Need to file a sales and use tax return in the state of Michigan? Look no further than Form 4567 – the Michigan Sales, Use and Withholding Tax Returns. This tax form is an important part of filing any business-related taxes within Michigan, providing key information such as details on taxable goods/services sold by your company as well as any applicable taxes collected from customers. In this blog post, we'll walk through the various aspects of Form 4567 from instructions for filling out each section to deadlines to keep in mind when filing returns. That way, you can confidently fill out this form knowing that you're doing it right!

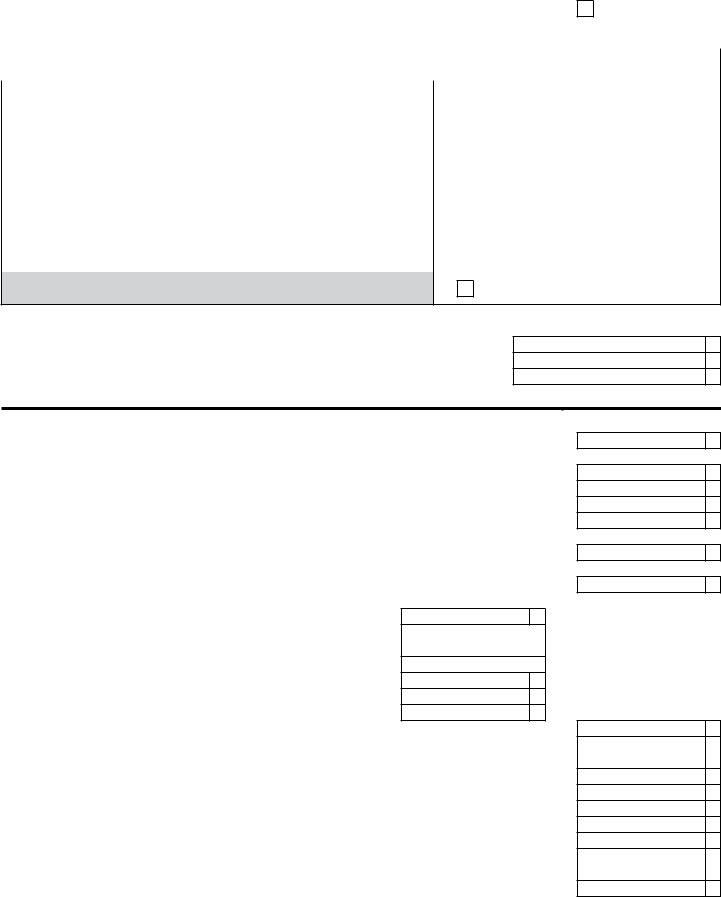

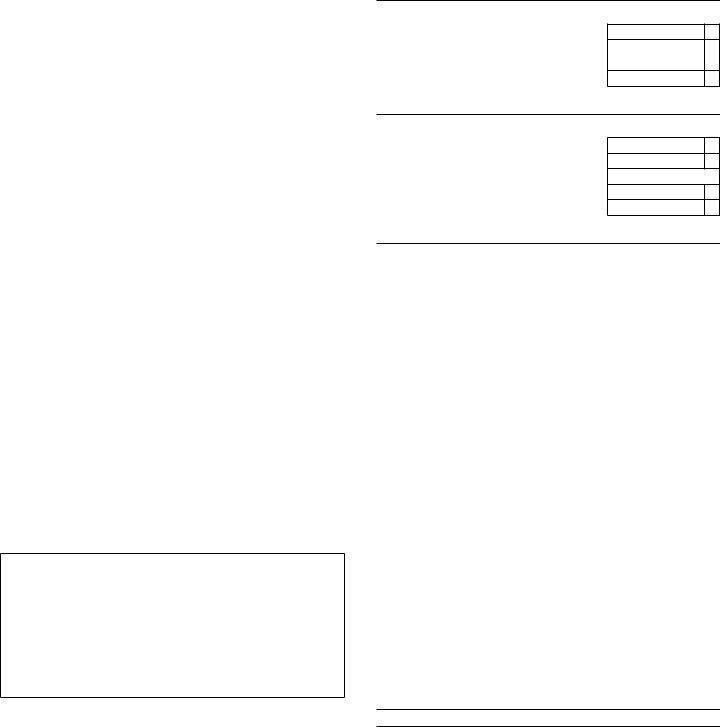

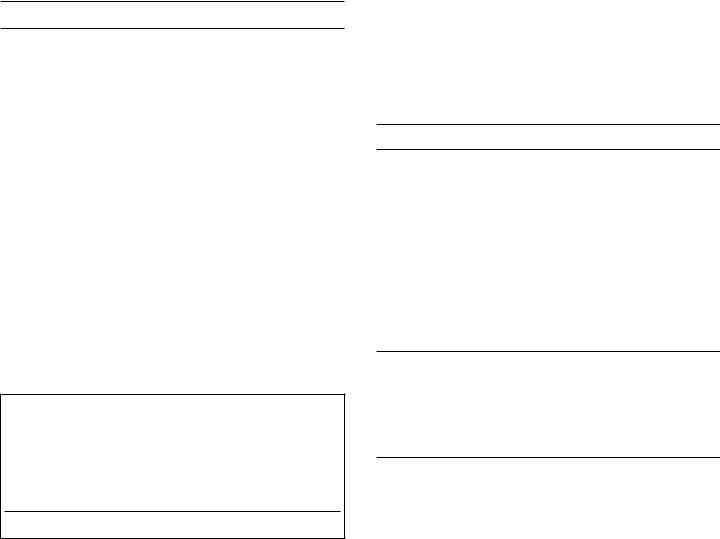

| Question | Answer |

|---|---|

| Form Name | Michigan Form 4567 |

| Form Length | 18 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min 30 sec |

| Other names | 4567 business tax, 4567 tax return, how to michigan tax, 4567 michigan tax |

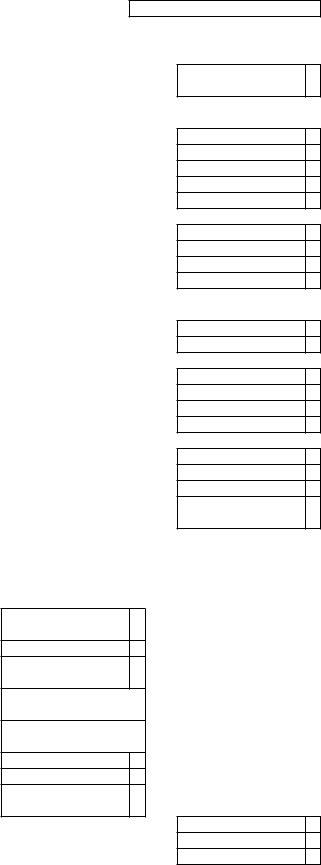

Michigan Department of Treasury

4567 (Rev.

2020 MICHIGAN Business Tax Annual Return

Issued under authority of Public Act 36 of 2007. |

Check if this is an amended return.

See instructions.

1. |

Return is for calendar year 2020 or for tax year beginning: |

|

|

|

|

|

|

|

and ending: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Taxpayer Name (print or type) |

|

|

|

|

|

|

|

7. Federal Employer Identification Number (FEIN) or TR Number |

||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

Doing Business As (DBA) |

|

|

|

|

|

|

|

8. Organization Type (LLC or Trust, see instructions) |

|||||||

|

|

|

|

|

|

|

|

|

|

|

Individual |

|

C Corporation / |

||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Street Address |

|

|

|

|

Check if |

|

|

|

LLC C Corporation |

||||||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

new address. |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

(See instructions) |

|

|

|

|

|

S Corporation / |

|||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City |

State |

ZIP/Postal Code |

|

|

Country Code |

|

|

Fiduciary |

|

||||||

|

|

|

|

|

LLC S Corporation |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. Principal Business Activity |

|

4. Business Start Date in Michigan |

|

|

Partnership / LLC Partnership |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. NAICS (North American Industry Classification System) Code |

6. If Discontinued, Effective Date |

9. |

|

Check if Filing Michigan Unitary Business Group Return. |

|||||||||||

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

(Include Form 4580.) |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

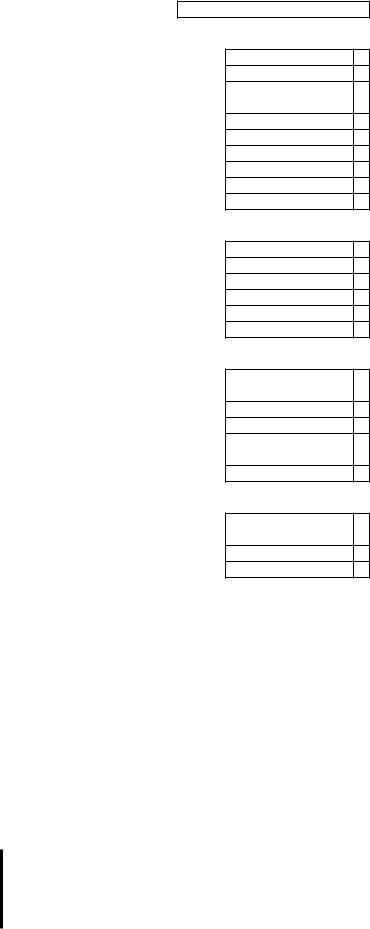

10.

