It won't be challenging to get midland national life insurance company beneficiary change request with the help of our PDF editor. This is how one could efficiently make your document.

Step 1: Select the "Get Form Now" button to get going.

Step 2: You are now free to update midland national life insurance company beneficiary change request. You have many options thanks to our multifunctional toolbar - you can include, eliminate, or alter the text, highlight the specific sections, as well as undertake similar commands.

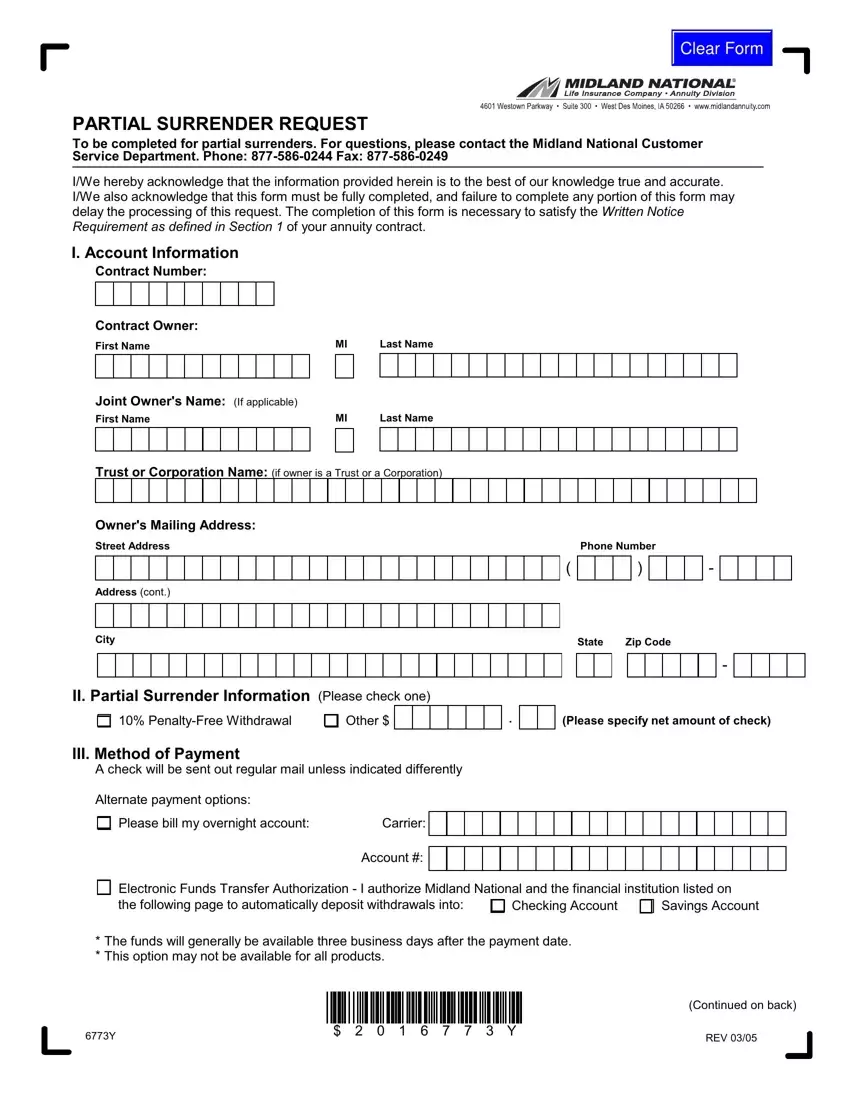

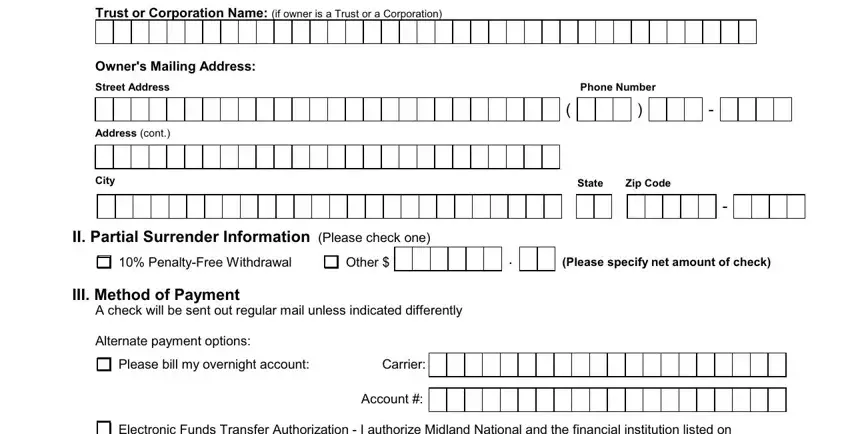

Please enter the following details to create the midland national life insurance company beneficiary change request PDF:

Put down the information in the Owners, Mailing, Address Street, Address Address, cont City, Phone, Number State, Zip, Code II, Partial, Surrender, Information Please, check, one Penalty, Free, Withdrawal Other, Please, specify, net, amount, of, check III, Method, of, Payment Alternate, payment, options and Please, bill, my, overnight, account area.

