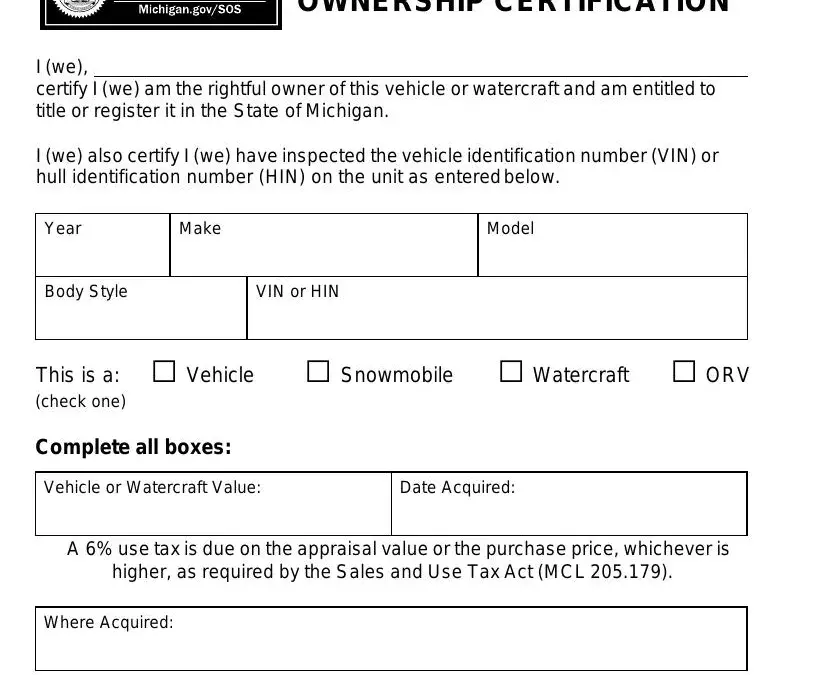

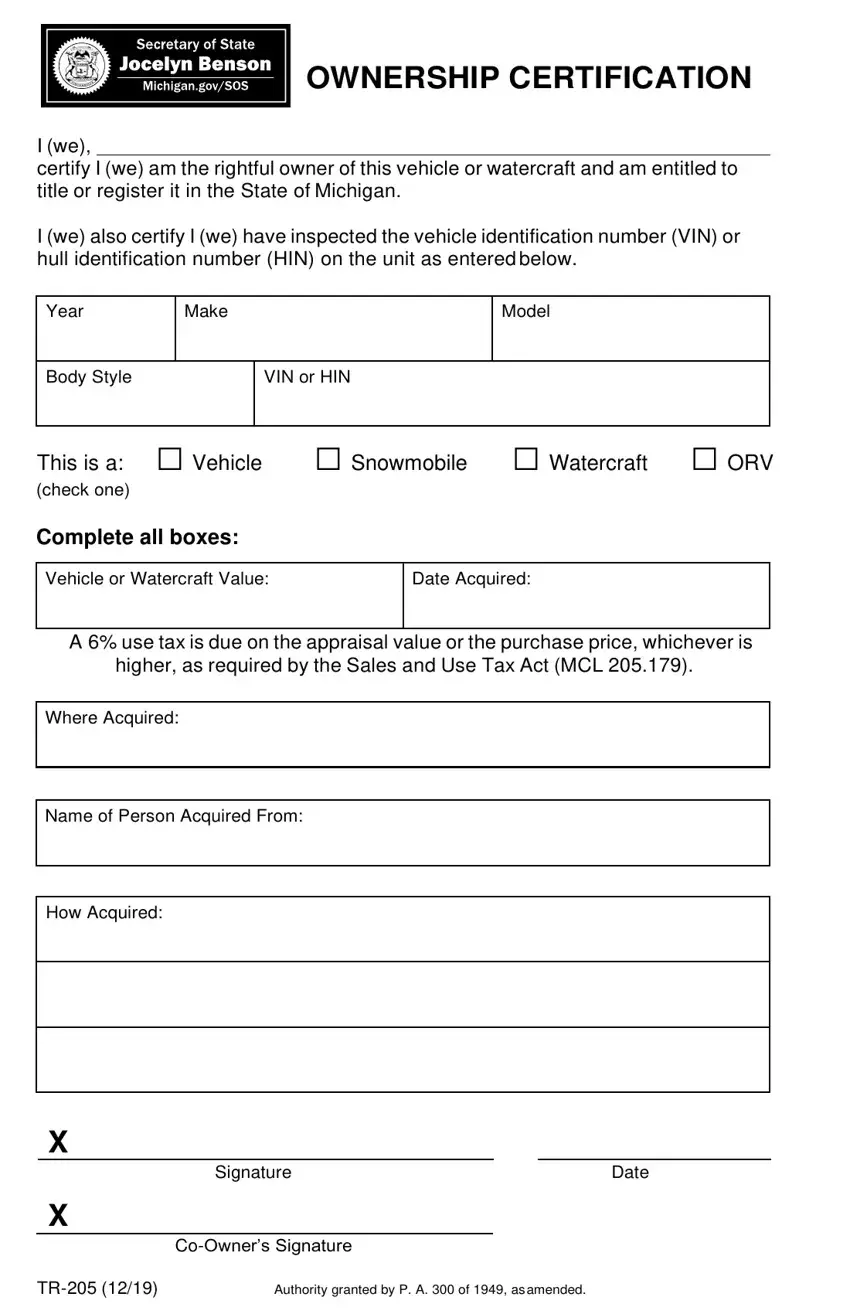

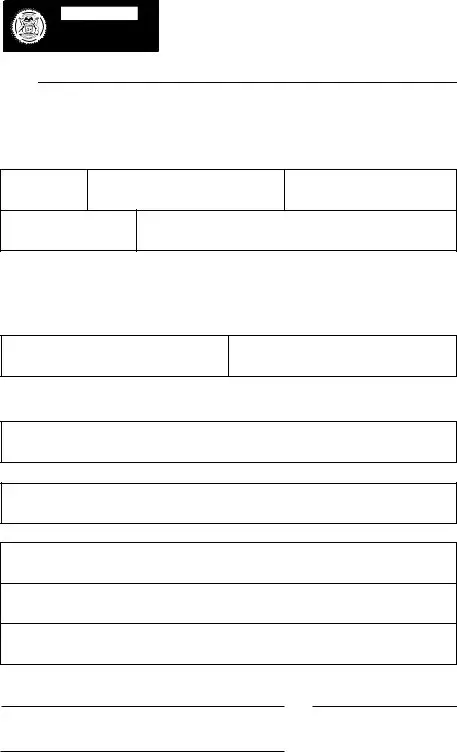

OWNERSHIP CERTIFICATION

I (we),

certify I (we) am the rightful owner of this vehicle or watercraft and am entitled to title or register it in the State of Michigan.

I (we) also certify I (we) have inspected the vehicle identification number (VIN) or hull identification number (HIN) on the unit as entered below.