Check if line 11 includes sales of transportation services.

11.Apportionment Calculation

a. |

Michigan Sales (if no Michigan sales, enter zero) |

11a. |

b. |

Total Sales |

11b. |

c. |

Apportionment Percentage. Divide line 11a by line 11b |

11c. |

00

00

%

PART 1: MODIFIED GROSS RECEIPTS TAX

12. |

Gross Receipts (see instructions) |

12. |

||

Subtractions from Gross Receipts |

|

|||

13. |

Inventory acquired during the tax year |

13. |

||

14. |

Depreciable assets acquired during the tax year |

14. |

||

15. |

Materials and supplies not included in inventory or depreciable property |

15. |

||

16. |

Staffing Company: Compensation of personnel supplied to customers |

16. |

||

If claiming the Small Business Alternative Credit, skip to line 18. |

|

|||

17. |

Deduction for contractors in SIC Codes 15, 16 and 17 |

17. |

||

|

SIC Code: |

|

|

|

18. |

Film rental or royalty payments paid by a theater owner to a film distributor and/or film producer |

18. |

||

19.Qualified Affordable Housing Project (QAHP) Deduction

a. |

Gross receipts attributable to residential rentals in Michigan |

19a. |

00 |

b. Number of residential rent restricted units in Michigan owned |

|

|

|

|

by the QAHP |

19b. |

|

c. |

Total number of residential rental units in MI owned by the QAHP .. |

19c. |

|

d. |

Divide line 19b by line 19c and enter as a percentage |

19d. |

% |

e. |

Multiply line 19a by line 19d |

19e. |

00 |

f. |

Limited dividends or other distributions made to owners of the QAHP |

19f. |

00 |

g. |

QAHP Deduction. Subtract line 19f from line 19e |

19g. |

|

20.Payments made by taxpayers licensed under Article 25 or Article 26 of the Occupational Code

|

to independent contractors licensed under Article 25 or Article 26 |

20. |

21. |

Miscellaneous (see instructions) |

21. |

22. |

Total Subtractions from Gross Receipts. Add lines 13 through 18 and 19g through 21 |

22. |

23. |

Modified Gross Receipts. Subtract line 22 from line 12. If less than zero, enter zero |

23. |

24. |

Apportioned Modified Gross Receipts Tax Base. Multiply line 23 by percentage on line 11c |

24. |

25. |

Multiply line 24 by 0.8% (0.008) |

25. |

26.Enrichment Prohibition for dealers of personal watercraft or new motor vehicles. Enter amount collected

during tax year |

26. |

27. Modified Gross Receipts Tax Before All Credits. Enter the greater of line 25 or line 26 |

27. |

+ 0000 2020 11 01 27 5

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Continue on Page 2

2020 Form 4567, Page 2 of 3 |

FEIN or TR Number |

|

PART 2: BUSINESS INCOME TAX

28.Business Income. If negative, enter as negative. (If business activity protected under PL

|

and attach Form 4586 and/or 4581, as applicable; see instructions) |

28. |

||

Additions to Income |

|

|||

29. |

Interest income and dividends derived from obligations or securities of states other than Michigan |

29. |

||

30. |

Taxes on or measured by net income |

30. |

||

31. |

Tax imposed under MBT |

31. |

||

32. |

Any carryback or carryover of a federal net operating loss |

32. |

||

33. |

Losses attributable to other |

33. |

||

|

Account No. |

|

|

|

34. |

Royalty, interest, and other expenses paid to a related person |

34. |

||

35. |

Miscellaneous (see instructions) |

35. |

||

36. |

Total Additions to Income. Add lines 29 through 35 |

36. |

||

37. |

Business Income Tax Base After Additions. Add lines 28 and 36. If negative, enter as negative |

37. |

||

Subtractions from Income |

|

|||

38. |

Dividends and royalties received from persons other than U.S. persons and foreign operating entities |

38. |

||

39. |

Income attributable to other |

39. |

||

|

Account No. |

|

|

|

40. |

Interest income derived from United States obligations |

40. |

||

41. |

Net earnings from |

41. |

||

42. |

Miscellaneous (see instructions) |

42. |

||

43. |

Total Subtractions from Income. Add lines 38 through 42 |

43. |

||

44. |

Business Income Tax Base. Subtract line 43 from line 37. If negative, enter as negative |

44. |

||

45. |

Apportioned Business Income Tax Base. Multiply line 44 by percentage on line 11c |

45. |

||

46. |

Available MBT business loss carryforward from previous MBT return. Enter as a positive number |

46. |

||

47.Subtract line 46 from line 45. If negative, enter here as negative, skip line 48, and enter zero on line 49. A

negative number here is the available business loss carryforward to the next MBT filing period (see instr.) |

47. |

48.Qualified Affordable Housing Deduction. If line 47 is positive, complete lines 48a through 48i as follows:

(1) If taking the QAHP deduction only, complete lines 48a through 48i. (UBGs, see instructions.) (2) If

taking the seller’s deduction only, skip lines 48a through 48h and carry the amount from Form 4579, line

5, to line 48i. (3) If taking both deductions, complete the QAHP deduction calculation on lines 48a through 48h, and add to the total at line 48i the amount from Form 4579, line 5.

a. |

Gross rental receipts attributable to residential units in |

|

|

|

Michigan |

48a. |

00 |

b. |

Rental expenses attributable to residential rental units in Michigan... |

48b. |

00 |

c. |

Taxable income attributable to residential rental units. Subtract line |

|

|

|

48b from line 48a |

48c. |

00 |

d. Number of residential rent restricted units in Michigan owned by |

|

|

|

|

the Qualified Affordable Housing Project |

48d. |

|

e. Total number of residential rental units in Michigan owned by the |

|

|

|

|

Qualified Affordable Housing Project |

48e. |

|

f. |

Divide line 48d by line 48e and enter as a percentage |

48f. |

% |

g. Multiply line 48c by line 48f |

48g. |

00 |

|

h. Limited dividends or other distributions made to the owners of |

|

|

|

|

the QAHP |

48h. |

00 |

i. |

Qualified Affordable Housing Deduction. Subtract line 48h from line 48g. (See instructions.) |

.................... 48i. |

|

49. Subtract line 48i from line 47. If less than zero, enter zero |

49. |

||

50. Business Income Tax Before All Credits. Multiply line 49 by 4.95% (0.0495) |

50. |

||

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

+ 0000 2020 11 02 27 3

Continue and sign on Page 3

2020 Form 4567, Page 3 of 3 |

FEIN or TR Number |

|

|

PART 3: TOTAL MICHIGAN BUSINESS TAX |

|

51. |

Total Michigan Business Tax Before Credits. Add lines 27 and 50 |

51. |

52. |

The annual surcharge is no longer applicable. There is no amount to be entered on this line |

52. |

53. |

Enter amount from line 51. If apportioned or allocated gross receipts are less than $350,000, enter zero |

53. |

54. |

Nonrefundable credits from Form 4568, line 40 |

54. |

55. |

Total Tax After Nonrefundable Credits. Subtract line 54 from line 53. If less than zero, enter zero |

55. |

56. |

Recapture of Certain Business Tax Credits and Deductions from Form 4587, line 13 |

56. |

57. |

Total MBT Tax Liability. Add lines 55 and 56 |

57. |

58. |

Corporate Income Tax adjustment from Form 4946, line 39 |

58. |

59. |

Total Tax Liability. Add lines 57 and 58 |

59. |

00

X X X X X X X X X 00

00

00

00

00

00

00

00

PART 4: PAYMENTS, REFUNDABLE CREDITS AND TAX DUE

60. |

Overpayment credited from prior MBT return |

|

|

|

|

|

|

60. |

|||||||

61. |

Estimated tax payments |

|

|

|

|

|

|

|

|

|

|

61. |

|||

62. |

There is no amount to be entered on this line. Skip to line 63 |

|

|

|

|

|

62. |

||||||||

63. |

Tax paid with request for extension |

|

|

|

|

|

|

|

|

|

|

63. |

|||

64. |

Refundable credits from Form 4574, line 23 |

|

|

|

|

|

|

64. |

|||||||

65. |

Payment and credit total. Add lines 60 through 64. (If not amending, then skip to line 67.) |

|

|

65. |

|||||||||||

|

AMENDED |

a. Payments made with original and/or amended returns |

66a. |

|

|

|

|

00 |

|

||||||

66. |

b. Overpayment from original and/or amended returns. |

66b. |

|

|

|

|

00 |

|

|||||||

RETURN |

c. Add lines 65 and 66a and subtract line 66b |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||||

|

ONLY |

|

|

|

|

|

|

|

|

|

|||||

|

|

from the sum |

|

|

|

|

|

........................................................ 66c. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

