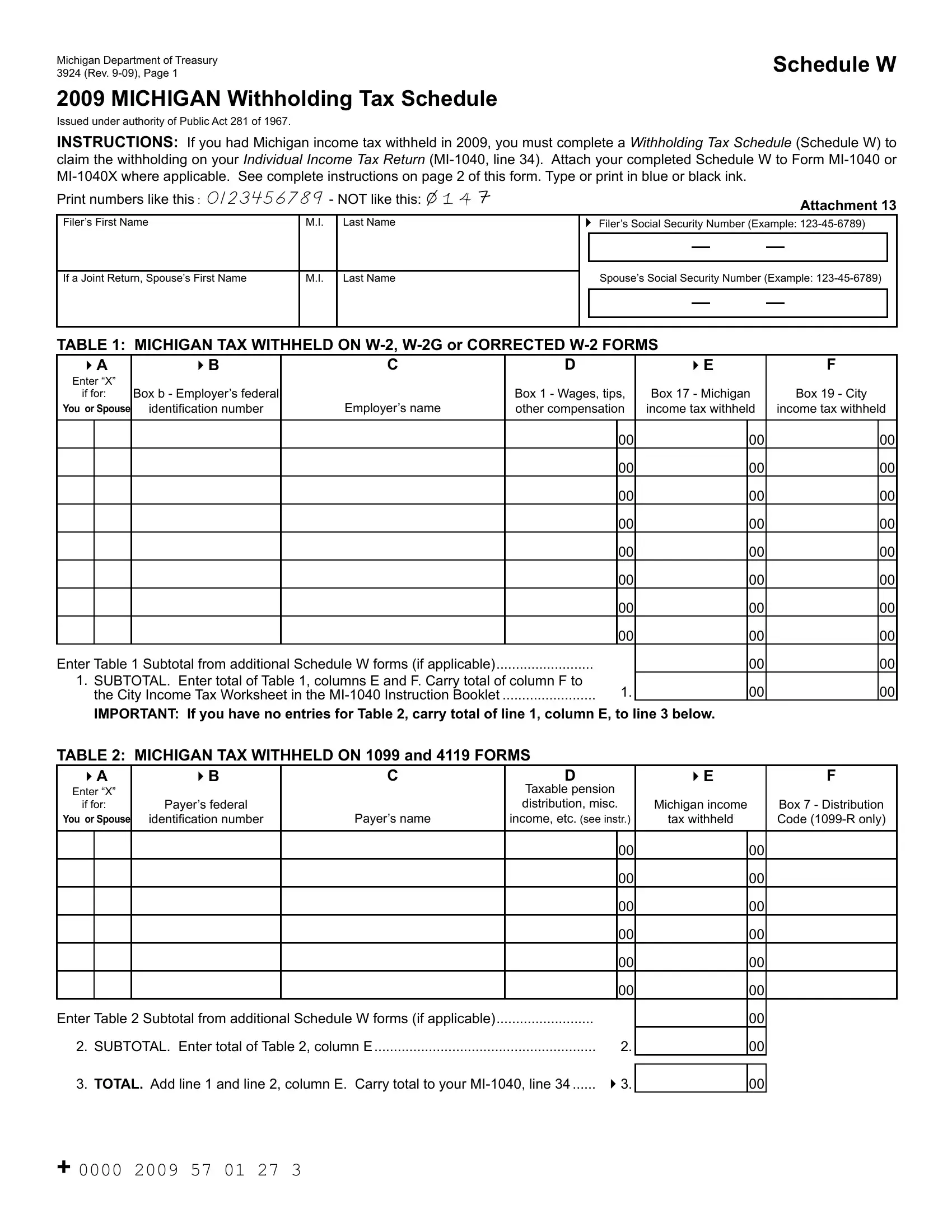

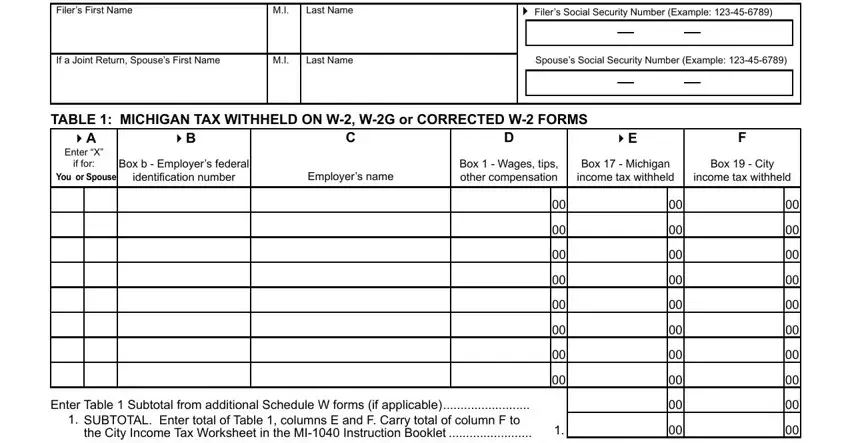

This document will require particular details to be filled out, so make sure you take your time to fill in what's requested:

1. While completing the Michigan Form 3924, make sure to complete all important fields in their relevant area. This will help facilitate the process, which allows your information to be handled swiftly and appropriately.

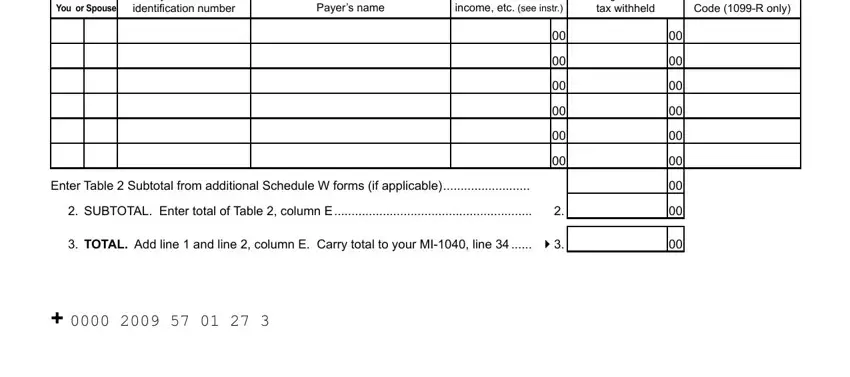

2. After the last part is filled out, go on to type in the applicable details in all these: if for, You or Spouse, Payers federal, identiication number, Taxable pension distribution misc, Michigan income, Payers name, income etc see instr, tax withheld, Box Distribution Code R only, Enter Table Subtotal from, SUBTOTAL Enter total of Table, and TOTAL Add line and line column.

Concerning tax withheld and if for, make sure that you get them right in this section. The two of these are the most important fields in the PDF.

Step 3: Make sure that your information is right and click "Done" to conclude the process. After getting a7-day free trial account here, you will be able to download Michigan Form 3924 or send it through email right off. The form will also be readily accessible via your personal account menu with your each edit. If you use FormsPal, it is simple to fill out forms without being concerned about database leaks or records being shared. Our secure platform makes sure that your personal data is stored safely.