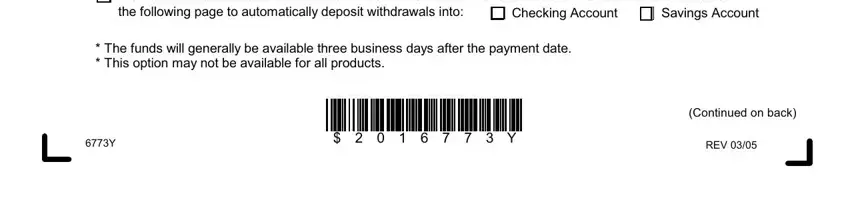

The software will request you to provide particular vital details to automatically complete the segment Checking, Account Savings, Account Continued, on, back and REV.

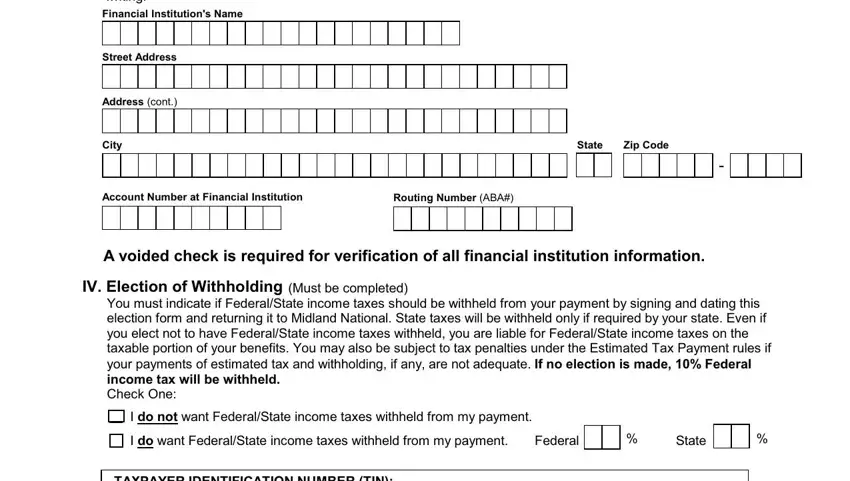

The Street, Address Address, cont City, State, Zip, Code Account, Number, at, Financial, Institution Routing, Number, ABA Federal, and State section is the place where all sides can put their rights and obligations.

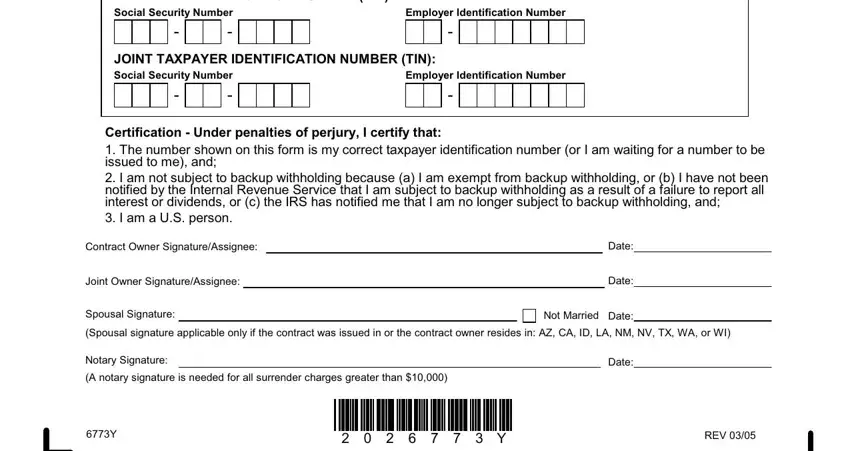

Prepare the form by reviewing the following sections: Employer, Identification, Number Employer, Identification, Number Contract, Owner, Signature, Assign, ee Joint, Owner, Signature, Assign, ee Spousal, Signature Date, Date, Not, Married Date, Notary, Signature Date, and REV.

Step 3: Once you hit the Done button, your completed document is readily transferable to each of your devices. Or alternatively, you will be able to deliver it by means of mail.

Step 4: Prepare around two or three copies of your file to keep clear of all of the possible concerns.