67. |

TAX DUE. Subtract line 65 (or line 66c, if amending) from line 59. If less than zero, leave blank |

67. |

|||||||||||||

68. |

Underpaid estimate penalty and interest from Form 4582, line 38 |

|

|

|

|

|

68. |

||||||||

69. |

Annual return penalty (a) |

|

% |

= (b) |

|

00 |

plus interest (c) |

|

00 |

. Total |

|

69d. |

|||

70. |

PAYMENT DUE. If line 67 is blank, go to line 71. Otherwise, add lines 67, 68 and 69d |

|

|

70. |

|||||||||||

00

00

X X X X X X X X X 00

00

00

00

00

00

00

00

00

PART 5: REFUND OR CREDIT FORWARD

71.Overpayment. Subtract lines 59, 68 and 69d from line 65 (or line 66c, if amending).

|

If less than zero, leave blank (see instructions) |

71. |

72. |

CREDIT FORWARD. Amount on line 71 to be credited forward and used as an estimate for next tax year.... |

72. |

73. |

REFUND. Amount on line 71 to be refunded |

73. |

00

00

00

Taxpayer Certification. I declare under penalty of perjury that the information in this |

Preparer Certification. I declare under penalty of perjury that this |

|

|||||||

return and attachments is true and complete to the best of my knowledge. |

return is based on all information of which I have any knowledge. |

|

|||||||

|

|

By checking this box, I authorize Treasury to discuss my return with my preparer. |

Preparer’s PTIN, FEIN or SSN |

|

|||||

|

|

|

|

|

|

|

|||

Authorized Signature for Tax Matters |

|

|

Preparer’s Business Name (print or type) |

|

|||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Authorized Signer’s Name (print or type) |

|

Date |

Preparer’s Business Address and Telephone Number (print or type) |

|

|||||

|

|

|

|

|

|

|

|

|

|

Title |

Telephone Number |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Return is due April 30 or on or before the last day of the 4th month after the close of the tax year.

WITHOUT PAYMENT. Mail return to:

Michigan Department of Treasury, PO Box 30783, Lansing MI 48909

WITH PAYMENT. Pay amount on line 70. Mail check and return to: Michigan Department of Treasury, PO Box 30113, Lansing MI 48909

Make check payable to “State of Michigan.” Print taxpayer’s FEIN or TR Number, the tax year, and “MBT” on the front of the check. Do not staple the check to the return.

+ 0000 2020 11 03 27 1

Instructions for Form 4567

Michigan Business Tax (MBT) Annual Return

Purpose

To calculate the Modified Gross Receipts Tax and Business Income Tax for standard taxpayers. Insurance companies should file the MBT Insurance Company Annual Return for

Michigan Business and Retaliatory Taxes (Form 4588) and Financial Institutions should file the MBT Annual Return for

Financial Institutions (Form 4590).

NOTE: Beginning January 1, 2012, only those taxpayers with a certificated credit, which is awarded but not yet fully claimed or utilized, may elect to be MBT taxpayers. If a taxpayer files an MBT return and claims a certificated credit, the taxpayer makes the election to continue to file and pay under the MBT until the certificated credit and any carryforward of that credit are exhausted.

Special Instructions for Unitary Business Groups

A Unitary Business Group (UBG) is a group of United States persons, other than a foreign operating entity, that satisfies the following criteria:

•One of the persons owns or controls, directly or indirectly, more than 50 percent of the ownership interest with voting rights (or rights comparable to voting rights) of the other United States persons; AND

•The UBG has operations which result in a flow of value between persons in the UBG or has operations that are integrated with, are dependent upon, or contribute to each other. Flow of value is determined by reviewing the totality of facts and circumstances of business activities and operations.

For more information on the control and relationship tests for UBGs, see Revenue Administrative Bulletin (RAB)

A foreign operating entity means a United States person that would otherwise be a part of a UBG that is taxable in Michigan; has substantial operations outside the United States, the District of Columbia, any territory or possession of the United States except for the commonwealth of Puerto Rico, or a political subdivision of the foregoing; and at least 80 percent of its income is active foreign business income as defined in Internal Revenue Code (IRC) § 871(l)(1)(B)(ii).

In Michigan, a UBG with standard members must file Form 4567. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a parent- subsidiary controlled group, the controlling member must serve as DM if it has nexus with Michigan. If it does not have nexus, the controlling member may appoint any member with nexus to serve as DM. The tax year of the DM determines the filing period for the UBG. The combined return must include each tax year of each member that ends with or within the tax year

of the DM.

NOTE on Designated Members: If the UBG filed MBT in 2011 and elected to file MBT in 2012, then the UBG must use the same DM if the DM still has nexus and is still a member of the UBG in 2012. If the DM no longer has nexus or is no longer a member of the UBG, then the UBG must select a new DM. See the “Supplemental Instructions for Standard Members in UBGs” in Form 4600 for the rules on selecting a new DM.

NOTE on Certificated Credits and the UBG: If a member of a UBG holds a certificated credit and wishes to claim that credit then the entire UBG, and not only the member, must make the election to remain taxable under the MBT. The UBG must file and pay under the MBT until the certificated credit and any carryforward of that credit are extinguished.

For MBT, taxpayer means a person or a UBG liable for tax, interest, or penalty. Beginning January 1, 2012, only those taxpayers with a certificated credit, which is awarded but not yet fully claimed or utilized, may elect to be MBT taxpayers. If a taxpayer files an MBT return and claims a certificated credit, the taxpayer makes the election to file and pay under the MBT until the certificated credit and any carryforward of that credit are exhausted.

For more information on UBGs, see the instructions for the

MBT Unitary Business Group Combined Filing Schedule

(Form 4580), and the “Supplemental Instructions for Standard Members in UBGs” in the MBT Forms and Instructions for Standard Taxpayers (Form 4600).

The gross receipts of a UBG is the sum of the gross receipts of each person included in the UBG, other than a foreign operating entity or a person subject to the tax as an insurance company or financial institution, less any gross receipts arising from transactions between persons included in the UBG. Gross receipts of each member should reflect the accounting method that member used to compute its federal taxable income.

The business income of a UBG is the sum of the business income of each person included in the UBG, other than a foreign operating entity or a person subject to the tax as an insurance company or financial institution, less any items of income and related deductions arising from transactions, including dividends, between persons included in the UBG. Business income of each member should reflect the accounting method that member used to compute its federal taxable income.

In general,

Taxpayer Certification

A return filed by a UBG must be signed by an individual

15

authorized to sign on behalf of the DM. Provide a telephone number for that individual at the DM’s office.

General Instructions

Dates must be entered in

For periods less than 12 months, see the “General Information for Standard Taxpayers” section in Form 4600.

A person that is a disregarded entity for federal income tax purposes under the internal revenue code shall be classified as a disregarded entity for the purposes of filing the MBT annual return.

A taxpayer, other than a UBG, that does not file a separate federal return must prepare a pro forma federal return or equivalent schedule and use it as the basis for preparing its MBT return. For standard members of a UBG, this pro forma requirement is addressed in Form 4580, Part 2A, and its instructions.

UBGS: Complete Form 4580 before beginning Form 4567. Answer lines 1 through 8 of Form 4567 as they apply to the DM.

MBT Liability: Beginning January 1, 2012, a taxpayer calculates MBT liability as the greater of MBT liability after all credits, deductions, and exemptions or hypothetical CIT liability minus deductions and credits available under that act and minus certificated credits allowed under the MBT. This calculation of liability requires a taxpayer to calculate the business income and modified gross receipts tax bases and available MBT credits, including certificated credits, deductions, and exemptions available under the MBT. Then, the taxpayer will calculate the CIT comparison on the Schedule of Corporate Income Tax Liability (Form 4946). A taxpayer is permitted to reduce hypothetical CIT liability by all deductions and credits which would be allowed under that tax as well as the amount of certificated credit allowed under the MBT. The amount of certificated credit allowed under the MBT is the amount of nonrefundable credit needed to offset MBT liability or the entire amount of a refundable credit.

If the taxpayer’s hypothetical CIT liability would be higher than its MBT liability, the taxpayer will add the difference to MBT liability on line 58 of Form 4567. This is the CIT adjustment. If the result of both steps of the calculation is a negative number, the taxpayer will receive a refund of the lower negative; but a nonrefundable credit cannot be used to reduce liability below zero. Remaining nonrefundable certificated credit may be carried forward to succeeding tax years.

For purposes of this calculation: For a Partnership or S Corporation, business income includes payments and items of income and expense attributable to the business activity of the partnership or S corporation and separately reported to the members.

Amended Returns: To amend a current or prior year annual return, complete the Form 4567 that is applicable for that year, check the box in the

Revenue Service (IRS) audit document, if applicable. Include all forms filed with the original return, even if not amending each form. Enter the figures on the amended return as they should be.

