Any time you intend to fill out Nonadmitted Insurance Premium Tax Return for Surplus Lines Brokers, there's no need to install any kind of software - simply try our PDF tool. To maintain our editor on the leading edge of convenience, we strive to integrate user-oriented features and improvements regularly. We are routinely looking for suggestions - play a pivotal role in revolutionizing PDF editing. If you're looking to get going, this is what it takes:

Step 1: Open the form inside our editor by pressing the "Get Form Button" in the top section of this webpage.

Step 2: When you open the PDF editor, you will get the form ready to be completed. Aside from filling in different blanks, you could also perform various other actions with the form, particularly putting on custom words, modifying the original textual content, inserting illustrations or photos, placing your signature to the form, and much more.

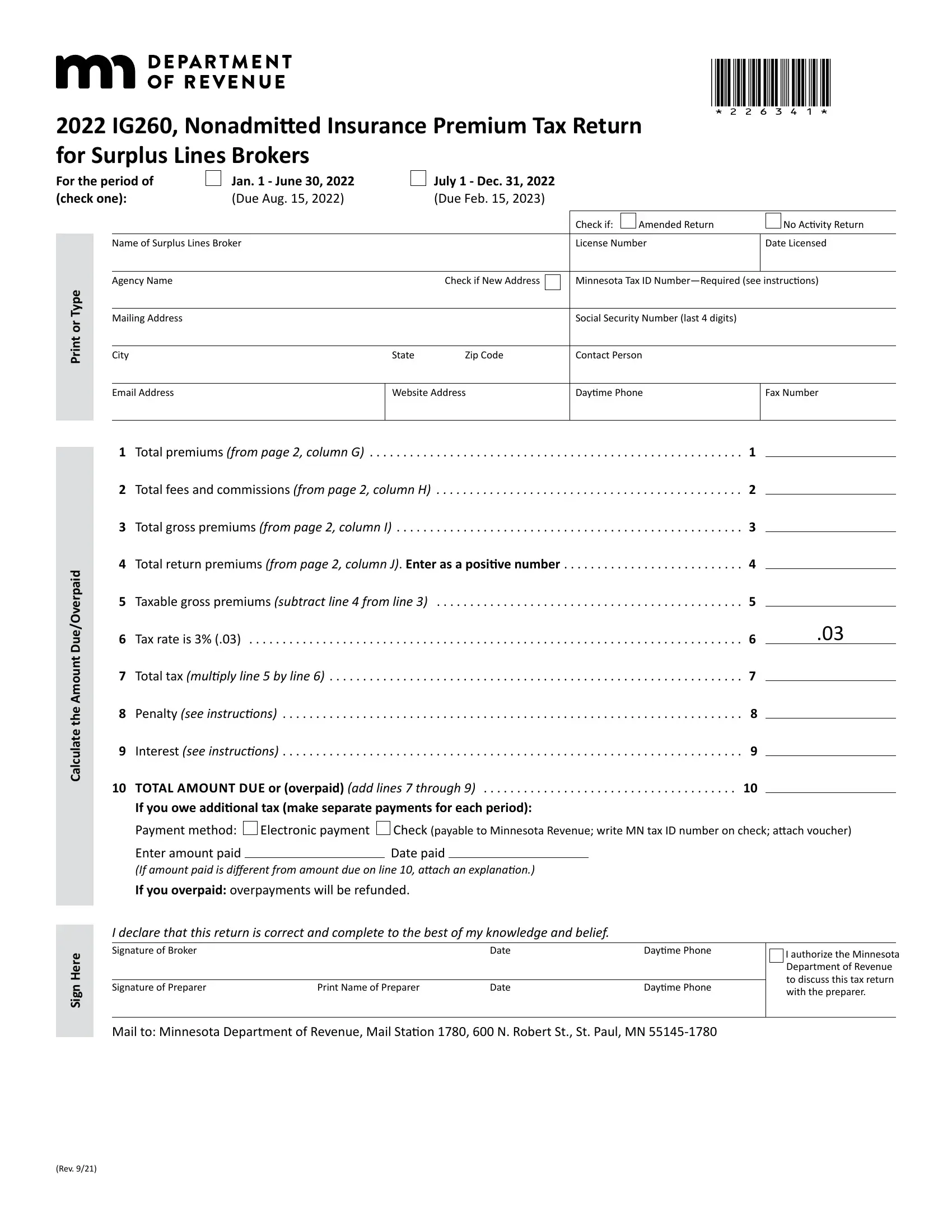

This document requires particular information to be typed in, hence be sure you take the time to type in what is expected:

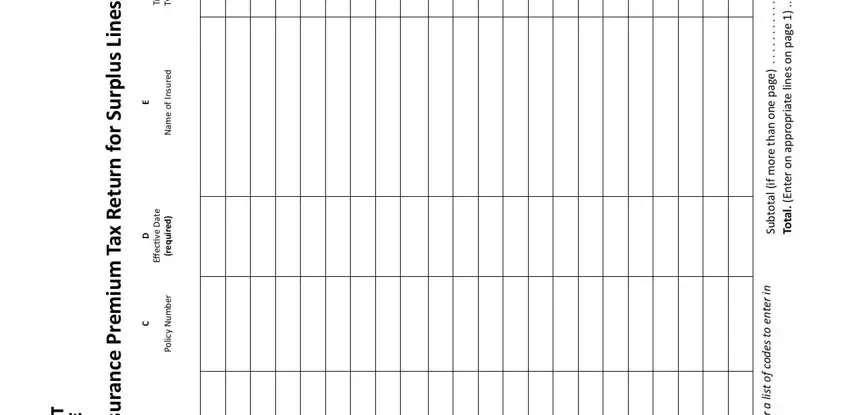

1. It is recommended to fill out the Nonadmitted Insurance Premium Tax Return for Surplus Lines Brokers accurately, hence pay close attention while working with the areas containing all these fields:

