Our PDF editor makes it simple to fill in forms. You don't have to perform much to enhance sc 220 forms. Just simply keep to all of these steps.

Step 1: This page includes an orange button saying "Get Form Now". Click it.

Step 2: Once you have accessed the editing page california court sc220, you'll be able to see every one of the functions available for the form inside the top menu.

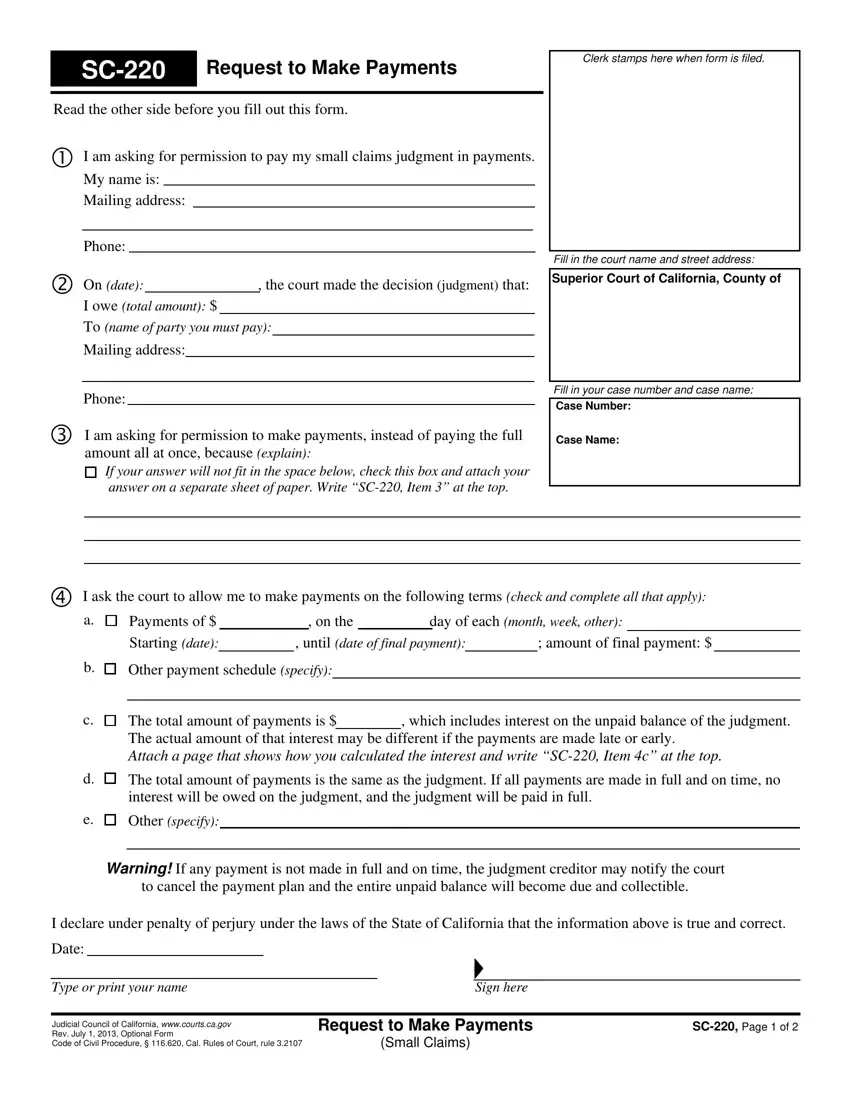

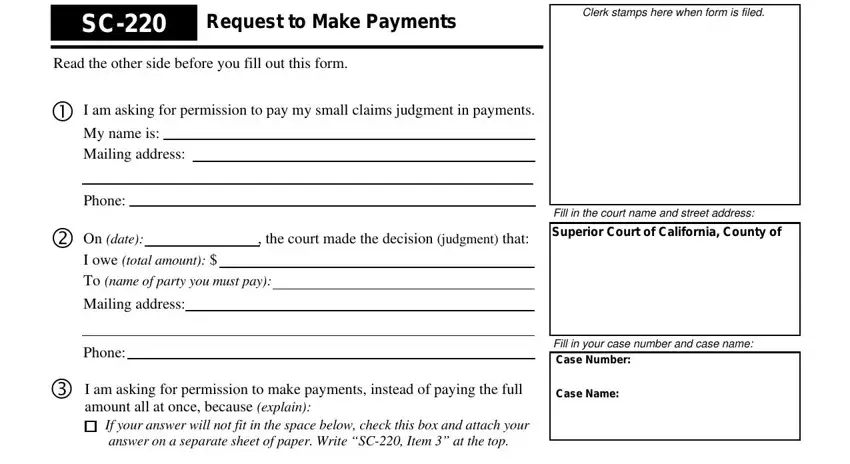

You'll have to provide the next information so you can create the file:

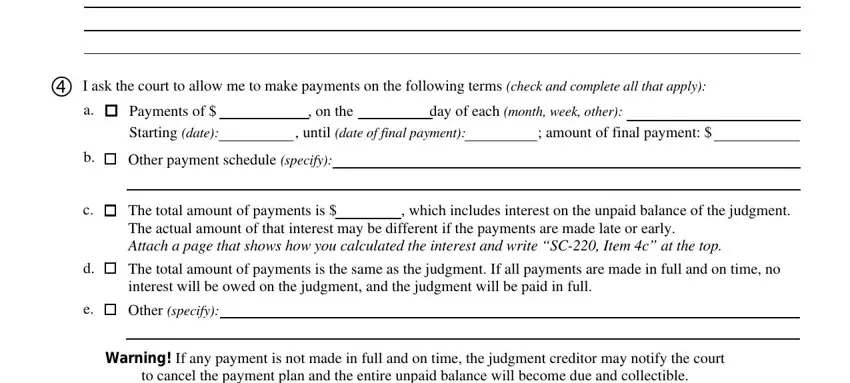

Write down the details in the I ask the court to allow me to, Payments of on the day of each, Other payment schedule specify, The total amount of payments is, The total amount of payments is, Other specify, and Warning If any payment is not made field.

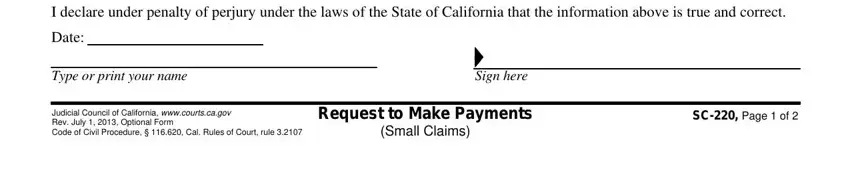

Write all information you need in the space I declare under penalty of perjury, Date, Type or print your name Sign here, Judicial Council of California, Request to Make Payments Small, and SC Page of.

Step 3: As soon as you are done, select the "Done" button to transfer your PDF form.

Step 4: Get at least several copies of the file to stay clear of any specific possible future challenges.