Do not include a copy of the original return with the amended return.

NOTE: A taxpayer may not amend a return to revoke the election to remain taxable under the MBT. Once the taxpayer makes a valid election to claim a certificated credit, the taxpayer must remain in the MBT until the credit and any carryforward of that credit are exhausted.

Refund Only: If apportioned or allocated gross receipts are less than $350,000 and there is no recapture, and the taxpayer is filing Form 4567 to claim a refund of estimates paid, skip lines 13 through 57 and lines 64 through 67.

UBGs: If combined apportioned or allocated gross receipts of all members (before eliminations) are less than $350,000 and there is no recapture, and the taxpayer is filing Form 4567 solely to claim a refund of estimates paid, Form 4580 must also be included. The designated member must complete Part 1A, Part 2B (skip lines 18 through 65), Part 3, and Part 4 of Form 4580. For each member listed in Part 1A, complete Part 1B and 2A (skip lines 18 through 65). See Form 4567 for instructions on completing that form.

Simplified Calculation

See the “2015 General Information for Standard Taxpayers”

in the Michigan Business Tax for Standard Taxpayers

(Form 4600) for instructions on “Computing the Simplified Calculation” for eligible taxpayers.

Lines not listed are explained on the form.

Line 1: If not a

Tax year means the calendar year, or the fiscal year ending during the calendar year, upon the basis of which the tax base of a taxpayer is computed. If a return is made for a part of a year, tax year means the period for which the return is made. Generally, a taxpayer’s tax year is for the same period as is covered by its federal income tax return.

Line 2: Enter the complete address and, if other than the United States, enter the

Instructions for Standard Taxpayers (Form 4600).

Any correspondence regarding the return filed and/or refund will be sent to the address used here. Check the new address box if the address used on this line has changed from the last filing. The taxpayer’s primary address in the Department of Treasury (Treasury) files, identified as the legal address and used for all purposes other than refund and correspondence on a specific MBT return, will not change until the customer specifically makes the change on their Michigan Treasury Online (MTO) account. Visit michigan.gov/mtobusiness for

16

more information.

UBGS: In the Name field, enter the name of the DM for the standard members of this UBG.

Line 3: Enter a brief description of business activity (e.g., forestry, fisheries, mining, construction, manufacturing, transportation, communication, electric, gas, sanitary services, wholesale trade, retail trade, finance, or services, etc.).

Line 4: Enter the start date of first business activity in Michigan.

Line 5: Enter the entity’s

Line 6: Enter the date, if applicable, on which the taxpayer went out of existence. If the taxpayer is still subject to another tax administered by Treasury, or continues to exist but has stopped doing business in Michigan, do not use this line. Also, do not use this line if the taxpayer is a UBG and one member has stopped doing business.

Adiscontinuance may be processed by updating the account by using the Michigan Treasury Online (MTO) website. Visit michigan.gov/mtobusiness for more information.

Line 7: Use the taxpayer’s Federal Employer Identification Number (FEIN) or the Michigan Treasury (TR) assigned number. Be sure to use the same account number on all forms.

If the taxpayer |

does not have |

an |

FEIN or |

TR number, |

||

the taxpayer must register before filing |

this |

form. |

||||

Taxpayers |

are |

encouraged |

to |

register |

online |

at |

www.michigan.gov/mtobusiness. Click on the quick link “New Business” for information on how to obtain a FEIN, which is required to submit a return through

Returns received without a registered account number will not be processed until such time as a number is provided.

NOTE: TR numbers are generally assigned to accounts that have not acquired an FEIN. Once an FEIN is received, Treasury will use the FEIN as the account number, if provided. To change account numbers, a taxpayer should submit Form 163 so Treasury can update the records and make sure the account numbers are linked.

UBGS: Enter the FEIN or TR Number of the DM for the standard members of this UBG.

Line 8: Check the box that describes the DM’s organization type. A Trust or a Limited Liability Company (LLC) should check the appropriate box based on its federal return.

NOTE: A person that is a disregarded entity for federal income tax purposes under the internal revenue code shall be classified as a disregarded entity for the purposes of filing the MBT annual return. This means that a disregarded entity for federal

tax purposes, including a single member LLC or

Line 9: Check this box if filing a Michigan UBG return and include a Form 4580 for each member of the UBG included in this filing.

Line 10: Check this box if the taxpayer has sales that are receipts from transportation services. Taxpayers that check this box also must complete lines 11a, 11b, and 11c. To calculate Michigan Sales from Transportation Services, see the instructions for line 11 and the table in the “Sourcing of Sales to Michigan” section of these instructions.

Line 11: For a

If no Michigan sales, enter zero.

MBT is based only on business activity apportioned to Michigan. A taxpayer that has not established nexus with one other state or a foreign country is subject to MBT on their entire business activity. Business activity is apportioned to Michigan based on sales.

Sale or Sales means the amounts received by the taxpayer as consideration from the following:

•The transfer of title to, or possession of, property that is stock in trade or other property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the tax period, or property held by the taxpayer primarily for sale to customers in the ordinary course of its trade or business. For intangible property, the amounts received will be limited to any gain received from the disposition of that property.

•Performance of services which constitute business activities.

•The rental, leasing, licensing, or use of tangible or intangible property, including interest, that constitutes business activity.

•Any combination of business activities described above.

•For taxpayers not engaged in any other business activities, sales include interest, dividends, and other income from investment assets and activities and from trading assets and activities.

Complete the Apportionment Calculation using amounts for the taxpayer’s business activity only. Do not include amounts from an interest in a Partnership, S Corporation, or LLC.

Use the information in the “Sourcing of Sales to Michigan” section of these instructions to determine Michigan sales. If sales reported are adjusted by a deduction for qualified sales to a qualified customer, as determined by the Michigan Economic

17

Growth Authority (MEGA), attach the Anchor District Tax Credit Certificate or Anchor Jobs Tax Credit Certificate from the Michigan Economic Development Corporation (MEDC) as support.

For sales from the performance of services, see RAB

For transportation services that source sales based on revenue miles, enter a sales amount on Line 11a by multiplying total sales of the transportation service by the ratio of Michigan revenue miles over revenue miles everywhere as provided in the “Sourcing of Sales to Michigan” chart for that type of transportation service. Revenue mile means the transportation for a consideration of one net ton in weight or one passenger the distance of one mile.

NOTE: Only transportation services are sourced using revenue miles. To the extent the taxpayer has business activities or revenue streams not from transportation services, those receipts should be sourced accordingly.

PART 1: MODIFIED GROSS RECEIPTS TAX

Line 12: Gross receipts means the entire amount received by the taxpayer, as determined by using the taxpayer’s method of accounting for federal income tax purposes, from any activity, whether in intrastate, interstate, or foreign commerce, carried out for direct or indirect gain, benefit or advantage to the taxpayer or to others, with certain exceptions.

Calculation of gross receipts also involves a deduction of any amount deducted as bad debt for federal income tax purposes that corresponds to items of gross receipts included in the modified gross receipts tax base for the current tax year or past tax years. This reduction is reflected in the Gross Receipts Worksheet (Worksheet 4700) discussed below. Receipts include, but are not limited to:

•Some or all receipts (sales proceeds) from the sale of assets used in a business activity.

•Sale of products.

•Services performed.

•Gratuities stipulated on a bill.

•Sales tax collected on the sale of tangible personal property, subject to a

•Dividend and interest income.

•Gross commissions earned.

•Rents.

•Royalties.

•Sales of scrap and other similar items.

•Client reimbursed expenses not obtained in an agency capacity.

•Gross proceeds from sales between affiliated companies, including members of a UBG.

Use Worksheet 4700, in Form 4600, to calculate gross receipts.

Attach the worksheet to the return. Gross receipts are not necessarily derived from the federal return, however, the worksheet will calculate gross receipts as defined by law in

most instances. Taxpayers and tax professionals are expected to be familiar with uncommon situations within their experience, which produce gross receipts not identified by specific lines on Worksheet 4700, and report that amount on the most appropriate line. Treasury may adjust the figure resulting from the worksheet to account properly for such uncommon situations.

A taxpayer should compute its gross receipts using the same accounting method used in the computation of its net income for federal income tax purposes.

Producers of Agricultural Goods: The total gross receipts from all business activity must be reported on line 12, including the gross receipts from agricultural activity of a person whose primary activity is the production of agricultural goods. A subtraction is allowed on line 21 for the gross receipts that have been included on this line that are from the agricultural activity of a person whose primary activity is the production of agricultural goods.

Producers of Oil or Gas, and Minerals: The total gross receipts from all business activity must be reported on line 12, including the gross receipts from the production of oil and gas even if this activity is subject to the Severance Tax on Oil or Gas, and Minerals, 1929 PA 48. A subtraction is allowed on line 21 for the gross receipts that have been included on this line that are from the production of oil and gas that are subject to the Severance Tax on Oil or Gas, and Minerals.