This is a: □ Vehicle |

□ Snowmobile □ Watercraft □ ORV |

(check one) |

|

Complete all boxes: |

|

Vehicle or Watercraft Value:

A6% use tax is due on the appraisal value or the purchase price, whichever is higher, as required by the Sales and Use Tax Act (MCL 205.179).

Where Acquired:

Name of Person Acquired From:

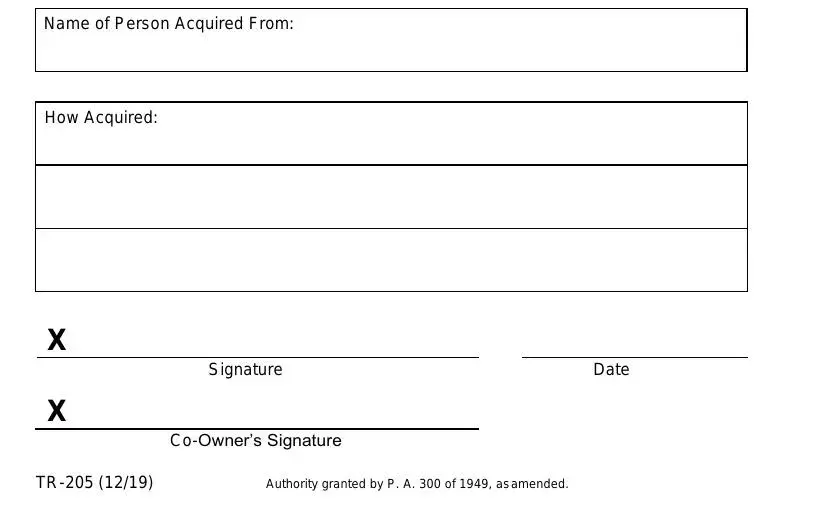

How Acquired:

X

SignatureDate

X

|

Co-Owner’s Signature |

TR-205 (12/19) |

Authority granted by P. A. 300 of 1949, as amended. |

Ownership Certification Instructions

Use of this form is limited as a last resort when a:

(a)Vehicle title, watercraft title or ORV title has been lost, destroyed, or stolen and the purchaser is unable to contact the previous owner for a duplicate title, or

(b)Snowmobile, non-titled watercraft, or moped registration has been lost and the purchaser is unable to contact the owner on record for an assigned registration or bill of sale.

1.Eligibility for using this procedure:

●The vehicle must be 10 or more years old (6 or more years old for ORVs).

●The value of the vehicle can’t exceed $2,500 ($1,500 for ORVs).

●Can’t be used with mobile homes.

●Can’t be used for vehicles acquired out of state. The out-of-state title is required.

●Can’t be used unless the applicant has exhausted all possibilities of contacting the titled or registered owner on record.

If the vehicle doesn’t meet the above criteria and you can’t obtain an assigned ownership document from the previous owner, a surety bond must be purchased.

2.For vehicles, applicants must submit a vehicle appraisal showing the value is $2,500 or less. This appraisal may be:

a)An appraisal completed by a licensed Michigan dealer, or

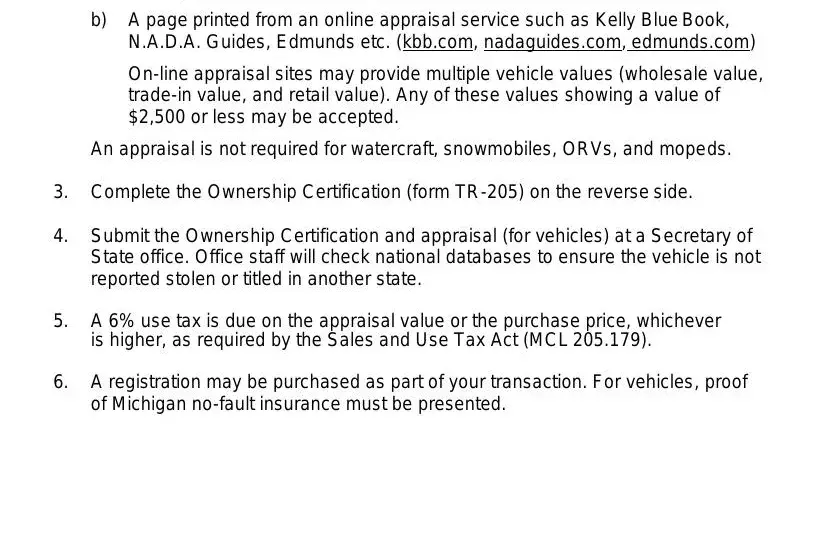

b)A page printed from an online appraisal service such as Kelly Blue Book, N.A.D.A. Guides, Edmunds etc. (kbb.com, nadaguides.com, edmunds.com)

On-line appraisal sites may provide multiple vehicle values (wholesale value, trade-in value, and retail value). Any of these values showing a value of $2,500 or less may be accepted.

An appraisal is not required for watercraft, snowmobiles, ORVs, and mopeds.

3.Complete the Ownership Certification (form TR-205) on the reverse side.

4.Submit the Ownership Certification and appraisal (for vehicles) at a Secretary of State office. Office staff will check national databases to ensure the vehicle is not reported stolen or titled in another state.

5.A 6% use tax is due on the appraisal value or the purchase price, whichever is higher, as required by the Sales and Use Tax Act (MCL 205.179).

6.A registration may be purchased as part of your transaction. For vehicles, proof of Michigan no-fault insurance must be presented.