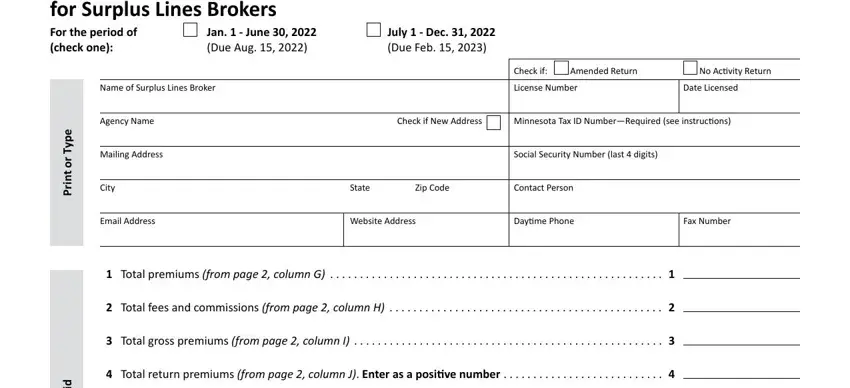

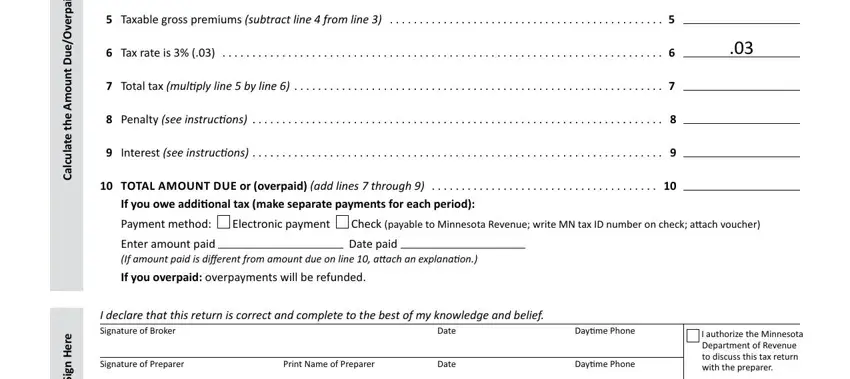

2. Once this segment is completed, you have to add the necessary particulars in Taxable gross premiums subtract, Tax rate is, Penalty see instructions, TOTAL AMOUNT DUE or overpaid add, If you owe additional tax make, Electronic payment, Date paid, Check payable to Minnesota Revenue, I declare that this return is, Date, Signature of Preparer, Print Name of Preparer, Date, Daytime Phone, and Daytime Phone so you're able to go to the 3rd stage.

When it comes to Daytime Phone and Taxable gross premiums subtract, be sure you take another look here. These are the key fields in the file.

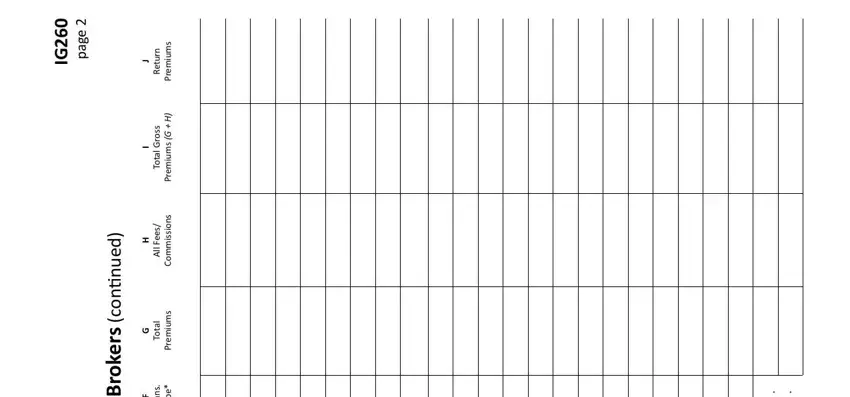

3. Completing e g a p, d e u n ti n o c s r e k o r B s, n r u t e R, m u m e r P, s s o r G, a t o T, H G, m u m e r P, s e e F, l l, s n o i s s i, m m o C, a t o T, m u m e r P, and s n a r T is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

4. This next section requires some additional information. Ensure you complete all the necessary fields - d e u n ti n o c s r e k o r B s, s n a r T, e p y T, d e r u s n, I f o e m a N, e t a D e v ti c e ff E, d e r i u q e r, r e b m u N y c i l, o P, e g a p e n o n a h t e r o m, f i l, a t o t b u S, e g a p n o s e n, i l, and e t a i r p o r p p a n o r e t n - to proceed further in your process!

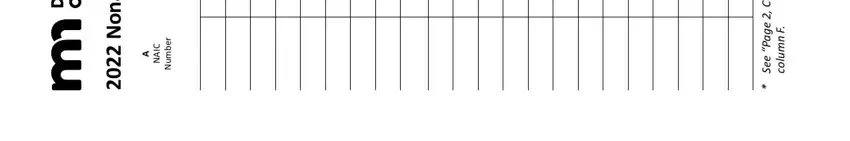

5. The very last step to finish this form is integral. Make sure you fill out the necessary blank fields, for instance d e tt m d a n o N, C A N, r e b m u N, n m u o C, e g a P e e S, and F n m u o c, before finalizing. Neglecting to do so may contribute to a flawed and probably invalid paper!

Step 3: Revise the details you have inserted in the blanks and hit the "Done" button. After starting afree trial account with us, it will be possible to download Nonadmitted Insurance Premium Tax Return for Surplus Lines Brokers or email it at once. The PDF file will also be readily available through your personal account with all of your edits. FormsPal guarantees safe document completion devoid of personal data recording or distributing. Feel comfortable knowing that your information is secure here!