Line 13: Enter inventory acquired during the tax year, including freight, shipping, delivery, or engineering charges included in the original contract price for that inventory, and any

Inventory means the stock of goods, including electricity and natural gas, held for resale in the ordinary course of a retail or wholesale business, and finished goods, goods in process of a manufacturer, and raw materials purchased from another person. Inventory also includes shipping and engineering charges so long as such charges are included in the original contract price for the associated inventory and floor plan interest for licensed new car dealers.

For purposes of this deduction, floor plan interest means interest paid that finances any part of the person’s purchase of new motor vehicle inventory from a manufacturer, distributor, or supplier. However, amounts attributable to any invoiced items used to provide more favorable floor plan assistance to a person subject to the tax imposed under this act than to a person not subject to this tax are considered interest paid by a manufacturer, distributor, or supplier.

For a person that is a securities trader, broker, or dealer or a person included in the UBG of that securities trader, broker, or dealer that buys and sells for its own account, inventory includes contracts that are subject to the Commodity Exchange Act, 7 USC 1 to 27f; the cost of securities as defined under IRC § 475(c)(2); and for a securities trader, the

18

cost of commodities as defined under IRC § 475(e)(2); and for a broker or dealer, the cost of commodities as defined under IRC § 475(e)(2)(b), (c), and (d), excluding interest expense other than interest expense related to repurchase agreements. As used in this provision:

•Broker and dealer mean those terms as defined under section 78c(a)(4) and (a)(5) of the Securities Exchange Act of 1934, 15 USC 78c.

•Securities trader means a person that engages in the trade or business of purchasing and selling investments and trading assets.

Inventory does not include any of the following:

•Personal property under lease or principally intended for lease rather than sale.

•Property allowed a deduction or allowance for depreciation or depletion under the IRC.

•Labor costs.

Line 14: Enter assets purchased from other firms, including the costs of fabrication and installation, acquired during the tax year of a type that are, or under the IRC will become, eligible for depreciation, amortization, or accelerated capital cost recovery for federal income tax purposes.

Line 15: To the extent not included in inventory or depreciable property, enter materials and supplies, including repair parts and fuel.

Materials and supplies means tangible personal property purchased in the tax year that are ordinary and necessary expenses to be used in carrying on a trade or business.

Materials and supplies includes repair parts and fuel. Fuel means materials used and consumed to produce heat or power by burning. Fuel does not include electricity.

Line 16: A staffing company may deduct compensation of personnel supplied to its clients, including wages, benefits, workers’ compensation costs, and all payroll taxes paid for personnel provided to the clients of staffing companies as defined under MBT. Staffing company means a taxpayer whose business activities are included in Industry Group 736 under the Standard Industrial Classification (SIC) Code as compiled by the United States Department of Labor.

Payments to a staffing company by a client do not constitute purchases from other firms.

Line 17: For taxpayers that fall under SIC major groups 15 (Building Construction General Contractors and Operative Builders), 16 (Heavy Construction Other Than Building Construction Contractors), and 17 (Construction Special Trade Contractors) and do not claim the Small Business Alternative Credit (SBAC) under MCL 208.1417, the following payments are considered purchases from other firms:

•Payments to subcontractors for a construction project under a contract specific to that project, and

•To the extent not deducted as inventory and materials and

supplies, payments |

for |

materials |

deducted as |

purchases |

in determining the |

cost |

of goods |

sold for the |

purpose of |

calculating total income on the taxpayer’s federal income tax return.

UBGs: This subtraction is only available to a member of the UBG if the group does not claim the SBAC for the tax year. However, for purposes of the SIC code requirement, it is sufficient that the UBG member that made the payments listed above be included in SIC codes 15, 16, or 17. Therefore, the relevant SIC code is entered in the member’s page of Form 4580 (Part 2A, Line 22), and the SIC code field on Form 4567 should be left blank by a UBG.

Persons included in SIC codes 15, 16, and 17 include general contractors (of residential buildings including

A subcontractor is an Individual or entity that enters into a contract and assumes some or all of the obligations of a person included in SIC codes 15, 16, and 17 as set forth in the primary contract specific to a project. Thus, payments made to an independent contractor to provide general labor services to the contractor not specific to a particular contract do not constitute purchases from other firms. However, payments made to a subcontractor for services and materials provided under a contract specific to a particular construction project (such as the construction of commercial property on Main Street) do constitute purchases from other firms. There is no limitation or condition that the subcontractors to whom such payments are made be licensed.

The taxpayer bears the burden to prove it is entitled to a deduction in computing its tax liability. It is presumed that good business practice would include documentation such as a written contract that would support a deduction from gross receipts for payments to subcontractors as purchases from other firms. The supporting information for payments to a subcontractor could be incorporated into the contract for the specific project or memorialized in a separate contract with a subcontractor specifying the project to which the costs pertain.

Line 18: Enter film rental or royalty payments paid by a theater owner to a film distributor, a film producer, or a film distributor and producer.

Line 19: Enter any deduction available to a Qualified Affordable Housing Project (QAHP).

Public Act (PA) 168 of 2008 provides for a deduction from the modified gross receipts and apportioned business income tax bases for a Qualified Affordable Housing Project.

Qualified Affordable Housing Project means a person that is organized, qualified, and operated as a limited dividend housing association that has a limitation on the amount of dividends or other distributions that may be distributed to its owners in any given year and has received funding, subsidies, grants, operating support, or construction or permanent funding through one or more public sources.

19

A limited dividend housing association is organized and qualified pursuant to Chapter 7 of the State Housing Development Authority Act (MCL 125.1491 et seq).

If these criteria are satisfied, a Qualified Affordable Housing Project may deduct its gross receipts attributable to the residential rental units in Michigan it owns multiplied by a fraction, the numerator of which is the number of rent restricted units in Michigan owned by that Qualified Affordable Housing Project and the denominator of which is the number of all residential rental units in Michigan owned by the project. This deduction is reduced by the amount of limited dividends or other distributions made to the owners of the project. Amounts received by the management, construction, or development company for completion and operation of the project and rental units do not constitute gross receipts for purposes of the deduction.

MCL 208.1201(8) governs the termination of this deduction.

UBGS: Leave lines 19a through 19f blank and carry the amount from Form 4580, Part 2B, line 24g, column C, to Form 4567, line 19g.

Line 20: Enter payments made by taxpayers licensed under Article 25 (Real Estate Brokers and Salespersons) or Article 26 (Real Estate Appraisers) of the Occupational Code [MCL 339.2501 to 339.2518 and 339.2601 to 339.2637] to independent contractors licensed under Articles 25 or 26.

Line 21: There are three items that qualify for entry on this line. If more than one type applies, enter the combined total as a single amount.

A)For a person classified under the 2002 North American Industrial Classification System (NAICS) Number 484, as compiled by the United States Office of Management and Budget, that does not qualify for a credit under Section 417, enter the payment, made on or after July 12, 2011, to subcontractors to transport freight by motor vehicle under a contract specific to that freight to be transported by motor vehicle. Attach a letter to explain the activity that qualifies for this subtraction and the date of the payment. Include the NAICS code.

B)Enter on this line the gross receipts included on line 12, which result from the agricultural activity of a person whose primary activity (i.e., more than 50 percent of gross receipts) is the production of agricultural goods.

C)Enter on this line the gross receipts included on line 12 which result from the production of oil or gas, and minerals if that production of oil or gas, and minerals is subject to the Severance Tax on Oil or Gas, 1929 PA 48.

Line 26: Enter the amount of MBT Modified Gross Receipts Tax collected in the tax year.

Section 203(5) of the MBT Act permits new motor vehicle dealers licensed under the Michigan Vehicle Code, PA 300 of 1949, MCL 257.1 to 257.923, and dealers of new or used personal watercraft to collect the Modified Gross Receipts Tax in addition to the sales price. The act states the “amount remitted to the Department for the [Modified Gross Receipts Tax] ... shall not be less than the stated and collected amount.”

Therefore, the entire amount of Modified Gross Receipts Tax stated and collected by new motor vehicle dealers and new or used personal watercraft dealers must be remitted to Treasury. There should be no instance where a dealer would be collecting amounts of Modified Gross Receipts Tax from customers in excess of the amount of taxes remitted to Treasury. Taxpayers who elect to separately collect the Modified Gross Receipts Tax, in addition to sales price, under MCL 208.1203(5) may file and remit the tax as estimated payments with their Corporate

Income Tax Quarterly Return (Form 4913).

NOTE: Only new motor vehicle dealers and dealers of new or used personal watercraft are permitted to separately itemize and collect a tax imposed under the MBT Act from customers in addition to sales price, and that authority is limited to only the Modified Gross Receipts Tax imposed and levied under Section 203 of the MBT Act. The statute does not authorize separate itemizing and collection of the Business Income Tax by any taxpayer.

UBGs: Add the combined total after eliminations from Form 4580, Part 2B, line 29, column C, to the number on Form 4567, line 25, and enter the sum on line 26.

NOTE: For a UBG in which no member charged MGR (Modified Gross Receipts) tax as an invoice item, line 26 should match line 25. For a UBG in which one or more members charged MGR tax as an invoice item and overcharged (on a

PART 2: BUSINESS INCOME TAX

If business activity is protected under Public Law (PL)

UBGS: If business activity of a UBG member is protected under PL

Line 28: Business income means that part of federal taxable income derived from business activity. For MBT purposes, federal taxable income means taxable income as defined by IRC

§63, except that federal taxable income shall be calculated as if IRC § 168(k) [as applied to qualified property placed in service after December 31, 2007] and IRC § 199 were not in effect. For a Partnership or S Corporation (or LLC federally taxed as such), business income includes payments and items of income and expense that are attributable to business activity of the

20

Partnership or S Corporation and separately reported to the partners or shareholders.

Use the Business Income Worksheet (Worksheet 4746), in

Form 4600, to calculate business income. Attach the worksheet to the return. The worksheet will calculate business income as defined by law in most instances. Taxpayers and tax professionals are expected to be familiar with uncommon situations within their experience, which produce business income not identified by specific lines on the worksheet, and report that amount on the most appropriate line. Treasury may adjust the figure resulting from Worksheet 4746 to account properly for such uncommon situations.

For an organization that is a mutual or cooperative electric company exempt under IRC § 501(c)(12), business income equals the organization’s excess or deficiency of revenues over expenses as reported to the federal government by those organizations exempt from the federal income tax under the IRC, less capital credits paid to members of that organization, less income attributed to equity in another organization’s net income, and less income resulting from a charge approved by a state or federal regulatory agency that is restricted for a specified purpose and refundable if it is not used for the specified purpose.

For a

For an Individual or an Estate, or for a Partnership or Trust organized for estate or gift planning purposes, business income is that part of federal taxable income (as defined for MBT purposes) derived from transactions, activities, and sources in the regular course of the person’s trade or business, including the following:

•All income from tangible and intangible property if the acquisition, rental, lease, management, or disposition of the property constitutes integral parts of the person’s regular trade or business operations.

•Gains or losses incurred in the taxpayer’s trade or business from stock and securities of any foreign or domestic corporation and dividend and interest income.

•Income derived from isolated sales, leases, assignments, licenses, divisions, or other infrequently occurring dispositions, transfers, or transactions involving tangible, intangible, or real property if the property is or was used in the person’s trade or business operation.

•Income derived from the sale of an interest in a business that constitutes an integral part of the person;’s regular trade or business.

•Income derived from the lease or rental of real property

NOTE: Personal investment income, gains from the sale of property held for personal use and enjoyment, or other assets not used in a trade or business, and any other income not specifically derived from a trade or business that is earned, received, or otherwise acquired by an Individual, an Estate, or a Trust or Partnership organized or established for estate or gift planning purposes, a person organized exclusively to conduct investment activity solely for a third party individual or a person related

to that individual, or a common trust established under the Collective Investment Funds Act of 1941, is not included in the Business Income Tax base. This exclusion only applies to the specific types of taxpayers identified above. Investment income and any other types of income earned or received by all other types of persons or taxpayers not specifically referenced must be included in the business income of the taxpayer.

Additions to Income

Additions are generally required to the extent deducted in arriving at federal taxable income. (Business income, line 28.)

Line 29: Enter any interest income and dividends from bonds and similar obligations or securities of states other than Michigan and their political subdivisions in the same amount that was excluded from federal taxable income (as defined for MBT purposes). Reduce this addition by any expenses related to the foregoing income that were disallowed on the federal return by IRC § 265 or 291.

Line 30: Enter all taxes on, or measured by, net income including city and state taxes, Foreign Income Tax, and Federal Environmental Tax claimed as a deduction on the federal return.

Line 31: Enter the Michigan Business Tax, including surcharge, claimed as a deduction on the federal return.

Line 32: Enter any net operating loss carryback or carryover that was deducted in arriving at federal taxable income (as defined for MBT purposes) reported on line 28. Enter this amount as a positive number.

Line 33: Enter any losses included in federal taxable income (as defined for MBT purposes) that are attributable to other entities that have made a valid election to file under the MBT and have filed under the MBT. If there is only one such entity to report, enter its FEIN or TR number in the field on this form. If there is more than one such entity to report, enter on the form the FEIN or TR number of one of the entities and attach a list of the account numbers of all. On the list include a breakdown of the amount of this loss

UBGs: It is not necessary to attach a list of entities in connection with this line item because all entities for which a loss

Line 34: Enter any royalty, interest, or other expense paid to a person related to the taxpayer by ownership or control for the use of an intangible asset if the person is not included in the taxpayer’s UBG. Royalty, interest, or other expense described here is not required to be included if the taxpayer can demonstrate that the transaction has a nontax business purpose other than avoidance of this tax, is conducted with

•Is a

21

terms.

•Results in double taxation. For this purpose, double taxation exists if the transaction is subject to tax in another jurisdiction.

•Is unreasonable as determined by Treasury, and the taxpayer agrees that the addition would be unreasonable based on the taxpayer’s facts and circumstances.

•The related person (recipient of the transaction) is organized under the laws of a foreign nation which has in force a comprehensive income tax treaty with the United States.

Line 35: There currently are no additions required that are recorded on this line. Leave this line blank.

Subtractions from Income

Subtractions are generally available to the extent included in arriving at federal taxable income (Business Income, line 28).

Line 38: Enter any dividends and royalties received from persons other than United States persons and foreign operating entities, including, but not limited to, amounts determined under IRC § 78 or IRC § 951 to 965.

NOTE: To the extent deducted in arriving at federal taxable income, any deduction under IRC 250(a)(1)(B) should be added back on this line (i.e., netted against subtractions made on this line).

Line 39: Enter any income included in federal taxable income (as defined for MBT purposes) that are attributable to other entities that have made a valid election to file under the MBT and have filed under the MBT. If there is only one such entity to report, enter its FEIN or TR number in the field on this form. If there is more than one such entity to report, enter on the form the FEIN or TR number of one of the entities and attach a list of the account numbers of all. On the list include a breakdown of the amount of this income subtraction that is attributable to each entity. In any case, the amount on line 39 should be the total of all income, not just the income of the one entity identified on the form.

UBGs: It is not necessary to attach a list of entities in connection with this line item because all entities for which an income subtraction is being reported have been identified on the corresponding line of Form 4580, or a similar list required as an attachment to Form 4580.

Line 40: To the extent included in federal taxable income (as defined for MBT purposes), deduct interest income derived from United States obligations.

Line 41: To the extent included in federal taxable income (as defined for MBT purposes), deduct any earnings that are net earnings from

Line 42: There are three items that qualify for entry on this line. If more than one type applies, enter the combined total as a single amount.

A)For tax years that begin after December 31, 2009, to the extent included in federal taxable income, deduct the amount of a charitable contribution made to the Advance Tuition Payment fund created under section 9 of the Michigan Education Trust Act, PA 316 of 1986, MCL 390.1429. This is deductible only to the extent that contribution was NOT federally deductible.

B)Eligible licensed marihuana trades or businesses may subtract ordinary and necessary expenses paid or incurred during the tax year that would be allowed if section 280E of the internal revenue code were not in effect. Under the Michigan Regulation and Taxation of Marihuana Act (which allows for what is often referred to as “recreational” or “adult use” marihuana), a marihuana establishment licensed under that act is allowed a deduction from Michigan income tax for certain expenses not allowed in arriving at federal taxable income. IRC 280E prohibits a deduction for any amount paid or incurred in carrying on a trade or business that consists of trafficking in Schedule I and II controlled substances (e.g., marihuana). However, the IRC is also structured to recognize the cost of goods sold before reaching gross profit, regardless whether taxpayer is in the business of trafficking in marihuana. Therefore, any expenses related to cost of goods sold (and any other expenses already allowed in reaching federal taxable income) may not be subtracted from the Michigan base.

C)Enter the

The

1)Total of amount reported on Column C of Form 4593 with the original 2008 MBT annual return. (For UBGS, compute the sum of the amounts reported by all current members of the group who filed Form 4593.)

2)Calculate the amount needed to offset the net deferred tax liability of the taxpayer which results from the imposition of the business income tax, at a rate of 4.95%, and the modified gross receipts tax, at a rate of 0.8%, calculated for the first fiscal period ending after July 12, 2007.

3)Take the lesser of the result of (1) or (2).

4)Report on this line 4% of the result of step 3. The remaining percentage of the amount from step 3 will be deductible in future years.

A taxpayer claiming the

Line 45: If line 45 is negative, enter as a negative number. A loss on line 45 will create (or increase) the MBT business loss carryforward for the next year.

22

Line 46: Deduct any available MBT business loss incurred after December 31, 2007. Enter as a positive number.

Business loss means a negative business income tax base, after apportionment, if applicable.

Only an MBT business loss may be used and only from prior consecutive years when the taxpayer was an MBT taxpayer.

NOTE: MBT business loss carryforward is not the same as the federal net operating loss carryforward or carryback. It is also not the same as a Corporate Income Tax business loss carryforward. A CIT business loss carryforward may not be entered on this line or applied against the MBT tax base. A taxpayer that acquires the assets of another corporation in a transaction described under section 381(a)(1) or (2) of the IRC may deduct any MBT business loss carryforward attributable to that distributor or transfer or corporation.

Line 47: Subtract line 46 from line 45. Any negative amount on line 47 is an MBT business loss which may be carried forward to the next filing period, except to the extent that all or some portion of this business loss has exceeded its usable life of ten tax years.

NOTE: Any business loss created on this return may only be applied against a subsequent MBT business income tax base. This business loss may not be applied against a subsequent Corporate Income Tax tax base.

Line 48: If line 47 is positive, enter the Qualified Affordable Housing Deduction, if applicable.

NOTE: If claiming both the seller’s and the QAHP deductions, complete the QAHP deduction calculation on lines 48a through 48h, and add to the total at line 48i the amount from Form 4579, line 5.

PA 168 of 2008 provides for a deduction from the apportioned Business Income Tax base to a Qualified Affordable Housing Project and a seller of residential rental units to a Qualified Affordable Housing Project. Qualified Affordable Housing Project is defined under instructions for line 19.

The seller may take a deduction from its apportioned Business Income Tax base equal to the gain from the sale of the residential rental units to the Qualified Affordable Housing Project, as calculated on the MBT Qualified Affordable Housing Seller’s Deduction (Form 4579). Enter the amount from Form 4579, line 5. (All MBT forms, including Form 4579, are available online at www.michigan.gov/mbt.)

The Qualified Affordable Housing Project may deduct from its apportioned Business Income Tax base an amount equal to the product of the taxable income attributable to residential rental units in Michigan it owns multiplied by a fraction, the numerator of which is the number of rent restricted units in Michigan owned by that Qualified Affordable Housing Project and the denominator of which is the number of all residential rental units in Michigan owned by the project. MCL 208.1201(8) governs the termination of this deduction.

In general, taxable income attributable to residential rental units is gross rental receipts attributable to residential rental units in Michigan (purchased pursuant to an operation

agreement) less rental expenses attributable to residential rental units in Michigan, including, but not limited to, repairs, interest, insurance, maintenance, utilities, and depreciation.

Specifically, Partnerships may use a Rental Real Estate Income and Expenses of a Partnership or an S Corporation (U.S. Form 8825) to determine its taxable income attributable to residential rental units in Michigan. To the extent that the Qualified Affordable Housing Project is taxed as something other than a Partnership or S Corporation, the Qualified Affordable Housing Project may use the Supplemental Income and Loss (U.S. Form 1040, Schedule E) or the relevant portions of the U.S. Corporation Income Tax Return (U.S. Form 1120), as appropriate. If the Qualified Affordable Housing Project is a Corporation, the expenses permitted should be limited to those also listed on the

Improvements that increase the value of the property or extend its life, such as replacing a roof or renovating a kitchen, are not deductible rental expenses. Any passive activity loss limitations applicable to the Qualified Affordable Housing Project’s federal return also apply for purposes of MCL 208.1201(7).

The Qualified Affordable Housing Project’s deduction is reduced by the amount of limited dividends or other distributions made to the owners of the project. Income received by the management, construction, or development company for completion and operation of the project and rental units does not constitute taxable income attributable to residential rental units.

UBGs: Leave lines 48a through 48h blank and carry the amount from Form 4580, Part 2B, line 45i, column C, to line 48i.

When the seller claims a deduction for the year of sale, the State will place a lien on the property equal to the amount of the seller’s deduction. If the buyer fails to qualify as a Qualified Affordable Housing Project or fails to operate any of the residential rental units as rent restricted units in accordance with the operation agreement within 15 years after the date of purchase, the lien placed on the property for the amount of the seller’s deduction becomes payable to the State. The lien is payable through a “recapture” to be added to the tax liability of the buyer in the year the recapture event occurs. The recapture is calculated on MBT Schedule of Recapture of

Certain Business Tax Credits and Deductions (Form 4587), and is reduced proportionally for the number of years the buyer qualified for the deduction.

PART 3: TOTAL MICHIGAN BUSINESS TAX

Line 53: IMPORTANT: If apportioned or allocated gross receipts are less than $350,000, enter a zero on this line. A return to report tax credit recapture is mandatory, however, even if a taxpayer is otherwise not required to file a return because it does not meet the filing threshold of $350,000.

23

Tax Years Less Than 12 Months: If the reported tax year is less than 12 months, gross receipts must be annualized. If annualized gross receipts do not exceed $350,000, enter zero on this line.

Annualizing

Multiply each applicable amount, total gross receipts, adjusted business income, and shareholder, officer, and partner income, and, for fiscal filers, divide the result by the number of months the business operated. Generally, a business is considered in business for one month if the business operated for more than half the days of the month. If the tax year is less than one month, consider the tax year to be one month for the purposes of the calculation.

UBGS: If apportioned or allocated gross receipts before intercompany eliminations (gross receipts from Form 4580, Part 2B, line 17, column A, multiplied by the apportionment percentage reported on Form 4567, line 11c) are less than $350,000, enter a zero on this line. Group members reporting a period of less than 12 months with this group return must annualize their gross receipts figure on a member by member basis. Use each member’s number of months reported in the group’s tax year. Once all applicable members’ gross receipts figures are annualized, add all members’ figures to determine the group’s annualized apportioned or allocated gross receipts.

Line 58: If the amount entered on Form 4946, line 39, is a positive number, enter that amount on this line. Only a positive amount may be entered on this line.

NOTE: Include a completed copy of Form 4946 with this return regardless of whether an amount is entered on Line 58.

PART 4: PAYMENTS, REFUNDABLE CREDITS, AND TAX DUE

Line 61: Enter the total estimated taxes paid. Include all payments made on returns that apply to the current tax year. For example, calendar year filers include money paid with the combined returns for return periods January through December.

Amended Returns Only:

Line 66a: Enter total payment(s) made with original and/or prior amended returns for this period.

Line 66b: Enter net overpayment received (refund(s) received plus credit forward(s) created) from the original and/or prior amended returns for this period.

Line 66c: Add lines 65 and 66a and subtract line 66b from the sum.

Line 68: If penalty and interest are owed for not filing estimated returns or for underestimating tax, complete

the MBT Penalty and Interest Computation for Underpaid Estimated Tax (Form 4582) to compute penalty and interest due. If a taxpayer chooses not to file this form, Treasury will compute penalty and interest and bill for payment.

Line 69: Enter the annual return penalty rate on line 69a. Add the overdue tax penalty on line 69b to the overdue tax interest in line 69c. Enter total on line 69d.

Refer to the “Computing Penalty and Interest” section in Form 4600 to determine the annual return penalty rate and use the following “Overdue Tax Penalty” and “Overdue Tax Interest” worksheets.

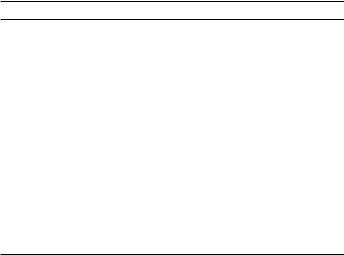

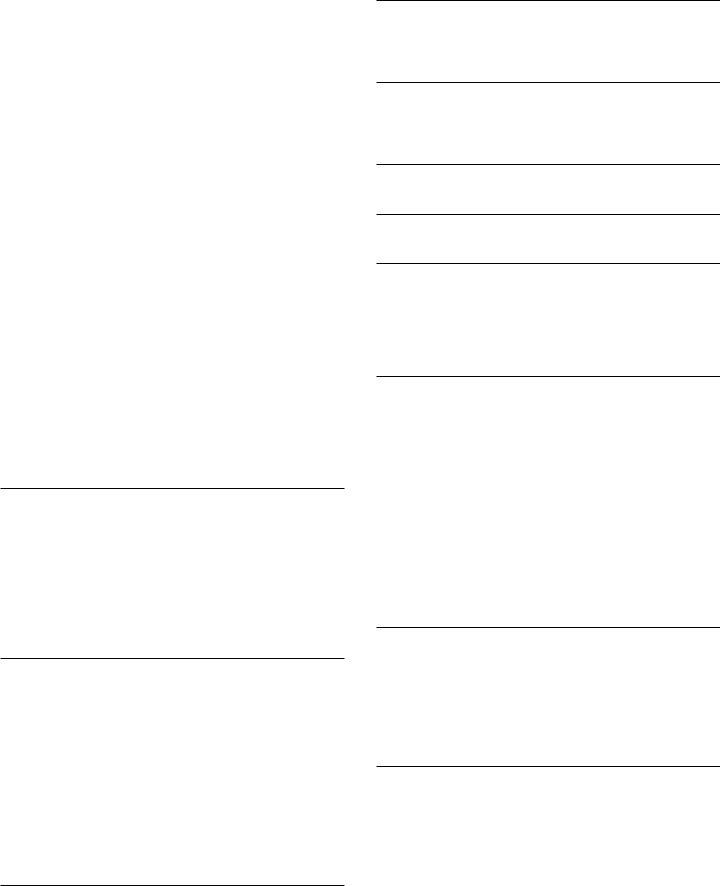

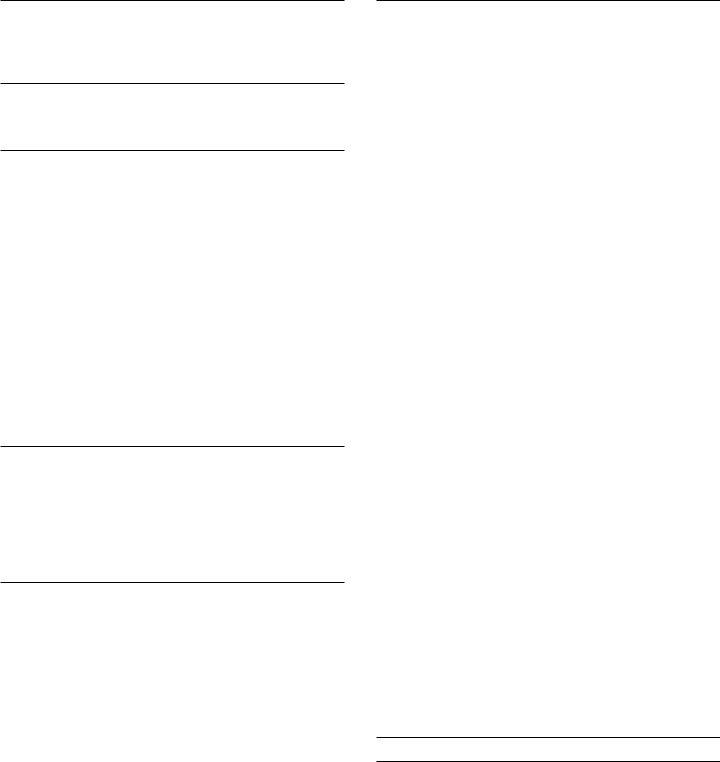

WORKSHEET – OVERDUE TAX PENALTY |

|

A. Tax due from Form 4567, line 67 |

00 |

B. Late/extension or insufficient |

|

payment penalty percentage |

% |

C. Multiply line A by line B |

00 |

Carry amount from line C to Form 4567, line 69b. |

|

WORKSHEET – OVERDUE TAX INTEREST |

|

A. Tax due from Form 4567, line 67 |

00 |

B. Applicable daily interest percentage .. |

|

|

% |

C. Number of days return was past due ... |

|

D. Multiply line B by line C |

% |

E. Multiply line A by line D |

00 |

Carry amount from line E to Form 4567, line 69c. |

|

Line 69c: NOTE: If the late period spans more than one interest rate period, divide the late period into the number of days in each of the interest rate periods identified in the “Computing Penalty and Interest” section in Form 4600, and apply the calculations in the “Overdue Tax Interest” worksheet separately to each portion of the late period. Combine these interest subtotals and carry the total to line 66c.

PART 5: REFUND OR CREDIT FORWARD

Line 71: If the amount of the overpayment, less any penalty and interest due on lines 68 and 69d is less than zero, enter the difference (as a positive number) on line 70. If the amount is greater than zero, enter on line 71.

NOTE: If an overpayment exists, a taxpayer must elect a refund of all or a portion of the amount and/or designate all or a portion of the overpayment to be used as an estimate for the next MBT tax year. Complete lines 72 and 73 as applicable.

Line 72: If the taxpayer anticipates an MBT liability in the filing period subsequent to this return, some or all of any overpayment from line 71 may be credited forward to the next tax year as an estimated payment. Enter the desired amount to use as an estimate for the next MBT tax year.

Reminder: Taxpayers must sign and date returns. Preparers must provide a Preparer Taxpayer Identification Number (PTIN), FEIN or Social Security number (SSN), a business name, and a business address and phone number.

Other Supporting Forms and Schedules

Federal Forms: Attach copies of these forms to the return.

UBGS: See Form 4580 instructions for information regarding federal attachments for members of UBGs.

•C Corporations: U.S. Form 1120 (pages 1 through 4), Schedule D, Form 851, Form 4562, and Form 4797. If filing as part of a consolidated federal return, attach a pro forma or consolidated schedule.

•S Corporations: U.S. Form

24

Schedule D, Form 851, Form 4562, Form 4797, Form 8825.

•Individuals: U.S. Form 1040 (pages 1 and 2), Schedules C,

•Fiduciaries: U.S. Form 1041 (pages 1 through 2), Schedule

D, and Form 4797.

•Partnerships: U.S. Form 1065, (pages 1 through 5)*, Schedule D, Form 4797, and Form 8825.

•Limited Liability Companies: Attach appropriate schedules listed above based on federal return filed.

• Federally Exempt Entities: In certain circumstances, a federally tax exempt entity must file an MBT return. In those cases, attach U.S. Form

*Do not send copies of

25

Sourcing of Sales to Michigan

TANGIBLE AND REAL PROPERTY

Sale of tangible personal property

Property is shipped or delivered, or, in the case of electricity and gas, the contract requires the property to be shipped or delivered, to any purchaser within this State based on the ultimate destination at the point that the property comes to rest regardless of the free on board point or other conditions of the sales.

Property stored in transit for 60 days or more prior to receipt by the purchaser or the purchaser’s designee, or in the case of a dock sale not picked up for 60 days or more, shall be deemed to have come to rest at this ultimate destination. Property stored in transit for fewer than 60 days prior to receipt by the purchaser or the purchaser’s designee, or in the case of a dock sale not picked up before 60 days, is not deemed to have come to rest at this ultimate destination.

NOTE: Tangible personal property means that term as defined in Section 2 of the Use Tax Act, Public Act (PA) 94 of 1937, MCL 205.92.

Sale, lease, rental or licensing of real property

Property is located in this State.

Lease or rental of tangible personal property

To the extent the property is used in this State. Extent of use is determined by multiplying the receipts by a fraction, the numerator is the number of days of physical location of the property in this State during the lease or rental period in the tax year and the denominator is the number of days of physical location of the property everywhere during all lease or rental periods in the tax year.

If the physical location of the property during the lease or rental period is unknown or cannot be determined, the tangible personal property is used in the state in which the property was located at the time the lease or rental payer obtained possession.

Lease or rental of mobile transportation property owned by the taxpayer

To the extent property is used in this State. For example, the extent an aircraft will be deemed to be used is determined by multiplying all the receipts from the lease or rental of the aircraft by a fraction, the numerator of the fraction is the number of landings of the aircraft in this State and the denominator of the fraction is the total number of landings of the aircraft.

If the extent of use of any transportation property within this State cannot be determined, then the receipts are in this State if the property has its principal base of operations in this State.

INTANGIBLE PROPERTY (IN GENERAL)

Royalties and other income received for use of or for the privilege of using intangible property including patents, knowhow, formulas, designs, processes, patterns, copyrights, trade names, service names,

franchises, licenses, contracts, customer lists, computer software, or similar items

Property is used by the purchaser in this State. If property is used in more than one state, royalties or other income will be apportioned to this State pro rata according to the portion of use in this State.

If the portion of use in this State cannot be determined, the royalties or other income will be excluded from both the numerator and the denominator.

If the purchaser of intangible property uses it or the rights to the intangible property, in the regular course of its business operations in this State, regardless of the location of the purchaser’s customers.

SALESFROMPERFORMANCEOFSERVICES(IN GENERAL)

Receipts from performance of services, in general

Recipient of services receives all of the benefit of the services in this State.

If the recipient of the services receives some of the benefit of the services in this State, receipts are included in the numerator of the apportionment factor in proportion to the extent that the recipient receives benefit of the services in this State.

For more information regarding how a taxpayer determines where the recipient of services performed receives the benefit of those services, see RAB

FINANCIAL SERVICES

Sales derived from securities brokerage services including commissions on transactions, the spread earned on principal transactions in which broker buys or sells from its account, total margin interest paid on behalf of brokerage accounts owned by broker’s customers, and fees and receipts of all kinds from underwriting of securities

Multiply the total dollar amount of receipts from securities brokerage services by a fraction, the numerator of which is the sales of securities brokerage services to customers within this State, and the denominator of which is the sales of securities brokerage services to all customers.

If receipts from brokerage services can be associated with a particular customer, but it is impractical to associate the receipts with the address of the customer, then the address of the customer will be presumed to be the address of the branch office that generates the transactions for the customer.

Sales of services derived directly or indirectly from sale of management, distribution, administration,

or securities brokerage services to, or on behalf of, a regulated investment company or its beneficial

owners, including receipts derived directly or

26

indirectly from trustees, sponsors, or participants of employee benefit plans that have accounts in a

regulated investment company